Strategic Marketing in Financial Services

1. Introduction

Marketing is one of the effective strategic planning of the organisations to sustain in the market. The financial organisations provide a scope to the customers to invest in financial instruments for gaining high interest and capital in future at agreed rate of interest (Adelkhani and Kashani, 2020). The financial organisations recently focus on product innovation to attract the customers in the market and establish the brands in the market sustainably and thus marketing strategic planning is beneficial for the organisations to operate in the financial market innovatively by developing financial instruments as per the market trends and customer’s requirements. The paper focuses on developing marketing and communication planning for the organisation Kenya Commercial bank (KCB). In this study, SOSTAC marketing model will be utilised for analysing the micro and macro environmental condition for the organisation and developing proper planning to promote the organisation successfully. In this context, one marketing n theme is selected which is market development, where KCB tries to expand their business through developing their position in the market with the new product innovation and creativity in their services to serve the customers in a unique way.

2. Innovation management for market development

2.1 Organisational background

KCB is the famous financial services holding company based on African great Lakes region. The head quarter of the bank is situated at Kenya and the major products of the organisation are credit cards, investments, loans and mortgages. Most of the products and services are related to mortgages and loans where the demand for these financial products is high among the customers in Kenya. Total revue in the last year was approximately $869.7 million and net income of the bank was more than $199 million. The organisation is successful to retain the customers with their innovative products and creative services which further provide KCB a chance to create values for the customers and maximise their satisfaction in long run. It serves across7 countries with more than 345 branches. Total numbers of employees is more than 7561 and there are 28 million customers who are satisfied with the financial instruments and the organisational services where the representatives of KCB are successful to serve the customers with innovative product and creative financial services. Loan in advances is 553.9 billion in KES and asset base is 947.1 in KES. Hence, KCB is one of the successful financial organisation serving their customers innovatively where continuous support, efficient services and communication further raise customer’s values in long run, of which the consumers can fulfil their needs and preferences with the organisational financial products and services. As per the SOSTAC analysis, SOSTAC stands for situational analysis, objectives, strategy, tactics, actions and control. Through this model, it is possible to conduct this research on KCB and develop appropriate marketing plan for fulfilling its objective (KCB Group, 2020a).

The major stakeholders of the company KCB are divided into external and internal. He major internal stakeholders engaged with the operations of KCB are manager, sales executives, employees and the owners. On the other hand, the external stakeholders are such as executives to manage the market operations government of Kenya, political parties in the localities, customers, social communities who are also engaged with the business of KCB (KCB Group, 2020b). The organisation is also efficient to conduct customer’s segmentation and target the right customers for the benefits of the business and in this regard, the customer’s segmentations depend on the age, occupation, economic status and personal preferences. The organisation KCB targets the age group between 45 years to 60 years where the clients are thinking of investing on good financial instruments for gaining higher return on investment. On the other hand, the organisation also focuses on the service man and business owners for the new product development to retain them for long run. The target customers are also done on the basis of the needs and preferences of the customers where KCB targets the clients where the need for the financial instruments is higher and the clients are interested for future secured income. Hence, the customer segmentation and targeting are effective where the new product diversification would be beneficial for the organisation to retain the clients and run the business profitably (KCB Group, 2020c).

2.2 Macro environmental analysis

Macro analysis is conducted through PESTLE analysis for evaluating the market condition of KCB, so that it would be possible to acknowledge the forces which influence the company to develop further strategic planning. The factors such as political stability, economic condition, social development, legal practice, technological up-gradation and environmental rules will be analysed in order to assess the eternal market condition for KCB.

2.3 Micro analysis

The SWOT analysis for the organisation KCB bank from Kenya will be conducted to identify the strengths and weaknesses as well as assess the market opportunities and threats for the company in future.

2.4 Abilities of the company

KCB is able to develop marketing and communication planning to fulfil the aim of market development as it has strong reputation and brand value in Kenya. The product base and service efficiency are also the strengths where the organisation is able to serve the customers innovatively with new innovative financial instrument. The organisation is also capable of utilising their strong and experienced workforce, sales network channel to run their business and make the business innovative in the recent era of globalisation competitive financial market. The major strategic theme of the organisation KCB is market development, where the organisation aims at developing new product and financial instrument to develop the market and establish the business strategically. The brand KCB is also financially stable organisation and it has the capability of investing in the market research and product development to establish the company innovatively. The objective of the company KCB is to develop market share by product innovation and service efficiency to manage the customers and strengthen their client base successfully in near future to stabilise the business uniquely (KCB Group, 2020d).

3. Proposing innovative marketing

3.1 Assessing the marketing functions at KCB bank from Kenya

The marketing functions including product and service development, pricing, market communication channel development, financing, selling, distribution and promotional activities which further influence the business strategies to promote their brands and make the business innovative to sustain in the market. Recently, the major challenges of the organisations are such as poor market share, lack of innovation, low customer base, inexperienced staff members at the workplace and lack of market promotional activities which may deteriorate the firm’s performance in the market. The marketing functions at KCB will be analysed here in order to mitigate the marketing challenges. The marketing functions at KCB will be evaluated to understand the linkage of the organisational functions with the innovation and creativity to that KCB would be able to mitigate the challenges at the market. The major market challenges for KCB are such as fluctuation in the financial market and interest rate on securities and investment, presence of substitute financial instruments in the market, high competition in the financial market of Kenya and lack of customer retention due to poor creativity of the businesses in the market. In order to improve innovation and creativity in representing the brand KCB successfully in the market, it is mandatory to review the marketing functions which are playing crucial role in managing the business activities in long run. The major marketing functions are such as product management, pricing, distribution, financing and promotion, market information management and selling.

According to the above mentioned marketing functions, the product management function is related to the product department where KCB focuses on managing their financial instruments such as credit cards, mortgages, loans and investment. These are the major product category that KCB offers to the customers. The product management function is one of the major functions in marketing and it is linked with the product department here the management team and employees are capable to managing the product portfolio for KCB to provide quality financial instruments to the customers for gaining better return on their investment. On the other hand, the pricing strategy is determined by the strategic team at the workplace and the board members and CEO where the pricing is also important function for their financial products to generate profitability. The sales department manage selling activities and they are also able to manage the customer’s relationship, where the sales representatives are efficient to support he customers and fulfil their queries as well. This is also effective functions to manage the business and secure future sustainable development at Kenya. KCB is also capable to developing the distribution network where the operation department at KCB is successful to handle their distribution and sales network. The operation manager and employees are taking care of the customers and distribute the organisational products and services efficiently to satisfy them in long run. On the hand, the organisation KCB is also able to develop the research and development department where the organisational data are managed well as well as the researcher and technical team are concerned about conducting market research as well as enhance technological innovation to run the business sustainably. Financing and promotion are other crucial marketing functions where these functions are linked with the finance and marketing department respectively. The finance manager are able to invest adequate capital for new product development, research and developmental activities, as well as make other investment decision for better operations and management of KCB (Wanjiku, 2019). Additionally, the promotional activities are controlled by the marketing department where the marketing manager and the executives handle the whole process of promotion to increase brand visibility and share information and data about the banking instruments with the customers so that it would be possible for KCB to retain the clients and make the business profitable.

3.2 Recommending strategic option for innovation

The business opportunities for KCB need to be evaluated to utilise current market trend and retain the customers for long run. In this regard, the recommendations to utilise the current market trend for KCB will be presented to fulfil the objectives of the firm in the financial market of Kenya. The organisation KCB is capable to investing in innovative product and services for better business management and expanding the business successfully. The major theme in this context is market development where the firm is able to develop their market share and secure future sustainable development. KCB is able to invest in the business for running it innovatively. There are strategic options for KCB to sustain in the market and run the business innovatively. KCB must focus on product innovation, where it is related to investment planning for the clients who are focusing on family planning (ATE, 2018). The parents can do insurance plan for their children at the early years, where there would be yearly insurance premium. The insurance plan would be for 10 years, where the lump sum amount would be doubled than investment. The client needs to invest yearly where the insurance premium set by the organisation according to the market interest rate and the lump sum assured amount required by the client after 10 years. It is one of the innovative investment plans, where the client can think about their clod education and marriage and invest accordingly with minimum insurance premium each year and they would get proper interest and huge lump sum amount for their children. On the other hand, the new product development to ensure product innovation, KCB must focus on retirement plan for the client, where the client can invest a lump sum amount and at the age of 55, the client will get monthly interest out of that investment amount. This is one of the best ways to provide secure income to the clients. The organisations able to improve their investment plan and provide the best plan to the clients, who are looking for sustainable and secure income for their old age. It is also another innovative plan, where the clients can invest a lump sum amount at their age of 45 and onwards and get the secured income from the age 55 years. This is fruitful for the old age people, where they can get secured income and fulfil their needs and preferences. This is one of the effective ways to provide quality financial instrument where the people would be able to get high return on investment and secure their income level at their old age. Moreover, the organisation must focus on the service innovation to support the customers with their product and support. The service innovation can be implemented through creating software program where the customers can handle their accounts. In this regard, the organisation KCB must invest in developing mobile application and arrange customer’s data according to their personal information, investment planning and maturity dates and interests. All the data and information related to customers are managed through the software where customer ID and password are set securely and it would be possible for KCB to manage the customers and create values for them.

3.3 Business case analysis for KCB to implement one innovative strategy

Proper strategic planning of the organisation KCB bank from Kenya will be presented to utilise the strategic option of business opportunity presented. In this re4grad SOSTAC model will be applied to conduct market segmentation, develop objectives, create tactics for KCB bank from Kenya for grabbing the market opportunities and establish the company sustainably. From the above strategic options, it is the best suited strategy for KCB to introduce the new financial instrument for family planning, where the clients invest trough yearly premium and get return and maturity amount after 10 long years. There is also the strategic option of investing for 5 years plan, but for 10 years, the maturity value of investment would be doubled were the client would be beneficial of getting high interest rate and a lump sum amount for family planning or education. In the rennet era of globalisation, the income level of the people is growing but at the low rate and it is difficult for the clients to invest a lump sum amount at once. Thus, this new innovative product planning is good for the clients, where the customers and invest yearly with small premium and get a lump sum amount of money after the maturity period.

Risk and benefits of the proposal:

Business opportunities presented:

Gaining high competitive advantage and improving organisational excellence are the major benefits of the organisation KCB where through product innovation, the organisation is able to attract more customers and gain high market share in future. KCB can ensure high retention of the customers, where strong employee base and financial stability of the firm is able to run their operations innovatively through developing the new financial instruments to provide the chance to the clients for investing in the instrument for better return in near future (Mwangi, 2010). Product innovation and business creativity are also possible where KCB can improve branding and increase brand visibility. Market development and penetration is other business opportunities where KCB can develop the market through new product development where the strategy of product diversification is good or KCB to sustain in the market and secure future sustainable development (Kiviti, 2018). KCB can maximising profitability as well as the service innovation provides an opportunity to enhancing communication and cooperation in the market where customers can be engage with the business and invest in a new financial instrument for high return in investment.

Stakeholder relationships:

Stakeholder’s relationship can be developed with the organisational leader of KCB were the project can be implemented efficiently. KCB is able to manage their stockholders where the major internal stakeholders are employees, sales staff, managers who are hired in different departments according to the functions of the organisation (Waweru, 2018). On the other hand, the external stakeholder customers, social communities and government as well as sales team and distributors are also engaged with the company, where the leader is able to communicate with team and follow the rules of government to run the business ethically.

Costs/resources needed:

Outline project proposal:

For the project at KCB, it is mandatory to develop proper planning for successful design of the new financial instrument at the organisation, so that the company is able to manage the customers and peach the product properly. First of all, KCB must invest in the plan to develop the new innovative product. The investment in the market research and communication is necessary where the staff member can understand the needs and preferences of the clients as well as improve communication at the market. Implementing Information and Communication Technology (ICT), creating good technological infrastructure at KCB with latest Information Technology (IT) is also necessary (Bulitia, Wanjala and Mwangi, 2018). After that, KCB must develop he product with proper planning of investment amount, premium of the client at each year according to the lump sum amount that they require after 10 years, and the maturity value creation and bonus in the insurance program. These are the major planning to develop the product and target the customers. After product planning, KCB must hire the experienced staff members and create the organisational portal for the new product development to handle the customers investing in this particular plan (Riungu, 2017). Developing the application with this plan for handling the customers and promotion the products to the audiences are also mandatory as per the product planning of KCB. After proper investment, the sales team must peach the product to the customers and understand their requirement to develop proper planning of investment amount, maturity amount and premium for the insurance.

4. Marketing and Communication Plan

4.1 Marketing plan for KCB bank from Kenya

Marketing mix planning

The marketing mix strategic planning is effective for the organisation KCB to launch the new innovative product and attar the target audiences in the market. the product, pricing, promotion, and placing are the major factors of marketing mix which are crucial to develop the marketing planning for KCB to fulfil the pre-specified objectives (Blut, Teller and Floh, 2018). The marketing planning will be evaluated further,

Product

Product of the organisation is needed to be innovative to retain the new clients as well as attract the old customers at KCB. The new product is related to the insurance policy, and it is one type of investment plan, in which the customers can invest for 10 years and will get a lump sum amount for their own purpose. This is also related to family plan for investment for educational plan, where the organisation KCB is able to provide high return on investment. The new product is related to long term investment where the customers should pay premium on yearly basis. The small amount of investment will be helpful to get a lump sum amount for family planning or education of the clients. This is one of the innovative products for the financial instrument to attract the clients and retain tem for long run investment (Wu and Li, 2018).

Pricing

Te price of the product is low at the initial stage so that KCB will be able to attar the audiences in the market. Premium pricing policy is adopted where it is beneficial for the brand to strengthen their customer’s base and retain tem for long run. There are also different offers of providing the premium where the premium amount would be discounted in long run. The clients would be able to pay the premium yearly basis as well as quarterly basis as per their convenience.

Place

Placing the product at the financial market of Kenya is also mandatory and for this the leader of KCB tries to strengthen their sales network. The sales managers try to pea the new developed product to the customers and nine tem to invest in this new product of the bank. There is strong distribution network, where the distributors are also playing crucial role for KCB to promote the product and establish the business sustainably.

Promotion

Promotional activities are also mandatory and in this regard, KCB must arrange social campaigning which is curial for gathering the information about the new product launch. Trough the social campaigning, it can attract the audiences in the market and promote the product sues sully. On the other hand, the organisation needs to invest in developing proper content for the website were the customers and access the authentic information about new plan launched and make their investment decision successfully. The organization also needs to utilise print media and television to promote the newly developed product for successful retention of the customers in the market.

Control

Monitoring, Control and evaluation

Continuous monitoring process must be implemented so that the product can be approached well to the customers and online clients for successful investment in the new financial instrument. The online cloud computing system is also required to be handled efficiently to manage the customers and retain them for long run. The key performance indicators are such as,

Organisational profitability

Customer investment on the new product

Retention of the customers

4.2 Changes in organisational culture

Two changes at organisational workplace will be partnership working practice and creating customaries services, as these are beneficial for the marketing department at KCB to launch the new product and improve innovation to secure the customers in a better way, the organisational culture of partnership working is necessary for the employees to work collaboratively and improve the expertise and knowledge to support the clients successfully. Communication and internal collaboration further enhance the efficiency and performance of the staff members (Kord et al., 2018). On the other hand, the culture of engaging the customers and develop client centred approach are also another crucial manage that would be required for gaining success of KCB. The employees and managers try to engage to customers with the business process and peach the best financial offer the low premium per years and high return on their investment after the maturity date so that the customers would be satisfied to invest in an innovative financial product of KCB.

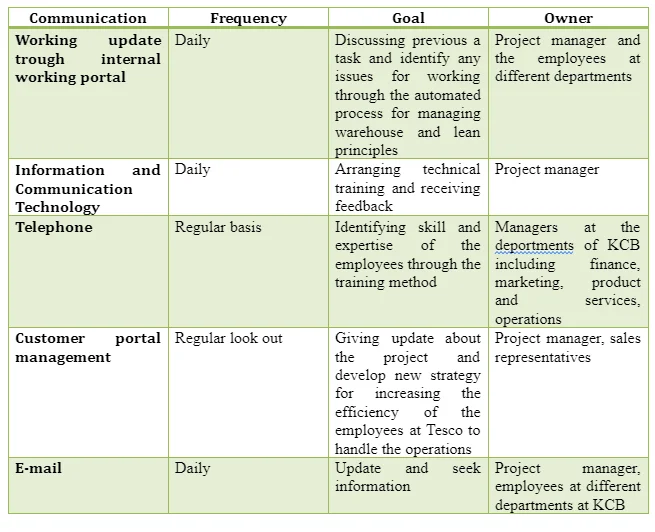

4.3 Communication plan

Communication plan to manage stakeholders during the project innovation at KCB includes,

5. Conclusion

KCB is able to manage their operations and invest in the new product development for running the business sustainably. The organisation is also able to retain and execute the marketing planning for successful establishment of the innovate product in the market and attar the clients for the financial instrument where the return on investment would be gained in long run after the maturity period of investment plan.

Reference List

Adelkhani, H. and Kashani, F.H., 2020. Designing, Evaluating and Prioritizing Sepah Bank's Marketing Strategies in the Banking Industry. Journal of System Management, (1), pp.065-078.

ATE, D.O., 2018. IMPLEMENTATION OF EXPANSION STRATEGY AT KCB GROUP PUBLIC LIMITED COMPANY, KENYA (Doctoral dissertation, SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI).

Braciníková, V. and Matušínská, K., 2017. Marketing mix of financial services from the customers perspective. In Forum Scientiae Oeconomia (Vol. 5, No. 4, pp. 36-48).

Bulitia, G., Wanjala, J.W. and Mwangi, G.W., 2018. Factors Affecting The Choice Of Promotional Mix By Commercial Banks In Kenya: A Case Study Of Kenya Commercial Bank Limited.

Išoraitė, M., 2016. Marketing mix theoretical aspects. International journal of research granthaalayah, 4(6), pp.25-37.

Kiviti, A.N., 2018. Effect of Market Positioning Strategies on Performance of Kcb Bank Group Ltd, Kenya (Doctoral dissertation, University of Nairobi).

Kord, B., Vazifeh, Z., Salarzehi, H., Joyami, E.N. and Biuki, N.A., 2018. Ranking the effect of services marketing mix elements on the loyalty of customers by using Topsis method (case study: Saderat bank branches in Isfahan).

Riungu, J., 2017. Customer Relationship Management as a Competitive Tool in the Kenyan Banking Industry: A Case of Kenya Commercial Bank (Doctoral dissertation, United States International University-Africa).

Sadeghpour, F., Far, M.G., Khah, A.R. and Amiri, M.A.A., 2017. Marketing Strategic Planning and Choosing the Right Strategy using AHP Technique (Case Study: Ghavamin Bank Mazandaran). Dutch Journal of Finance and Management, 1(2), p.45.

Wu, Y.L. and Li, E.Y., 2018. Marketing mix, customer value, and customer loyalty in social commerce. Internet Research.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts