Brexit's Impact on Nissan: A No-Deal Analysis

Chapter 1: Introduction

1.0: Chapter Introduction

Historically, the major uncertain events such as the 9/11 terror attacks and the assassination of President John F. Kennedy have resulted in sudden surges impacting the political and economic landscape not only in the country but also affecting the global economy. However, these shock and their impacts subsided reasonably quickly, particularly among the general population and the economic performance. The decision in 2016 by the United Kingdom (UK) to leave the European Union (EU) resulted in sharp flow in the stock market and political tension at both country level and global arena. However, unlike the other unexpected events, the economic and political impacts of Brexit have been substantially different. In 2016, immediately vote in favor of leaving the EU, there was experienced an increase and persistence in political and economic uncertainties (Bloom et al., 2019). Experts believed that this uncertainty was attributable to agreements on how to go about leaving the EU. Unfortunately, this uncertainty has dragged on for years since the vote to leave the EU, particularly due to the speculations of the possibility of a second referendum. (Menon and Portes, 2018). From a geo-political standpoint, experts believe that Brexit was an unprecedented move and that it led to economic and political shocks in the entire world, especially in Europe. Political pundits in the country, for instance, offered statistical suggestions that the probability of leaving the EU was nothing more than 30% (Campbell, 2019). And despite the vote for the country to exit the Union, there has yet to be a deal made on the terms of their exit with regards to political and economic policies and collaboration. This study focuses on establishing how a No-Deal Brexit outcome would impact the operations of the Nissan Company in the United Kingdom.

1.1: Background of the study

In 1986, Margaret Thatcher opened Nissan’s vehicle manufacturing plant off the A19 at Washington near Sunderland (Bailey and De Propris, 2017). Since then Nissan`s operations have expanded to cover over 800 acres of productions sites, which produce well over 519,000 cars each year. Conn (2018) outlines that export of Nissan vehicles to other EU nations account for more than 55% of Nissans total annual revenue. In the 2016-2017 financial year, Nissan-UK’s annual reports show that £6.4 billion-worth of sales were raked in, leading to the employment of over 7755 workers (Menon and Portes, 2018). The company also sent up to £427 million to cater for employee salaries (Conn, 2018). Approximately half of the 5,000 automobile parts and components in UK-made cars are manufactured domestically within British borders (Automotive News Europe, 2019). UK’s withdrawal from the EU will highly likely lead to higher vehicle-import tariffs. This will unprecedentedly raise the cost of cars manufactured in the country. Besides, the Nissan Company would most likely have to deal with declined profits due to the 55% imposition of tariffs on vehicle parts. Due to this uncertainly caused by Brexit, Nissan’s shares fell over 12% in the days following the referendum (Bailey and De Propris, 2017). Persistence of its effects may lead to cutting down of costs which leads to loss of jobs and minimized revenues. The conclusion of a free trade agreement between the European Union and the United Kingdom can be a potential result of the Brexit negotiations (Blagden, 2017), which will only have a positive impact on Nissan by minimizing the negative effects of the tariffs imposed. Reid (2019) also points out that the basic requirement for a free trade agreement is that most vehicle components come from the exporting country. This means that Nissan must be involved in the production of up to 50% of British car components to qualify for duty-free exports to the European Union. This requires Nissan to halve the foreign components, which can significantly affect the brand and quality of the vehicle parts. If Nissan cannot achieve this, a 10% duty could be imposed on all EU imports (Reid, 2019).

1.2: Research problems

The exit of the UK from the EU without a safe agreement to continue smooth trade will lead to the regulation of all trade relations between the UK and the whole EU in accordance with the rules of the World Trade Organization. According to Campbell (2019), in contrast to the guidelines and rules in the European Union, this rule does not allow harmonized product standards and, as such, will see the introduction of harmonized product standards and subsequent consumer control at European borders. This will undoubtedly make a large contribution to the additional costs of border delays and the impact of tariffs, which will have a significant impact on UK businesses after Brexit. Carlos Gossn, President of Nissan, focused on two main points after the vote to leave the European Union. He stressed that Nissan would not make additional investments because of the uncertainty of future British trade agreements (Halliday, 2019). He also stressed that Nissan would contemplate cutting down on its UK-based operations, if Brexit significantly increased trade and cost barriers. But what exactly are some of the obstacles and potential trade impacts that Nissan faces at Brexit without agreement? How will Brexit without agreement affect the company's internal and external environment? Is there a positive effect on Britain's exit from the EU on the economy and various manufacturing companies like Nissan? And how can Nissan reduce the impact of the negative results that Brexit had hoped for without an agreement?

1.3: Research Aim and Objectives

While no agreement has yet been reached on the trade and political aspects of Brexit, the decision for UK to exit EU has already seen significant impacts on the UK economy and multiple companies including Nissan. A possible favorable outcome of Free trade agreement could cushion some of the negative impacts especially with regards to tariffs. However, a no-deal outcome could have adverse impacts on the countries trade, economy and companies. The study aims to evaluate the possible impacts of a no-deal Brexit to Nissans operations within the UK.

1.3.1: Research Objectives

The major objectives guiding the study include:

To highlight the potential trade barriers and economic impacts as a result of a no-deal Brexit

To evaluate the impacts of a no-deal Brexit to Nissans internal environment and operations

To evaluate the impacts of a no-deal Brexit to Nissans external environment and operations

To highlight recommendations for cushioning negative impacts of a no-deal Brexit on Nissans operations

1.3.2: Research Questions

What are the potential trade barriers and economic impacts of a no-deal Brexit?

How will Nissans internal environment and operations be impacted by a no-deal Brexit?

How will Nissans External environment and operations be impacted by a no-deal Brexit?

In what ways can Nissan cushion any negative impacts of no-deal Brexit?

1.4: Study Rationale

The no-deal Brexit vote has significantly thrown the country’s economy into a wide range of uncertainties which has already impacted a number of industries in the UK. With the expected changes in trade agreements and financial policies, Investors and companies are in a dilemma with regards to how to proceed with their various investments which hugely rely on the economic and trade agreements between the countries of the EU. UK companies specifically are more likely to be severely impacted given the increased tariffs as well as import and export duties and the new financial environment which is likely to result upon a no-deal Brexit conclusion. This study as such aims to evaluate and predict the major trade barriers and economic impacts likely to arise from a no-deal Brexit in a bid to enlighten companies on what to expect and how to maneuver the economic situation. Through the Use of Nissan as a case, the study will effectively point out the primary concerns that are likely to result from a no-deal Brexit and how to manage them.

Chapter 2: Literature Review

2.0: Chapter Introduction

This chapter presents a narrative review of the various theories, concepts and information provided by other peer reviewed scholars with regards to Brexit and its impact on the UK economy and individual companies specifically its impact to the operations of Nissan. A majority of the sources reviewed include business and economic review journal articles, company information from Nissans company websites as well as books on economic and political concepts and policies The section critically evaluates available information on the the various effects of Brexit on Nissans UK operations as well as the potential trade and economic barriers to be faced upon a no-deal British exit.

2.1: Brexit

The vote for the exit of United Kingdom from the European Union in 2016, popularly termed as British Exit or in short Brexit was a surprise to the country as well as the whole world leading to economic and political shock that significantly left long and short term effects (Tetlow and Stojanovic, 2018). Further discussions on the terms of the exit, yet to be agreed upon and finalized have effectively led to an uncertainty with regards to trade agreements between UK and other countries in the EU. Amstrong and Portes (2016) emphasize that the panic in itself has already impacting the economy significantly as evident in the collapse of the stock market and subsequent country GDP. However while the effects have persisted with the uncertainty unlike many other occurrences impacting global and national economy, a no-deal exit of the UK at the end of the discussions is likely to cause much sharper impacts that will significantly impact organizations and companies alike (Wolff, 2019).

2.2: Economic Impacts and Barriers of Brexit

Brexit has already effectively impacted UKs Macro economy on a short term level and is set for extended long term effects. According to Moschieri and Blake (2019), a concensus has been arrived at even among the proponents of the exit move that the exit will have a short term negative shock to the EU economy as well as a possible widespread impact on UK, assuming no deal is arrived at with regards to Trade agreements. This, Begg and Mushovel (2015) confirm, will be as a result of two prominent factors: the uncertainty of the referendum’s outcome and the costs of changing to a new trade regime. Further the financial markets reaction due to a looming financial instability and currency volatility is bound to significantly impact local economic activity further amounting to the negative impacts of the exit (Begg and Mushovel, 2015). According to Reenen (2016) the loss of GDP impacted by British exit will significantly impact lower level of employment leading to loss of jobs and shut down of companies within the country. This includes among the potential effects that Nissans’ operations could face as a company operating in the UK. Tetlow and Stojanovic (2018) highlights that Britain’s main expectations from the EU revolves around over 12% of the demand for its goods and services, which translates to 3.3 million jobs that are being risked pending Brexit. The UK’s economy is gradually becoming reliant operations in the service sector to power exports and job creation. According to the ONS data on final demand, cited by Stevovic, (2018), the proportion of services in UK’s total exports rose from 28% to 41% between 1997 and 2013. This growth is mainly due to the rapid growth in the provision of main services, including financial services and business services. These sectors are now as crucial to the country’s exports as other manufacturing industries, including the, aerospace, computing & electronics, and pharmaceutical industries that are likely to adversely affected by a no-deal Brexit. One such company includes Nissan. According to the British Governments assessment of the economic impacts of Brexit cited by Bulmer and Quaglia (2018), the North East of England is at risk of the deepest damage given the reliance of that area on increased exports to countries in the EU. Nissan located near sunderland puts it within this location and as such at a higher risk of impact.

2.3: Theoretical Framework

A business environment impacting its operations according to Gitman (2018) comprises a sum collection of factors for consideration by companies or organizations including: employees, customers’ expectations, demand and supply, administration, suppliers, owners, tech-innovation, social trends, market trends, economic changes and a wide range of many others, classified between external and internal business environment factors. Each of these factors directly impacts a company’s operations and has the capability of significant impact. The external business environment is often composed of outside rival and complimentary organizations as well as forces which are often grouped into seven sub environments including: economic, political and legal, demographic, social, competitive, global, and technological environments (Grimsley, 2017). Each of these sectors creates a unique set of challenges and opportunities for businesses operations and can perhaps be most effectively evaluated using the PESTEL business environment analysis model which can be traced back to Francis J. Aguilar in 1967 (Morrison, 2007). The internal business environment on the other hand, involves organizations resources, competencies and competitive advantages that an organization possesses and that impact its continued growth, development and success. Internal evaluation of factors and analysis of operations often highlights organization or industries strengths and weaknesses (Mirkovic, 2019). According to Kenton (2019) the McKinsey 7’s Model developed by business consultants Robert H. Waterman, Jr. and Tom Peters in the 1980’s identify 7 internal factors to look for in an organizations business environment and operations including: Strategy, structure, style, staff, skills, systems and shared values all of which will be evaluated within the literature review to unveil the internal structure and operations of Nissan in the UK. The study also utilizes SWOT model for internal business operations analysis to highlight the strength and weaknesses of company’s internal environment and operations. The PESTEL and SWOT analysis models and frameworks highlight the theoretical perspective with which Nissans operations will be evaluated within this chapter

2.4: Nissan Internal Environment and Operations

2.4.1: Strengths

Nissan has had a highly fruitful alliance with various companies, including Renault. According to details of the alliance, the company has a 43.4% stake in Nissan while Nissans retains a 15% stake of Renault’s operations (Bailey, 2017). The Joint Nissan-Renault alliance is a major boost for the two companies, although Nissan stands to benefit the most. In recent years, the two companies have achieved the following because of their union:

Participated in extensive and expensive research and development activities

Invested in new projects throughout the world

Negotiated a better contractual agreement

Explored new markets and even shared the costs of design, purchase, and production (Chau and Witcher, 2008).

Nissan’s operations have also been under the competent management of Carlos Ghosn, who is the company’s CEO. His style of management primarily focuses on reforming the company and instituting new changes that will boost its performance (Toma and Marinescu, 2013). Since the year 2013, the company’s revenues have substantially grown by over 8%. Its net incomes has experienced a constant rate of growth at 16% annually while its operating profits grew by 26.4%, on average (Bloom et al., 2019). This, to a large extent, points to the efficiency of the company’s current operations. Over the years, Nissan has been able to manage a rather robust brand equity, mainly due to the consistency in technological innovations, positive customer experiences, investing in corporate social responsibility, focusing more on employees and other appealing to stakeholders (Nicolides and Harding, 2012). According to Toma and Marinescu (2013) the company has further enhanced its strategic plans with the goal of growing its brand equity. (Gunarante, 2018) further confirms that the company’s inherent involvement in different aspects of Corporate Social Responsibility has effectively influenced its brand equity as well.

2.4.2: Weaknesses

Nissan however has had to deal with thousands of vehicle recalls that as part of its passenger safety program. This recalls as highlighted by (Nicolides and Harding, 2012) not only impact the quality ranking of their brand but also influence the brand’s reputation and image. Nissan has also been forced to maintain vehicles free of charge, something that extended the company’s operational costs. In 2018, for instance, the company recalled up to 215,000 units as a result of the risk of fire. Among the recalled units were the 2018 Nissan Pathfinder, the 2017 Nissan Maxima, the 2018 Nissan Murano and the Infiniti QX60 model (Bloom et al., 2019). According to (Gunarante, 2018) the company also relies on significant amounts of imported parts for the manufacturing and Assembly of their cars and other vehicles. This based on the outcome of the Brexit agreements and vote may significantly impact the company’s operations.

2.4.3: Opportunities

Globally, in the last few years, there has been a substantial rise in the sale of electrical vehicles (Bailey, 2017). While there was a slight reduction in car sales in 2019, there was a notable increase in the sale of electric units across certain markets (Gunarante, 2018). This shows that there is an undoubted increase in demand for electric cars. Nissan as such has an opportunity for market exploration with effective extension of its electric cars models.

2.4.4: Threats

Among the major threat currently impacting all companies within the UK including Nissan is the uncertainties of the Brexit negotiation outcomes. A no-deal Brexit will significantly impact the company’s operations as pointed out by. The company also faces significant competition within the UK and globally from established and upcoming brands such as Honda, Toyota and Ford (Gunarante, 2018). These companies invest heavily in research and development as well as marketing with goals of growing their market shares presenting a major threat to the profitability of the company.

2.5: Nissan External Environment and Operations

2.5.1: Political Aspects

Motor vehicle driving poses tons of risks. As such, the UK government has instituted multiple safety regulations that are strict in nature to govern the motor vehicles manufacturing sector on areas, such as production of top quality seat belts and other vehicle parts. Such safety features like seatbelts are meant to enforce the safety of drivers and passengers. These regulations are not so favorable for new market entrants but rather work to the aid of already established brands in the market (Toma and Marinescu, 2013). According to applicable EU regulations, the United Kingdom has laws that set maximum emission standards for vans and cars. The purpose of this emission standard is to reduce car emissions to 95 g CO2 this year. The EU has recently adopted additional new standards that require further reductions to the level of 2021 from 15% in 2015 and 37.5% in 2030 (Uyarra, Shapira and Harding, 2016). However, it should be noted that the proposed Brexit will not be automatically entered into British law. The British government has made a statement that they are making substantial progress by now. This will follow a future approach to regulating vehicle emissions that will be as ambitious as the EU’s. However, it is not clear whether this commitment applies to agreements that have already been approved by the EU or not. Before actually leaving the EU, it would be advisable for the UK government to adopt transportation emissions regulations that are similar to future and current EU emissions regulations. Ideally, this would include legislation related to heavy vehicle emission reduction requirements (Uyarra, Shapira and Harding, 2016). This must be zero in the case of Britain's exit from the EU. In order for Nissan to be allowed to drive its autonomous car models on European roads, it must receive a grand approval from unnamed UK authorities who must test the new vehicle in the city of London in a modified electric Leaf vehicle with a special camera, laser package and a radar system, known as Nissan Intelligent Mobility. Nissan is expected to continue testing in disguise only after approval from local authorities.

2.5.2: Economical Factors

There is a general trend throughout the world that people make more and more money every year. This means they can spend more money on various luxury items such as electronics and even cars. Toma and Marinescu (2013) show that demand for motorized vehicles has increased. However, Brexit must reduce the disposable income of British households because the first effect of the deal caused a sharp rise in inflation and further weakened the outlook for the UK economy. The National Institute for Economic and Social Research (NIESR) also estimates that the government freezing tax credits will play a role in reducing disposable income (Cooke, 2017). The expertise center commissioned by NIESR warns that the economy as a whole will ultimately be affected by changes in household income. Rising inflation will cause a decrease in average income, which will be reduced by limiting public sector wages, freezing the benefits of wages and higher wages in the private sector. Ultimately, reduced disposable income will lead to reduced car sales, and this will make a major contribution to reducing the profitability of the British automotive industry until the country is stable.

2.5.3: Socio-cultural Factors

From a socio-cultural perspective, over the years, driving has become significantly popular in the UK. Vehicle ownership has, therefore, become a commonplace for nearly all families throughout the country. This implies that there has been an increase vehicle ownership in the UK, leading to a subsequent increase in the number of vehicles on British roads.

2.5.4: Technology

Improving self-driven vehicles is undoubtedly the biggest technological change affecting the automotive industry. Although this development is not always bad or good, it means that conventional car makers who want to stay relevant need to change their business strategy.zAmelia Heathman predicted that Nissan would become the first company to have a self-driven vehicle on European public roads (Heathman, 2017). In addition to the global emergence of self-driven cars, motor vehicle safety is another important technological advance in the automotive sector. Mandatory wearing of seat belts became a legal requirement in the 1980s. It was only in the early 2000s that other vehicle brands, makes, and models began to include airbags in their vehicles. These safety standards, together with their core technology in the automotive industry, are increasing and developing. In the recent past, car manufacturers have worked on the introduction of an emergency braking system which tends to significantly reduce the chance of a direct collision.

2.5.5: Legal Factors

It is interesting that the topic of copyright also exists in the automotive industry. Patent, trademark, and copyright laws are used to protect certain properties of cars from their brands into their forms (Madslien, 2012). Although legal ads are not as common in the automotive field, they appear from time to time. In recent decades, the problem of Chinese auto makers stealing designs from their western counterparts has increased. At present, Nissan will continue to participate in copyright, patents, and bitcoin trademarks. However, it was reported that the Chinese brand Geely made several copies of the same Rolls Royce Phantom that caused the conflict. Although copying is still prevalent in the automotive sector, it is unclear on what the net effect of copying is bound to be in future.

2.5.6: Environment

Carbon dioxide is undoubtedly one of the most serious global environmental pollutants in the automotive industry today. Mainly due to the resultant greenhouse effect, the carbon dioxide gas emitted by vehicles plays an important role in advancing global climate change. Carbon emissions have attracted worldwide attention for years, and most governments have implemented policies and strategies to reduce and reduce carbon emissions. People around the world continue to drive cars every day, but it is not yet clear whether the government will one day be forced to take stronger steps to perhaps prevent and completely stop the adverse effects of global warming. This might mean a total ban on the manufacture and use of motorized vehicles or switching to electric vehicles.

Chapter 3: Research Methodology

3.0: Chapter Introduction

The research methodology contains a description of the actual method that must be used to carry out the actual research process to obtain consistent results. According to Kumar (2005), scientific perceptions and scientific perspectives in various activities and efforts including research work clearly define the stipulations of a good research methodology. This chapter consistently describes the procedures used and other data collection activities to provide useful information for drawing conclusions about research subjects from relevant available sources. In this chapter, research approaches, research methods, data collection methods as well as analytical methods and ethical considerations are discussed in detail.

3.1: Research Approach

A research approach refers to a procedural plan that consists of the broad assumptions which are necessary in concluding the course of the research (Woo et al. 2017). Three major research approaches are always considered depending on the nature of the research, including; the deductive approach, inductive approach and abdicative approach. The deductive approach would largely tests the validity of any noticeable assumption. The approach starts with simple facts, referred to as hypotheses, which have to be supported or rejected in the course of the research. The basis of deductive reasoning is the premise, before proceeding to the inference (Silverman (2016). On the other hand, the inductive approach doesn’t require the hypotheses development. Rather; only the aims, research questions, and objectives are regarded as the genesis of the research process. Notably, the evaluation of the impact of a no-deal Brexit to the internal and external environment and operations of the Nissan Company is constructed on the research’s main objectives (Tjora 2018). Building from this, inductive approach is best suited for evaluating significant impacts likely to be experienced by Nissans operations in the UK due to a no deal Brexit.

3.2: Research Method

A research method refers to a systematic plan that can be used in conducting research. Three common methods exist to guide researchers especially in social sciences, these include: quantitative, qualitative, and mixed method research. The three highlight platforms that establish the grounds for a collection of tools to be used in a research process (Mackey and Gass 2015; Silverman 2016; Taylor et al. 2015). However, qualitative research is largely research that collects understanding of phenomena through reason, motives, and individual opinions. This is used to help with knowledge related to research problems to develop ideas about research goals and objectives and to highlight the most appropriate research methods used in the study.

3.3: Research Design

Research design largely denotes the strategy chosen for integrating significant components behind a study in a logical and coherent way. This ensures that that the research takes note of the research problem while forging a blueprint meant for collection, measurement as well as analysis of data. In the evaluation of the trade barriers and economic impacts experienced by Nissan due to a no-deal Brexit, the research has a pool of options with regards to the research designs (Marczyk et al. 2017). First, the action research design follows a cycle where the exploratory stance is effectively adopted. This brings in the essence of understanding the problem before producing an interventional strategy. The action research design fosters pragmatic as well as solution-driven research, which is better than simply testing various theories.

3.4: Data collection methods

This is an integral part of the research, which uses the clearly stated and defined tools for data collection. Given the nature of research as a qualitative study, qualitative tools for data collection will be more convenient. Some tools that will be extensively used include personal interviews, administration of prepared questionnaires, conducting systematic surveys, conducting comprehensive case studies, making observations, focus groups, ethnography and oral history. In this research, however, a systematic review of available literature regarding Brexit and its various expected impacts to the British economy as well as British companies will be collected for secondary data evaluation (Heitink et al., 2016). Systematic reviews include evaluations of previous studies and quantitative or qualitative synthesis of results by making use of a systematic approach towards the secondary data collection processes. This approach is advantageous for empirical associations if valid conclusions are based effectively and sufficiently on the results. To achieve the research objectives in such a way that all research variables and questions are taken into account, this study takes a qualitative approach by collecting data from secondary sources and the systematic review of existing articles (Bernard et al. 2016). The secondary data collection method encompassing careful planning and documenting various articles capturing a wide data from previous structured and reviewed studies related to research topic. Ideally, adopting this data collection mechanism was informed by assumption that the field was extensive explored previously by vast number of researcher, hence time saving and cost-efficient accessing secondary data rather that collecting directly from existing populations. Notably, the research captured key findings from the documented records, which will mostly constitute journal articles published over the recent times, government release and sectionals papers and articles, as well as relevant books (Taylor et al. 2015). The adoption of systematic reviewed was largely due to a number of advantages the tool provided to this research. Systematic reviews are largely comprehensive in that they attract the process of social research as one way of expressing the attitude, opinions and the behaviors that can be noted across common settings. However, systematic reviews would still suffer from limited representatives, which make generalization impossible in any research. Systematic reviews bear no fixed limits and would depend on a situation and dynamics that regulate the outcomes (Mackey and Gass 2015). Regardless of the shortcomings, case studies would offer a significant support to the research process by providing pieces of evidence that can be aligned to the research objectives.

3.4.1: Selection of material

When identifying articles for use in this research, specific keywords were entered into the following databases; namely EBSCO, Google Scholar, Proquest, ScienceDirect, Scopus, Sage Journal, JSTOR and Emerald. In general, searches are conducted based on the research objectives and the following main variables. Key words used included Brexit, Trade Agreements, Tariffs, Business environment and economic impact. In addition, the web search focused on various environmental components and Nissan's internal and external operations in the UK. Although the research materials used were not limited in terms of the dates of publication, most of the preferred articles were published after the 2016 Brexit vote.

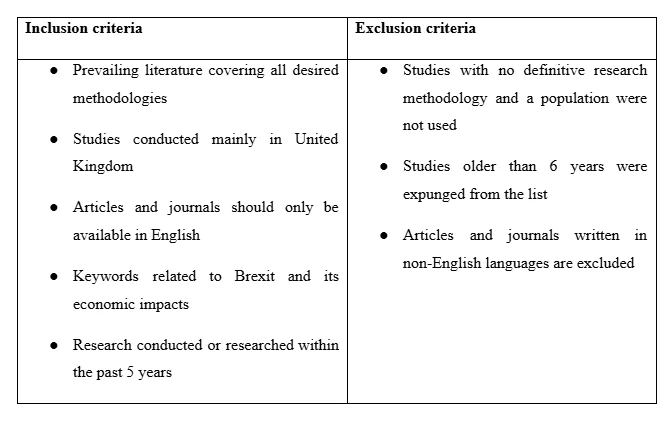

3.4.2: Inclusion and exclusion criteria

While research methods and data collection methods are important components of the research process, sampling methods are equally vital. This implies that a criteria required to be set to determine the selection of articles from a large number of possibilities returned by the database searches. Multiple sampling methods are highly likely to be used in this study (Gorny and Napierała 2016).

3.5: Data Analysis

Data analysis is the process for reviewing, cleansing, changing and modeling data with the main aim of identifying important details, supporting important decisions, and drawing conclusions. While the figures will be recorded in the case studies included in the sample for this research, it is believed that the data collected is qualitative and thus requires qualitative data analysis techniques (Agresti 2018). This research uses content analysis, known as a research method, to replicate text material, draw valid conclusions, and interpret textual content. This includes evaluation of data and other information from the identified and selected credible articles and documents that focus on text, graphics, and even verbal communication from other articles that can be cross-referenced (Erlingsson and Brysiewicz, 2017).

3.6: Ethical Consideration

The research will use secondary data meaning it will not be in contact with human or living participants. However, it is free from observing ethical consideration. The research will ensure academic integrity and rigor that include citing and referencing accordingly is maintained through from review of literature to sampling of articles to systematic review. Similarly, it will ensure it adhere to university guidelines and Britain policy of conduct an academic research and handling of any personal data that might be encountered during reviewing articles.

Chapter 4: Data and Findings

4.0: Chapter Introduction

The aim of the study was to evaluate the impact of a no-deal Brexit to the operations of the Nissan Company, an automobile company operating in the North Eastern region of England and that heavily relies on export of its vehicles for its annual revenues. In analyzing the business environment and operations, various aspects of the company that can be impacted by changes in policies and trade agreements including procurement and export of products are effectively identified. Internal environment highlight internal factors of operations while external aspects outline external relationships and operation that can potentially be impacted by a no-deal Brexit. However in striving to attain this aim and stipulated objectives, this study followed a qualitative research approach employing systematic review of existing literature highlighting a SWOT and PESTEL analysis of:

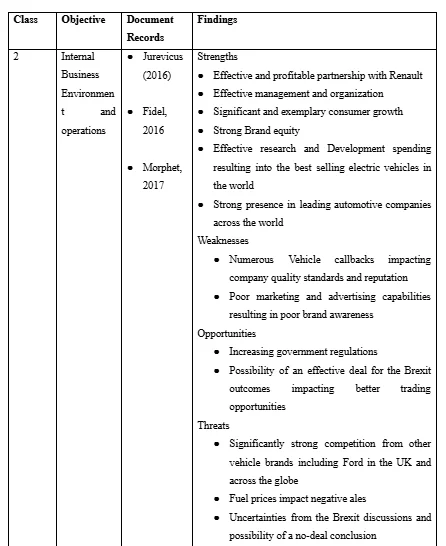

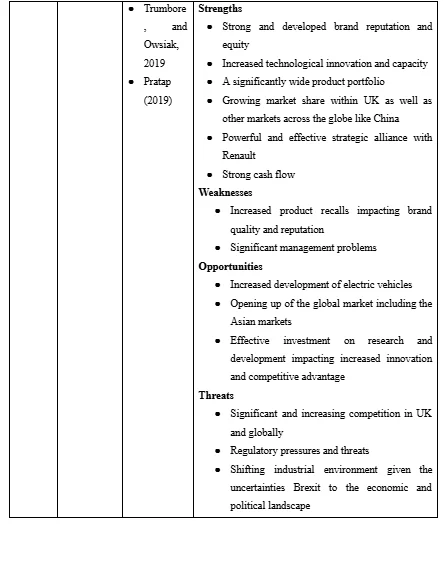

4.1: Internal Nissan environment and operations

An evaluation of Nissans internal environment was conducted with a SWOT analysis of the company’s internal factors and operations. Two sources highlighting the internal environment of the company are highlighted in the findings. The impact a no-deal Brexit outcome on some of the internal environmental factors and operations are discussed in the analysis and discussion chapter to highlight the impact in Nissans overall internal operations

4.2: External Nissan environment and operations

An evaluation of Nissans external business environment that potentially impact its operations was conducted with a PESTEL analysis of the businesses environment. Two major Sources highlight the external environment of the UK automotive industry including Nissan in the findings. Impact of a no-deal Brexit on the external environment factors highlighted within the findings and that subsequently impact the company’s operations are discussed and analyzed in the discussion chapter.

Chapter 5 Analysis and Discussion

5.1: Internal Environment and operations

One of the major aspects of Nissan as a corporation is the effective management systems that they have in place. Toma and Marinescu (2013) highlights that Mr. Ghosns’ management style is reformative in nature has proved effective in other businesses. This is a major opportunity for which Nissan can utilize in managing some of the effects and impacts foreseen as a result of a no-deal Brexit. All the companies’ strengths including a wide portfolio, growing national and international markets as well as its alliances stand to be impacted by a no deal due to the significant impact brought in by new trade policies and practices. Reenen (2016) highlights that a no-deal Brexit implies new business and trade agreements as well as policies which are bound to negatively impact the GDP subsequently affecting companies and organization operations. Reduced GDP implies reduced disposable income thus decreased market and revenue which subsequently also impact a reduction in employment opportunities. With minimized workforce the company experiences minimized operations leading to less production and lesser productivity. The uncertainty of the Brexit negotiation with a possibility of a no-deal conclusion creates economic uncertainties which impact consumer decision making. According to Begg and Mushoevel (2015), the high levels of uncertainty involved in the unforeseen outcome of the UK opinion polls as well as the costs associated with the much-needed shift to a new regime of governance and trade is guaranteed to have negative economic impacts in UK due to a looming financial instability. Given the intense financial reliance of the Nissan Company in its day to day operations, a significant impact is bound to be felt on its operations as a result of a no-deal Brexit. Nicolides and Harding (2012) highlight that financial investors could significantly pull out or redirect their investment to other countries thereby impacting the UK economy significantly reducing its potential of and market for the diverse portfolio offered. The company’s operation costs as well as investment in energy efficient and electric vehicles could also be impacted negatively by a no-deal Brexit. According to Automotive News Europe (2019) industry expert estimations show that less than half of the 5,000 vehicle parts in cars made in Britain cars are manufactured locally. Give that the policies of a possible free trade agreement from the Brexit Referendum requires that the exporting company have at least half of the components in their products manufactured locally (Reid, 2019). Nissan will also be forced to indulge in development of additional car parts in order to avoid a 10% tariff on its exports and imports. While locating and hiring new suppliers for the parts required within the local market is also a possible solution for this situation, it still might cost the company more than manufacturing their own parts. In addition a no-deal Brexit is also likely to significantly impact the company’s competitive advantage, increase regulatory pressures and significantly impact the business environment of the Automotive industry for which Nissan has to crucially adapt to if they are to survive in the UK.

5.2: External Environment and operations

The major impacts of the British exit from the European Union and one that significantly causes the uncertainties and the economic shock and impacts is the possibility of a shift in the international economic landscape due to a change in the various trade policies and agreements as well as the reaction of financial institutions. Brexit without an agreement guaranteed to continue the culture of smooth trade will result in trade relations between the UK and other EU countries be regulated in accordance with the World Trade Organization's rules. According to Campbell (2019), in contrast to European Union guidelines and rules, this rule does not allow harmonized product standards and, thus, will most likely see the introduction of harmonized product standards and subsequent consumer controls at European borders. This implies that companies within the UK will for instance spend more on importing parts from the EU countries than when they were previously under the EU impacting an increase in costs for companies such as Nissan. Given the country imports more than half of its 5000 components for a majority of their vehicles, all these will impact increasing cost of production. With an increasing cost of production, the company will either be forced to minimize the quantity of produced vehicles or cut down on the cost of production in other production aspects such as the employees leading to loss of jobs. Nissan also significantly invest in research and development for development of unique, superior and innovative products. As pointed out by Pratap (2016) extensive research and development of their wide variety of vehicles in the portfolio is one of the major strengths of the company and a subsequent limiting of this amount as a result of the negative economic impact of a no-deal Brexit is also likely to effectively impact Nissans operations within the UK. Gunarantne (2018) points out one of the threats facing Nissan as a company operating in the UK to include changes in legal systems which might effectively impact their businesses. A no-deal Brexit significantly impacts trade laws and legislations as well as monetary and fiscal policies. The reorganization of the country’s economy in the attempts to adapt to the new trade agreements and financial policies will effectively impact the economy and various companies and organizations within it. Nissan for instance will be forced to develop new legal protocols and policies in order to stay competitive and effective within the country. These new legal gurdles and policies are bound to significantly impact the internal as well as external operations of the company negatively leading to limited profitability.

Summary

Eventually a no-deal Brexit is guaranteed to have negative effects on the UK economy as well as companies such as Nissan. However the extent with which companies are exposed to these effects and their reactions is a big determinant of its effective survival. Through anticipation strategies and techniques, companies can foresee the looming financial and economic effects of the referendum vote and as such develop effective measures for countering the negative impacts so as to stay profitable and stable within the resultant new market.

Chapter 6 Conclusion and Recommendation

6.1: Conclusion

Uncertainties as a result of the vote for the UK to exit the European Union have left the country in a political as well as economic shock. While the political shock subsided significantly, the economic shock and impacts persist and are even forecasted to grow worse should the referendum on the terms of British exit from the EU be concluded without a deal. The negative effects of the no-deal Brexit will fundamentally impact the economy in two significant ways:

Uncertainties as a result of the expected outcome impact the economy inducing a reaction from financial institutions such as investors to withdraw from investment within the country subsequently impacting the economy and the companies within the country. The resultant dip in economy impacts consumer income and preferences leading to significantly limited market for Nissan in the UK. Limited operations eventually impact a significant change in operations which may include reduced production or a cut down on employees.

The resultant deal leads to significant changes in the UK business environment impacting introduction of new trade policies, rules and regulations which are bound to impact legal changes in companies. Due to the changes in the trading agreement and policies, Nissan will also be forced to change its mode of operation to significantly conform to the highlighted standards. However based on Nissans strengths the company can effectively alter their operations and strategies to counter the negative aspects of Brexit.

6.2: Recommendations

Among the recommendations for possible cushioning and management of the negative impacts include;

While Nissan has less than half of its product components manufactured within the country, effective engagement in the manufacturing of car parts not only affords it the upper hand to be able to counter the Brexit impacts but also increases its competitive advantage and revenue streams.

The company’s effective investment of Research and Development also provides an opportunity for effective cushioning from the negative impacts of no-deal Brexit. Nissan can beforehand study the likely outcome of a no-deal Brexit and thus develop effective solutions for managing its effects.

Nissans’ sterling management also offers an opportunity with which to effectively manage the effects of Brexit. Through enhanced management strategies to identify potential setbacks the company can effectively position itself for minimal impact.

References

Agresti, A., 2013. Categorical Data Analysis. 3rd ed. Hoboken: John Wiley & Sons

Armstrong, A. and Portes, J., 2016. The economic consequences of leaving the EU. National Institute Economic Review, 236, pp.2-6.

Bailey, D. and De Propris, L., (2017). Brexit and the UK automotive industry. National Institute Economic Review, 242(1), pp.R51-R59.

Bulmer, S. and Quaglia, L., 2018. The politics and economics of Brexit. Journal of European Public Policy, 25(8), pp.1089-1098.

Chau, V. and Witcher, B., 2008. Dynamic capabilities for strategic team performance management: the case of Nissan. Team Performance Management: An International Journal, 14(3/4), pp.179-191.

Coulter, S. and Hancké, B., 2016. A bonfire of the regulations, or business as usual? The UK labour market and the political economy of Brexit. The Political Quarterly, 87(2), pp.148-156.

Erlingsson, C. and Brysiewicz, P., 2017. A hands-on guide to doing content analysis. African Journal of Emergency Medicine, 7(3), pp.93-99.

Fitzgerald, O.E. and Lein, E. eds., 2018. Complexity's embrace: the international law implications of Brexit. McGill-Queen's Press-MQUP.

Heitink, M., Van der Kleij, F., Veldkamp, B., Schildkamp, K. and Kippers, W., 2016. A systematic review of prerequisites for implementing assessment for learning in classroom practice. Educational Research Review, 17, pp.50-62.

Holmes, P., Rollo, J. and Winters, L.A., 2016. Negotiating the UK's post-Brexit trade arrangements. National Institute Economic Review, 238(1), pp.R22-R30.

Hopia, H., Latvala, E. and Liimatainen, L., 2016. Reviewing the methodology of an integrative review. Scandinavian journal of caring sciences, 30(4), pp.662-669.

Nash, C. J. (2016). Queer methods and methodologies: Intersecting queer theories and social science research. Routledge.

Nicolaides, A. and Harding, P., 2012. Evaluation of the Nissan Plant Management System as a global improvement tool and the role of Hoshins. Journal of Emerging Trends in Economics and Management Sciences, 3(4), pp.339-353.

Reenen, J., 2016. Brexit’s Long-Run Effects on the U.K. Economy. Journal of Developmental and Physical Disabilities, 1(2), pp.367-383.

Silverman D. (2016). Interpreting Qualitative Data: Methods for Analysing Talk, Text and Interaction. London: Sage Publications. ISBN 0-8039-8758-7.

Thompson, H., 2017. Inevitability and contingency: The political economy of Brexit. The British journal of politics and international relations, 19(3), pp.434-449.

Trumbore, P.F. and Owsiak, A.P., 2019. Brexit, the Border, and Political Conflict Narratives in Northern Ireland. Irish Studies in International Affairs, 30, pp.195-216.

Uyarra, E., Shapira, P. and Harding, A., 2016. Low carbon innovation and enterprise growth in the UK: Challenges of a place-blind policy mix. Technological Forecasting and Social Change, 103, pp.264-272.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts