Corporate Governance and Its Implications for HSBC Holdings PLC

Introduction

Corporate organization is a great deal of rules, practices and methods used to direct and control an association. It incorporates changing the premiums of an association's accomplices, for instance, the board, speculators, suppliers, customers, operators, government and the system (Anginer et al. 2018). Furthermore, it is essential for the accomplishment and sensibility of the business over some vague time period. Exactly when the game plan of rules and strategies which structure the organization arrangement of a firm are inadequate or missed the mark, it can have horrifying repercussions for a business.

The research will cognizance on the degree of corporate employer in HSBC Holdings percent where it'll satisfy its appropriate codes so one can be given by using the Council of Financial Reporting similarly as Practices of Corporate Governance. The HSBC Holdings PLC sheets will at first take into account and will recognize the document in the UK that could begin to be penetrated. It would require preserving up the extent of reliability which has to be high. The established order of pick out requirements might be required for its obligation (John, De Masi and Paci, 2016). The assessments will raise awareness on the point similarly as the objective with the goal that it might have a terrific discussion about the technique for thinking.

The exam would be bolstered to activity reality similarly as corporate corporation as per the want of the budgetary business. It would require the unforeseen development and the vitality of the made undertaking. As the shape of the corporate employer similarly as a suitable position could have the affirmation to gain ground and development in HSBC Holdings PLC (Hopt, 2020). The evaluation will in like way want to have a consideration at the pioneers for their crucial of the moral lead similarly as infused into the subordinates that won't have any little estimation helping in controlling an exploitative direct in HSBC Holdings. The evaluation will revolve around taking a look at the composing similarly as the research methodology. The research gadget will in like way be included in the evaluation close by the orchestration of the complete endeavor that will mirror the particular time for finishing the research (Kotz. and Schmidt, 2017).

Rationale

Banks assume an important job within the progression of capital. Banks are associate degree objective constituents of any economy. Consequently, the simplest doable administration of banks is extremely essential for development associate degreed advancement of the economy and also the nation as an entire (Honey et al. 2019). The money framework in a very nation can normally be intensely controlled with limitations and prudent requirements. This is often on the grounds that disappointment of foundation might have a falling impact transferral concerning the frustration of alternative foundations prompting vital expenses to the economy. On a really basic level, banks should act in a very manner that advances "certainty" to its partners (Kumar and Kaur, 2019).

Aims and Objectives

The research intends to discover the methodologies just as initiative style and extent of corporate administration of HSBC Holdings plc. It is required to decide the essentialness of corporate administration concerning corporate disappointment or vital achievement in HSBC Holdings plc.

Research Objectives

- To recognize the strategies for administration style and degree of HSBC Holdings plc concerning corporate administration

- To assess whether HSBC Holdings plc has satisfied all its corporate administration as its standards

- To dissect the essentialness of corporate administration in HSBC Holdings plc concerning corporate disappointment or vital achievement

- To recommend the connection among the corporate social duties just as corporate administration in HSBC Holdings plc concerning account

Research Questions

- What are the strategies for authority style and degree of HSBC Holdings plc concerning corporate administration?

- What is the essentialness of corporate administration in HSBC Holdings plc concerning corporate disappointment or vital achievement?

Literature Review

Banks will in general have a decent measure of tact to pick their corporate administration structures inside the legitimate systems of their nations of area. Henceforth, banks' corporate administration structures mirror a blend of national lawful necessities and the inclinations of banks' key partners, and specifically their shareholders (Demaki, 2018). The connection between bank corporate administration and bank capitalization can mirror an effect of the legitimate framework on corporate administration, which at that point influences capitalization procedures. Then again, investor inclinations can together decide bank corporate administration and bank capitalization.

By either chain of causation, investor benevolent corporate administration ought to shift decidedly with hazardous bank capitalization procedures (Aguilera, Florackis and Kim, 2016). Investor benevolent corporate administration as controlled by the lawful framework, specifically, can be required to prompt low bank capitalization, as this builds bank valuation by moving danger towards a blend of the bank's loan bosses and the money related security net. On the other hand, more investor impact over the bank can mutually offer ascent to investor cordial corporate administration and offer worth upgrading low bank capitalization (Hassan, Zulkafli and Ibrahim, 2018).

Board independence

As to measure, a little board may not be compelling in controlling management, as the weight of viable oversight would fall on not many board individuals. An enormous board may comparably not be extremely powerful, as it could be liable to free-rider issues among its numerous members, reducing their motivating force to obtain data and screen managers (Aguilera, Florackis and Kim, 2016).This proposes that a bigger board might be either better or more awful at advancing investor premiums, offering ascend to either lower or higher bank capitalization. All the more explicitly, sheets of middle of the road size might be best at advancing investor premiums, offering ascend to most minimal bank capitalization.

Provision of anti-takeover

Looking for further insights on Navigating Corporate Residence in the Digital Age? Click here.

Notwithstanding corporate administration, we consider how bank capitalization changes with official pay. The connection between by and large official remuneration and bank chance taking is a priori dubious. Stock and choice awards can adjust the motivating forces of supervisors to those of investors, and accordingly support chance taking (Aras and Crowther, 2016). The hazard motivators as such that are inserted in the offers and alternatives that have been allowed to an official ought to incite higher hazard taking, driving to bring down capitalization. However, noteworthy official yearly pay and non-diversifiable monetary riches attached to a bank additionally give administrators motivations to face less challenge, prompting higher bank capitalization. An experimental writing looks at two records that sum up the hazard taking motivating forces certain in value based official compensation. First, 'delta' quantifies the affectability of the estimation of official remuneration to the stock cost. Higher delta opens administrators to more hazards, which disheartens chance taking (Bae, et al. 2018).

Stakeholders role

The episode is concentrated on the possible issues of leadership as well as the approaches implemented in HSBC holding PLC. Here, influence of corporate governance is of prime importance defining success or failure of the company (Siming, 2018). The internal or external stakeholders committed to enhance the business operations related to corporate governance. Issues faced by HSBC holding PLC, a mechanism that has been highly rendered ineffective by governance. The business operation happens due to absence of board committee and limited involvement of the board members. Issues can be reserved through a series of mechanisms implemented by the government for effective business operations.

strategy in business is rightly influenced by financial outcome exhibited by the business. Hence, the current research works on analysing the possible link between corporate governance and distress in terms of finance as a possible matter of interest to the stakeholders (Bentley, Pugalis, and Shutt, 2017). The conflict of interest between management and shareholders is more severe during the course of financial distress. Management can make decisions to obtain short term personal advantages rather than overcoming the financial issues due to the insecurity of their employment. Under the possible circumstances, the level of ownership among the large shareholders and directors possibly contribute to reduce the conflict of interest. The issues associated with the concentration of ownership are widely discussed in previous literature (Siming, 2018). How the situation is market different when the result analyzes the possible impact of ownership concentration on corporate governance and strategic management. In the situation the largest shareholders could suffer great loss due to the participation in a financial distressed organisation.

Importance of Effective Corporate Governance

The primitive and prime factor contributing to economic development and growth is ensuring suitable governance. It is because of the same reason corporate governance motivates efficient use of limited resources making these resources to flow within these entities ensuring effective production of services and meeting demands of the stakeholders (Heracleous and Werres, 2016). Additionally, corporate governance gives a series of broad mechanisms for the directors to govern these limited resources; corporate governance in HSBC PLC. The corporate administration of banks is extraordinary and one of a kind from that of the different associations. This is on the grounds that the exercises of the bank are less straightforward than different associations. In this way, it gets difficult for speculators and leaders to screen the works out of the bank. The circumstance turns out to be essentially progressively troublesome when a critical piece of the offer capital is with the government (Kok and McDonald, 2017). Moreover, banks likewise differentiate for the most part from other organizations as distant as the multifaceted nature and scope of their trade threats, and the results in the event that these threats are incapable of being managed.

The problems related to poor corporate governance is a matter of concern for developing and developed economies. The issue remains the same in the chosen country where corporate governance can be deemed appropriate for providing the suitable structure in any system if supported by the right kind of infrastructure. It becomes inevitable to know that corporate governance within the banking sector boosts the confidence of investors by reducing the possible capital of the economy and increasing the flow of capital within the economy. Similarly the cost of capital becomes lower if corporate governance is rightly followed within the banks (Martin et al. 2016). The degree of adherence to the basic principle of governance at corporate level increases the chances of confidence in those banks as the potential investors. mostly the countries embrace financial deregulation as a proper outcome.

The financial framework is ending up being progressively unusual and open, and thus, it is now, a necessity for an emotional rule is felt. Emotional standards consolidate rules, for instance, internal controls, structure and occupation of the Board, exposure rules and peril the board. Such disclosure measures would put the UK practically identical to widespread measures (Kok and McDonald, 2017). Continuous progressions have shown that inadequate corporate organization standards in banks and budgetary associations result in money related frailty. Badly arranged progressions happening in one bank or then again cash related association can make practically identical designed effects in various banks or money related foundations. Inadequate corporate organization blueprints in banking systems consolidate deficiently qualified and experienced bank boss, and administrators with basic hopeless circumstances; lacking appreciation of banking threats by a bank' s boss and senior organization; inadequate depiction of non-official and free boss on the board; lacking danger the officials structures, internal controls and inside audit strategies; insufficient duty of boss; lacking oversight of positioning chiefs by sheets of officials, additionally, low quality budgetary offering an explanation to the board; lacking rights for speculators (Zhao, 2016).

Application of corporate governance in modern banks such as HSBC PLC

Corporate organization is transformative and ever-developing. Banks must improve and change their corporate organization practices in order to remain genuine. It may be famous here that there's a prime capability between the private zone banks and open portion banks: the degree that HSBC Bank's action in organizing things fitting to managing an account is concerned. The current administrative structure relating to prudential standards set up by the HSBC PLC gives a comparative treatment to private banks and open division banks (De Haan and Vlahu, 2016). In any case, where organization focuses are concerned, the HSBC Bank recommends the arrange structure as it were for private portion banks. For open division banks, it advances propositions subject to a comparative structure to the Government for thought. The movements have accomplished various movements to the money related part, reviewing for the districts of corporate organization. Competition is being invigorated as a frequently growing number of banks are being given licenses. Progressively fundamental opportunity is being given to sheets of open division banks (Zhao, 2016).

By either chain of causation, financial specialist altruistic corporate organization features should move firmly with dangerous bank capitalization techniques. Financial specialist generous corporate organization as constrained by the legitimate system, explicitly, can be required to incite low bank capitalization, as this fabricates bank valuation by moving risk towards a mix of the bank's credit supervisors and the cash related security net (Bae et al. 2018). Then again, more speculator sway over the bank can commonly offer a climb to financial specialist heartfelt corporate organization and offer worth updating low bank capitalization. Banks structure (governance) an essential association in a nation's financial system and their success is fundamental for the economy. The basic altar of the keeping money industry in the UK is doubtlessly clear from the transformative nature of the money related markets. Globalization has obtained with it more essential competition and hence more genuine perils. In such a circumstance, utilization of great corporate organization practices in banks can ensure them to adjust to the advancing condition (Lagasio, 2018). Banks structure a critical association in a nation's budgetary system and their success is fundamental for the economy. The basic changes in the managing an account industry in the UK is unmistakably clear from the Trans developmental nature of the budgetary markets. Globalization has obtained with it more conspicuous competition and hence more genuine threats. In such a circumstance, utilization of great corporate organization practices in banks can ensure them to adjust to the changing environment. Corporate organization is extraordinary (Demaki, 2018).

Governance in HSBC PLC

The board aims to promote long-term success of the bank while delivering sustainable value to the possible stakeholders and promoting a culture of debate and innovation. The board member consists of independent non-executive directors with the prime role to challenge the scrutinizer performance of the management and help in developing strategies for business. During the course of exercising the duty to promote the success of the company the board is responsible for overlooking the management of HSBC on a global level. Banks will in common have a conventional degree of thoughtfulness to choose their corporate organization structures interior to the true blue frameworks of their countries of region. From now on, banks' corporate organization structures reflect a mix of national legal necessities and the slants of banks' key accomplices, and particularly their shareholders (Siming, 2018). The association between bank corporate organization and bank capitalization can reflect an impact of the true system on corporate organization, which at that point impacts capitalization methods. At that point once more, speculator slants can together choose bank corporate organization and bank capitalization. By either chain of causation, speculator kind corporate organizations highlight the need to move determinedly with unsafe bank capitalization strategies. Speculator generous corporate organization as controlled by the legal system, particularly, can be required to incite moo bank capitalization, as this builds bank valuation

Regardless of corporate organization, we consider how bank capitalization changes with official pay. The association between by and expansive official compensation and bank chance taking may be a priori questionable. Stock and choice grants can alter the persuading powers of administrators to those of speculators, and appropriately back chance taking (Honey et al. 2019). The hazard motivators as such that are embedded within the offers and options that have been permitted to an official have to prompt higher danger taking, driving to bring down capitalization. Be that as it may, essential official annual pay and non-diversifiable financial wealth connected to a bank furthermore donate chairmen inspirations to confront less challenge, provoking higher bank capitalization. A test composing looks at two records that entirely up the risk taking propelling powers certain in esteem based official emolument. To begin with, 'delta' measures the affectability of the estimation of official compensation to the stock fetched. The scene is concentrated on the conceivable issues of authority as well as the approaches executed in HSBC holding PLC. Here, the impact of corporate administration is of prime significance characterizing victory or disappointment of the company (De Haan and Vlahu, 2016).

Literature gap

There is no doubt that several mediating factors influence the corporate governance structure of HSBC. Furthermore the role between the chairman and executive with clear division of responsibilities helps in understanding the ways corporate governance works in the chosen organisation. Search currently works on understanding the possible factors that help in evaluating the possible impact of such factors on corporate governance. The current gap in literature remains in understanding the exact impact of the factors on governing HSBC PLC. Representatives of HSBC Holdings Plc. who are the interior partners have been taken for considering the effect of corporate administration and managerial practices over the hierarchical system. In the studies and meetings no such secret data were approached to keep away from operational complexities.

More data from different partners like investors, budgetary officials, and so forth would be of more prominent incentive to comprehend the adequacy of this financial assistance giving association. Be that as it may, it would be a tedious venture.

HSBC Holdings plc is a global corporate association and to meet its hierarchical objectives and destinations. From the writing part it very well may be comprehended that ineffectively organized corporate administration is considered as a grave issue in creating countries. Since all around organized corporate administration empowers an association to continue capital development and keep up support capital stream in the economy. In this examination exposition the country which has been decided for directing the investigation on corporate administration falls in specific situations that rehearsing of real activities would empower it to turn out to be all the more monetarily needy.

Methodology

The methodology is the most information-packed and calculative part of a research dissertation. To reach the research goals and fulfill the objectives, practicing of methodological data collection and evaluation practices are essential. The collected information must be valid and legitimate in nature. Diversified research strategies must be applied by the researcher so that productive research results can be obtained. The methodology consists of several other elements like Research approach, Research Design, Data sampling, and Data collection related constraints. Data collection methods can be further segregated into two parts-primary and secondary data collection methods.

In the case of this research dissertation, a mixed approach of both qualitative and quantitative data has been used. To understand the effectiveness of the corporate governance of HSBC Holdings plc and scrutinize the developing areas of corporate administration, this methodology would be of extreme importance.

Research Onion

Proper knowledge and application-based understanding of Research onion aid the researcher to perform the study by taking several viewpoints and measuring the most effective approach from that study (Melnikovas, 2018). Mostly, six layers of research onion are critical for deciding the proper method for gathering information, analyzing gathered data, and formatting the conclusion (Cooper, Schindler, and Sun, 2016). Apart from the statistical reports and observations, proficient use of research variables can be understood through this research onion (Crossan, 2013).

Figure: Research onion

Source: Melnikovas, 2018

Research approach

To direct the investigation of data and interpretation of the outcome in an effective legitimate manner are the principal tasks of the research approach. Inductive and deductive are the key types of Research approach (Cooper, Schindler, and Sun, 2016). The deductive research approach is generated from the existing theory (Sahay, 2016). Primary data can be attained in this manner, whereas qualitative research is mainly involved with the Inductive research approach (Melnikovas, 2018). Primary data collection method and quantitative-based research are other aspects of Deductive research approach (Welman, Kruger, and Mitchell, 2015). Qualitative based aspects are major aspects of Inductive research approach.

Research methods

Data collection and analysis of the gathered information are the research methods that are most conveniently applied by several researchers. In this study also both this has been used and their application techniques have been discussed in the context of HSBC Holdings Plc. with detailed information (Webb, 2014).

Research strategies

Experiment, survey, case study, business scenario analysis, grounded research, ethnography, action-based and archival research are the types of research strategies. In this study, survey-based and archival research strategies are used to getting better results (Crossan, 2013). Moreover, the survey-based strategy is for getting firsthand data from respondents and understanding the situation.

Research Design

In the case of a research dissertation, mixed-method or combination of both Qualitative and Quantitative research approaches have been applied (Holden, and Lynch, 2014). Application of Qualitative and Quantitative research approaches is dependent on the types of gathered information and data sampling methods (Sinha, Clarke, and Farquharson, 2018). The interpretive research philosophy is the most trustworthy as practical information, figures factual and unbiased viewpoints help the researcher to take equitable and proficiently evaluated results (Belcher et al. 2016). Descriptive, exploratory, and explanatory research designs are the types of Research Design.

In this study, Secondary information and primary surveys and interviews have been used for analyzing the significance of corporate governance in the organizational framework of Holdings Plc. Additionally, inferential and analytical study techniques have been performed for getting realistic and reliable information.

Descriptive research designs

Descriptive research designs

Exploratory research designs

Data that are of not so much importance or partly inconspicuous, those data are used under this design and critical hypotheses is performed to gather the composed data.

In this study, the descriptive research design has been applied by the researcher such that an effective research paper could be generated. Primary or secondary or both data collection processes can be used for accommodating the data analysis (Sapsford, and Jupp, 2016).

Sample size

The number of respondents who are going to take part in the survey and interviews is referred to under-sample size. In this study, around 30 ex-employees and present employees have been taken for asking their views over the efficacy of corporate governance and its impact over the strategic success of HSBC Holdings Plc.

Data collection methods

To proclaim the conclusion and recommend further insights into the study, Data collection method must be performed aptly (Kothari, 2014). As stated before, ex-employees and those who are presently working under HSBC Holdings Plc. have been taken for performing surveys and interviews. A set of the questionnaire has been prepared for this purpose (Mies, 2013). The results of this survey and individual interviews would be taken for interpreting the effectiveness of corporate governance at the mentioned organization (Kumar, and Phrommathed, 2015). Those individuals would be personally interviewed and surveyed. A set of 5 questions would be asked to 10 individuals.

Research philosophy

The philosophical insights of research learning are essential for analyzing the primitive nature of the study. In general, research philosophy can be differentiated into many forms, like positivism, Realism, Interpretive, Interpretive, Objectivism, Subjectivism, etc.

But mainly realism, interpretive, and positivism are three mostly-used kinds of research philosophy in research dissertations. Research learning and data analysis are heavily influenced by philosophical aspects. Majorly secondary information is viable to this sort of deduction and understanding (Newman, and Benz, 2013).

Realism:

As the name suggests, Realism aids to scrutinize valid, data-packed and reliable marketable data that has been gathered from reliable resources. This sort of philosophical aspect is dependent on practical business environment based data (Belcher et al. 2016). In the case of this study, utilization of this philosophical insight would enable the researcher to examine gathered information, although this aspect is a time-taking elongated method (Peffers et al. 2017).

Interpretive:

In this aspect, self-interpretation and an analytical mindset of the researcher is important for determining and evaluating the research objectives and reaching conclusions. Qualitative analysis of the gathered information and statistical nature are primary requisites of this research philosophy (Marton, 2016).

Positivism

: Flow-based contingency exercise is the main mantra of this research philosophy. But to meet the project goals and perform emergency-based work this approach is extremely helpful. In summary, this research philosophy aids the researcher to use secondary and primary data collection methods as per emergency (Belcher et al. 2016). In this research dissertation Positivism research philosophy has been applied after judging all these mentioned reasons (Lewis, 2015).

Data Collection Method

Data Collection is an essential part of methodology as this step aids the researcher to perform the analysis and conduct scrutinization (Lewis, 2015). To gather information, a researcher must consider primary data collection and secondary data collection methods. These two methods are necessary for performing qualitative and quantitative approach based study (Marczyk, DeMatteoand Festinger, 2015). Primary and secondary data collection methods are helpful to perform the research and collect the necessary information to conduct the data analysis (Leonelli, 2018). A set of the questionnaire is prepared for the respondents so that they can be reviewed over any particular topic and their responses are checked through qualitative or quantitative research. Important business decisions are dependent on such a research study (Marton, 2016).

There have several tools for getting primary information from several respondents. Respondents are mainly major stakeholders of this study as they share their responses; more details about the corporate governance structure can be understood (Cadez, Dimovski, and Zaman Groff, 2017). Qualitative and quantitative analysis for the research study includes both the primary and secondary data. Information like published journals, magazines organizational official websites, and digital organizational records is responsible for secondary information (Feder, 2018).

Primary data collection method:

Non-published sources like interviews, feedback forms, face-to-face meeting, surveys etc. are the primary information that must be reviewed for valuable information. Formal or informal meeting, field overview is essential for getting the reaction of the respondents. To conduct Primary data collection method, both quantitative and qualitative approaches have been undertaken in this research dissertation. 30 present employees and ex-employees have been taken for surveying and interviewing about their views on corporate governance and its impact over the corporate success or failure in the context of HSBC Holdings Plc

. Secondary data collection method:

Published journals, magazines organizational official websites, digital organizational records are the key resources of secondary data collection. In the case of this study, the application of both primary and secondary data collection methods has been propped (Cadez, Dimovski, and Zaman Groff, 2017). Such that the researcher would be able to apply the mixed research method of both qualitative and quantitative research method to interpret the gathered data and comprehend the findings from that study.

Statistical data, figures, charts are essential for performing a quantitative research project, and survey-based information would enable the researcher to get qualitative information (Aksnes, Langfeldt, and Wouters, 2019). Relevant questions must be asked to the respondents such that they can relate with the asked matter. Primary sources are first-hand unpublished data that would aid the researcher to get proficient results.

Sampling Method

Non-probability and Probability sampling are mainly the types of the sampling method. Between these two methods, suitable sampling practice is practiced by the researcher to conduct the research. Understanding of sampling method would enable the researcher to perform the sampling procedure in a balanced and effective manner.

Non-Probability Sampling

Random sampling practice is not associated with Non-Probability sampling. Convenience analysis, Quota Sampling, and Purposive Sampling are different types of Non-Probability sampling method. To perform Non-Probability sampling, both primary and secondary data are used. Selection of respondents is an important part of sample size selection method. In this study,

Probability Sampling

Random sampling of data is preferred by most of the researcher as these aids to gather information from an unbiased perspective. Random data variants are useful for interpreting and reviewing the collected information. Unsystematic sampling practice is linked with this sampling method. Probability sampling can be further segregated into Systematic reviewing, Cluster analysis, Stratified random measuring, and Simple random analysis.

Ethical Aspects

The individuals may not have a clear idea about corporate governance, such that they would not be judged for their responses and pressurized for answering all the questions. The researcher must consider their will to answer as the prime-most factor while interviewing them. Additionally, no such questions and comments must be done over their responses. The respondents must not be influenced to give biased responses as this would lower the effectiveness and reliability of the study. 30 present employees and ex-employees have been asked for opinions on impact of corporate governance over the corporate success or failure in the context of HSBC Holdings Plc.

Individuals who are designated with managerial post were also part of this research study. They agreed to become part of this research. Although, the researcher has to keep in mind the fact that the survey questionnaire must not aggravate their reputation. The researcher must conduct this study in such a manner such that the basic aims and objectives of this assessment are met.

Validity and Authenticity of the Project

The qualitative and quantitative approach has been distinctly featured in this research dissertation such that the results of the analysis could be unbiased and informative. Valid and verified data is essential for generating an authentic report. To generate such a report, both secondary and primary data collection method is important. Secondary information is taken from mass mediums, like published reports, newspapers, annual reports of the company, newspapers. Primary information has been collected from 30 respondents who are present and ex-employees of HSBC Holdings Plc. Although gathered information from the primary data collection method can be sometimes of delusional and inappropriate nature. In the case of this research study, 30 present and ex-employees have been chosen as respondents.

Employees are the internal stakeholders of HSBC Holdings Plc. and they are more aware of the organizational framework. Corporate governance and administrative practices are the top-most prior departments of any organization. Any confidential information must not be asked in the survey and personal interviews. As releasing of company secrets would generate operational complexities so that the respondents must not be provoked or pressurized to release in any such data.

Study Limitations

There are several limitations and research constraints that must be considered while studying. Any research study is mainly dependent on secondary and primary information. Secondary information means verified information like published journals, news reports, reviewed papers, etc. whereas primary information is composed of non-published firsthand information, like interviews, personal reviews, feedback, etc. Lack of verified secondary data would impede the data analysis and further study of that topic.

If any respondent leaves the place without completing all the responses, he or she cannot be forced to stay and answer. Respondents must be asked for their consent before such interviews and surveys. Thus, any sort of unwanted situations can be avoided.

Reliability Facts of Research Design

As it is believed that to understand the effectiveness of a multinational banking service providing organization, like HSBC Holdings Plc., the researcher has to depend on the first-hand information that would be available from the stakeholders. Majorly internal stakeholders, such as employees and ex-employees, can tell what have been the major operational difficulties in the administration of the organization, how the company used to handle any inconvenient troubles, etc. Although it is also true that employees are bound to organizational ethics that prevent them from sharing sensitive and confidential issues of the organization.

Data Analysis

After implementing qualitative and quantitative analysis, further assessment of corporate administration at HSBC Holdings Plc. can be practiced. In this research dissertation, the responses that are gathered from the 30 respondents have been used for validating the competences of corporate governance on strategic corporate accomplishment or disappointment of HSBC Holdings Plc.

Data Analysis part is essential for performing a hypothetical study of the research dissertation. As mentioned before, this study survey was carried out as part of the quantitative research approach, and respondents were personally interviewed as part of the qualitative study.

Quantitative Questions

- Do you think that the service quality of HSBC Holdings Plc. is of standard quality?

- Do you know if an invitation on meeting details with stakeholders was submitted on the Stock Exchange forum?

- Do you believe that corporate governance has been embedded in the administrative strategic framework of HSBC Holdings plc?

- Can corporate governance change the level of transparency, responsibilities, and equality in the present situation at the organization?

- Do you think proper articulation of administrative practices at HSBC Holdings plc would enable the company to generate higher growth prospects?

- Does corporate governance impact the success or failure of an organization?

Qualitative questions

| Question |

|---|

| 1. As per your opinion, implementation of the required changes in terms of administrative practices would be fruitful for organizational framework at HSBC Holdings plc? |

| 2. Do you believe that the integration of the main viewpoints of corporate governance at HSBC Holdings plc would be profitable for the stakeholders? |

| 3. As per your opinion, the union between bank capitalization and bank corporate organization would be fruitful for organizational framework in terms of administrative practices? |

| 4. Do you refer bank capitalization strategies as the most convenient one in the circumstances of corporate governance at HSBC Holdings plc? |

Data findings

Quantitative questions

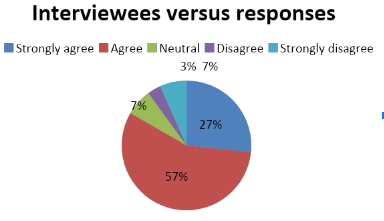

1. Do you think that the service quality of HSBC Holdings plc is of good standard quality?

| Respondents | Variable | Percentage (%) |

|---|---|---|

| Strongly agree | 8 | 26.66666667 |

| Agree | 17 | 56.66666667 |

| Neutral | 2 | 6.666666667 |

| Disagree | 1 | 3.333333333 |

| Strongly disagree | 2 | 6.666666667 |

As per the graphical presentation, it can be understood that among 30 interviewees, 16 (56%) respondents agreed that the service quality of HSBC Holdings plc is of good standard quality. Around 8 respondents were strongly agreed to the fact. From rest, 3 respondents (10%) were neutral and 3 respondents did not agree to the point.

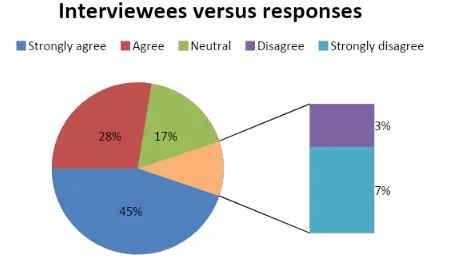

2. Do you know if invitation on meeting details with stakeholders was submitted on the Stock Exchange forum?

| Respondents | Variable | Percentage (%) |

|---|---|---|

| Strongly agree | 7 | 23.33 |

| Agree | 14 | 46.67 |

| Neutral | 4 | 13.33 |

| Disagree | 2 | 6.67 |

| Strongly disagree | 3 | 10.00 |

As per the graphical presentation, it can be understood that among 30 interviewees, 14 (47%) respondents agreed to the fact that an invitation on meeting details with stakeholders was submitted on the Stock Exchange forum. Around 7 (23%) respondents strongly agreed to the fact. Among others, 4 respondents (27%) did not have any idea and 5 respondents did not agree to the point.

3. Do you believe that corporate governance has been strongly embedded in the administrative strategic framework of HSBC Holdings plc?

| Respondents | Variable | Percentage (%) |

|---|---|---|

| Strongly agree | 5 | 16.66666667 |

| Agree | 11 | 36.66666667 |

| Neutral | 8 | 26.66666667 |

| Disagree | 23 | 10 |

| Strongly disagree | 3 | 10 |

As per the graphical presentation, it can be understood that among 30 interviewees, 11 (37%) respondents agreed and 5 respondents were strongly agreed to the fact that HSBC Holdings plc. corporate governance has been strongly embedded. Around 6 (20%) respondents disagreed to the fact. Among others, 8 respondents (27%) did not have any idea of this concept.

4. Can corporate governance change the level of transparency, responsibilities, and equality in the present situation at the organization?

| Respondents | Variable | Percentage (%) |

|---|---|---|

| Strongly agree | 8 | 26.66666667 |

| Agree | 16 | 53.33333333 |

| Neutral | 3 | 10 |

| Disagree | 1 | 3.333333333 |

| Strongly disagree | 2 | 6.666666667 |

As per the graphical presentation, it can be understood that among 30 interviewees, 16 (53%) respondents agreed and 8 respondents were strongly agreed to the fact that HSBC Holdings plc. corporate governance has been strongly embedded. Around 3 (10%) respondents disagreed to the fact. Among others, 3 respondents (10%) did not have any idea about this concept.

5. Do you think proper articulation of administrative practices at HSBC Holdings plc would enable the company to generate higher growth prospects?

| Respondents | Variable | Percentage (%) |

|---|---|---|

| Strongly agree | 14 | 46.66666667 |

| Agree | 8 | 26.66666667 |

| Neutral | 5 | 16.66666667 |

| Disagree | 1 | 3.333333333 |

| Strongly disagree | 2 | 6.666666667 |

As per the graphical presentation, it can be understood that among 30 interviewees, 8 (27%) respondents agreed and 14 (47%) respondents were strongly agreed to the fact that to generate higher growth prospects, administrative practices at HSBC Holdings plc are essential. Around 3 (10%) respondents disagreed to the fact. Among others, 5 respondents (17%) did not have any idea of this concept.

6.Does corporate governance impact the organizational success or failure of an organization?

| Respondents | Variable | Percentage (%) |

|---|---|---|

| Strongly agree | 14 | 46.66666667 |

| Agree | 8 | 26.66666667 |

| Neutral | 5 | 16.66666667 |

| Disagree | 1 | 3.333333333 |

| Strongly disagree | 2 | 6.666666667 |

As per the graphical presentation, it can be understood that among 30 interviewees, 8 (27%) respondents agreed and 14 (47%) respondents were strongly agreed to the fact that the organizational success or failure is very much dependent on corporate administration to generate higher growth prospects. Around 3 (10%) respondents disagreed to the fact. Among others, 5 respondents (17%) did not have any idea about this concept.

Qualitative analysis

|

As per your opinion, implementation of the required changes in terms of administrative practices would be fruitful for organizational framework at HSBC Holdings plc?

Manager 1: “Corporate governance has been instigated in our organizational structure since inception. Day by day the laws and related regulations have been improved. So that as per my view, there would be no such hesitation to implant the best for the company.”

Manager 2: “I have seen many downturns and upsides of many companies. I believe the implementation of required changes would enable the lawmakers and other stakeholders to work better.”

Manager 3: “I fully support the implementation of the required changes in terms of administrative practices for the company.”

|

|

2. Do you believe that the integration of the main viewpoints of corporate governance at HSBC Holdings plc would be profitable for the stakeholders?

Manager 1: “Yes obviously. Our company policy always looks into the matter that our internal and external stakeholders are getting their rightful proportions of profit. As per my concern, corporate governance has enabled our organizational structure to expand profitably.”

Manager 2: “I also belong to one of the stakeholders. Yes, it is the company who is dependent upon us and we are upon the company.”

Manager 3: “Yes, because laws and related regulations like Shareholders Rule of Procedure, Code of Corporate governance, and Articles of Association have been mentioned on the official website of HSBC Holdings plc. To notify the stakeholders, starting with the Shareholder's Assembly.”

|

|

3. As per your opinion, the union between bank capitalization and bank corporate organization would be fruitful for organizational framework in terms of administrative practices?

Manager 1: “I fully support the union between bank capitalization and bank corporate organization as these would enhance the financial strength of our company.”

Manager 2: “I believe this would be fruitful for the organizational framework. The financial strength of our company would become more and then we can work better.”

Manager 3: “Well I support this initiative, but I propose that proper data analysis is required for the final statement.”

|

|

4. Do you refer bank capitalization strategies as the most convenient one in the circumstances of corporate governance at HSBC Holdings plc?

Manager 1:: “Corporate governance can be compared as a thrust to heighten the confidence of shareholders and to enhance the capital flow within the economy.”

Manager 2:“Well, in the circumstances of corporate governance at HSBC Holdings plc, I believe bank capitalization strategies would be useful for reducing the feasible investment of the realm and stakeholders can work better.”

Manager 3:“I fully believe that bank capitalization strategies would be the best for the company in terms of sustainability and capital expansion.”

|

After conducting this Qualitative analysis, it can comprehend that all the three respondents put their company credentials first in terms of corporate governance. All of them agreed to the fact that they would implement certain changes in the corporate structural framework if required. They agreed to the issue that to sustain capital growth and generate higher capital flow business organizations have to take certain emergency based decisions. Four questions were part of the survey questions. Respondents gave positive remarks over the implementation of the required changes in terms of administrative practices. They stated that it would be fruitful for the organizational framework at HSBC Holdings plc. They were asked about the importance of stakeholders to apply administrative practices in the corporate environment. The respondents agreed that bank capitalization strategies as the most convenient strategy in the circumstances of corporate governance at HSBC Holdings plc.

Project plan

To interpret the importance of corporate authority in the context of HSBC Holdings Plc. defining an appropriate project plan is essential. The research will be performed to get the fruitful result of identifying the significance of corporate authority on strategic success or corporate failure in HSBC Holdings plc. The entire research will be performed within twenty-three weeks and by this, the complete analysis can be obtained. The research can be scheduled with ensuring different stages which would help all the activities that will be involved in the research. Each of the stages in the research like selecting the topic as well as collecting all the data for the primary research will be allocated with a certain timeframe. This should be maintained properly as there are more operations like planning layout, review of literature, selection of the research design and method and many more and all these needs to be done as per the expected deadlines. It would be better for the researcher to complete each of the tasks within the deadline so that a proper analysis can be done and also the results can reflect the perspective of the research. (cargo. law, 2016)

| Tasks under research | Duration in weeks | ||||||

|---|---|---|---|---|---|---|---|

| 1 to 2 | 3 to 7 | 8 to 11 | 12 to 13 | 14 to 16 and 17 | 17 to 21 | 22 | |

| Topic selection process | ✔ | ||||||

| Studying research journals, official reports, and other writing down | ✔ | ||||||

| Preparation of layout | ✔ | ||||||

| Reviewing literature and the research gaps | ✔ | ||||||

| Setting up a research project plan | ✔ | ||||||

| Choosing a suitable research method | ✔ | ✔ | ✔ | ||||

| Perform secondary data collection method | ✔ | ✔ | |||||

| Analysis of data | ✔ | ||||||

| Data findings | ✔ | ||||||

| Looking for recommendation and conclusion | ✔ | ||||||

| Project Overdraft | ✔ | ||||||

| Submission of final project report | ✔ | ||||||

Conclusion and recommendations

In this research study, the collected data has been presented in a verbatim format and graphical representation. Quantitative analysis has been used for understanding the effectiveness of corporate governance in the context of HSBC Holdings Plc. through charts like graphical representation. Both interpretative and factual data presentation has been used for this study. Further it can be understood that corporate practices of the banks has been improved as per the national standards and strict managerial provisions has been implied for better regulation.

In the methodology part, elaborated discussion on the research design, sampling method, data collection method, ethical aspects of the study, and research limitations has been stated. Several points have been mentioned under the research limitations. In general, secondary and primary information are considered for collecting the data for the research study. The employees and ex-employees of the organization have been taken as respondents such that the information gained from them would be of reliable quality.

The qualitative and quantitative approach has been distinctly featured in this research dissertation such that the results of the analysis could be unbiased and informative. Valid and verified data is essential for generating an authentic report. To generate such a report, both secondary and primary data collection method is important. Secondary information is taken from mass mediums, like published reports, newspapers, annual reports of the company, newspapers. Primary information has been collected from 30 respondents who are present and ex-employees of HSBC Holdings Plc. Although gathered information from the primary data collection method can be sometimes of delusional and inappropriate nature.

In the case of this research study, 30 present and ex-employees have been chosen as respondents. Additionally, published journals, news-reports, reviewed papers etc. which have been taken as secondary information has been referred with appropriate references. Alongside first-hand information, like interviews, personal reviews, feedback, etc. are the primary information. Other financial and official information has been taken from the company website. But more verified secondary data would be helpful for interpreting the results and conducting the data analysis of that topic. In the project plan part, timely segmentation has been generated for better conducting of the dissertation.

In the wake of directing this Qualitative examination, it can be understood that all the three respondents put their organization certifications first in quite a while of corporate administration. Every one of them consented to the way that they would execute certain adjustments in the corporate basic system whenever required. They consented to the issue that to continue capital development and produce higher capital stream business associations need to take certain crisis based choices. Four inquiries were a piece of the study questions. Respondents gave positive comments over the execution of the necessary changes as far as regulatory practices. They expressed that it would be productive for the authoritative system at HSBC Holdings plc. They have gotten some information about the significance of partners to apply regulatory practices in the professional workplace. The respondents concurred that bank capitalization techniques were the most helpful system in the conditions of corporate administration at HSBC Holdings plc.

Employees of HSBC Holdings Plc. who are the internal stakeholders have been taken for studying the impact of corporate governance and administrative practices over the organizational framework. In the surveys and interviews no such confidential information were asked to avoid operational complexities.

More information from other stakeholders like shareholders, financial officers, etc. would be of greater value to understand the effectiveness of this banking service providing organization. But it would be a time-consuming project.

HSBC Holdings plc is a multinational corporate organization and to meet its organizational goals and objectives. From the literature part it can be understood that poorly structured corporate governance is considered as a grave issue in developing nations. Because well-structured corporate governance enables an organization to sustain capital growth and maintain sustain capital flow in the economy. In this research dissertation the nation which has been chosen for conducting the study on corporate governance falls under certain circumstances that practicing of legitimate actions would enable it to become more financially dependent.

In the previous part, type of organizational style that followed by HSBC Holdings plc has been asked under research questions so that effectiveness of the authority style can be discussed. To understand the impact of corporate governance over the strategic framework of HSBC Holdings Plc. factual data presentation is necessary. Alongside personal opinions and views has been taken for interpretative discussion.

The data findings are essential for drawing conclusions concerning business administration in the mentioned organization. After interviewing and surveying the respondents, it can be suggested that practicing business in the domestic and international market, implementation of business administration is vital for attaining corporate accomplishment. Most of the employees and ex-employees voted for more focused application of corporate administration in HSBC Holdings plc to avoid distressful circumstances in terms of operational framework.

The data analysis explains that the research objectives and aims of this research dissertation have met the requisite criteria. Principal issues have been mentioned in the survey questionnaire and important information has been effectively drawn out. The literature review justifies the fact that to provide suitable infrastructure appropriate application of corporate governance policies are important. This study is majorly driven by the primary data that has been collected from 30 respondents. These respondents are comprised of ex-employees and presents employees of HSBC Holdings plc. The information gained from the respondents has been used for analyzing the main motive of the study and getting conclusion.

The data findings are important for getting the conclusions. In the literature review part of this dissertation, Board independence, role of the stakeholders, anti-takeover measures, and effective measures taken by the mentioned organization has been discussed in the literature review part of this assessment. The literature review part is a credible discussion of the background research of the study and review segment is perfectly linked to the conclusions. Both descriptive and analytical data analysis method has been used in this dissertation for productive results.

Reduction of unnecessary costs can become possible by the implementation of corporate governance within the organization. Proper regulation of corporate governance practices at the banking sector is important for generating the productivity rate of the operational framework and boosting the poise among the stakeholders. Circulation of capital in the economy is another part that such sectors have to deal with. If the corporate are not abide by such organizations then the capital cost of an economy becomes lower than usual. Apart from the company environment, larger market and global economy would get affected by deregulation of business practices. Shareholders are the potent stakeholders of any business organization in terms of financial assistance. Those potential investors must be communicated regarding any operational changes such that their views can be considered also. Proper regulation of financial activities is dependent on legitimate collaboration of both bank capitalization and corporate administration.

It can be further concluded that shareholders are the potent stakeholders of an organization like HSBC Holdings plc that deals in capital flow and banking services. To perform the operational activities, instigation of corporate governance in the organizational framework is of prior importance. The research aids to culminate that economy of an organization puts an impact over the operational corporate governance of a company. Especially in case of an organization, like HSBC Holdings plc that deals in banking services. Strong relationship between the shareholders and policymakers of HSBC Holdings plc plays a significant function in terms of corporate governance.

It is recommended that lawful framework must be jointly practiced by the shareholders and policymakers of HSBC Holdings plc such that bank capitalization procedures can run smoothly.

Additionally, investors can be offer low bank capitalization if they are agreeing to certain measures. To practice any such changes in the monetary framework of the business, the consent of both shareholders and policymakers of HSBC Holdings plc must be considered. Moreover, elements that can lower the efficiency and bank capitalization growth have been noted accordingly. The offers and investment terms have been changed to rapid the bank capitalization rates. Corporate leaders agree with the fact that corporate governance holds principal importance deciding disappointment or accomplishment of the business. Both the stakeholders, external and internal stakeholders put serious impact over the functional structure of a business. The management and shareholders of HSBC Holdings plc have to collaboratively solve in distressful situations so that financial insecurities and other issues can be overcome easily.

The board committee must render effective corporate governance practices to operate the financial and operational activities properly. In reviewing the importance of corporate administration, motivating factors has also been discussed such that investors and other shareholders of the company can gain confidence over the administration. Motivating forces of risk taking aspects is comprised of two records, where official remuneration to the stock cost has been considered under 'delta' part, and administrative level forces has been considered for elevated ‘delta’.

It is recommended that level of ownership among both Management and shareholders are essential for solving the inconvenient circumstances. They have to understand that corporate governance is an important aspect of strategic management.

Lack of knowledge of the factors that intervene into the corporate governance structure has been discussed in the literature gap. Understanding of intervening factors would be helpful for better understanding of the corporate governance structure in the context of HSBC PLC. Relationship between the executive managers and the chairman of HSBC PLC could be understood better if certain instances have been provided to the researcher.

Business organizations have to undergo consistent transformation and continuous development for competing with the competitive forces and sustaining in the market. HSBC PLC has set up their business administrative structure such that open division banks and private banks can be viable to the standard. In other words, open portion banks and private zone banks fall under these criteria.

Discover additional insights on Business strategic Management by navigating to our other resources hub.

Reference list

Aguilera, R.V., Florackis, C. and Kim, H., 2016. Advancing the corporate governance research agenda. Corporate Governance: An International Review, 24(3), pp.172-180.

Anginer, D., Demirguc-Kunt, A., Huizinga, H. and Ma, K., 2018. Corporate governance of banks and financial stability. Journal of Financial Economics, 130(2), pp.327-346.

Aras, G. and Crowther, D., 2016. Corporate governance and corporate social responsibility in context. In Global perspectives on corporate governance and CSR (pp. 23-64). Routledge.

Bae, S.M., Masud, M., Kaium, A. and Kim, J.D., 2018. A cross-country investigation of corporate governance and corporate sustainability disclosure: A signaling theory perspective. Sustainability, 10(8), p.2611.

Bentley, G., Pugalis, L. and Shutt, J., 2017. Leadership and systems of governance: The constraints on the scope for leadership of place-based development in sub-national territories. Regional Studies, 51(2), pp.194-209.

De Haan, J. and Vlahu, R., 2016. Corporate governance of banks: A survey. Journal of Economic Surveys, 30(2), pp.228-277.

Demaki, G.O., 2018. Corporate Governance And Banks Profitability In Nigeria. Archives of Business Research, 6(4), pp.9-17.

Hassan, H., Zulkafli, A.H. and Ibrahim, H., 2018. Corporate Governance of Banks in Asia Emerging Market: A Study on Independent Audit Committee and Liquidity. Global Business and Management Research, 10(3), p.65.

Heracleous, L. and Werres, K., 2016. On the road to disaster: Strategic misalignments and corporate failure. Long Range Planning, 49(4), pp.491-506.

Honey, D., Tashfeen, R., Farid, S. and Sadiq, R., 2019. Credit Risk Management: Evidence of Corporate Governance in Banks of Pakistan. Journal of Finance and Accounting Research, 1(1), pp.1-18.

Hopt, K.J., 2020. Corporate Governance of Banks and Financial Institutions: Economic Theory, Supervisory Practice, Evidence and Policy. Evidence and Policy (March 13, 2020). European Corporate Governance Institute-Law Working Paper, (507).

John, K., De Masi, S. and Paci, A., 2016. Corporate governance in banks. Corporate Governance: An International Review, 24(3), pp.303-321.

Kok, S.K. and McDonald, C., 2017. Underpinning excellence in higher education–an investigation into the leadership, governance and management behaviours of high-performing academic departments. Studies in Higher Education, 42(2), pp.210-231.

Kotz, H.H. and Schmidt, R.H., 2017. Corporate governance of banks: A German alternative to the" standard model" (No. 45). SAFE White Paper.

Kumar, S. and Kaur, M., 2019. CORPORATE GOVERNANCE OF BANKS. CORPORATE GOVERNANCE, 7(02).

Lagasio, V., 2018. Corporate governance in banks: Systematic literature review and meta-analysis. Corporate Ownership & Control, 16(1).

Lazarides, T.G., 2019. Corporate Governance of Banks, Performance, Market and Capital Structure. Performance, Market and Capital Structure (February 24, 2019).

Martin, G., Farndale, E., Paauwe, J. and Stiles, P.G., 2016. Corporate governance and strategic human resource management: Four archetypes and proposals for a new approach to corporate sustainability. European Management Journal, 34(1), pp.22-35.

Salvioni, D.M., Gennari, F. and Bosetti, L., 2016. Sustainability and convergence: the future of corporate governance systems?. Sustainability, 8(11), p.1203.

Shibani, O. and De Fuentes, C., 2017. Differences and similarities between corporate governance principles in Islamic banks and Conventional banks. Research in International Business and Finance, 42, pp.1005-1010.

Siming, L., 2018. Government involvement in the corporate governance of banks. Review of Economics and Statistics, 100(3), pp.477-488.

Zhao, J., 2016. Promoting a more efficient corporate governance model in emerging markets through corporate Law. Wash. U. Global Stud. L. Rev., 15, p.447.

Aksnes, D.W., Langfeldt, L. and Wouters, P., 2019. Citations, citation indicators, and research quality: An overview of basic concepts and theories. Sage Open, 9(1), p.2158244019829575.

Belcher, B.M., Rasmussen, K.E., Kemshaw, M.R. and Zornes, D.A., 2016. Defining and assessing research quality in a transdisciplinary context. Research Evaluation, 25(1), pp.1-17.

Cadez, S., Dimovski, V. and Zaman Groff, M., 2017. Research, teaching and performance evaluation in academia: the salience of quality. Studies in Higher Education, 42(8), pp.1455-1473.

Cooper, D.R., Schindler, P.S. and Sun, J., 2016. Business research methods (Vol. 9). New York: McGraw-Hill Irwin.

Crossan, F., 2013. Research philosophy: towards an understanding. Nurse Researcher (through 2013), 11(1), p.46.

Feder, S.L., 2018. Data quality in electronic health records research: quality domains and assessment methods. Western journal of nursing research, 40(5), pp.753-766.

Holden, M.T. and Lynch, P., 2014. Choosing the appropriate methodology: Understanding research philosophy. The marketing review, 4(4), pp.397-409.

Kothari, C.R., 2014. Research methodology: Methods and techniques. New Age International.

Kumar, S. and Phrommathed, P., 2015. Research methodology (pp. 43-50). Springer US.

Leonelli, S., 2018, October. Rethinking reproducibility as a criterion for research quality. In including a symposium on Mary Morgan: curiosity, imagination, and surprise. Emerald Publishing Limited.

Lewis, S., 2015. Qualitative inquiry and research design: Choosing among five approaches. Health promotion practice, 16(4), pp.473-475.

Marczyk, G., DeMatteo, D. and Festinger, D., 2015. Essentials of research design and methodology. John Wiley & Sons Inc.

Marton, F., 2016. Phenomenography—a research approach to investigating different understandings of reality. Journal of thought, pp.28-49.

Melnikovas, A., 2018. Towards an explicit research methodology: Adapting research onion model for futures studies. Journal of Futures Studies, 23(2), pp.29-44.

Mies, M., 2013. Towards a methodology for feminist research. Theories of women's studies, 117, p.139.

Newman, I. and Benz, C.R., 2013. Qualitative-quantitative research methodology: Exploring the interactive continuum. SIU Press.

Peffers, K., Tuunanen, T., Rothenberger, M.A. and Chatterjee, S., 2017. A design science research methodology for information systems research. Journal of management information systems, 24(3), pp.45-77.

Sahay, A., 2016. Peeling Saunder's Research Onion. Research Gate, Art, pp.1-5.

Sapsford, R. and Jupp, V. eds., 2016. Data collection and analysis. Sage.

Schommer-Aikins, M., 2014. Explaining the epistemological belief system: Introducing the embedded systemic model and coordinated research approach. Educational psychologist, 39(1), pp.19-29.

Sinha, T., Clarke, S. and Farquharson, L., 2018, July. Shrek, Saunders and the Onion Myth: Using Myths, Metaphors and Storytelling. In Proceedings of the 17th European Conference on Research Methodology for Business and Management Studies (p. 366).

Webb, C., 2014. Action research: philosophy, methods and and personal experiences. Journal of advanced nursing, 14(5), pp.403-410.

Welman, C., Kruger, F. and Mitchell, B., 2015. Research methodology (pp. 35-40). Cape Town: Oxford University Press.<

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts