Marketing Audit of Monzo Limited

Introduction

A structured marketing auditing ought to be not only systematic and comprehensive but also periodic and independent. These are the core principles under which this market auditing is premised. The market environment is highly dynamic due to constant changes in the realms of technology and innovation, consumer distribution patterns, consumer preferences and tastes, and geographic mobility of consumers (Paştiu and Lazea, 2014). These factors have required periodic conduction of a marketing audit to establish the real image of market demand. Therefore, this task is constructed on the quest to evaluate the current UK market for Monzo, and assess how it is best suited to compete favourably in the market space. In-depth knowledge of market forces and circumstances will excite the formulation of relevant response scheme to the available crises. Thus, the aim is to carry out a detailed Marketing audit analysis of Monzo Limited Company in the UK market sphere. Besides, this study will explore and establish current opportunities and threats underlying Monzo in the context of the UK market, and after that, recommend a detailed action plan for the betterment of performances. For those needing assistance, seeking marketing dissertation help can provide essential support in navigating complex analysis and strategies.

Monza Limited Company Background Information

Monzo is a United Kingdom-based digital challenger bank that mainly offers retail-banking services to customers. The company offers a variety of services including overdrafts, current accounts, fixed-term loans, partnerships with third parties and saving pots, which by the end of the day help customers have access to modern banking services. Currently, the company has more than two million customers with active accounts. The bank is constructed on the aim to offer services that are easy and easy to use, yet with impeccable customer service and creative features to assist her customers to understand and manage their finances effectively (Gavinelli and Mazzucchelli, 2015). The company’s long-term vision is to provide her consumers and customers with the capacity to view and manage a broader range of financial and non-financial services that are provided through the Monzo App. Monzo Company was conceived with a mission to make money work for everyone, and therefore assist its customers in managing their finances with little effort and stress. The company ensures this mission is actualized by providing customers’ money attains more value, and by finding affordable mechanisms to borrow through the App. Currently, more than two million people have access to hot coral cards to help them, manage their finances, and spend globally. Key to the company’s mission is the concept of long-term sustainability that the company intends to generate lifelong profits while taking part in social transformation. The other goal is to bring Monzo to the capture of more than one billion active not only in the UK but also beyond borders. The bank recognizes that a quarter of the world population has no access to banking services. Therefore, it aims to harness this market and also support vulnerable customers in debt management through financial literacy. This objective is in line with the authentic vision of the company of launching and actualizing a hub for all customers’ money.

Macro analysis of Monza Limited Company's External Environment

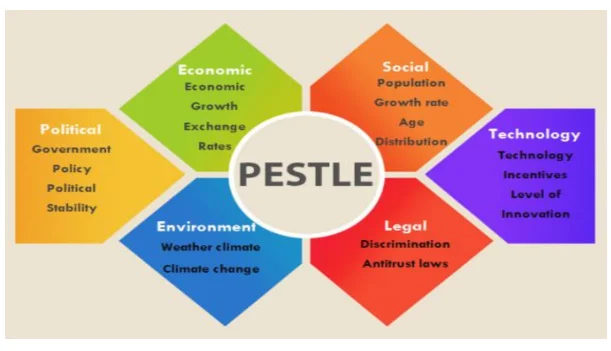

Monzo Bank Limited is one of the significant challenger banks in the UK alongside other banks such as the Starling, Revolut, Tandem, and Atom. These banks are highly flexible, quicker to adapt to user demands and indeed more user-friendly relative to traditional banks. In this section, this review examines the external environment under which Monzo Banking Limited operates in the context of the UK. This involves critically examining the prospects of the bank’s political, environmental, sociological, technological, legal, and economic (PESTLE) environments under which the bank is thriving (Gilligan and Lowe, 2018).

Political factors

The political environment encompasses the extent by which the UK government intervenes in the economy through policy formulations, which directly influence Monzo’s banking operations. Besides, political factors include the prospects of political stability as experienced in the country, tax policy, labour legislations, and environmental law. Political factors constitute a direct influence on Monzo Banking Limited and the influence it has on business performance. The company ought to react to the present and expected future legislation and adjust its market policy accordingly. Chambers and Odar (2015) observe that political factors such as government stability, regulatory frameworks and financial policies ought to be continued to ensure the company conforms to current standards in place. Political disruptions are one of the significant threats faced by the UK’s banking domain, which consequently brings forth financial crises. In the World Economic Forum, many claims raised demonstrated that political turmoil was a significant cause of failures in the financial and banking industry. As a result, Monzo Banking Limited should adequately design its strategies in line with the legislative frameworks guiding the Banking Industry. For instance, the UK Government recently introduced regulations to the Open Banking to force banks to share their customers’ information with third parties that can offer financial services upon request by their customers. This reform took effect in 2018 and was geared to boost competition but as well as challenge the dominant position of traditional banks in the market sphere by forcing them to share customers with new players.

Economic Environment

Economic factors comprise of crucial effect on how Monzo Limited Company does business and how profitable it is. Factors such as interest rates, economic growth, exchange rates, consumers’ disposable income, and inflation constitute the economic environment of a business (Lee et al., 2014). These factors may further be disintegrated into micro-economical and macro-economic factors. Whereas macro-economic factors focus on the prospects of demand management in the economy; microeconomic elements concentrate on people income consumerism patterns appears. Under macro-economic factors, the UK government mainly uses interest rate control, government expenditure and taxation policy as a major mechanism for regulating the Banking Sector. The UK economic environment is favourable to challenger firms in the Banking Sector. The current economic arrangements following the Brexit have continually inspired domestic investments in a broader range of sectors, including banking. The favourable environment ought to be one of the opportunities for Monzo to expand in the UK market sphere (Kupec, 2015).

Social Environment

The social environment encompasses a shared attitude and belief among consumer groups. Such factors also cover population growth, banking consciousness, age distribution, and investment patterns and saving habits (Yen, 2014). The financial services and retail banking industry of the UK are encountering fundamental issues since control lies within the hand of few organisations. Comparatively, the UK banking sector is an equivalent of an oligopoly market. Customers are continually inclining towards online banking services. Based on the growing demand for online banking services, many firms have expanded towards bridging this gap; and in turn, capture more customers. The dominance of traditional banks has reached a point where such banks are deemed too big to experience failure. Further, the traditional banks obtain support from wholesale retailers providing cheap rates as they are confident of the fact such banks are not likely to fail. The social factors are important since they directly influence how Monza managers perceive customers that drive them.

Technological Environment

The evolution of technology and innovation in the banking sector is too fast that only forms that can respond positively to such technological advancements will win more customers. According to Chen and Yang (2019), banking enterprises that will fail to embrace technology will be naturally discredited from the market. Technology is dynamic and fast, with the capacity to disrupt service promotion. Additionally, technology in the UK market landscape inspires how products and services are produced and disseminated to consumers. Banking technologies also can affect communication with target audiences. Thus, in-depth mastery of technological innovations in the banking sector will help the Monza Banking Limited update their way of producing services, delivering their services and communicating with their customers.

Legal Environment

This domain of macro business environment revolves around issues such as health and safety demands, advertising standards, equal opportunities, consumer rights, and law and product safety. Monza Banking Limited ought to develop in-depth awareness of that which is legal for a successful trade. The introduction of the Bank of England Act and Banking Act intended to excite an environment for safe banking. Besides, other legislations such as the Banking Reform Act designed to promote a unique culture for banking. The UK government also introduced the new service known as the 7-Day Current Account Switching Service to enable customers to stitch their current accounts (Sikka, 2015). The establishment of the Independent Commission on Banking in 2010 intended to review and suggest great reforms in the banking domain that will consequently bring forth healthy competition and maintain financial stability. The introduction of the Financial Service Act of 2013 equally sought to induce changes to regulate financial services banks. As Monza Banking Limited strives to expand in the UK market, it ought to be well-conversant with a myriad of such regulatory and legislative frameworks; to avoid unnecessary frictions with the law forces that consequently might incur the company extra financial resources to resolve.

Environmental Factors

Integrating environmental constraints into the heart of company operations is an essential prospect in ensuring ethical and sustainable standards are maintained. Companies accommodate contemporary ecological challenges such as pollution, climate change due to increased carbon footprints by companies through the adoption of equitable and green business operations. This has become not only a legal obligation but also an ethical necessity for successful trading. Many consumers have demanded that services and products they consume are sourced ethically and from sustainable sources. Under this new orientation, business enterprises that uphold environmental concerns at the centre of production are likely to maintain their market space or expand it more.

Strategic Triangle Analysis for Monza Banking Limited

The UK banking sector is highly competitive. The challenger markets are competing with the already established companies such as Barclays. As competition intensifies, strategic planning becomes a necessity to remain relevant in the market. Strategies are adopted in the quest to capture arising needs ascending from the competition and competitive market environment. Strategic plans assist companies in adjusting to external factors quickly. Kenichi Ohmae conceived the strategic triangle performance model as a strategic plan for countering external forces. Also known as the 3C s model, the strategic triangle comprises of three parameters, namely; corporation, competition, and customers. The model proposes that sustainable competitive advantage for a business enterprise can be obtained through the integration of the three parameters of s strategic triangle.

Customers

The art of managing meaningful contacts with customers is one of the surest ways of ensuring business continuity. Alongside maintaining the already existing customers, Monza Banking Limited also ought to expand the market sphere and acquire more customers. This pursuit is achievable by attending to the customers and market demands by providing services those suit consumers’ tastes and preferences at an affordable cost. Monza Company Limited’s core aim is to provide its customers with more personalised and innovative services that traditional banks are not able to offer. Based on its flexibility, Monza is quicker to adapt and more user-friendly. Monza began in 2015, and its most significant advantage is that it started with the latest technology of the time. The assimilation of latest technology expanded the capacity to capture more customers through mobile applications that are easily accessible. Monza Company is helping her customers in fair and transparent borrowing of loans and overdrafts. The bank is addressing customers challenges experienced during lending. Such problems include inflexible payments, hidden fees, and complicated paper works. The company began with lower value loans and gradually rolled out to more customers with abundant of feedback along the way (Whittle, Mueller, and Carter, 2016). The bank is equally committed to building its business empire. This is evidenced by its decision to hire more than 400 professionals to help build the company and construct its image upon the face of customers in the UK. The team of expert has continually provided fast and friendly support and has won various awards for customer service delivery. The customer needs are at the heart of all processes.

Competition

To counteract the competitive forces, Monza company should venture into particular strategies that structurally differentiated and unique from those applied by competitor firms. For instance, the company should strengthen its company image as a source of positive differentiation.

Corporation

The corporation requires strategies gearing towards optimising corporate strengths relative to the competition in the market sphere (Lipnická and Dado, 2017). Based on this parameter, Monza Company does not necessarily need to lead in every sector. The focus should be one core function that will form the basis of enhancing other areas in the banking industry. In the context that the production costs of services go higher than the company can accommodate, it is essential to consider subcontracting a significant share of the company’s operations. In the context that competitors are unable to shift production to subcontractors, the consequential effect in cost structures or in the company’s capacity to cope with demand may constitute a significant strategic implication. Additionally, cost-effectiveness can be enhanced by adopting three significant methods. These methods include; reducing basic costs of services to gain a better competitive advantage. The second method is to exercise selectivity in the types of services delivered to customers. The third method involves sharing certain fundamental functions within the company with their corporations

Analysis of the Internal Business Environment

The analysis of corporate resources is one of the most applied tools in the study of internal business environments. This approach of analysing the internal business environment is constructed on five salient stages. The first stage is identifying and categorising organisational resources. Identifying and categorising resources forms the basis of evaluating the business strengths relative to those of competitors. The second phase involves establishing the company’s potentials and that which can contribute to making the company more effective relative to competitors. The third face encompasses analysing the company’s ability to yield a competitive advantage using the available resources. The fourth phase involves selecting a viable strategy that would react to the company’s resources and capacities based on current opportunities. Lastly, various missing resources which ought to be present for optimal market competitiveness are identified, and the available resources upgraded to suit market demands. The underlying principle of analysing the company’s resource base is to identify resources that can contribute to a sustainable competitive advantage for the bank (Lu, 2017).

Competitive Analysis

Strategic groups, & perceptual mappings

The UK financial industry is a construct of highly competitive markets that is dynamic alongside the spinning wheel of time. The resultant complex, competitive environment offers the opportunity to evaluate how financial services firms such as Monza, Revolut and Starling view markets where they compete with one another for space and control. Before identifying and formulating a competitive advantage, a company ought to establish and demarcate its market boundaries where the competition takes place. The process is customer-oriented in that the number of customers is the basis for benchmarking how large a company controls the market space. Monza Company Limited has continually maintained focus with a core vision that is founded on its mission and goals. To actualise its vision of providing its consumers and customers with the capacity to view and manage a broader range of financial and non-financial services that are provided through the Monzo App; there would be a need to have a highly-skilled workforce. A well-skilled workforce is attained through constant training of employees, to equip them with new market skills and developments. The studies focusing on the effects of group membership on corporate performances is pervasive in literature. The fundamental axiom of strategic groups and their focal point lie in the sense that performance can be attributed to strategic groups and not solely idiosyncratic character of the individual company. Djakeli, (2014) proposed a strategic group as a group of firms within an industry having similar patterns concerning their extents of product diversification, structural costs, control systems and preferences and perceptions of individuals. Strategic groups comprise of firms in a particular sector (for instance financial sector) following a distinct strategy concerning related dimensions. Firms within the same industry as in Monza with Revolut and Starling amongst others in banking domain tend to compete with one another for competitive advantages. Despite the firms mutually learning from one another, they internally tend to lay unique structures and culture likely to win more space in the market landscape. Thus, there is a significant rivalry amongst strategic groups in efforts to outshine one another. The art of drawing positioning maps is vital in highlighting the relationship between the products and services delivered by Monza Company Limited and how to market consumers find them of use considering the price under which the company sells the service may significantly differ with those of other firms. Creating positioning maps requires in-depth mastery of the company's market boundaries. The company should focus on the services that meet the consumers' needs so that the new market entrants do not find a chance of outshining the already established venture (Lu, 2017). Mapping prices for services, the primary benefits of such services should be given preference. The decision should be made whether to study wholesale or retail prices while choosing which market to focus on. When the company has established the primary benefits of her services, a positioning map is drawn by plotting the position of various companies in the market space. Such positioning maps may be an oversimplification but may showcase the relative position of competitors on leverage and standard scale.

Marketing Mix 4 P’s

The marketing mix comprises of various marketing decision variables that are utilised by companies to market their services and goods (Radulescu and Cetina, 2012). Following a comprehensive market evaluation and market need assessments, the next thing modern banking industries do is to pursue the direction of market programming. Under market, programming decisions are derived which seek to meet the customers’ demands and gain competitive advantage. The marketing mix is classified under four main elements, namely; product, promotion, price, and place. According to Fahy and Jobber (2015), market mix refers to the controllable varies, which the company harnesses to influence customers responses positively.

Pricing

The price of the services, as provided by Monza, is one of the vital cogs in the marketing logistics. Service price may make or break the abilities to attract customers. As a growing challenger banking companies in the UK, Monza company should provide its services at a relatively lower price to obtain broader competitiveness in the UK market. This may be integrated into essential services such as opening account; which should be free to attract prospective customers. In other areas, the company ought to find a need for subsidising services delivered to meet the customers' financial demands. In the competitive UK market, the Monza Banking Group is operating in the market where the young population are vibrant towards saving plans, and many are in dire need of financial services such as investment advice and plans. Monza Banking Limited grants these services. The company should give discounts to customers seeking partnership with the company, and an aggressive pricing strategy embraced.

Promotion

Promotion constitutes another major area within marketing mixes. The application of online promotional tools alongside social media such as Facebook, G+, and Twitter are becoming essential in enticing and building a customer base. The Banking sectors adhere to the online platform to trigger brand awareness and the kind of new services revolutionised by the company to its market customers. Online marketing with the help of social media is relatively cheaper but again convenient in reaching a broader array of customers. A dedicated online marketing plan may turn out as an impeccable marketing strategy considering its cost-effectiveness, and that fact that many citizens are social media users. Alongside online and social media platforms, other tools such as print and electronic media ought to be continually harnessed not only to keep customers updated about the type of services provided frequently but also new developments and innovations in place for enriching customers preferences and needs. Social marketing and search engine marketing will equally help Monza in optimising the returns from promotional prospects.

Product

Monzo Bank Limited will pay special attention to the quality of services to promote the company's sustainability agenda. The services provided by the company ought to be built on the threshold of political, economic, environmental and social consciousness; to guarantee responsiveness in various pillars of sustainability. This will bring forth different multiplier benefits such as local adoption of the company's services, less friction and confrontations with the rule of law, less penalties for contravening the law, and positive public reception and image. In the modern world coupled with numerous climatic challenges, civic emancipation in the UK and the world at large about environmental issues has excited the public to reorient their consumerism patterns by accomodating companies that uphold ecological conservation and management practices. The company ought to assimilate sustainable practices such as reducing paperwork and strengthening online transactions to reduce the pressure exerted upon environmental resources. The bank should also demonstrate its in-depth understanding of ecological, social, and economic issues of the time through providing necessary help to reinforce different developments in these domains. Further, various governmental protocols ought to be strictly adhered to while preparing and providing banking services to consumers. As such, the services should strictly conform to details as supplied and stipulated in the advertisement and labels.

Place

Monzo seeks to penetrate the highly competitive market space of banking that is dominated by Barclays, HSBC Holdings, Lloyds Banking Group, Standard Chartered PLC and Santander UK. More focus ought to grant to ensuring the relevant services and products are availed to consumers at the right time. Due to this requirement, traditional and conventional platforms ought to be utilised while marketing Monzo's products and services. Online thresholds will be used as channels of converting prospective customers into real customers.

SWOT Analysis for Monza Company Limited

Strengths, Weaknesses, Opportunities, and Threats (SWOT) framework is one of the tools used to analyse internal and external business environments. According to this framework, a business’s strategies can be formulated by integrating internal environment factors (strengths and weaknesses), with external environment factors (opportunities and threats).

Strengths

Monza was conceived in the year 2015 when technology had been revolutionised in favour of consumers' needs. As opposed to traditional banks such as Barclays and HSBC, Monza is more flexible and responsive to technological changes. Technology is regarded as the most disruptive aspect in the banking sector, especially following the introduction of credit cards. Monza Company Limited aims to provide value for customers; money the help of technology. Technology is the production and dissemination of services to consumers is cost-effective in the long-run period, based on the premise that technology reduces production costs. Monza enjoys the comfort of contemporary technology, and being a young company makes it easy to operationalise latest developments in the realm of technology and innovation. Whereas technology may be a challenge to other banking firms, Monza ought to capitalise on technology to maximise returns out of it in product and service promotion (marketing), reacting to market needs and in the provision of differentiated services from other challenger firms such as Revolut and Starling Banks. Additionally, Monza stands a better chance of making the interaction between financial service providers and consumers simpler and more comfortable. Monza Limited Company provides instrumental financial services in a cheaper, efficient, and modern ways, which ensures customers' demands and needs, are quenched especially in areas of money lending, personal finance, payments and money transfer.

Weaknesses

The banking sector has been subjected to lockdowns for many reasons. In the context of Monza Company Limited, the core weakness lies in the capacity to conform to the demands in the highly legislated banking sector. Besides, the banking sector is highly dynamic in terms of technological development. Whereas today the company might enjoy the best technology; tomorrow, the same technique may become obsolete and irresponsive to market demands. Companies waking up on the technological fortunes may outshine yesterday's market leaders and ascend the market pedestal as the most instrumental banks to the people. Additionally, banks have always been cautious about anything revolving around culture and innovation. Based on this observation, it may require constant research to alert the company about market development to keep the pace. Whereas this process may be costly, especially in training employees to meet the dynamic market needs and acquire relevant technologies; for a small bank like Monza; such finances may not be readily on disposal. Another weakness lies in the privacy of information provided by customers online, which has ascended into the public limelight in modern days. The contemporary data breach at Facebook, for instance, arouses new threats at Monza. The risks revolving around financial fraud associated with consumers inability to understand new online services provided by the company wholly is a potential threat.

Opportunity

Many customers are scrambling for the services provided at Monza Banking Limited based on the company's newness in the market and its capacity to offer essential banking services that are relevant and fundamental to contemporary humanity. As the company enjoys new clients and customers, it also gradually increases its financial base which the company should harness to develop new technologies and construct operational models to tomorrow's consumers (Joshi et al., 2013). The declining internet services costs and the constant growth of mobile usage in the UK is an opportunity than Monza ought to utilise to expand its market territory. Besides, there are significant fractions of the people in the UK without access to formal financial services. Such population ought to be reached in the quest to expand the capital base. Monza Bank Limited does not necessarily have to always compete with its market rivals, but instead, take the initiative to learn, especially from the traditional banks that are already established and thus stable. Monza should take pride in complementing other well-performing companies in the banking sector while enacting new partnerships for effective delivery of financial services.

Threats

One of the biggest threats facing Monza Company Limited is its proneness to criminal hackers (cybercrime). The financial industry is characterised by constant attempts by criminal hackers to penetrate the system and eject off the savings. Security prospects in a start-up company like Monza is a threat based on the premise the company's young age in the market has not equipped with the possibilities of data protection and security. Based on such a view, constant innovation and monitoring are necessary throughout the journey. Alongside cybercrime which may potentially harm the integrity of the company's financial system, there is equally a threat of abuse of the company. Without proper legislation, easy access to leans can motivate risky behaviours such as irresponsible borrowing from the company and high personal debt concentration. This may consequently limit the company's capacity to deliver services due to vast amounts of finances lenders without timely payback. The prospect of competitors is another threat likely to suppress Monza Limited Company. A few challenger firms such as Revolut and Starling may swiftly ascend the market ladder and become monopolies controlling larger customers. Besides, many financial firms permeating into the market, offering similar services may crowd the market and complicate supervision. Following the Brexit, the UK government's new legislative frameworks influencing the local financial sector may influence Monza's operations. Despite such new structures aiming at financial and economic prosperity, they may disrupt the already established structures, which may, therefore, take time to solidify. The contemporary outbreak of the Corona Virus Pandemic (COLID-19) also pauses a threat to Monza Limited Company. The pandemic has disrupted the saving culture of the local people and thus paralysing the completely revenue-generating activities as well as potential economic crisis in future as workforce are grounded affecting the service and manufacturing industries.

Strategic Priorities

Based on Monza Company Limited's current position in the market sphere, this study proposes the company can ascend the market ladder and become a leader in the financial sector. This conception is founded on the view that the company is built on fundamental technology that harnesses mobile phones; thus accessible to a broader audience. The company ought to further focus on customer satisfaction. In the competitive banking sector, customer satisfaction defines the capacity to accrue news clients while maintaining the already existing ones. Customers’ satisfaction will also contribute to a positive image of the entire organisation brand. Additionally, the company should focus on expanding its customer base by tapping into the new markets in the UK. A good number of people without access to financial services; may turn out to be real customers. Thus, the company should continually struggle to expand ints market territory by investing in the promotion of their products. Constant cyber-crimes invite the company to remain vigilant, to ensure the company's financial pool is intact and safe. This can be enhanced through continuous monitoring and in-depth testing of technologies before fully integrated into the company system.

References

Chambers, A.D. and Odar, M., 2015. A new vision for internal audit. Managerial Auditing Journal.

Chen, H.C. and Yang, C.H., 2019. Applying a multiple criteria decision-making approach to establishing green marketing audit criteria. Journal of cleaner production, 210, pp.256-265.

Djakeli, K., 2014. Mission-Objectives Matrix (MOM) as an Innovative Tool of Marketing Audit. Journal of Business, 3(1), pp.37-40.

Gavinelli, L. and Mazzucchelli, A., 2015. Managing intangible assets in international contexts: an empirical analysis on Monza and Brianza SMEs. ISSN 2045-810X, p.54.

Joshi, M., Cahill, D., Sidhu, J. and Kansal, M., 2013. Intellectual capital and financial performance: an evaluation of the Australian financial sector. Journal of intellectual capital.

Lipnická, D. and Dado, J., 2017. Marketing audit and factors influencing its use in practice of companies (from an expert point of view). Journal of competitiveness, 5(4).

Kotler, P., Gregor, W., and Rodgers, W. (2017). The marketing audit comes of age. Sloan Management Review, 18(2), 25-43.

Kupec, V., 2015. MARKETING AUDIT OF CORPORATE COMMUNICATION IN BANKING SECTOR. Studies of Socio-Economics & Humanities/Socioekonomické a Humanitní Studie, 5(2).

Lee, J.G., Henriksen, L., Myers, A.E., Dauphinee, A.L. and Ribisl, K.M., 2014. A systematic review of store audit methods for assessing tobacco marketing and products at the point of sale. Tobacco control, 23(2), pp.98-106.

Lu, L., 2017. Financial Technology and Challenger Banks in the UK: Gap Fillers or Real Challengers?. Journal of International Banking Law and Regulation (2017), 32(7), pp.273-282.

Paştiu, C. and Lazea, R., 2014. Marketing audit in industrial companies in Romania. Progress in Economic Sciences, (1), pp.281-288.

Sikka, P., 2015, March. The corrosive effects of neoliberalism on the UK financial crises and auditing practices: A dead-end for reforms. In Accounting Forum (Vol. 39, No. 1, pp. 1-18). Taylor & Francis.

Whittle, A., Mueller, F. and Carter, C., 2016. The ‘Big Four’in the spotlight: Accountability and professional legitimacy in the UK audit market. Journal of Professions and Organization, 3(2), pp.119-141.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts