Woolworths in China: A Comprehensive Analysis of Market Entry Strategies and Opportunities

Executive summary

The business opportunity report has been formulated on the basis of the hypothetical scenario of penetration of Chinese retail market by the Australian retail organisation Woolworths. The study has taken into consideration the various factors constituting the internal and external business environment of the targeted market for the company under consideration. Specific emphasis has been concentrated on the delineation of the organisational particulars regarding the resources and capabilities of the selected retailer in the backdrop of the Chinese domestic retail market conditions. The strengths and weaknesses of and opportunities and threats for Woolworths in the selected market segment have been evaluated in juxtaposition to those of the PESTLE format of market evaluation tool. Furthermore, the utilisation of the Hofstede model of cultural dimension analysis has been also undertaken. The general findings from these issues have been assessed to format the required recommendations which are necessitated to be invested towards market penetration and service expansion by Woolworths at China. For those struggling with similar academic analyses, seeking marketing dissertation help can provide essential guidance in structuring such complex reports effectively.

Introduction

The corresponding market opportunities and challenges related study report would be formulated on the research of market opportunities and challenges which could be encountered by an Australian business organisation while having to invest effort in developing new markets at the Asian economic powerhouse of China. To this purpose, the Australian retail giant Woolworths Limited has been selected. The report would further highlight the rationale of the selected business organisation to enter into the Chinese market destination and the various types of services and products which are marketed by Woolworths Limited. The process would entail the utilisation of analytical framework of PESTLE and SWOT to evaluate the various issues which could confront the business expansion efforts of the selected Australian retailer.

Company identification

Please refer to Appendix I

Global aspirations of Woolworths and theoretical perspectives

Xu & Lee (2019) have stated that the Woolworths Limited currently operates 5 different business segments such as Australian Foods (operates in sourcing of edibles to be resold at Australian domestic markets), New Zealand Foods (sourcing of edibles to be resold at New Zealand domestic markets), Endeavour Drinks (sourcing of drinkables to be resold to Australian domestic markets), BIGW (provisioning of discounted general merchandises to Australian customers) and Hotels (hospitality, entertainment and leisure service sector). In this context, the predominant business expansion of the company is situated within the domestic or Anzac markets. To this effect, Arli et al (2013) have observed that Woolworths is poised to expand into the burgeoning markets of East Asia (particularly that of China) for the reason of comparative advantage of trade and the gains which could be obtained from the same.

Target market introduction

Naidoo & Gasparatos (2018) have argued that despite the complicated business licensing policies of China along with restrictive market limitation environments, it is relatively assistive for the various retail enterprises, both domestic and overseas ones, to get established within the Chinese domestic retail markets since the entry thresholds have been consistently lowered to encourage specific business formats and this entails the grocery and luxury merchandise retail markets as well. The emphasis has been on the boosting of domestic consumption by the Chinese authorities (Tabuchi, Fujimoto & Senga, 2017). This could be further exemplified through the information from National Bureau of Statistics of China which suggests that per capital disposable income of the average Chinese citizen was US$4,033 in 2017 which indicates an incremental pattern of 7.3% on a per annum basis (Export markets – China, 2020). Lei, Guo & Liang (2016) have suggested that such trends at the Chinese retail sector have become predominant due to the comparatively strong consumer base with expanding purchasing power and grater preference for the betterment of shopping experiences.

Such factors, thus, could be interpreted as the greater openness of stance which the Chinese economy has adopted towards international trade to foment greater growth prospects in the domestic economy of that country (The World Factbook, 2020). According to Freeman (2018), the utilisation of the New Trade Theory could become effective in terms of the justification of the expansive effects of Woolworths in the Chinese market since this theoretical construct suggests that selective and limited governmental interventions could support the domestic consumption based industries at various developing and semi-developed economies.

PESTLE analysis

Economic Analysis

The retail sales sector in China would be experiencing a projected growth rate of 7.5% during the financial year of 2019-2020. This amounts to the cumulative valuation of $5.636 trillion of the entire Chinese retail market segment (Shucheng, 2017). This has been a marked increase from the previously registered growth measure of 3.5% during the financial year of 2017-2018 which amounted to $5.291 trillion (cumulative approximation). This increment has been a positive outline regarding the Quarterly 4th growth estimations regarding the current financial climate and China currently is poised to surpass the USA in terms of growth estimations in the next financial year segment of 2020-2021 (inclusive of all quarterlies) (Boianovsky, 2019). However, the current import valuation of the country stands at a considerable high value of $ 2.14 trillion (2018-19) of which 4.9% is comprised by Australian goods (5th in terms of highest importing sources after South Korea, Japan, USA and Germany). The major imported products are integrated circuit based machinery, computer components, petroleum, other technical equipment, automobile parts and selective agricultural products such as Soybeans (The World Factbook, 2020).

Dig deeper into Strategic Marketing Planning for Market Entry with our selection of articles.

Political analysis

Laxities in retail trade regulations

Schütte & Ciarlante (2016) have observed that trade regulations within the Chinese retail sector are provided with relative lax approaches by the Chinese government and thus, the sanctions are applied in a liberal manner as well. Trinh, Khan & Lockshin (2018) have highlighted the instance of the French hypermarket organisation of Carrefour which had ignored the existing regulations within the Chinese domestic food retail markets and had not been prosecuted for it. This exemplifies the fact that the Chinese governments do not prefer to restrict the development of such an industrial discipline in this context (Wahyuni, 2010).

Government trade agreements

The largest foreign export destination in terms of top overseas market for Australian products is China and bilateral export trade amounted to $116 billion between the countries during financial year of 2017-18. Currently, greater than 25% of Australian exports are destined for China on a per annum basis as these products are primarily composed off services and agricultural products. The China-Australia Free Trade Agreement (ChAFTA) had been brought into force on 20.12.2015 which has provided Australian business entities with greater access to the Chinese markets involving differential business interests (Doing business with China, 2020).

Decentralisation

According to Lai (2017), the increasing decentralisation of power on the prefectural administrative elements has spanned greater emergence of local governments at the provincial and district levels of China. These local governments, on an increasing pace, have shaped the traditional structural architecture of the retail markets (alternatively known as the wet markets). The outcome has been increasing numbers of supermarkets at the newly emerging urban centres of the country. Furthermore, Swinnen (2018) has determined that the exponential industrialisation and financial activities at the Western provinces of China are poised to contribute to the establishment of greater numbers of supermarkets at such provinces.

Legal Analysis

Specific legal/administrative promulgations

Chow (2017) has pointed out that prior to joining the World Trade Organisation during 2001, the emphasis in China was on placing of extensive trade restrictions concerning the involvement of foreign firms and FDIs within the domestic retail sector. However, the provisions of WTO Accessions Agreement for China had established the imperatives concerning the gradual removal of the trade restrictions and barriers for overseas investors and enterprises. In this context, the PRC government had stipulated the Directive of Administrative Measures for Foreign Investment in Commercial Sectors in 2004 which permitted the establishment of retail businesses through direct investment and collaborative approaches by foreign business enterprises such as the Woolworths and the factor of geographic limitations was also abolished in terms of market penetration. This could be comprehended to be the direct acknowledgement of the impact of Globalisation. Ansar, Flyvbjerg, Budzier & Lunn (2016) have contextualised this perception through the dual effects of Globalisation in the form of thrusting the previously centralised economies, such as China, towards a unit of greater integrated global economy and the changing of national economies from controlled to hyper liberal operational structures.

Legal assistance

Thus, the physical stores of Woolworths are not subjected to be only limited to the major metropolises and Chinese urban centres only and the hinterland penetration effect could be utilised as well for generation of additional revenue. Apart from this fact, the aforementioned directive had also permitted for foreign investors (such as Woolworths) to engage in Joint Venture (JV) based business propagations within the Chinese domestic markets as well as the permission to establish WFOEs (Wholly Foreign-Owned Enterprises). Furthermore, according to Zhang, Xu, Oosterveer & Mol (2016), in 2009, the directive of the PRC government termed as Administrative Measures for Foreign Enterprises or Individuals Establishing Partnership Enterprises was also issued which promulgated the scope of establishment of partnership based retail enterprises from 2010 onwards.

Si, Regnier-Davies & Scott (2018) have delineated that the Ministry of Commerce (MOFCOM) of the PRC and the State Administration for Industry and Commerce (SAIC) are the two primary central agencies through which the PRC governments provide approval to business licenses and applications for registrations to the foreign investors and commercial enterprises, such as the Woolworths. However, the impact of Globalisation has been apparent in the development of gradual devolution of the centralised authorities of these two institutions to the increasing numbers of local governments. For Woolworths, this could effectively simplify the licence obtainment process (Raghuram & Kuberkar, 2008).

Socio-cultural analysis

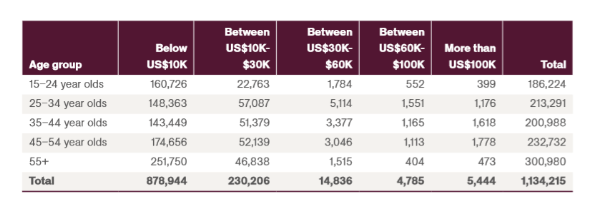

Demographical transition

Shan Ding (2017) have specified that the rate of population growth in China has been diminishing at an estimate of 0.655% per annum since 2019 with the life expectancy to be 73.18 years on an average basis. Furthermore, the age distribution specifics of China have been characterised by the relatively small youth group measure of 0-14 years (19.8%) and the majority of the population (72.1%) are of 15-64 years of age. The rest are of 65 years and above. According to Feng, Gu & Cai (2016), the single child policy of the Chinese government has been responsible for this demographic transition since 1979. However, the benefit which has been garnered by China in this context has been that the unemployment rate has come down to a manageable 4.02% of the entire available labour force.

Awareness of Health

According to Liu & Niyongira (2017), the increased online activity of the Chinese retail customers have provided them with greater awareness concerning the debilitative effects of improper food products on their health prospects. One particular incident which had occurred during 2008 could be mentioned in this regard where baby food, including milk and, food components were adulterated with the substance of Melamine which affected the health of 300000 infants of which 6 were fatalities from kidney damages through kidney stones.

Hofstede model of cultural dimensions

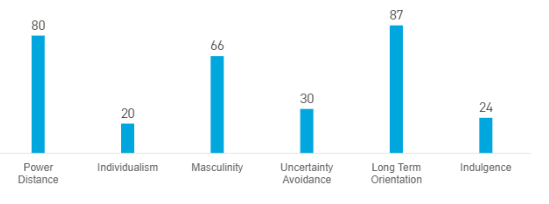

Power Distance Index

The score of 80 in the PDI highlights the suggestion that the Chinese society is fervent in accepting the inequalities amongst different classes of people. Polarisation dominates the superior-subordinate relationships and abuse of power by the superiors could be acceptable to a wide range since individuals are submissive to formal authority. Leadership initiative at the authority levels could be acceptable as well.

Individualism

China holds the score of (20) which indicates a collectivist culture within the country where group interest gains predominance over individuals. Preferential treatment is accorded to the favoured groups and such collectivist psychological approaches also dominate the retail product purchase preference scenario of the majority of the Chinese populace.

Masculinity

The high score of Masculinity (66) regarding the dimensions is indicative of the fact that the Chinese society is oriented towards enhancement of quality of life. This is associated with the psychological approach of attempting to be the best in every field to become outstanding ones. This cultural dimension could have definite implications on the new urban classes Chinese middle class personnel who could become inclined towards acquisition of foreign goods and services to demonstrate their financial class status.

Uncertainty Avoidance

The low score (30) of UA highlights that, in the Chinese society, adherence to the laws could be a relative prospect with certain measure of involved flexibility. This is an indication of pragmatism. The Chinese do not detest ambiguity and they are entrepreneurial and adaptable to the situations. Thus, high potential of acceptance of new products could be a possibility to be realised by the Australian Retailer entity in the Chinese markets.

Long term orientation

The relatively high score of (87) highlights the fact that as a culture, China has extensive pragmatic orientation where truth could be contextualised in terms of the time and conditions which exist. Thus, the Chinese society could adapt with immediacy to the existing work processes and this behaviour could be reflected in their purchase preferences as well. However, one market cultural trait of the Chinese society is the propensity to save, thriftiness and preserving of capital.

Indulgence

The restrained societal perspectives of China could be comprehended from the low score of 24. The underscoring cultural inclinations in this dimension are cynicism and pessimism. The Chinese are more inclined towards controlling their gratifications in terms of desires. Thus, primarily, the Chinese are averse to luxury related indulgence and are compliant towards the social norms.

Technology issues

Distribution based issues

Havinga & Verbruggen (2017) have indicated that the necessity of establishment of a surfeit of effective warehouses at the various locations of strategic significance for Woolworths to be one of the technical challenges which would be encountered in the process of business expansion and market penetration at China. The rationale could be comprehended as the relatively prodigious geographical area of China and the comparative dearth of communication infrastructure at the western districts of China. To this effect, the company would also be encountering the technical challenge of establishment and communicating with the local grocery outsourcing JV partnerships.

Supplier based issues

It would be another issue to properly locate and communicate with the Chinese suppliers who could be equipped with the necessary IT infrastructure for effective integration of their services within the existing system of distribution for Woolworths.

Standards and amenities of living

According to Liu & Niyongira (2017), few of the Chinese households possess any refrigeration device and the shopping behaviour of the same are thus oriented towards such conditions which could be suited to the living standards of the Chinese households. It is unlikely that shifting of such purchasing behaviours could be a definite proposition.

Environmental issues

Sustainability issues

Hsueh (2016) has observed that the abolishment of polymer based bags by the Chinese government during 2009-2010 could be illustrated as the effort towards fostering sustainability and preservation of the environment. The orientation has been towards rapid development of environmental decision formulations in China. Furthermore, the National and Social Progress Planning Programme (NSPPP) of China emphasised on the introduction of recycling efforts at the administrative levels.

Wastage reduction

The Chinese consumers are extensively sensitive towards the issues of pollution emanating from food wastes and associated debris. Thus, the general regulatory promulgations are mostly stricter at China concerning the food waste disposal processes. Devin & Richards (2018) have outlined that within the duration of 2013-2016, 17-18 million tons of grocery and edible wastes had been generated at Chinese urban settlements. To this effect, the MOHURD (Ministry of Housing and Urban Rural Development) of the Chinese government had pointed out 4 large urban settlements (Beijing, Shanghai, Guangzhou, and Shenzhen) to launch a pilot project of implementation of innovative policies of reduction of grocery and other edible wastes at the Municipality levels during 2017. This effort culminated in the national regulation promulgation to streamline the waste disposal chains. Such environmental policies and related promulgations would be paramount for Woolworths to take cognisance off.

SWOT Analysis

Strength

Perception management

Balancing the identified customer segments across the strata of income has been one of the strengths of Woolworths and this has been made possible through the element of perceptions management through effective promotional policies and pricing strategies for the Australian domestic markets. Such strengths could be applied by Woolworths at the Chinese market level as well. A balanced approach of combining both the low and premium pricing policies could be utilised by the retailer in this context. Hardaker (2017) has observed that such policies could garner 55% the Chinese middle class customer segments.

Business analytics based customer tracking

Woolworths could effectively and consistently track the customers through application of business analytics tools which are purposively developed for the social media and shop data based information analysis. The second category consists of the shopping bills based tracking so that customer preferences could be outlined in stock and inventory management.

Value proposition

This involves the effort of informing the customers about the value which could be attached to the purchasing of Woolworths products. This could be coupled with maintaining entry level prices of the products commensurate with the lowest purchasing threshold of the Chinese consumers. Furthermore, Chinese customers could be informed on a weekly basis about the best offers launched by the company.

Weaknesses

In the market of the purchasers regarding the grocery and food retail, the Chinese suppliers often have to put up with specific unfair treatment in terms of inferior pricing positions given the monopoly of the domestic Chinese supermarkets in the retail sector. The suppliers have to bear the risk of selling on commission and this culminates in the transference of risks in the final prices regarding the supply of materials to the foreign investors or third parties such as that of Woolworths. This directly contributes to inflation of prices in spite of the reduction of flow costs through effective logistics network management by foreign retail managerial systems. This could be a marked weakness of Woolworths in the prospectus Chinese markets.

Opportunities

The Chinese markets

Vellinga (2019) has outlined that 70% (approximate) of the Chinese population is comprised of rural populaces. Thus, the rural population based market could yield a great sales potential, including the vast and relatively sparsely populated western provinces (Xinjiang). The western and rural markets are mostly underdeveloped in China. Thus, it would be effective for Woolworths to establish retail stores in those regions which are gaining affluence slowly to seize the expected opportunities.

Threats

Franchise shop based replacement of retail formats

Greater consumer attention is directed towards the living standards improvement of the Chinese society by the domestic consumers of retail products at Chinese markets. This involves greater emphasis on specialised services in terms of the determination purchasing orientation. This trend has contributed to the popularity enhancement of franchise shops which could precisely corroborate to the customer preference cycles regarding sought after retail goods.

Increased competition

Chinese businesses sites are expanding at a larger rage that the increase in sales numbers and this intensifies competition. Furthermore, average retail sector profit rate in China is 12% only and this highlights low profit possibilities given for Woolworths given the existence of other leading international retail enterprises such as Carrefour, Auchan, Lotus, Wal-Mart, Metro and others.

Recommendations

The suggested recommendations are as the following:

1: The initial market background research has to be effective and extensive regarding the urban centres of retail sales were Woolworth could launch product offerings. This could involve the prime urban locations such as Shanghai, Beijing, Guangzhou, Jiangsu, Shenzhen, Zhejiang and Shandong.

2: Undertaking of segmentation of the market on the basis of geography, customer purchase habits and income prospects.

3: Determination of the most effective entry methods through which profit margin enhancement could be ensured and this could involve the utilisation of market research results.

4: The best routes to the market components have to be determined.

5: Undertake consultations with legal experts to resolve the legal issues which might arise.

6: Due diligence would have to be carried out on the prospective employees and business partners.

7: Desist from investing in local presence initiatives prior to completion of the market research.

Conclusions

At the conclusive stage, it could be perceived that the preceding business opportunity report has highlighted the positives and negatives, in terms of opportunities for business expansion, at the retail sector of a selected country (China) for the organisation of Woolworths, with particular emphasis on the critical issues which could influence the efforts of the company under consideration in terms of shaping the business decisions, to expand the business envelop within the targeted market. This opportunity report could specifically be assistive to the selected company to chart a careful course through different opportunities and adversities, towards penetration of the targeted market to achieve profitable share at the Chinese markets.

Reference list

Ansar, A., Flyvbjerg, B., Budzier, A., & Lunn, D. (2016). Does infrastructure investment lead to economic growth or economic fragility? Evidence from China. Oxford Review of Economic Policy, 32(3), 360-390.

Arli, V., Dylke, S., Burgess, R., Campus, R., & Soldo, E. (2013). Woolworths Australia and Walmart US: Best practices in supply chain collaboration. Journal of Economics, Business & Accountancy Ventura (JEBAV), 16(1).

Boianovsky, M. (2019). Reacting to Samuelson: Early development economics and the factor-price equalization theorem.

Chow, G. C. (2017). Capital formation and economic growth in China (pp. 1186-1221). BRILL.

Devin, B., & Richards, C. (2018). Food waste, power, and corporate social responsibility in the Australian food supply chain. Journal of Business Ethics, 150(1), 199-210.

Feng, W., Gu, B., & Cai, Y. (2016). The end of China's one‐child policy. Studies in family planning, 47(1), 83-86.

Freeman, A. (2018). Value and price: A critique of neo-Ricardian claims. Capital & Class, 42(3), 509-516.

Hardaker, S. (2017). The changing role of international grocery retailers in China, 1978–2016. History of Retailing and Consumption, 3(1), 53-69.

Havinga, T., & Verbruggen, P. (2017). The Global Food Safety Initiative and state actors: Paving the way for hybrid food safety governance. In Hybridization of Food Governance. Edward Elgar Publishing.

Hsueh, R. (2016). State capitalism, Chinese‐style: Strategic value of sectors, sectoral characteristics, and globalization. Governance, 29(1), 85-102.

Lai, J. (2017). The comparative research on online impulsive buying behaviour between the UK and China. Journal of Residuals Science and Technology, 14(S1), S119-S124.

Lei, Q., Guo, J., & Liang, C. (2016, November). The impact of e-commerce development level on location choice of foreign retail companies in China. In 2016 IEEE 13th International Conference on e-Business Engineering (ICEBE) (pp. 134-138). IEEE.

Liu, A., & Niyongira, R. (2017). Chinese consumers food purchasing behaviors and awareness of food safety. Food Control, 79, 185-191.

Naidoo, M., & Gasparatos, A. (2018). Corporate Environmental Sustainability in the retail sector: Drivers, strategies and performance measurement. Journal of cleaner production.

Parkinson, M. M. (2018). Case Study 4: Woolworths Group plc. In Corporate Governance in Transition (pp. 203-221). Palgrave Macmillan, Cham.

Raghuram, G., & Kuberkar, G. (2008). Woolworths Limited, Australia.

Schütte, H., & Ciarlante, D. (2016). Consumer behaviour in Asia. Springer.

Shan Ding, Q. (2017). Chinese products for Chinese people? Consumer ethnocentrism in China. International Journal of Retail & Distribution Management, 45(5), 550-564.

Shucheng, L. (2017). Chinese Economic Growth and Fluctuations. Routledge.

Si, Z., Regnier-Davies, J., & Scott, S. (2018). Food safety in urban China: Perceptions and coping strategies of residents in Nanjing. China Information, 32(3), 377-399.

Swinnen, J. F. (2018). The political economy of agricultural and food policies. Basingstoke, UK: Palgrave Macmillan. Swinnen, J. F. (2018). The political economy of agricultural and food policies. Basingstoke, UK: Palgrave Macmillan.

Tabuchi, T., Fujimoto, M., & Senga, S. (2017). Introduction: Ricardo’s international trade theory 200 years on. In Ricardo and International Trade (pp. 1-6). Routledge.

Trinh, G., Khan, H., & Lockshin, L. (2018). Purchasing behaviour of ethnicities: Are they different?. International Business Review.

Vellinga, M. (2019). The dialectics of globalization. Routledge.

Wahyuni, D. (2010). The importance of supply chain management in competitive business: A case study on Woolworths. Manajemen Usahawan Indonesia, (1), 32-39.

Xu, E., & Lee, T. (2019). Supermarket magazines and foodscape mediation in Australia. Communication Research and Practice, 1-14.

Zhang, L., Xu, Y., Oosterveer, P., & Mol, A. P. (2016). Consumer trust in different food provisioning schemes: evidence from Beijing, China. Journal of Cleaner Production, 134, 269-279.

Appendices

Appendix I

Woolworths Limited Group has been one of the largest Australian retail supermarkets chain and grocery stores. The company was established during 1924 and the company exerts a duopoly within the Australian supermarkets with the market rival Coles in accounting for approximately 80% of the entire Australian domestic markets (Parkinson, 2018). The predominant products marketed by Woolworths Limited are packaged foods such as vegetables, fruits, meat etc. Apart from these, various other products such as beauty and health products, magazines, DVDs, household amenities, supplies for pets and babies as well as stationary elements are also sold by the Woolworths Limited. Till 2019, Woolworths Limited operates 981 supermarkets and 43 convenience stores at different metropolises within Australia. The online home delivery service operated by Woolworths Limited is known as the Woolworths Online (Woolworths Group, 2020).

Looking for further insights on The Dynamic Role of Design Practitioners in Shaping Modern Business Strategies? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts