UK Real Estate Market Post-Brexit

Introduction

Housing is an important factor for the British nation, where the sociologists and political scientists suggested that the British people rely on their houses for retirement and against any employment surprises (Ansell, 2014). According to Amadeo (2018), the term real estate comes from Latin language means physical or property. In the UK, there are four types of real estate: residential, commercial, industrial and land. This study focuses on the first type which is buying and selling of the Residential real estates, SICS code: 68100. The Aim of this research is to analyse the changes of the property market in the United Kingdom as the result of United Kingdom’s exit from the European Union (Brexit’s) and identify the factors contributing to the price change in the real estate sector. Nearly 52% of the British citizens voted to leave the European Union in 23/06/2016. Smith, (2016) argued that, for many it seems hard to predict what going to happen in the future in the housing market and how Brexit’s will affect the housing prices, availability of mortgages, housing regulations, property tax (stamp duty) and so on? (Smith, 2016). This report focuses at the micro and macro-economic environment of the housing industry in the UK and highlights the issues that affect the real estate’s business, mentioning three of the biggest players in the industry: Hunters, Foxton and Dexter’s. The work structured as follow, Macroeconomic analysis (PESTEL) followed by Microeconomic analysis (porter’s five forces), then the conclusion contains predicted scenario of Brexit implications on real estate market drawn from the research finding.

Macroeconomic analysis (PESTEL):

The focal point of PESTEL analysis is on external influences on the industry, with primarily focus on Brexit as the biggest challenge affecting the property sector. According to Dhingra et al, (2016), all other factors including higher taxation and stricter bank lending are not as influential as Brexit.

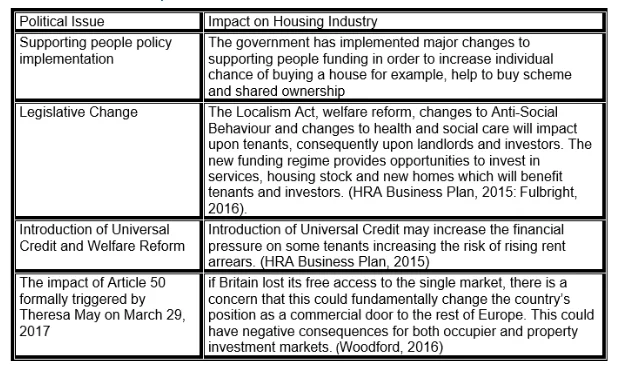

Political:

Dhingra, et al, (2016) stated that, any drop-in demands from overseas buyers on the back of the Brexit could have a significant impact on the real estate market. The PWC Report 2016 showed that by value, overseas buyers have accounted for roughly half of all transactions in the British commercial property market over the past few years. A key question at this current stage after Brexit would be around the UK ability to agree positive deals with non-EU countries that would compensate and reduce trade costs and boost FDI. This ability is deemed unlikely by CEP, 2016. CEP (2016) emphasised that, despite the fact that the UK would be free from the need to compromise with other EU countries during negotiations, the UK economy size (which is one fifth of the EU’s Single Market) would simply have a significantly reduced bargaining influence than the EU currently enjoys. The UK will no longer enjoy the automatic access to any new or potential EU deals such as those currently being negotiated between the EU and Japan and the United States.

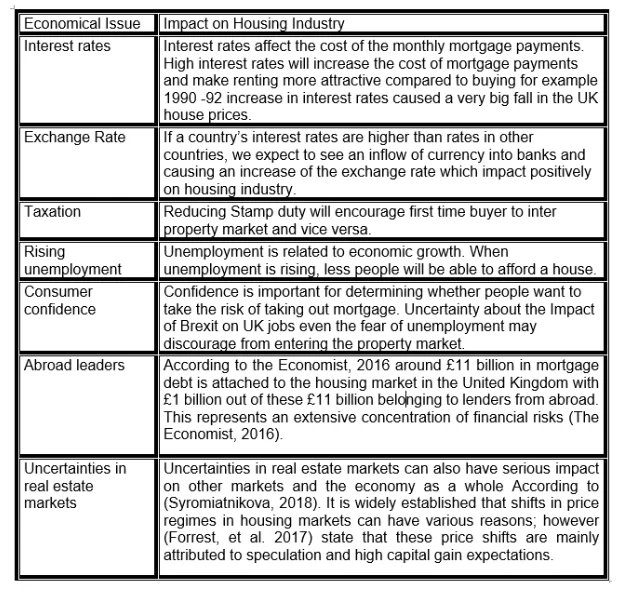

Economic:

The figures below are currently established in relation to the Real Estate market in the UK (RICS. 2017); • The market value of the UK real estate is £1,662bn. •The built environment sector in UK employs 260,000 professionals •Real estate contributes £94bn to the UK economy (5.4% of the Britain’s GDP). •Commercial property directly employs 2.1 million people (6.8% of labour force). It is regarded as counter intuitive that, with increasing prices, demand is also increasing as well. It is however explained by the idea that, people expect prices to inflate even further (Sampson, et al., 2017). These can destabilise the real economy in cases where households withdraw equity from their mortgage for an increase in consumption similar to what happened in the early 2000s (Syromiatnikova, 2018). Syromiatnikova, (2018) argued that, leaving the European Union can cause damage to the property markets and the macro-economy in the UK which will result in lower consumption rates. Sampson, et al., (2017) also stated that, it is widely believed that, Brexit can its negative impacts on growth and job creation in the country. On the other hand, it is also viewed that, there may be evident that, there is potential benefits in terms of achieving more controlled immigration policies, the ability to strike trade deals with more freedom with lower levels of regulation and the potential savings to the public purse. Moreover, it is also viewed that, costs of financial services and foreign direct investment are more likely to last for only short time with long-term opportunities likely to emerge even in the currently affected areas (The Economist, 2016).

Social:

According to CBRE (2018), the hostility to and opposition towards immigration was one of the main drivers in UE Referendum vote rhetoric as a valid reason to leave the EU. Yet it is still seen by many official opinions that, a controlled migration policy would be both complicated and expensive. CBRE (2018) attributes the negative effect of immigration on house prices to the mobility response of the native population. This is viewed in the way in which the natives respond to immigration as the people with the highest income and financial abilities naturally leave certain housing areas. This generates a negative income effect on housing demand and pushes down house prices as the market will therefore be occupied by the immigrants with normally the lowest financial and educational abilities. On a different point of view, Sampson, et al. (2017) argued that, economists generally agree that net migration brings with a range of economic benefits. They also argued that, the impact on wages and unemployment rates is almost insignificant as migrants normally tend to be from well-educated backgrounds, of working age and with higher or equal spending power compared to natives and therefore are net contributors to the economy. Decreased net immigration as a result of stricter entry regulations would reduce the demand for housing. Wadsworth, et al (2017) stated that, according to Oxford Migration Survey 74% of recent migrants who have been in the UK for five years or less were in the private rented sector in the first quarter of 2015. Furthermore, the reduced demand in the number of rentable houses will increase the pressure on house prices too. The weakened demand for renting will also decrease number of buy to let landlords. It is therefore evident that, with net immigration increasing the UK households’ demand for housing will rise.

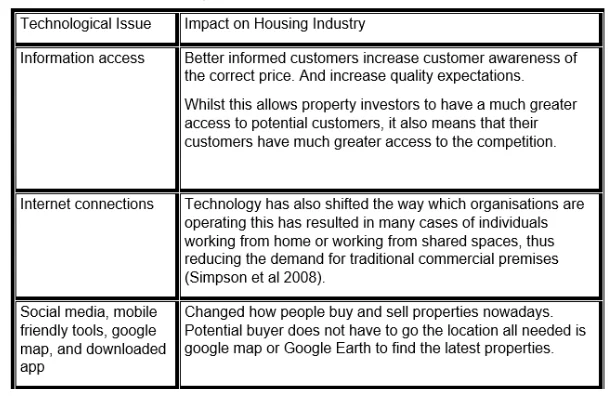

Technological:

Technology continues to influence all the sectors, nevertheless, the housing sector, in a form of for example a new vehicle such as truck platooning which announced in August 2018 by the government. According to CBRE (2018), the UK road trail would proceed this technology that has a potential significant implication on the property market if it provides relief to drivers from the strict but necessary rules governing driver hours. It could be argued that, Brexit can affect positively the technological innovation in the UK. According to Teresa May promises to supply of best material for the construction and building as well as latest Vehicle technology of the UK through reaching a new customs union deal with the EU, where the countries agree on not to impose tariffs on each other’s' goods and also have a shared tariff on goods coming in from elsewhere (Dhingra et al., 2016).

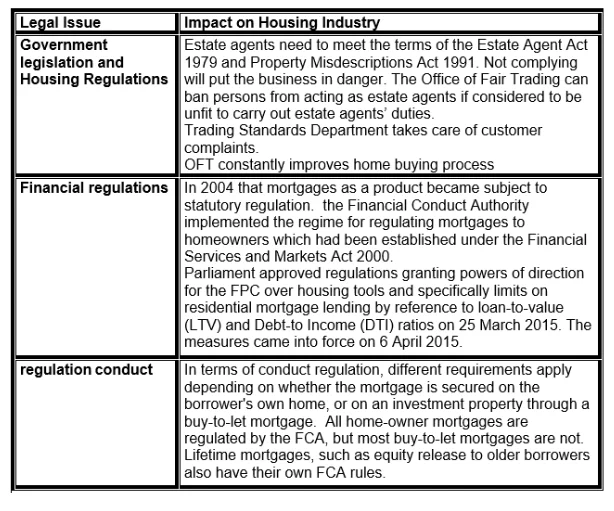

Legal:

According to the economist (2016), none of these will be directly affected by Brexit, as in the UK, there is a certain set of domestic jurisdictions that administrate real estate prices, with no major intervention from the EU. Therefore, the legal formalities required for land registration, leases and tenancies, the conveyancing process, land ownership, taking security over land and property taxes such as stamp duty land tax and non-domestic rates, are largely unaffected by Brexit (The economist, 2016)

Environment:

Continue your journey with our comprehensive guide to Property Valuation Approaches and Justification.

There is a serious concern over domestic environmental legislations as a direct result of Brexit. Fulbright (2016) stated that, obligations imposed on EU member states resulted in compulsory measures to improve the energy efficiency of buildings and also restrictions on letting commercial and domestic private property that do not meet energy efficiency standards. Environmental groups and professional bodies have expressed their concerns regarding leaving the EU and EEA where environmental standards in the UK could be shortened down (RICS, 2017). Furthermore, it is also regarded as concerning that, laws transferred through the Repeal Bill would be amended or revoked by the government in the future (CBRE, 2018). Although, EU law will be imported into UK law at the point of exit, the UK Government is exploring the possibility to adjust EU-derived planning and environmental laws after the UK has left the EU. Due to the need and urgency to get Brexit legislation passed by the Parliament may leave little space for major real estate legislations such planning law or infrastructure projects (Brown 2018).

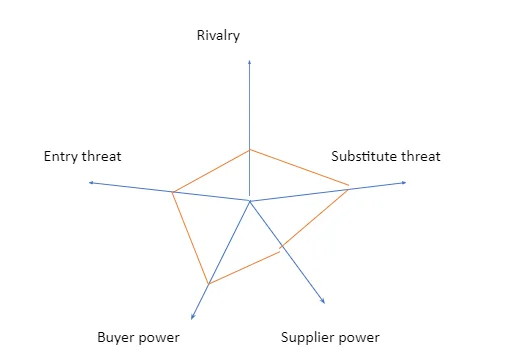

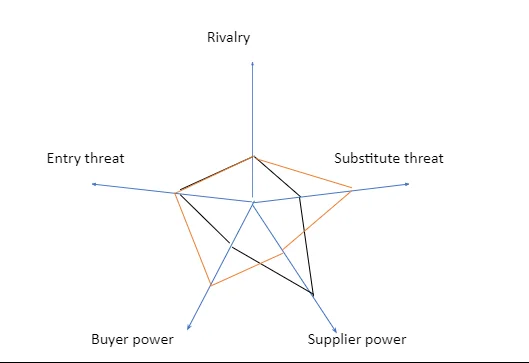

Microeconomic analysis (porter’s five forces):

Real estate agencies such as Foxton, Dexter’s and F&C UK Real Estate would benefit from using Porter Five Forces as an effective tool to gain profound understanding on how the five forces of competitiveness can influence the long-term profitability of the company as well as the development of strategies to enhance the competitive advantage for the company.

Threats of New Entrants:

New entrants in Real Estate come with ideas and innovative approaches as well as different ways of carrying out businesses. This inevitably puts various challenges and pressures on existing player Hunters, Foxton and Dexter’s., in the form of lowering pricing strategies, reducing of costs and providing new value adding options to its customers. In addition to managing all these challenges. One way to mitigate the threat of New Entrants can be achieved through research and development and the building capacities .to enable the business to introduction of innovative products and services. Another way to control the threat of New Entrants in the market can. It is perceived that New Entrants are less likely to enter a vibrant industry where key businesses such as Foxton, redefine the standards on a regular basis. This will largely significantly narrow the access for massive profits to be generated by new firms and will eventually discourage new businesses entering the industry.

Bargaining Power of Suppliers

It is evident that, almost all companies in the Real Estate industry procure their raw material from various suppliers. It is therefore likely that, suppliers with dominant position can decrease the profit margins where Foxton, Dexter’s and F&C UK Limited can generate in the market. It is also a fact that, suppliers with powerful status in the financial market can use their bargaining power to charge higher prices from businesses in Real Estate sector consequently this leads to a drop in the overall profitability of Real Estate businesses. An effective way for Hunters, Foxton and Dexter’s to mitigate the Bargaining Power of the suppliers can be achieved through the establishment of an efficient supply chain system with various and multiple suppliers in the markets. Another way can be through the trial and exploration of alternative products and designs using alternative materials which will provide a back-up plan for procuring raw materials with more cost effective and reasonable prices. Moreover, the development of loyal and long-term suppliers whose business is inter-dependant with the Real Estate business is another viable way to overcome this threat.

Bargaining Power of Buyers

Buyers are naturally demanding and constantly willing to buy the best products available with the least price possible. This is a challenging point for Hunters, Foxton and Dexter’s profitability in the long-term side of the business. The powerful status of customers will highly increase the bargaining power of the customers and their ability to seek increasing discounts and offers. This threat can be mitigated by establishing a large base of customers. This will help the business in two ways as it will reduce the bargaining power of the buyers and it will also enable the business to rationalise its sales and production process. Another option can be realised by continuous development and innovation of new products as customers often seek discounts and offers on established products.

Threats of Substitute Products or Services

New products or services nowadays can meet various and different customers’ needs which will cause the industry profitability to suffer. The clear examples of this are services such as Dropbox and Google Drive as substitutes to storage hardware drives. It is therefore evident that, in this modern world, the threat of a substitute product or service is high if it offers an added value that is uniquely different from what is available in the industry. Hunters, Foxton and Dexter’s can mitigate the threat of Substitute Products /Services by focusing on the service rather than the product. Another way to tackle this threat is by the profound understanding of the customers’ needs rather than the current buying trends of customers. It is also essential for Hunters, Foxton and Dexter’s to increase the switching cost for the customers.

Rivalry among the Existing Competitors

Intense rivalry among existing businesses in an industry will drive down prices and eventually shrink the overall profitability. Hunters, Foxton and Dexter’s Operate in a very competitive Real Estate industry, hence, this fierce competitive market will have a negative impact on the overall long-term profitability of the organisation. Hunters, Foxton and Dexter’s can tackle Intense Rivalry among the Existing Competitors in Real Estate industry by building a sustainable differentiation, building scale so that it can compete better or collaborate with the competitors to increase the market size rather than just competing for a small market.

Conclusion:

The research showed that, British property market will be severely affected if the United Kingdom opt to leave the European Union. It also found that, there is uncertainty on the economic and political environment of the UK due to unclarified polices and regulation. As it is evident that, uncertainty creates a negative environment to businesses, it is therefore essential that both the UK Government and the EU Commission maintain transparency about potential changes in environmental measures and legislations. Literature reviewed suggested that, Foreign direct investment (FDI) will be decreased dramatically after Brexit and it is unlikely that, the UK would strike great deals with non-EU countries that would reduce trade costs and boost FDI. The study found a positive correlation between net immigration and property prices as the decrease in the number of households and rentable demand would put downward pressure on house prices too. Weakened demand for renting will decrease the number of buying to let landlords looking to profit from weakening demand and falling rent prices. With net immigration increasing the number of UK households, demand for housing will rise. The predicted scenario illustrated below on the comparative structure analysis in ten years’ time when bargaining power of buyers increases as a result of demand decrease due to thousands of EU migrants leave the UK, substitute threat raises a result of opening the door to new technology innovations from all over the world, supplier power will be decreased as a result of Asian and other overseas developers will compete with EU developers.

References and bibliography:

- Ansell, Ben. 2014. “The political economy of ownership: Housing markets and the welfare state.” American Political Science Review, 108(02), pp.383–402.

- Ian Smith,2016, QBE What Brexit means for business. The Economic Journal . 125(587), pp.1393-1424.

- CBRE, 2018. Real estate market outlook,

- CEP, 2016. BREXIT ANALYSIS No. 3.

- Forrest, R., Koh, S., Wissink B. 2107. Series: The Contemporary City.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts