Research and Development CEO Share Ownership and Board Independent

Abstract

The researcher explored the relationship between the Chief Executive Officer ownership, board independence and the Research and development Spending (R&D). The researcher will utilize the Ordinary Least Square, Fixed effect and random effect model. This the researcher achieved by use of different analytical tools including Statistical Packages for Social Sciences (SPSS) and EVIEWS. For those who may find this challenging, seeking statistics dissertation help can provide valuable insights and support in navigating the complexities of statistical analysis.

Data and the expected relationships

In this study the researcher considered two regression models, the first regression estimated with consideration of the Profits as the dependent variable. This means that the multiple regression was done with the explanatory variables being; Ownership, Risk, MTBR, Board independence, Board size, CEO_Ownership, Firm Size, Leverage and finally R&D.

The researcher also estimated a model with the R&D being considered as the dependent variables while the others that is Ownership, Risk, MTBR, Board independence, Board size,, CEO_Ownership, Firm Size, Leverage and finally R&D as the explanatory variables.

This study explored the relationship between the relationship between the directors that is the number of directors and the expenditure allocations on the research and development. The researcher investigated the possibility of increase in the talents and abilities in the board room and its impact on Research and development spending by different organizations included in this study. The different organizations have not been named or reported directly in this study for ethical reasons. According to previous literature the studies which have undertaken an examination on the relationship between the Chief Executive officers compensation and the R&D.

Previous studies have also reported a positive relationship between the R&D and the CEO ownership rate (Cheng, 2004). According to their findings they found out that an increase in the ownership levels of the CEO increase the spending on research and developments. This is mostly attributed to the motivation brought about by the ownership and returns garnered from the same. The motivation to invest and make informed decision on how to steer the company is also more enhanced by the promise to organization and the value of the stocks.

The data adopted by the current study was for 287 companies, the data contained their historical values. The researcher used Regression equation to demonstrate the influence of CEO ownership on the decisions made by the officer concerning research and development. On the other hand the correlation matrix was done in order to demonstrate the liner relationship between these variables in the study. The additional variables in this study were adopted in order to be used as control variables which are a crucial factor in estimation of regression equation.

Hypothesis and Models

According to a study by Ryan et al., (2002), the stock option in most cases records a positive effect on the long run. Thus, the study postulates that the expectation is an increase in the CEO ownership of the company would in most cases affect their decision making in the long run. These decision would mostly be based on the expenditure allocated on the R&D projects. One would expect that after such a change in the increase of the CEO ownership of the stocks or the company the officer would now make more informed decisions for the best interest of the organization curtesy of his stakes and ownership in the firm.

In that note the hypothesis that the study answered are as follows:

H1; There is existent of a positive relationship between CEO ownership and firms’ spending on R&D.

According to previous studies the different firms which have majority independent directors insist on their spending on R&D spending which affect the firm’s performance positively in the long term (Chung et al. 2003). It is therefore expected in this study that a higher number of independent directors or board members would positively affect R&D spending. His is postulated in the hypothesis below:

H2; There positive relationship between the board independence and firms spending on the Research and Development.

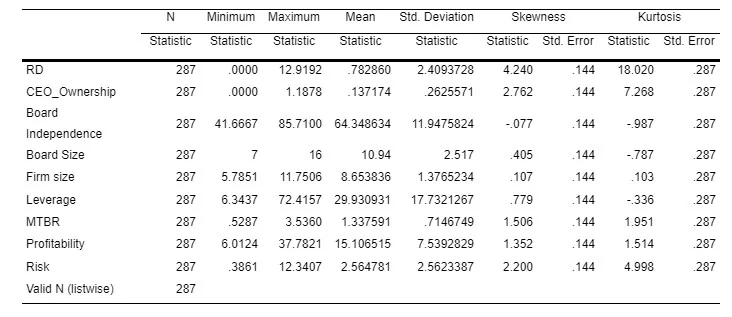

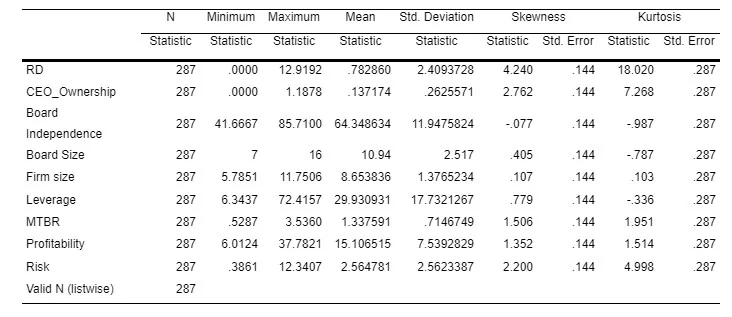

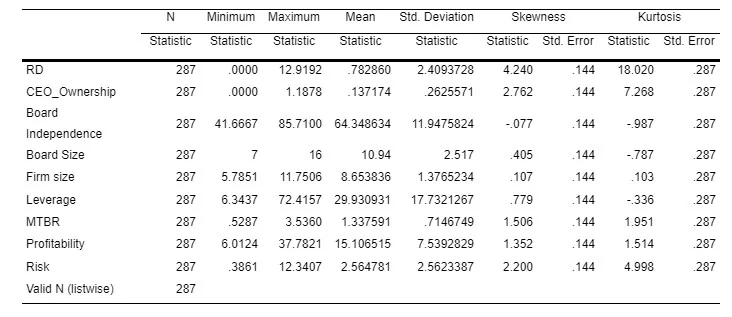

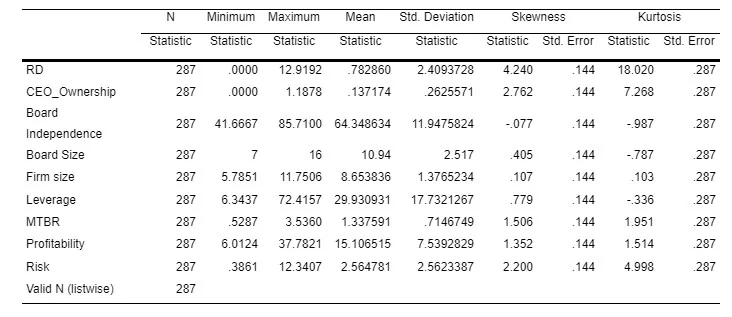

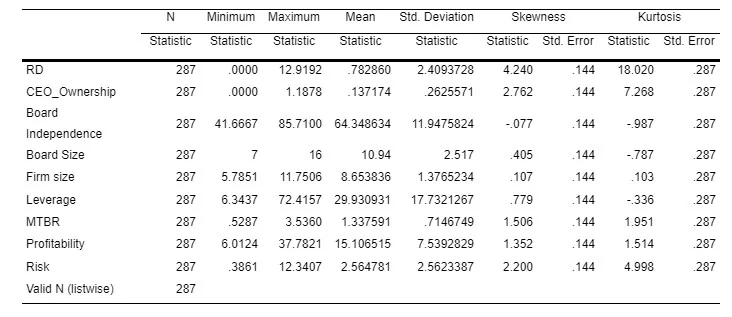

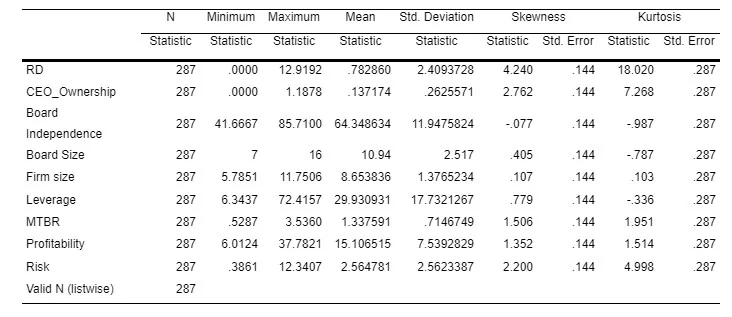

Table 1: Summary Statistics

The table1 above shows the descriptive statistics for the data that was adopted for this study. The findings there in shows that the mean for the R&D displayed the percentage or the expenditure that was allocated for the R&D of the available annual sales. The descriptive statistics shows that the CEO_Ownership was at a high of 0.14% of the issued shares by the respective companies. The Board of Directors independence was negatively skewed at a low of –0.07, which for this study express an almost normal distribution.

Regression

The findings on the regression equation shows that the ‘CEO_ownership’ had a positive relationship with the profitability of the organization. This is courtesy of the positive coefficient which indicates that an increase in the ‘CEO_ownership’ increases ‘Profitability’ of the organization. The coefficient also indicates that there is a positive relationship between the dependent variable and the independent variable ‘CEO_ownership’. The findings shows that there was a positive coefficient of 2.952411 between the Ownership and Profitability. This means that a unit increase in the ‘CEO_Ownership’ leads to a 2.952411units increase in the ‘Profitability’ of the organization.

The above findings also shows that a unit increase in the R&D leads to a 0.122610units increase in the Profitability of the organization. This is because if the organization invests in research and development this enables the organization to make more informed decisions and this leads to investments in potential stock which give good returns. If an organization invests in the R&D then the organization can understand why its environment better and this enables the organization to invest in capital investments which enables the firm to make more profits. Thus, the positive relationship.

Regression equation

The model above was estimated to demonstrate the relationship between the R&D and the CEO_Ownership. The same shows that there was a negative relationship between the dependent variable-CEO_Ownership and the explanatory variable R&D. The two variables have a coefficient of -0.933639, this shows that there was an inverse relationship between the R&D and the CEO_Ownership. This means that a unit change in the CEO_Ownership results to a -0.933639units change in the R&D.

Correlation matrix

The correlation matrix above in table2 shows the linear relationship between the different variables. The findings shows that there was a positive relationship between the ‘Board Size’ and R&D. This is because the two variables had a positive coefficient between them that is 0.193830262. This means that the two variables have are linearly related.

The above findings on the correlation matrix also shows that the two variables that is have an inverse linear relationship. The coefficient between CEO_Ownership and the R&D was -0.14670793, this shows that there was a negative linear relationship between the CEO_Ownership and the R&D spending. This means that the companies have a choice on either to invest on the R&D or to increase the CEO_Ownership at a particular financial year. The negative liner relationship on the correlation matrix above shows that the two change inversely.

The findings shows that there was a positive linear relationship between the ‘Board size’ and ‘R&D’. The two variables had a coefficient of 0.193830262, this is lower than the critical value that is 0.6. This shows that there was a linear relationship though the same was not as significant.

Summary findings

The study found out that there was a negative relationship between Research and development and the CEO_Ownership courtesy of their positive coefficient.

Further the study found that there was a positive relationship between the Board independence and the organization’s spending on the Research and Developments. The study also established that there is an insignificant linear relationship between the Chief Executive Officer’s ownership and the Board independence. Even though we demonstrated that the adoption of the random model is was preferred for this study. The study recommends non-liner relationship between variables for the future scholars.

Limitations and potential problems

The study explored the relationship between the CEO_Ownership and the R&D spending or the allocation for R&D. Some of the potential problems include the components of the dataset used in the study. The researcher ability to assess the correctness of the data is limited and as such the researcher made an assumption that the scholars who collected the data used the right methods and collected the correct data.

The second limitation is that the organization can utilize its funds on other activities including ploughing back or giving it out as dividends. This is another limitation, the researcher worked with the assumption that the positive relationship between the CEO_Ownership and the R&D means that an increase in the CEO_Ownership increases the motivation of the CEO and as such the CEO invests more on research and development in order for him to grow his own returns which at it grow the shareholders wealth. The researcher therefore made an assumption that the CEO did not invest in any other activity but increased the research and development when their ownership status was improved.

References

Billett, Matthew, Tao-Hsien King, and David Mauer (2007), “Growth opportunities and the choice of leverage, debt maturity, and covenants,” Journal of Finance, 62 (2), 697-730.

Burgstahler, David and Ilia Dichev (1997), “Earnings management to avoid earnings decreases and loss- es,” Journal of Accounting and Economics, 24 (1), 99-126.

Chen, H. L., & Hsu, W. T. (2009). Family ownership, board independence, and R&D investment. Family business review, 22(4), 347-362.

Cheng, Shijun (2004), “R&D expenditures and CEO compensation,” The Accounting Review, 79 (2), 305-328.

Chung, K. H., Wright, P., & Kedia, B. (2003). Corporate governance and market valuation of capital and R&D investments. Review of Financial Economics, 12(2), 161-172.

Dechow, Patricia and Richard Sloan (1991), “Executive incentives and the horizon problem: An empirical investigation,” Journal of Accounting and Eco- nomics, 14 (1), 51-89. Tsai, Shih-chuan (2008), “Information asymmetry and corporate investment decisions: A dynamic ap- proach,” The Financial Review, 43 (2), 241-271.

Kabir, R., Li, H., & Veld-Merkoulova, Y. V. (2013). Executive compensation and the cost of debt. Journal of banking & finance, 37(8), 2893-2907.

Continue your journey with our comprehensive guide to Reliability Analysis and Professional Insights.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts