Bitcoin And How It Affects Our Society

1: Introduction& Background

1.1 Background

The revolution in digital technologies as well as internet-based communication solutions has incorporated several changes in payment tool and techniques. The internet plays a critical role in establishment of high speed and global monetary transactions system such as net-banking services of banking firms, card-based payment, cryptocurrency, and many more. The concept of cryptocurrency is evolved in the form of digital currency for managing the cross-border transfer of money with the help of computers, internet, and smartphones (Liu and Tsyvinski, 2021). The cryptocurrency would be emerged as an important element of moneyless society when it is controlled by different domestic and international regulations. For improving the efficiency of financial transactions, government agencies are focusing to establish money structure to support the seamless global payments. Moreover, there have been several vulnerabilities identified in the context of cryptocurrency. This is because this type of currency does not have any significant institutional control because it is managed by a certain group of programmers or benefits from it effectively. For students seeking insights into this area, business dissertation help can provide them with valuable guidance and support.

In the context of cryptocurrency, the moneyless transactions are being carried with the help of block chain system that manages all types of transactions and controls the information flow with reference to distinct transactions requirements. The safety issues connected to cryptocurrency as well as finance with the private keycryptocurrency, which is connected to block chain, lessens the adeptness of hackers to interfere with online transactional steps. In dealing with monetary transactions through cryptocurrency, the safety issues are aligned with the digital payment that covers a variety of tasks such as bi-verifications in two nodes (Mukhopadhyay and Brooks, 2016). Moreover, the existence of block chain capabilities is being termed as dominant reason that assists entrepreneurs along with the investor for considering the cryptocurrency as an important tool for investment and it manages the moneyless transaction with simple identification of customer’s identity and safe movement of digitalised funding. In this context, the Bitcoin is being emerged as regionalised cryptocurrency but it not regulated by any kind of government agency (Chuen, Guo and Wang, 2017). It has been emerged as a great platform of business dealings because all types of payment transactions are being checked with the help of network nodes via crptography aligned with block chain within Bitcoin. In the establishment of moneyless economic system, Bitcoin and other cryptocurrencies would be emerged as a great support to develop network-based payment and investment systems. With reference to technological advancement, the role of Bitcoin has been enhanced on significant in various global dealing. However, there are several vulnerabilities in the usage of Bitcoins.In this context, the lack of legal control or taxation is being emerged as an important safety issues because it could increase the chances of cyber crimes and money laundering. Therefore, the security aspect of cryptocurrency has been perceived as an important area of concern. It does not have any kind of institutional control so as people would find the risk of information theft and frauds in digital payment transactions through cryptocurrency. This system is connected with various internet technologies and sensors that contain the data safety related issues while performing a variety of digital transactions (Liu, Tsyvinski and Wu, 2019). Therefore, the safety implications of Bitcoin and other cryptocurrency are playing a critical role in influencing the change in social perception and understanding. For assessing different social implications, this investigation is focused to evaluate different issues aligned with moneyless society and emergence of Internet of Things.

1.2 Rationale of Study

The rationale behind consideration of area of current investigation was that the role of digital payment services has been enhanced on significant manner in the establishment of moneyless economy. In this regard, the cryptocurrencies like Bitcoin have been emerged as the most popular the payment and investment tool within different countries. In this regard, the past studies have paid extra attention on the emergence of various digital or internet-based technologies and their application in developing an appropriate payment infrastructure and managing the seamless cross-border financial transactions. However, the current study was focused to present a distinct approach by analysing the safety implications of the change to a moneyless economy in relation to Cryptocurrency (Corbet, Peat and Vigne, 2020). In this regard, Bouri, Shahzad and Roubaud (2019) argued that the consideration of digital payment tools assists people for conducting the quick and seamless financial transactions within and outside the country, but internet-based tools contain several safety issues such as cyber-attack, financial frauds, and others. In similar way, the cryptocurrency is having several security vulnerabilities that could incorporate threats on various financial transactions. Therefore, the study would be found very effective to determine the important security implications in terms of block chain technology such as two-way validation which helps robotic execution of Cryptocurrency on the global arena. In the context of digital business operations, Bitcoin has gained huge popularity but it has faced several issues related to the attack from hackers as the financial transaction data have been collected (Makarov and Schoar, 2020). In the moneyless economy, safety of financial transaction is being perceived as key area of concern and cryptocurrency cannot be regulated by an appropriate institutional and legal structure so as there are no effective appropriate policies and rules that have been created with the government for Cryptocurrency because it is supervised with volunteer programmers group that increases the vulnerabilities of Bitcoin and other cryptocurrencies. Therefore, the researcher has examined both positive and negative social implications of Bitcoin to determine its role for changing the social perception and promotion of new framework for money less society (Alexander and Dakos, 2020). Moreover, this study is going to offer the in-depth understanding both positive and negative social implications that are aligned with the growing usage of cryptocurrency for managing monetary transactions or development of moneyless economy.

1.3 Report Structure

The first section is called the Introduction that provides a brief overview to reader about the motives and goals of study with reference to background and other factors that have influenced the researcher to consider the area of investigation. The second chapter is related to Literature Review. This section carries a detailed evaluation of a variety of secondary data that have been acquired from various books, journal, articles and others. By comparing the views and argument of different scholars about the cryptocurrency and other areas of current investigation, researcher is able to generate the in-depth understanding about the subject matter. The third chapter is associated with Research Methodology that contains a systematic comparison and evaluation of different research tools and techniques that are considered by researcher to manage data collection along with the selection of data analytics techniques with reference to nature of investigation. In the context of present investigation, researcher has considered different research tools and methods aligned with the qualitative research methodology. The next section presents the Research Findings. This section evaluates findings of current study with reference to data collected from various primary and secondary data. The next chapter is termed as Discussion in which the investigator is carried out an in-depth assessment and comprising of the findings of current study with reference to outcomes of past studies with reference to different research objectives. The last section is called as Conclusion and Recommendations. This part presents final outcomes with consideration of study aim. Moreover, researcher also suggests some recommendations in relation to area of current study.

2. Research Questions

With reference to study aim and objectives, researcher follows the below mentioned research question for managing the collection of data from different sources:

1. What are the key characteristics of Cryptocurrency within a cashless economy?

2. How does Bitcoin become huge popular?

3. What are different safety issues of Cryptocurrency in the digital world?

4. What are the positive and negative social implications of Bitcoin usage?

3: Literature Review

2.1 Introduction

The section of literature review assists researcher for carrying a detailed comparison of views of different scholars and findings of past studies. In this context, researcher considers different secondary sources of information such as online books, journals, internet-based articles, reports, and many more. In the context of present investigation, the section of literature review carries out a detailed evaluation of different elements of cryptocurrency in moneyless economy and social implications of the usage of Bitcoin and other cryptocurrencies (Narayanan and Goldfeder, 2016).

2.2 Characteristics of Cryptocurrency within a cashless economy

Hayes (2017) stated that Cryptocurrency is being emerged as the most popular internet-based tool to manage a variety of financial transactions. It plays a critical role in developing the moneyless economy. Currently, more than 1400 cryptocurrencies are working around the world within the cryptocurrency market, and this has a worth of about $ 300 billion. Moreover, cryptocurrency market has reported the massive change in development of new system for attainment of distinct requirements of moneyless economy. This is because it assists people to manage their monetary transactions through a secured encrypted transmission network. As per the DeVries (2016), the development of cryptocurrency would be taken place without consideration of third-party agencies because the transmission link is mainly developed by sender or receiver of funds. It reduces the cost of fund transfer that can be termed as an important characteristic of cryptocurrency to support the cashless economy. Furthermore, Raymaekers (2015) stated that cryptocurrency provides a platform for the person-to-person business dealing or financial transactions in absence of supervisory institution that can control the cryptocurrency system. Moreover, the lack of supervisory or institutional control offers the seamless cross-border transactions and business dealing that could promote the overall economic development. The absence of institutional framework plays an important role to support the digital economy.

The investigation Sovbetov (2018) determined that the tranparcny and anonymity have been perceived as an important characteristic of cryptocurrency. This is because the personal data along with other information about the financial transactions is not highlighted without consideration of sender and receiver. It enhances the level of privacy that could support the cashless economy. Yi, Xu and Wang (2018) stated that the key benefit of the cryptocurrency over the conventional currency is that it develops the 16 particular encoded crypto symbols over the block chain technologies and it protects customer’s ids and transactional data from unauthorised access. Moreover, it offers a chargeback ecosystem for supporting the digital transactions in which an individual could reverse the business dealing and financial transactions because the taking Bitcoin without permission could not be performed because it requires optimum execution of security protocols. Therefore, the privacy of data has been perceived as an important feature of cryptocurrency that may influence the popularity of cryptocurrency (Narayanan and Goldfeder, 2019). The research of Sovbetov (2018) concluded that the cryptocurrency is a regionalized cashless system so as it offers an extensive support to small business. This is because the business dealings of cash could be carried in all over the globe that have zero taxes. Moreover, it could be managed in little transaction cost as compared to conventional systems.

The research of Raymaekers (2015) determined that the Internet of Thing (IoT) is the most critical element of digital economy in which network based and automated system are being used to perform daily task and other activities. In this context, several factors are considered by different technologies such as authentication, data privacy and security, self-maintenance, and others. These variables are also playing an important role in developing cashless economic system (Narayanan and Goldfeder, 2016). Therefore, the concept of cryptocurrency could easily align with Block chain based IoT for creating an efficient payment system that could offer quick, efficient and reliable financial transaction system for supporting the cashless economy. Chuen, Guo and Wang (2017) argued that the concept of cryptocurrency offers a decentralised system like Bitcoin so as it do not require any third party permission for managing overseas financial transactions. In this regard, different nodes are established for creating an effective block chain network to regularise the seamless and secured payment.

2.3 Increased popularity of Bitcoin

Bitcoin is addressed as the most popular cryptocurrency in all over the world since its development in 2009. The assessment of the usage of Bitcoin has determined that United States of America and Romania are being considered as top countries for the usage of Bitcoin (Makarov and Schoar, 2020). The investigation of Alexander and Dakos (2020) determined that the Bitcoin has gained as a significant popularity as a cryptocurrency. This is because it offers higher volatility level as compared to traditional currencies used in different countries of the world. The usage of Bitcoin is significantly varied to traditional banking system. This is because the traditional banking system requires an appropriate institutional system and networks to manage the monetary flow and financial transactions (Liu, Tsyvinski and Wu, 2019). However, the Bitcoin uses an internet-based system and block chain so as it does not require any approval for carrying out the business and financial transactions in an efficient manner. Moreover, it is emerged as an important investment tool for managing a variety of investment activities. Hayes (2017) stated that Bitcoin seems to be a secure area during periods of unpredictability within US and other countries. As per the report of the Partisan Conflict Index and the Economic Policy Uncertainty Index, it plays a critical role to manage the investment with low uncertainties.Moreover, the security and stability that Bitcoin gives changes over a longer period of time are being perceived as key drivers that influence the popularity of Bitcoin.

In the context of contemporary investment conditions,investors prefer certainty over uncertainty and so if Bitcoin can provide certainty that plays an important role in influencing the popularity of Bitcoin as an investment tool (Yi, Xu and Wang, 2018). In the context of global pandemic of Covid-19, the Bitcoin promotes the cashless transactions because several individuals are involving in the work from home activities so as it supports management of business in lowering the transactional cost while managing the oversea business transactions (DeVries, 2016). Sovbetov (2018) stated that the Bitcoin uses the block chain technologies that can easily compatible with other technologies so as businesses and individuals could manage the financial transaction through Bitcoin. Therefore, the popularity of Bitcoin has been enhanced on significant manner in developing the cashless economic structure with low government interference.

2.4 Assessment of safety issues of Cryptocurrency in the digital world.

The growing usage of cryptocurrency in digital world to influence the cashless economy incorporates several safety issues and other problems. In this context, Sasand Khairuddin (2015) stated that the mechanism of cryptocurrency is aligned with the blockchain and other computer-based systems so as these platforms could become vulnerable for various cyberattacks like Dos attack. It could lead huge financial losses because the information about theft cannot be extracted again because the cryptocurrency structure has only one-way system. In similar way, the research of Vandervort, Gaucasand St Jacques (2015) has determined similar outcomes in which scholars identified that the information secured over the digital platforms can be unlocked by the hackers and it could be used for unethical objectives. For example, the Bitcoin Wallets can be manipulated by the phrase cods by developing the lost cryptocurrency that would enhance vulnerability to cyber-attacks. In this regards, the phrase codes are termed as the storing software that takes the information about the owners of cryptocurrency so as it increases privacy issues associated with personal information of clients. The investigation of Kimand Chung (2019) determined that cryptocurrency regionalization management does not have the ability for supervising the clients in an appropriate manner, because the handler of different digital platforms cannot stop customers from doing business dealings if it takes place, because there is an absence of a governing body to take full control, which is very different to a debit card that can be stopped in a similar incident by communicating to the governing bodies in charge to halt fraudulent activity (Yussofand Al-Harthy, 2018). Guadamuzand Marsden (2015) stated that several large group of companies are not accepting the cryptocurrency even after they are knowing the fact that there aren't financial institutions around that are reducing its production to supervise a moneyless society. The research of Liand Wang (2017) spotted the data manipulation within blockchain that could be performed. This is because the end-to-end encryption fails to cover the metadata that may influence the leakage of sensitive information. In the context of block chain system, the metadata is being used for managing the communication in the scattered from within the distribution ledger that cannot be collected at one centralised point. In this regard, the decentralised network of blockchain cannot be censored through digital channels (Shaikh, 2020).

He and et.al.(2018) determined that safety characteristics of cryptocurrency incorporate several safety issues while managing the digital transactions. This is because the cryptography protocol which is connected to block chain technologyin which the absence of government supervision could incorporate several threats. Drożdż and et.al.(2020) argued that the probability is termed as the biggest area of concern with the cryptocurrencies because other payment systems like Visa and Mastercard have developed different infrastructures that are massively scaled that enhance the speed of traditional systems. Babkin Alexander and et.al.(2017) stated that price volatility associated with the lack of inherent value is being termed as a critical area of concern because some individuals have characterised the cryptocurrency as a bubble but it could be overcome by linking the cryptocurrency with different kind of tangible and intangible assets. Moreover, it contains the huge operational risk because the centralised clearing house in the traditional payment system provides the guarantee about the validity of transactions that has appropriate ability to reverse the monetary transactions in a coordinated manner so as people would not find any kind reversal facilities in the cryptocurrency (Frizzo-Barkerand Green, 2020). Moreover, the people cannot restore the money when the keys of different accounts of cryptocurrency are stolen.

2.5 Evaluating the positive and negative social implications of Bitcoin

In the context of contemporary business environment and digital monetary transactions, there have been several positive and negative social implications of Bitcoin identified. De Filippiand Loveluck(2016) stated that the increase in usage of cryptocurrency like Bitcoin has played a critical role in elimination of human errors by facilitating the automatic detection of frauds. It creates virtual impenetrable fence around data, transactions, identities and other that creates the foundation of future smart contract in the context of cashless economy. The transactions These self-executing contracts are treaties with the terms of the agreement between buyer and seller being directly written into lines of code. The code and the agreements contained therein exist across a distributed, decentralized blockchain network. Tekobbeand McKnight (2016) stated that smart contracts are become popular in several industries from health care (digital identity) to politics (digital voting), from automobiles to real estate, and other so as Bitcoin technologies would play a critical role to establish new techniques and measures for different business transactions to support the cashless economy. Moreover, the application of blockchain technology would not be limited to corporates along with other companies working in the financial industries. For example, the Coindesk has considered the blockchain and other technologies for managing different security issue in different industries (Moniruzzaman, Chowdhuryand Ferdous, 2020). Therefore, the blockchain-based cryptocurrency like Bitcoin has been emerged as the most critical disruptive technologies in all over the world. The investigation of Drozd, Lazur, and

Serbin (2017) determined that the growing popularity of Bitcoin and other cryptocurrency is going to influence the usage of this technology for the protection of a variety of sensitive records and authentication of user’s identity within the banking sector. This is because the blockchain enables the authentication of service users and access devices without any kind of password protection because these types of transactions are being performed over different decentralised networks that help banking firms for developing the consensus between the two or more parties through a blockchain-based SSL certification (ur Rehman, Salah, Damianiand Svetinovic, 2019). Therefore, the distributed and decentralised network system would play a critical role in restructuring the contemporary social and business transaction.

As per the study of Limba, Stankevičiusand Andrulevičius (2019), it has found that the increase usage of Internet Of Thing has increased different security concern. In this regards, certain block-less distributed ledgers have been found very effective in enhancing the structural security of different types of IoT devices. The system of block-chain will provide a great support to different IoT devices to recognise and interact with each-other in a peer-to-peer manner without the need for a third party-authority that would have a significant impact on the social lifestyle of people. In addition to that, the usage of blockchain technologies within the cryptocurrency offers a two factor authentication that plays a critical role in developing a secured network of different business transactions (Adhami, Giudiciand Martinazzi, 2018).Taskinsoy (2019) stated that it reduces the requirements of middleman in business dealing because the consideration Bitcoin provides seamless transactions that may reduce the requirement of detailed paper work in creation of different business dealing influenced by the brokers, agents and legal representatives. It offers the peer-to-peer network structure that avoids the middleman in different standard practices. This thing leads to greater clarity in establishing the audit trails and lowering the payment confusion over who should pay what to whom that enhances the accountability of contemporary business transaction so as the Bitcoin is emerged as tools to establish the peer-to-peer networks in an efficient manner. Massaroand Bagnoli (2020) argued that the cryptocurrency blockchain can be resembled in the form of large property rights database so as people can execute two party contracts on different types of commodities and assets. Moreover, it provides an appropriate assistance to manage or facilitate the specialist mode of transfer that plays a critical role in the strategic planning and resource management. It plays a critical role in minimising the time and expense involved in making assets transfer.

The research of Massaroand Bagnoli (2020) disclosed that the existing financial system based on cash/credit creates the transactional history and incorporates the reference document for the bank or credit agency which is involved in establishment of transactions. However, the usage of Bitcoin and other cryptocurrencies establishes the unique exchange for making each transaction with reference to predetermined terms and conditions. It provides protection from the identify theft that could be aligned with financial history and other banking transactions(Narayanan and Goldfeder, 2016). Therefore, society will find the better confidentiality while managing a variety of financial and business transactions.Hayes (2017) stated that the usage of Bitcoin plays a critical role in reducing the transactions fees. This is because traditional banking and financial transaction are being performed by different agencies such banks, and others so as people and businesses have to pay transactional fees for writing cheques, fund transfer, cash handling, and other legal practics. However, the cryptocurrency is used decentralised network then different individuals or companies will find very low transactional fees or nil transactional fees for performing different financial transactions. Furthermore, the usage of cryptocurrency has been governed by any government agencies of any country so as the peer-to-peer mechanism of block chain technology influences a wide range of the cross-border transfer and financial transactions without facing any complication of traditional currency exchange fluctuations (DeVries, 2016). It plays a critical role in the investment planning and resource management.Raymaekers (2015) argued that block chain based technologies have been found very effective to provide individual ownership in dealing with different banking and financial transactions. This is because it avoids the requirements of third-party agencies.

However, there have been several negative social implications identified aligned with the usage of Bitcoin. Sovbetov (2018) stated that bitcoin nowadays is unfortunately being used for facilitating a wide range of illegal activities such as funding terrorist’s organisations along with the attainment of tax evasion goals within the international financial transactions. Tax evasion could be incorporated in the Bitcoin transactions because it follows a decentralised the unconventional architecture of Bitcoin, unlike to traditional financial system. Block chain technology that is used with Bitcoin does not only have disadvantages, but it offers several benefits to different companies. Moreover, Bitcoin features related to anonymity, security along with the privacy are significantly varied from traditional currency transactions that influence the unethical practices in the form of evasion. In this regard, different tactics or methods usually (Yi, Xu and Wang, 2018) deployed in the cryptocurrency related technologies to influence the anonymity, privacy and security so as government agencies have not found appropriate control on the bitcoin-based transactions. Therefore, there are not any kind any regulations developed by governments to govern the transactions associated with cryptocurrency. Furthermore, Narayanan and Goldfeder (2019)argued thatcryptocurrency is working like the cash currency so as it attracts a large set of the criminal community in which different criminals breaks into crypto exchanges, drains the crypto wallets as well as infects individual computers with malware for stealing cryptocurrency. Moreover, the cryptocurrency is also being used in different unethical activities such as terror funding, payment of drugs and others that leave various social implications. In the context of Bitcoin, different transactions are being conducted on the internet so as the hackers target the people along with the service handling or storage areas for conducting the phishing and malware attacks.Therefore,investors should have to be dependent upon the strength of their own system and different types of computer security systems, and third-party measures to protect the cryptocurrencies from theft (Sovbetov, 2018). These online attacks adversely affect the social perception and social activities in relation to Bitcoin.

As per the research of Raymaekers (2015), it found that cryptocurrencies like Bitcoin is highly reliant upon unregulated companies and some of these companies do not have appropriate internal controls that could increase the chances of fraud and theft as compared to financial or payment system regulated by leading financial institutions. Furthermore, the software should be update on regular manner to manage the cyber-attacks and other bugs. In the context of contemporary business operations, the consideration of blockchain technology to vendors may result a significant increment in the third-party risk exposure. It may leave adverse impact on the efficiency of business communities. The research of Narayanan and Goldfeder (2016)determined that an organisation faces a variety of business risk with the increased use of cryptocurrency like Bitcoin. The business risk is aligned with the loss of confidence over the digital currencies. This is because the nascent nature of the Bitcoin contains a high degree of uncertainty that hampers the efficiency and reliability of business transactions. Online platforms and digital currencies have generated a large trading activities and other transactions by speculators for attainment of the profit goals from the short-term or long-term holding. However,cryptocurrency-based transactions are not being monitored by a central bank of country, a national or international organization, and other firms(Makarov and Schoar, 2020). Therefore, the value of digital currencies is strictly determined by the market transactions and investment made by the participants along with the market demand so as the loss of confidence in Bitcoin and other cryptocurrencies may bring a huge collapse of trading activities and it would disrupt the business transactions.

Chuen, Guo and Wang (2017)stated that regulatory/compliance risk has been emerged as the most critical risk factor that is faced by society and business while dealing with the cryptocurrencies so as some countries are preventing the usage of the currency that may break anti money laundering regulations in different transactions. As a result of high level of digital complexity and decentralized nature of the Bitcoin, a single AML approach cannot be applied in an efficient manner because several individuals are involved in digital truncations within cryptocurrencies such as senders, receivers, processors (online mining along with the trading platforms), currency exchanges, and others. The investigation of Alexander and Dakos (2020) determined that the market risk is being termed as the most critical risk factor that may leave adverse impact on the efficiency of corporate procedures and business operations within cryptocurrencies. Moreover, the market risks have found idiosyncratic in which currency trades with reference to its market demand. There is a finite amount of the currency which means that it can suffer from liquidity concerns. Moreover, the limited ownership may increase the chances of the market manipulation so as people will find the high risk of change in currency rate (Hayes, 2017). Furthermore, the limited acceptance of cryptocurrenciesas well as the lack of alternatives can make digital currency more volatile as compared to other physical currencies and it would be influenced by speculative demand along with the exacerbated by hoarding. Therefore, it seems difficult to maintain stability in cryptocurrency transactions.

4. Research Aim and Objectives

Aim

The current study is aimed to evaluate the safety implications associated with change to a moneyless society in relation to cryptocurrency.

Objectives

As per the study aim, researcher considers the below mentioned objectives for managing different variables of current study:

To analyse safety characteristics of Cryptocurrency within a cashless economy.

To examine key elements that enhance the popularity of the Bitcoin.

To evaluate safety issues of Cryptocurrency in the digital world.

To assess the positive and negative social implications of Bitcoin.

5. Research Methodology

5.1 Introduction

Research Methodology plays a most crucial role in the contemporary studies because it supports researcher in selection of different research tools and tactics with reference to nature and study goals. This study is focused to evaluate the safety implications associated with change to a moneyless society in relation to cryptocurrency so as researcher has considered different research tools and approaches with reference to qualitative research methodology (Kumar, 2018). This section covers a detailed evaluation of different research elements and data collection tools in relations to study goals.

5.2 Research Philosophy

Research philosophy plays a critical role in developing an appropriate research methodology. As per the study goals, researcher adopted interpretivism research philosophy. The main reason behind consideration of interpretivism research philosophy was that it supports the researcher in completion of social studies or qualitative studies. This philosophy provides better return in qualitative investigation when researcher is looking to evaluate different social issues (Flick,2015). This philosophy assists researcher in evaluation of different variables and social risk factors that are aligned with the cryptocurrency. It seems a great tool to evaluate the objective reality and personal experiences of different individuals. This model seems a great tool to manage the unstructured interviews and assessment of useful information about the study goals in an efficient manner. On the other hand, the positivism research philosophy was not found suitable by researcher in the current study. This is because the positivism research philosophy provides better results when researcher is going to consider the quantitative study with consideration of a variety of statistical data and other quantitative information about the subject matter (Nayakand Singh, 2021). Therefore, interpretivism research philosophy did not find appropriate in the context of current investigation.

5.3 Research Approach

In the contemporary studies, researcher considers different research approaches with reference to nature and goals of investigation. It includes the inductive and deductive research approach. In the present study, investigator has tried to determine the social implications of the usage cryptocurrencies. Therefore, the researcher adopted the inductive research approach because it seems a great tool in exploring new phenomena about the area of investigation (Taherdoost,2016). The inductive research approach provides a great support in generating new theory with consideration of a variety of primary and secondary data. On the other hand, deductive research philosophy did not find a reliable tool in the area of current investigation because it offers a great result when researcher is going to carry out quantitative research with consideration of a variety of secondary data. The deductive research approach provides a great support when researcher is looking to test the hypothesis by determining the relationship among different variables (Mohajan,2018). In addition to that, it pays extra attention on causality that could not be aligned with current study goals. This is because the researcher has aim to evaluate the contemporary trends in cryptocurrencies and their role in the cashless economy so as researcher has focused on qualitative data that has removed the requirement of deductive research approach (Zangirolami-Raimundo, Echeimberg,and Leone, 2018). Moreover, the deductive research approach offers better results in the scientific research so as it would not provide appropriate result in the qualitative investigation in which researcher is looking to evaluate the contemporary social issues.

5.4 Research Design

With reference to nature of investigation, there are mainly two types of research design followed by researchers i.e. exploratory and descriptive. The exploratory research design was being preferred by researcher in which researcher tires to assess the in-depth understanding about new ideas (Igwenagu, 2016). The rationale behind consideration of exploratory research design was that it provides a greater flexibility so as researcher would be able to maintain the necessary changes in data collection and other research activities to meet the research goals in an efficient manner. It is considered as unstructured approach so as researcher could control different research operations. Therefore, exploratory research design is mainly preferred in qualitative study. On the other hand, the descriptive research design did not find a reliable tool in the context of current investigation because it follows a structured and rigid process that would provide better results in evaluation of statistical data by determining the relationship among different variables (Mishraand Alok, 2017). Therefore, research adopted the exploratory research design with reference to nature of study and process of data collection.

5.5 Data Collection

As per the study goals, researcher selected both primary and secondary sources of information. In the context of primary data collection process, researcher evaluates the views and arguments different individual through questionnaire-based survey, interviews and observation. With consideration of nature of current investigation, researcher considered the questionnaire-based survey to assess the useful information about the subject matter (Hegde,2015). The secondary sources of information includes online books, journals, and other internet-based articles that were being considered by investigator in literature review that supported investigator in assessing the in-depth understanding about different aspects of cryptocurrency such as key characteristics of cryptocurrency, security issues, social problems and others. In the context of secondary data collection, researcher is able to examine views and findings of different researchers or scholars with reference to different research objectives (Ngozwana,2018). By considering both primary and secondary sources of information, investigator would be able to gain reliable data to generate an appropriate conclusion with reference to research objectives.

5.6 Sampling and Sample Size

In the context of primary data collection, the sampling approach is being termed as the most critical part that supports investigator in selection of an appropriate group of participants to provide their responses in questionnaire-based survey. As per the study goals, researcher adopted purposive sampling approach because it assists researcher in selection of a target group of individuals that are having unique characteristic (Ledfordand Gast, 2014). However, the random sampling approach would not find a reliable tool to attain the study goals in an efficient manner in the current research. This is because the random sampling approach has been found very effective when the size of target population is very large. In the context of present investigation, the purposive sampling provides assistance to researcher for considering the finance analyst of different fine-tech companies as the target respondents to assess the useful information (Scott, 2016). To meet study objectives, a sample of 20 financial analysts was being considered for filling questionnaire.

5.7 Data Analysis

In the context of current investigation, researcher considered both primary and secondary sources of information so as thematic analysis would be emerged as the most reliable approach to evaluate responses of participants with reference to past studies. Moreover, the thematic analysis is termed as the most appropriate tool to evaluate the qualitative data (Giungatoand Tricase, 2017). On the other hand, the statical analysis did not find appropriate to evaluate the perception of participants because it would offer better results when researcher is looking to evaluate the relationship with different variables along with descriptive statistics for attainment of study goals. Moreover, the approach of statistical analysis is mainly applied in the scientific studies.

6. Bitcoin Architecture & Structure/consumer Spending Use of Bitcoin & the Consequences

6.1 Bitcoin Architecture & Structure

In the context of the architecture of the Bitcoin blockchain, there have been several important design elements are identified that are playing a critical role in managing different aspects of financial transaction and payment system (Hileman and Rauchs, 2017). In this regards, key elements of Bitcoin Architecture & Structure are listed below:

1. The Bitcoin application itself

2. The role of nodes is aligned with the overall blockchain network, and it could be also termed as the node discovery process

3. Transactions include all type of data or payment operations which is responsible for making up the blocks running within different nodes

4. The security implementation is also considered as an important element of Bitcoin structure that generates the blocks

5. The last element covers the process of adding new blocks within the blockchain.

The blockchain itself works on a network that contains a variety of distributed servers in which the core application is termed as the transaction database and it is also called as a secure ledger. The secured ledge is being shared by all nodes or servers that run with consideration of all elements of the Bitcoin protocol. Therefore, Bitcoin transactions are also termed as the decentralized transactions system and these transactions are also acting as a highly transparent ledger (Mukhopadhyay and Brooks, 2016). In this regard, any full node operational blockchain protocol is having appropriate capabilities to control or operate the entire blockchain locally after installing the full stack of the software. These softwares include the blockchain client syncs-up with the other nodes in the network and it also contains different elements of the peer-to-peer fashion. Therefore, that node or decentralised servers are maintaining the all Bitcoin transactions or any other application or technologies that are ruuning over the Bitcoin network (Chuen, Guo and Wang, 2017). In addition to that, the integrity along with the chronological order of transactions is being enforced by a variety of cryptographic rules and other guidelines. The nodes in the overall network are also using a peer-to-peer IP network for processing and verifying a variety of business transactions. Nodes that are having the same block optimise their individual databases for carrying out the consensus.

Bitcoin’s P2P network architecture has found a significant system as compared to a simple topology choice. In addition to that Bitcoin is also termed as the peer-to-peer digital cash system in the form of design in which the network architecture presents the reflection and foundation core characteristic. Furthermore, decentralization of control has been identified as the core design principle and that could only be achieved along with the maintained by a flat as well as the decentralized P2P consensus network for managing different financial and business transactions (Liu, Tsyvinski and Wu, 2019).

Apart from that, the term “bitcoin network” is also referred as the collection of different nodes that are running over the bitcoin P2P protocol. In addition to the bitcoin P2P protocol, there are several other protocols addressed that are responsible for managing different blockchain-based transactions and other platforms. For example, Stratum that is used for mining along with managing the mobile wallets. In the context of different payment transactions, these additional protocols are being provided by gateway routing servers that are having appropriate access to a variety of the bitcoin network with consideration of the bitcoin P2P protocol, and then it would be extended to the network of nodes which are responsible for running other protocols (Alexander and Dakos, 2020). For example, Stratum servers is responsible for connecting the stratum mining nodes with consideration of a variety of the stratum protocol to control the main bitcoin network and it plays a critical role in the bridging the Stratum protocol to different kinds of bitcoin P2P protocol. In similar way, the “extended bitcoin network” is also referred as the overall network that contains the bitcoin P2P protocol, pool-mining protocols, Stratum protocol, and any other related protocols that are connecting different components of the bitcoin system.

6.2 Usage of Bitcoin in Consumer Spending and it consequences

Payment businesses have gained huge transformation and revolution within the last few years. In this regard, different technologies from the blockchain technologies, and FinTech to AI along with the cryptocurrencies are playing a critical role to transform the international commerce and establishment of cashless economy. Therefore, the future of the payment industry is mainly influenced by mobile devices or computer-based systems. It happens at home and it plays a critical role in changing the consumer spending process. Therefore, various types of digital payment systems have transformed the online business and usage of bictoin in the consumer spending (Sovbetov, 2018). According to different estimations, e-commerce was recorded the revenue of $3.53 trillion from the sales of a variety of products in 2019 as compared to $2.92 trillion of 2018. Furthermore, the global e-commerce or internet-based business transactions is expected to rise up to $5.69 trillion. It plays a critical in development and growth of various digital platform or payment solutions and it would represent the expected growth of 61% within the next three years. The growth of the digital marketplace has also influenced and other or future belongs to the businesses that would record a significant growth in upcoming years. Therefore, the cryptocurrencies have recorded a huge growth to influence a variety of business transactions (The Rise Of Crypto As Payment Currency, 2019).

In the context of contemporary shopping trends, customers prefer different digital tools such as mobile phones or tablets for managing their purchases. In this regard, a whopping 72% of the e-commerce sales would be taken place through mobile device by 2021. It seems as an important approach for influencing the demand of digital payment solutions. Therefore, the high growth rate in the context of online spending of people has been emerged as key driver of the demand of Bitcoin and other digital payment solutions in which customers would be able to maintain the seamless payment in different nodes over within the decentralised network. It influences companies for developing and managing a variety of digital payment systems with reference to change in the market demand of e-commerce services (Narayanan and Goldfeder, 2019). As a result of the rapid change in the commercial activities, it seems that the demand and role of the online and offline payment system have stayed relatively stationary. In this context of e-business operation, the most sales are being carried out with the consideration of traditional methods such as credit and debit cards. Apart from that, various new technologies are offering new options along with the traditional payment systems.

In this regard, virtual assets like Bitcoin have been emerged as the powerful financial tools which can be used to the transfer the wealth immutably. It contains the decentralized network so customers and merchants would be able to transfer wealth between one another without consideration of any intermediary and banking organisation. On the other hand, the adoption of these types of currencies has currently found week because most of the blockchain-related payments have found the quite slow (DeVries, 2016).. In addition to that, the innovation will come in upcoming years that would accelerate the growth and market demand of the crypto-currency within different payments markets. A cryptocurrency has been addressed as the digital asset that is worked on the shared ledger which is called a blockchain. The blockchain cannot be altered so as it provides the assurance that the funds along with the goods could be transferred trustfully. This thing increases the transparency and it would also reduce the possibility of fraud. In upcoming years, it would not be considered as the surprising element for seeing that both merchants along with the consumers are turning to cryptocurrency payments that would be emerged as the cheap as well as more efficient payment solution in the context of cashless economy. Therefore, several merchants and other companies have already begun the onboarding crypto payments. For example, HUPAYX is known as the South Korean based payment platform which supports multiple cryptocurrencies that include Bitcoin (BTC), Ethereum (ETH), along with the PG/VAN based services that provide the international access to credit cards (Shaikh, 2020). This solution platform has found very effective in developing the fast and easy online and offline payments along with the safe storage of cryptocurrencies to manage their trading as well as the real-time market information. The company is focused to “transform traditional payment infrastructure” with all-in-one blockchain-based cryptocurrency payment platform. In addition to that, the combination of AML compliance, quick payment, transparency, and security, the compaby is going to offer multi-cryptocurrency wallets that could be accessible anytime and anywhere from different mobile devices. The catchy point is, with the applicability of the platform, they’re in the process to be implemented more than 400,000 locations in Seoul area.

In development of digital economy, spending of people plays a critical role and these companies are also committed for creating an efficient infrastructure or payment systems through which the national governments, solution providers, SMEs, corporates, and the general public could get benefited by making or receiving payments with consideration of different cryptocurrencies that plays a critical in influencing the global trade. In addition to that, cryptocurrency payments are having the great potential in creation of borderless and globalized economy (Frizzo-Barkerand Green, 2020). Moreover, an efficient payment system would be found very effective in managing the financial inequality by offering the fast along with the secured financial services to people without having any significant access to a bank. It plays a critical role in managing the online and offline payments in an efficient manner.

7. Consumer Bitcoin Shopping Scenario

The popularity of the Bitcoin has been enhanced on significant manner in the form of preferred alternative to traditional banking. In the context of contemporary business environment, the importance and popularity of cryptocurrency has been enhanced on significant manner. This is because it has gained huge popularity among the mass network of fundamental users that is more than with any other alternative digital payment currency, who rely on Bitcoin. Therefore, the preference of people and change in digital business transactions are being termed as key driver of to influence the market demand of Bitcoin and other similar currencies (Moniruzzaman, Chowdhuryand Ferdous, 2020).. In the context of retail business operations, the increase in usage of block chain based technologies influences the millions of Bitcoin users in all over the world so as uses are continuing to view this currency as a true asset, its prevalence will only propagate. In addition to that, this technology will be emerged as the internet in which the many startup technologies have recorded a significant growth along with the popularity over a few decades. In this regard, the Bitcoin will break through to the mass market in the form of the common alternative form of payment that would offer a significant encouragement to those individuals and companies have relied on traditional banking system in the past and looking to transform the business operations towards the cryptocurrency transactions (Hayes, 2017). However, the three most common types of retail consumers who are using the Bitcoin are millennials, the underbanked or unbanked population, and early adopters within general public.

In the context of contemporary business, each retail consumer has significant spirite willingness for using the Bitcoin despite its confusing market reputation in the some countries. In this regard, the Bitcoin has found a quite popular with the millennial generation because this age group regard Bitcoin highly as a store of value and an investment, often one that has found more valuable to them as compared to government bonds, stocks, and other investments (Chuen, Guo and Wang, 2017). In different studies, 93% of millennials saying that no-fee banking would be found a critical task when an individual is selecting the right or high value financial institution so as a low-cost alternative like Bitcoin welcomes the change. Millennials are looking to assess the new way of banking and payment system that would be different from the traditional systems that have been used by their parents and grandparents. In this context, Bitcoin ATMs and other related services enable financial transactions with instant funding that would not holds any funds, and people would not find any rejected transactions. In addition to that, these types of transactions do not contain any unnecessary fees beyond exchange rate costs for converting the cash into Bitcoin. Apart from that the most important reason for the preference of millennials towards the Bitcoin is the simple or tech-savvy nature of digital currency. This is considered the same generation that grew up with a smartphone in their hands or this generation has also witnessed the major transition in digital economy along with other technologies from an analog to a digital age during their formative years (Makarov and Schoar, 2020). With this acceptance and competencies with the latest technological advancements, millennials are more willing to take more risks and try to assess the new things along with the traditional banking. For instance, an older generation could consider an e-commerce platform that accepts cryptocurrency payments in the form of the considerable detractor that may be dissuade them from the online shopping practices, but millennials are viewing the growing popularity of Bitcoin and others as an exciting opportunity for saving the money.

The underbanked or unbanked locations that do not have sufficient access to traditional banking system with appropriate financial system then people would not find any kind of everyday financial products or services that are offered by most mainstream banks that include the credit cards and loans in which the popularity of Bitcoin has been enhanced as a great tool of investment. For example, 25% of all U.S. households are located in either unbanked or underbanked so as the Bitcoin is being emerged as the much-needed chance to manage the financial insecurity in unbanked locations (Raymaekers, 2015). For the underbanked, interacting with Bitcoin has been considered as a necessary gamble because the majority of communities are located in the underbanked and unbanked are mainly performing the financial transactions in cash. However, many of Bitcoin users are relying on bank accounts or credit cards for the purchase of Bitcoin. In this context of unbanked locations, the ability to use a Bitcoin ATM or cash-to-Bitcoin service are being emerged as a great approach for managing appropriate engagement among different individual with the digital currencies, especially it seems a quick and efficient approach (Sovbetov, 2018). In this regard, the availability of the physical kiosks along with the teller locations to buy Bitcoin instantly, people do not have to worry about substantial transaction limits or delays in transactions, which are commonly identified within the traditional banking institutions. In addition to that, it is important perceived that the underbanked have essentially been forced out of the traditional banking system in which the. dealing in Bitcoin would opens up a variety of the exciting financial possibilities and opportunities to manage a wide range of financial and business transactions.

In the context of contemporary business environment, early adopters have gained several opportunity with Bitcoin. This is because the interest and perception of people has influenced people to manage their investment in new form of new form of currency. Even today after decade of the emergence of Bitcoin, some people general public are pursuing it as a significant investment opportunity that would offer appropriate returns with liquidity. Furthermore, the spending through Bitcoin has been enhanced on significant manner in the contemporary retail operations (Sovbetov, 2018). Moreover, it plays a critical a critical role in attracting the investment because the general public believes that Bitcoin presents them with a tremendous opportunity as an investor because the value of Bitcoin has recorded the rapid growth. Therefore, it is only a matter of time before initial new-to-market volatility subsides almost entirely, and an diversified protofolio has found an effective tool for making it a stable investment. Recent market volatility aligned with the pandemic has influenced the resurgence of investor interest in Bitcoin. The application of Bitcoin gives budding entrepreneurs more avenues for capital creation and other transactions (Makarov and Schoar, 2020). It would support companies for assessing the competitive edge. Furthermore, the curiosity about new digital payment options has encouraged companies and other agencies to transform their perception and understanding about different variables of the strategic planning and investment management that are aligned with Bitcoin. In the context of future business environment, cryptocurrcies would be emerged as key driver to manage different communities and perception of customers. With numerous reasons to deal in Bitcoin, millennials, the underbanked, and curious members of the general public will persist in their active usage of Bitcoin and ATMs (Makarov and Schoar, 2020). In the upcoming years, the Bitcoin will be emerged as an important part of day to financial transactions and it plays a critical role to influence the financial stability of people.

8. Results of survey to assess Bitcoin acceptability

Introduction

As per the study goals, researcher performed a questionnaire-based survey to assess useful information about the subject matter. In this context, investigator selected 20 financial analysts with consideration of purposive sampling approach that are working in different fine-tech companies. The main reason behind consideration of financial analysts for the survey was that these individuals are having a significant understanding about the contemporary trends in financial market and growing popularity of cryptocurrencies (Scott, 2016). For assessing the reliable data from the responses of participants, selection of questions of questionnaire was being carried out with reference to study aim and objectives.

Thematic Analysis

Theme 1: Have you heard about the Bitcoin, Litecoin or other cryptocurrencies

The above table presents the response of participant when they were asked about their perception of about the Bitcoin, Litecoin or other cryptocurrencies in which the 19 out of 20 participant were accepted that they have maintained an appropriate understanding about different elements of cryptocurrencies.

Theme 2: The cryptocurrency is being emerged as the most critical element of cashless digital economy.

As per the above table, it has addressed that the majority of participants were provided their positive response towards the increase usage of cryptocurrencies in the context of cashless digital economy because 75% of participants were selected the option of Strogly Agreed and Agreed. It plays a critical role in influencing the efficiency of contemporary payment practices.

Theme 3: Bitcoin and other cryptocurrencies are having several important characteristics.

The above table presents the responses of participants when they were asked about the important characteristics of the Bitcoin and other cryptocurrencies in which researcher found mixed responses because the 25% of participants were selected the option of high liquidity, 20% of participants were considered the option of usage of encrypted system, 20% of financial analyst were selected the option of decentralised network, and only 20% individual were selected the option of the low cost of transaction.

Theme 4: Bitcoin has gained a significant popularity as an alternative to traditional payment system aligned with banking and other regulators

The above table represents the responses of participants when they were asked about the usage of Bitcoin as popularity as an alternative to traditional payment system aligned with banking and other regulators in which 40% of participants were selected the option of Agreed and 35% of participants were considered the option of strongly so as it can be perceived that the popularity of Bitcoin has been enhanced in significant in the contemporary financial operations.

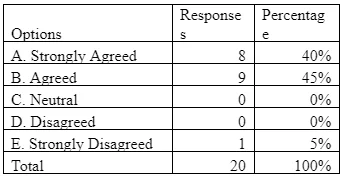

Theme 5: The lack of regulatory control has addressed as the key driver that influences the overall popularity of Bitcoin

When the participants were asked about the key elements that influence the overall popularity of Bitcoin then the majority of participants were provided their positive responses toward the lack of regulatory control over the crytpocurrencies as the key popularity driver. In this context, 95% of participants selected the options of Agreed and Strongly Agreed. Therefore, the lack of government control plays an important role in increasing the usage of Bitcoin.

Theme 6: Digital security related challenges are being considered as the most critical problem associated with cryptocurencies.

The above table determines the responses of participants when they were asked about different digital security related challenges within the cryptocurencies in which the 35% of participants selected the option of Strongly Agreed and 50% of participants selected the option of argeed so as the cryptocurencies are facing several security related challenges.

Theme 7: Bitcoin contains the several social risk factor aligned with their different usage.

With reference to study when researcher asked to participants about the most critical social risk factors aligned with the usage of Bitcoin then the researcher found mixed responses because 25% of participants selected the option of cyber attacks, 15% of participants selected the option of the risk devaluation, 20% of respondents considered the option of lack of government monitoring, 20% of participants selected the option of unethical payment and remaining 20% individual selected the option of lack of fund reversal. .

9. Research limits

In the context of present investigation, key research limits are explained below:

The present study considered both primary and secondary sources of information in which the selection of appropriate secondary from several source could limit the appropriateness of literature review.

The primary data collection was being performed with reference to views of financial analyst that would limit the efficiency of data collection process because researcher was not considered the users of Bitcoin as the participants.

The budget constraints limits the primary data collection to only 20 respondents

10. Conclusion

The above assessment has focused to evaluate the safety implications associated with change to a moneyless society in relation to cryptocurrency. For attainment of study goals, researcher has addressed multiple objectives. The first objective is to analyse safety characteristics of cryptocurrency within a cashless economy in which the assessment of primary and secondary research concludes that cryptocurrency market has reported the massive change in development and it plays a critical role for development of new system for attainment of distinct requirements of moneyless economy. This is because it assists people to manage their monetary transactions through a secured encrypted transmission network. Moreover, the tranparcny and anonymity have been perceived as an important characteristic of cryptocurrency that would simulate the market demand of cryptocurrency in upcoming years.

The second objective is to examine key elements that enhance the popularity of the Bitcoin and the comparison of both primary and secondary research findings have reported similar outcomes in which researcher concludes that several factors influence the popularity of cryptocurrencies such as the higher volatility level as compared to traditional currencies used in different countries of the world, Bitcoin uses the block chain technologies that can easily compatible with other technologies so as businesses and individuals could manage the financial transaction through Bitcoin. Further assessment concludes that the role of contemporary retail operations and growing demand of e-commerce services have presented the Bitcoin as an alternative payment tool.

The third objective is to evaluate safety issues of Cryptocurrency in the digital world in which the comparison of a variety of findings in the present study addressed several safety issues aligned with Bitcoin because it vulnerable for various cyberattacks like Dos attack, and several large group of companies are not accepting the cryptocurrency due to lack of government control and decentralised network of blockchain cannot be censored through digital channels.

The last objective of current investigation is to assess the positive and negative social implications of Bitcoin in which the assessment of a wide range of primary and secondary data concludes that the increase in the usage of cryptocurrency like Bitcoin has played a critical role in elimination of human errors with consideration of automatic detection of frauds. It creates virtual impenetrable fence around data, transactions, identities and other that creates the foundation of future smart contract in the context of cashless economy. Moreover, it seems a great tool to establish the peer-to-peer networks in an efficient manner. However, it could increase the chances of the tax evasion that could be incorporated in the Bitcoin transactions with the help of decentralised the unconventional architecture. It supports various criminal transaction also in the form of unethical funding and financial transactions.

Reference

Adhami, S., Giudici, G. and Martinazzi, S., 2018. Why do businesses go crypto? An empirical analysis of initial coin offerings. Journal of Economics and Business, 100, pp.64-75.

Alexander, C. and Dakos, M., 2020. A critical investigation of cryptocurrency data and analysis. Quantitative Finance, 20(2), pp.173-188.

Babkin Alexander, V., Burkaltseva Diana, D., PshenichnikovWladislav, W. and Tyulin Andrei, S., 2017. Cryptocurrency and blockchain-technology in digital economy: development genesis. St. Petersburg State Polytechnical University Journal. Economics, 67(5), pp.9-22.

Bouri, E., Shahzad, S.J.H. and Roubaud, D., 2019. Co-explosivity in the cryptocurrency market. Finance Research Letters, 29, pp.178-183.

Chuen, D.L.K., Guo, L. and Wang, Y., 2017. Cryptocurrency: A new investment opportunity?. The Journal of Alternative Investments, 20(3), pp.16-40.

Corbet, S., Cumming, D.J., Lucey, B.M., Peat, M. and Vigne, S.A., 2020. The destabilising effects of cryptocurrency cybercriminality. Economics Letters, 191, p.108741.

De Filippi, P. and Loveluck, B., 2016. The invisible politics of bitcoin: governance crisis of a decentralized infrastructure. Internet Policy Review, 5(4).

DeVries, P.D., 2016. An analysis of cryptocurrency, bitcoin, and the future. International Journal of Business Management and Commerce, 1(2), pp.1-9.

Drozd, O., Lazur, Y. and Serbin, R., 2017. Theoretical and legal perspective on certain types of legal liability in cryptocurrency relations. Baltic Journal of Economic Studies, 3(5), pp.221-228.

Drożdż, S., Kwapień, J., Oświęcimka, P., Stanisz, T. and Wątorek, M., 2020. Complexity in economic and social systems: cryptocurrency market at around COVID-19. Entropy, 22(9), p.1043.

Flick, U., 2015. Introducing research methodology: A beginner's guide to doing a research project.

Frizzo-Barker, J., Chow-White, P.A., Adams, P.R., Mentanko, J., Ha, D. and Green, S., 2020. Blockchain as a disruptive technology for business: A systematic review. International Journal of Information Management, 51, p.102029.

Giungato, P., Rana, R., Tarabella, A. and Tricase, C., 2017. Current trends in sustainability of bitcoins and related blockchain technology. Sustainability, 9(12), p.2214.

Guadamuz, A. and Marsden, C., 2015. Blockchains and Bitcoin: Regulatory responses to cryptocurrencies. First Monday, 20(12-7).

Hayes, A.S., 2017. Cryptocurrency value formation: An empirical study leading to a cost of production model for valuing bitcoin. Telematics and Informatics, 34(7), pp.1308-1321.

He, S., Wu, Q., Luo, X., Liang, Z., Li, D., Feng, H., Zheng, H. and Li, Y., 2018. A social-network-based cryptocurrency wallet-management scheme. IEEE Access, 6, pp.7654-7663.

Hegde, D.S. ed., 2015. Essays on research methodology. Springer.

Hileman, G. and Rauchs, M., 2017. Global cryptocurrency benchmarking study. Cambridge Centre for Alternative Finance, 33, pp.33-113.

Igwenagu, C., 2016. Fundamentals of research methodology and data collection. LAP Lambert Academic Publishing.

Kim, M.S. and Chung, J.Y., 2019. Sustainable growth and token economy design: The case of steemit. Sustainability, 11(1), p.167.

Kumar, R., 2018. Research methodology: A step-by-step guide for beginners. Sage.

Ledford, J.R. and Gast, D.L. eds., 2014. Single case research methodology: Applications in special education and behavioral sciences. Routledge.

Li, X. and Wang, C.A., 2017. The technology and economic determinants of cryptocurrency exchange rates: The case of Bitcoin. Decision support systems, 95, pp.49-60.

Limba, T., Stankevičius, A. and Andrulevičius, A., 2019. Cryptocurrency as Disruptive Technology: Theoretical Insighs.

Liu, Y. and Tsyvinski, A., 2021. Risks and returns of cryptocurrency. The Review of Financial Studies, 34(6), pp.2689-2727.

Liu, Y., Tsyvinski, A. and Wu, X., 2019. Common risk factors in cryptocurrency (No. w25882). National Bureau of Economic Research.

Makarov, I. and Schoar, A., 2020. Trading and arbitrage in cryptocurrency markets. Journal of Financial Economics, 135(2), pp.293-319.

Massaro, M., Dal Mas, F., Chiappetta Jabbour, C.J. and Bagnoli, C., 2020. Crypto‐economy and new sustainable business models: Reflections and projections using a case study analysis. Corporate Social Responsibility and Environmental Management, 27(5), pp.2150-2160.

Mishra, S.B. and Alok, S., 2017. Handbook of research methodology. Educreation,.

Mohajan, H.K., 2018. Qualitative research methodology in social sciences and related subjects. Journal of Economic Development, Environment and People, 7(1), pp.23-48.

Moniruzzaman, M., Chowdhury, F. and Ferdous, M.S., 2020, February. Examining usability issues in blockchain-based cryptocurrency wallets. In International Conference on Cyber Security and Computer Science (pp. 631-643). Springer, Cham.

Mukhopadhyay, U., Skjellum, A., Hambolu, O., Oakley, J., Yu, L. and Brooks, R., 2016, December. A brief survey of cryptocurrency systems. In 2016 14th annual conference on privacy, security and trust (PST) (pp. 745-752). IEEE.

Narayanan, A., Bonneau, J., Felten, E., Miller, A. and Goldfeder, S., 2016. Bitcoin and cryptocurrency technologies: a comprehensive introduction. Princeton University Press.

Narayanan, A., Bonneau, J., Felten, E., Miller, A. and Goldfeder, S., 2019. Bitcoin and cryptocurrency technologies. Cursoelaborado pela.

Nayak, J.K. and Singh, P., 2021. Fundamentals of Research Methodology Problems and Prospects. SSDN Publishers & Distributors.

Ngozwana, N., 2018. Ethical Dilemmas in Qualitative Research Methodology: Researcher's Reflections. International Journal of Educational Methodology, 4(1), pp.19-28.

Raymaekers, W., 2015. Cryptocurrency Bitcoin: Disruption, challenges and opportunities. Journal of Payments Strategy & Systems, 9(1), pp.30-46.

Sas, C. and Khairuddin, I.E., 2015, December. Exploring trust in Bitcoin technology: a framework for HCI research. In Proceedings of the Annual Meeting of the Australian Special Interest Group for Computer Human Interaction (pp. 338-342).

Scott, B., 2016. How can cryptocurrency and blockchain technology play a role in building social and solidarity finance? (No. 2016-1). UNRISD Working Paper.

Shaikh, I., 2020. Policy uncertainty and Bitcoin returns. Borsa Istanbul Review, 20(3), pp.257-268.

Snyder, H., 2019. Literature review as a research methodology: An overview and guidelines. Journal of business research, 104, pp.333-339.

Sovbetov, Y., 2018. Factors influencing cryptocurrency prices: Evidence from bitcoin, ethereum, dash, litcoin, and monero. Journal of Economics and Financial Analysis, 2(2), pp.1-27.

Taherdoost, H., 2016. Sampling methods in research methodology; how to choose a sampling technique for research. How to Choose a Sampling Technique for Research (April 10, 2016).

Taskinsoy, J., 2019. Blockchain: moving beyond bitcoin into a digitalized world. Available at SSRN 3471413.

Tekobbe, C. and McKnight, J.C., 2016. Indigenous cryptocurrency: Affective capitalism and rhetorics of sovereignty. First Monday.

ur Rehman, M.H., Salah, K., Damiani, E. and Svetinovic, D., 2019. Trust in blockchain cryptocurrency ecosystem. IEEE Transactions on Engineering Management, 67(4), pp.1196-1212.

Vandervort, D., Gaucas, D. and St Jacques, R., 2015, January. Issues in designing a bitcoin-like community currency. In International Conference on Financial Cryptography and Data Security (pp. 78-91). Springer, Berlin, Heidelberg.

Yi, S., Xu, Z. and Wang, G.J., 2018. Volatility connectedness in the cryptocurrency market: Is Bitcoin a dominant cryptocurrency?. International Review of Financial Analysis, 60, pp.98-114.

Yussof, S.A. and Al-Harthy, A.M.H., 2018. Cryptocurrency as an alternative currency in Malaysia: issues and challenges. ICR Journal, 9(1), pp.48-65.

Zangirolami-Raimundo, J., Echeimberg, J.D.O. and Leone, C., 2018. Research methodology topics: Cross-sectional studies. Journal of Human Growth and Development, 28(3), pp.356-360.

The Rise Of Crypto As Payment Currency. (2019). [Online]. Accessed through:< https://www.forbes.com/sites/ilkerkoksal/2019/08/23/the-rise-of-crypto-as-payment-currency/?sh=68d6b9f926e9>. [Accessed on 29th July 2021].

Continue your exploration of An Investigation into the Use of Facial Recognition Technology to Enhance Gamers’ Engagement with our related content.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts