Understanding Asset Bubbles

Chapter One

Introduction

An asset bubble which is also referred to as market prices or a speculative bubble is a term used to describe an asset that has been traded at a price that highly exceeds its intrinsic value. It is also used to describe a situation where the economic prices happen to be based on inconsistent or implausible perspectives regarding the future (Shiller, 2002). Asset bubbles are as old as the 1600s and in the modern economics, they are seen as recurrent (Bénabou and Tirole, 2016). The obvious cause of an asset bubble is that fact that it is impossible to observe the intrinsic values in markets in the real life.

As such, they are unavoidable as they are only identified after a sudden drop in the market prices has been experienced. At this point when a bubble is identified, it is referred to as a bubble burst or a crash (Smith, 2005). Two phases are recognisable and these are a boom and a burst. At each of these phases, the prices erratically fluctuate and as a result, they are impossible to predict by the use of the demand and supply forces. So what does it mean by the intrinsic value?

Using the firm-foundation theory, each investment asset or instrument is recognised by its firm anchor. This firm anchor is mainly determined by analysing the prevailing conditions as well as all the future expectations and prospect (Smith, Van Boening and Wellford, 2000). This means that when the market prices rise above or fall below this anchor or value, then a selling or a buying opportunity will arise. It means that depending on the fluctuation of an asset value, an investor will make the decision to buy or to sell an asset (Smith, Suchanek and Williams, 1988).

This introduces the psychology of speculation which brings in the psychic values introduces by Keynes in the theory of castle-in-the air (Breaban and Noussair, 2017). The theory argues that instead of estimating the intrinsic values of an investment, investor and investment professional analysts tend to rely on the analysis of the crowd behaviour in the future. Crowd investors are expected to be optimistic and therefore tend to build their hope into the castle in the air. This way, the investors can buy the asset before the crowd’s castle building.

Continue your journey with our comprehensive guide to Data Collection and Survey Analysis.

Each time we witness a fall in resource costs or a money related emergency, we appear overpowered. Indeed, even the most experienced financial specialists, monetary forecasters, and controllers are found napping. Be that as it may, in the event that we take a gander at the verifiable information for the previous two centuries, we see that benefit bubbles and monetary emergencies are just the same old thing new to humankind (Clayton, 2016). The primary archived resource bubble occurred in 1636 (the Dutch tulip insanity) while the main reported worldwide money related emergency goes back to 1825. Lamentably, in the next decades, we experienced various different air pockets and budgetary emergencies. Against this setting, we should ask ourselves, for what reason do we encounter these occasions at such high recurrence? Most market members trust that simple cash (low financing costs and free credit conditions), absence of appropriate direction what's more, covetous budgetary examiners (e.g. investors, fence investments directors, and so forth) lie at the core of the issue. It is almost certain that these elements played an imperative part in most resource bubbles and monetary emergencies before. Be that as it may, they are proximate causes in any case. In this report, we are more looking for the extreme reason for these occasions. The main shared factor we can consider is human conduct (Quigley, 2002). In our view, human conduct offers the best and generally complete clarification for repeating money related emergencies and unstable resource value developments. This involves both great and awful news. Fortunately, once we shape a profound comprehension of our own mind, we ought to be marginally more effective in spotting approaching emergencies. With respect to the terrible news, until the point when we bear on carrying on like we do (i.e. as people), we will never have an emergency free world. Nobody ought to be under a deception that we can ever win the war on monetary emergencies. Diminishing their recurrence and seriousness is the most we can ever be sought after (Malkiel and McCue, (1985). Continue your journey with our comprehensive guide to Reflections and Conclusions: Analyzing Findings, Limitations, and Recommendations.

Financial matters, as a field, got in a bad position since business analysts were enticed by the vision of a great, frictionless market framework. In the event that the calling is to make up for itself, it should accommodate itself to a less appealing vision that of a market economy that has numerous ideals however that is additionally shot through with defects and grindings (Coval, Jurek and Stafford, 2009). Fortunately, we don't need to begin without any preparation. Indeed amid the prime of flawless market financial aspects, there was a considerable measure of work done on the routes in which the genuine economy strayed from the hypothetical perfect (Driscoll and Holden, 2014). What's most likely going to happen now — truth be told, it's as of now happening is that defects and-gratings financial aspects will move from the fringe of financial examination to its inside. There's now a genuinely all around created case of the sort of financial matters I have as a main priority: the school of thought known as conduct fund. Specialists of this approach underscore two things (Duffy and Ünver, 2006). In the first place, some true financial specialists look to some extent like the cool number crunchers of efficient market hypothesis: they're very subject to crowd conduct, to episodes of silly extravagance and baseless frenzy (Dufwenberg, Lindqvist and Moore, 2005). Second, even the individuals who endeavour to construct their choices in light of cool count regularly find that they can't, that issues of trust, validity and restricted security compel them to run with the group. On the primary point: notwithstanding amid the prime of the proficient market speculation, it appeared glaringly evident that some certifiable financial specialists aren't as reasonable as the predominant models expected. But what sort of boneheads (the favoured term in the scholarly writing, really, is "commotion brokers") are we discussing? Conduct fund, drawing on the more extensive development known as social financial aspects, attempts to answer that inquiry by relating the obvious mindlessness of speculators to known predispositions in human insight, similar to the propensity to think more about little misfortunes than little pick up or the inclination to extrapolate too promptly from little examples (e.g., expecting that on the grounds that home costs ascended in a previous couple of years, they'll continue rising) (Shiller, 2015). Until the emergency, proficient market advocates like Eugene Fama rejected the confirmation delivered on a benefit of conduct back as a gathering of "interest things" of no genuine significance. That is a significantly harder position to keep up now that the crumple of an immense bubble — an air pocket effectively analysed by conduct financial analysts like Robert Shiller of Yale, who related it to past scenes of "unreasonable abundance" — has pushed the world economy to the brink of collapse (Erixon and Weigel, 2016).

The research problem

In his work, “How did economists get it so wrong”, Krugman (2009) criticised the economists arguing that while they try to congratulate themselves over the field’s success, this success is theoretical. As such, the effectiveness of the models and theories with which the economist base their success on is debatable. Krugman (2009) argued that “many real-world investors bear little resemblance to the cool calculators of efficient market theory: they’re all too subject to herd behavior, to bouts of irrational exuberance and unwarranted panic”. Explained in another way, Krugman takes note of the fact that behavioral economist, like humans, do not have limitless knowledge and information and they have no total understanding of the complex system of the economy. Similar to the behavioral economist, all people can never have complete knowledge of all investment portfolio when they make investment decisions (Dupor and Liu, 2003). The world faces an information overload and people tend to be selective based on their confidence in their ability. This is the reason why they will in most cases select the information that confirms their views and believes (Clayton, 2016). When it comes to investment, however, people are aware of the financial costs that are associated with investments and they focus on reducing or preventing these costs. It is under this illusion of control that we get overly exposed to new and unexpected occurrences leading to market bubbles. The interesting question that arises is why we (as investors) keep on falling for market bubbles (Fama, 2014). Is it because we never learn? Or is it just inevitable? This research seeks to pursue this interesting question by critically reviewing the literature about asset bubbles and the role of human behavior.

Research objectives

To critically review the role of human behavior in an asset bubble.

To investigate theories of behavioral economics in asset bubbles

To determine the implications of an asset bubble

Research question

What is the role of human behavior in an asset bubble and resultant financial crisis?

What theories of behavioral economics are used to explain asset bubbles

What are the implications of an asset bubble

Chapter Two

Methodology and Research Methods

The current study employed a literature review study method in which past research papers were used as the source of data. The papers used to gather the secondary data analysed in this study were all peer-reviewed. Literature review is a research method that is used to identify gaps in current studies. From a review of these studies, a new research topic is identified and designed. Using this method, a research analyses literature to determine how the new topic is supported by the empirical evidence presented. Literature review can be used as the main research contribution or may be used to support the main contribution. In the current study, literature was used as both the main contribution and also used to support this main contribution. Literature used for the study was sourced to contribute and support the theories of behavioural economics. Also, literature was used to support and contribute to the concepts of the role of the human in assets bubbles. Several steps are involved when using this research method. First, the planning of the study is performed in which the researcher reviews the protocol of the study. Next, a search is conducted. The aim of search is to identify the potentially relevant studies that would be useful for supporting the main theories being pursed. Also, this step is supportive of the next one which is selecting. Selecting involves pinpointing the studies with literature that is most relevant and which will be reviewed to achieve the objective of that study. In the search and selecting steps, the researcher is required to identify the protocol with which studies will be searched and selected. Relevance is key to accessing useful literature. To get relevant papers, the researcher ought to identify the keywords or themes which are used as the search words. In the current study, the key search words were as follows; Dig deeper into Data Collection and Survey Analysis with our selection of articles.

Assets bubble Economic bubble Economics Financial crisis Behavioural economics Human and behavioural economics

After selecting the studies that will be used, the research analyses the data. This process involves reading the literature guided by the research objectives to identify data that contributes to and supports the hypothesis of the current study and also responds to the research question. The final step is to write down the findings. The current study used a broad approach to the study concept and as such was not limited by year of publication. However, all the studies used in this study were all peer-reviewed journal. The reason for this was to ensure relevance and to cover the study topic from all aspects.

Chapter Three

Analysis of Literature

Introduction

Numerous theories regarding the rational behaviour of investors have been used in efforts to account for asset price movement. The assets market is likened to a beauty contest in that participants are devoted to not judge the concept of beauty that is underlying and instead, they anticipate the what the average opinion of beauty ill expect the average opinion to be (Breaban and Noussair, 2017). Concepts of herd-like and irrational behaviour among the investors have been acknowledging and elaborated in depth in this paper in relation to existing literature. Borrowing from Keynes (1936, p. 157), “There is no clear evidence from experience that the investment policy which is socially advantageous coincides with that which is most profitable". This means that employing a rational and long-term investment strategy may be scarcely practicable especially in a market where most participants are short-term game players. During economic developments, it is expected that asset and equity prices can be driven to unsupportable levels leading to a bubble. Asset bubbles and the consequential financial crisis have been there in the history of mankind over the centuries (Shiller, 2014). Researchers have focused on the behavioural economist’s view regarding assets bubbles and resultant financial crises with the aim of establishing an association between human behaviour and asset bubble. Krugman (2009) argued that trouble of asset bubble is mainly caused by the fact that economist tends to be seduced by the assumption of a perfect frictionless market. He claimed that by assuming a less alluring vision, an economy with frictions and flaws, then economics would redeem itself from asset bubble trouble. Kamalodin, (2011) looked at the association between financial crises, asset bubbles, and the human behaviour. The study noted that in the wake of a financial crisis, even the economic regulators and forecasters, and most experienced investors, all seem to be caught off-guard. And while at that point many market participants associate the bubbles and crises to greedy financial spectators, easy money and lack of proper regulations among others factors, Kamalodin, (2011) argue that these are just proximate causes and not the ultimate cause. Kamalodin, (2011) goes on to justify that the ultimate cause is human behaviour.

Assets bubble

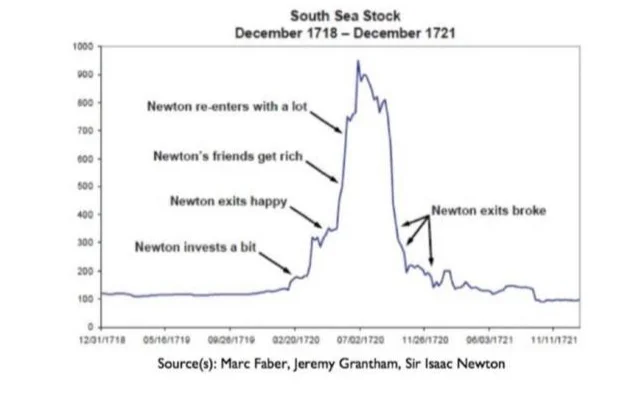

The 2008-2009 economic recession is so far the most recent and server example of an asset bubble. It was referred to as the housing bubble. In the Economic Letter, economists highlighted that in Wall Street, history tends to not only be repetitive but it is also uniform. This work continues to base this argument on the fact that referring to financial booms and panics in the Wall Street, it is almost clear that the difference between yesterday’s stocks speculation and speculators and today’s is not visible (Bordo and Jeanne, 2002). This statement means that although speculators are aware of the many factors that ought to be considered prior to making the decision to invest, such as the type of portfolio, the market forces and so on, they tend to use the same speculation strategies regarding the performance of an investment instrument always. The result is always the same which bring up the same question that was asked by Krugman (2009). So, does it mean that investors never learn? Or is it entirely inevitable to fall into this kind of speculation? The history of boom and bursts is a clear indication that the human nature does not change and neither does the game. Asset bubbles resulting from speculation have been witnessed in the history in different asset markets and countries. In fact, the term itself, "bubble" can be traced back in 1720 in England. It was coined following a price run-up followed by a crash of the South Sea Company shares (Frydman and Camerer, 2016). When the prices went up, the public enthusiasm for the stock market and other enthusiastic companies that sought the business of selling shares to investors. This enthusiasm was followed up by an epidemic of fraudulent stock offering schemes. To curb this problem, the "Bubble Act": An act to restrain the extravagant and unwarrantable practice of raising money and voluntary subscription for carrying on projects dangerous to the trade and the subjects of the UK, was passed by the British government in 1720.

Generally, the economist meaning of the term “bubble” today is an asset price which exceeds the justifiable economic fundamentals. That is based on the measures of the discounted stream of the expected future cash flow of an asset, that asset is over price. In the US, the risk in stock prices and house prices in the 1990s and 2000 have also lead to some of the greatest asset bubbles such as the housing bubble (Caginalp, Porter and Smith, 2000). From theory, the economist says that the price of a stock that is observed only represents the forecast of discounted future cash flows payable to investors. These forecasts are expected to be less variable in comparison to the object forecasted. However, in real life, the forecast prices are usually far more variable in comparison to the present value of a subsequent asset. Using the bubble model is the most convenient way of accounting for the excess volatility since stock prices are allowed to be detached from the fundamentals. Shiller (2005) compares the irrational exuberance to rational speculation to look at the intuitive and simple feedback bubbles model. This model explains that in the vent that the asset prices have started to rise, the public's attention is drawn to the few successful investments/investors. As a result, the attraction fuels enthusiasm which spreads in the market and new investors enter the market which bids the prices even higher. This behaviour is referred to as irrational exuberance and is responsible for heightened expectations leading to further price increments (Galbraith, 2012). Usually, such market meteoric rises are explained and justified by the popular culture of superficially plausible “new era theory”. Despite the justifications, the resultant bubble is carried with it destruction because if the prices start to drop, pessimism leads to some investors exiting the market. This downward motion of prices leads to the expectation of further downward motion until a burst (bottom) is reached (Campbell and Vuolteenaho, 2004). According to the feedback model of bubbles, investors refrain from the market fundamentals and instead make assumptions in favour of simple price estimation rules. Lansing (2006) goes ahead to elaborate that individual investors are tuned to use the estimation rule if the investors in the market are likewise using it. The assumption for this behaviour is that an investor would reduce their accuracy for estimation if they switched to a fundamental-based forecast. Based on this argument, the fundamentals-based forecast lacks the incentive for use by an investor (Camerer, Loewenstein and Rabin, 2011).

The rational bubble model in contrast, or what is referred to as irrational exuberance, assumes that an investor is fully cognisant of an asset’s fundamental (intrinsic) value but may be willing to pay more (James and Isaac, 2000). According to this model, an investor would be willing to pay more than the intrinsic value if the expected future price appreciation is high enough to satisfy the required rate of return of the rational investor. The challenge with the rational bubble is that to sustain it, the price of the stock must grow higher than the cash flow through in perpetuity, it is, therefore, unrealistic and ineffective model in the long-run behaviour of a market (Greenwood and Nagel, 2009). Protests of this model argue that it is impossible to believe on a literally stuck market on a path where the price to dividend rations explode in the long run (Hommes et al., 2008). Contrary to such a model, a more elaborate model where the bubble is assumed to crash periodically is determined. The periodic crash is assumed caused by a universally known probability function (Hefti, Heinke and Schneider, 2016). Arguments based on the theoretical perspectives of a rational bubble mandates the bubble to be positive. This means that in the case of a rational bubble, the asset price is always higher than its intrinsic value. Based on this argument, therefore, expectations are on average correct (Haruvy, Lahav and Noussair, 2007). For example, if investors who are rational are of the idea that the price of an asset will depreciate below its intrinsic value, then they would willingly overpay for that asset because the bubble would never occur. Secondly, the number of market participants would be infinite (Himmelberg, Mayer and Sinai, 2005). In the absence of conditions such as these two, then rational investors willing to overpay for an asset now and sell at a higher price to other rational investors would not be there. Disagreements that these conditions would prevent a rational asset bubble has however been observed amongst researchers. The main weakness of the rational bubble model is that while it assumes that investors know the exact size of the bubble and use this information to construct a separate forecast for the intrinsic and bubble price components, in the real world, investors are inclined to constructing a single forecast which is primarily used to predict the stock price movement (both for the intrinsic and the bubble prices) (Powell and Shestakova, 2016). In counter of this assumption, Lansing (2007) introduces the “near-rational” bubble model. In Lansing’s model, the investor uses a simple extrapolative forecast rule on observable asset market data. Using the model, upward and downward swings of the price-cash-flow ratio is exhibited. The result is excess volatility only that unlike in the rational bubble model, the ratio is seen to return to the vicinity in the long-run average. Also, the bubble is unlikely to become negative in the near-rational model and this feature makes the asset prices to stay below the intrinsic value.

Causes and outcome of an asset bubble

Phillips, Wu and Yu, (2011) examines the rise in the bitcoin and uses some of this information to elaborate on what cause an asset bubble. In this work, it is stated clearly that when the price of an asset starts to rise dramatically, two types of investors are usually in play. The first investor is the value investor who makes decisions along the line “is the investment getting too expensive?” and the other investor who is a momentum investor who makes decisions along the lines “am I missing out on a trend?” It is the balance between these two that can prevent an asset bubble. However, both of these investors are likely to lead to an asset bubble.

However, this is just but one of the many theories that have been used to explain the cause of the asset bubble. It is crucial to note that even after decades of research, no agreement has been reached regarding the cause of the asset bubble. For every asset bubble that is experienced, analysts have to ask themselves hard questions such as; is it the investors' optimistic behaviour regarding the asset fundamentals the cause especially when after a period into the investment, they realise that it was just a mirage? Another question is, do investors buy assets at inflated prices knowingly with the hope that they will find another investor who is not aware of the inflation and sell to them before a crash? Do investors simply follow the herd leading to an asset bubble? Phillips and Yu, (2011) explains that the main cause of assets bubble is when investor make mistakes in their projections in expected asset returns, this often happen if an asset has performed outstandingly in a couple of years and the earnings have grown to a faster trend. This phenomenon would make the people assume that this trend is the new normal and as such pay high prices only to experience unimaginably low prices. Another possible cause of assets bubble is that most of the economic models that are used to explain the happenings of the market are usually based in rational expectations and this is used to justify the assumption that when making a future forecast, people do not systematically make errors. Critics of this assumption have gone ahead to ask what would be the market behaviour if the investors' improperly extrapolated trend were applied in the future. The problem with this is that if people are convinced that this recent trend is the new normal, then they will be willing to pay higher prices, besides being extrapolative expectations that have been erroneously generated (Agarwal et al., 2007). This is likely to spiral things out of control prior to people coming to their senses leading to repeated bubbles. This has been used to explain the housing bubble noting the investors are the ones who decide how much a house is worth. They do so by guessing how much that the people who may want to leave here would pay in the future. A factors such as an expected rise in demand would mean that the local would be comfortable paying for more assuming that future buyers will drive this price further. But the important question here is why one would assume that the future demand for these houses would increase. The response to this is that if the recent trend shows an increasing spiral, then it is possible that the demand will rise. This means that to make an investment, investors rely on the past prices to estimate the future prices. The crucial observation that they forget to note is that all other investors are doing the same guess and estimates. This means that everybody in the market guesses but based on another person’s guess. Predictably, this leads to repeated booms and bubbles. Generally, numerous research works have shown that extrapolative expectations are the reason for many asset bubbles. However, the assumptions of this theory contradict most theories that have been used and developed by economist showing what works in the markets and what does not, for example, the efficient market theory. Closely related to the concept of an asset bubble is economics which is perhaps the most expected impact of bubbles. The most prominent recessions that have been associated with stock market bubbles include that of 1920, the 1990s dot-com bubble and the 2000s real estate bubbles. All these three bubbles were followed by economic downturns. Economist insists that asset bubbles have the most impact on the investors who are late to enter the market shortly prior to the burst. The main cause for a recession from this point is that as businesses and investors enter at the market late, the net worth is eroded into the burst causing businesses failure, unemployment, financial panic and lower productivity.

How the asset bubble works

An asset bubble works like a snowball feeding on itself. This means that as the price rise, opportunistic speculators and investors get into the market and resultantly take the process further up. This upward spiral continues because as the process goes up, further speculation takes the prices to levels that are unsupported by the fundamentals in the market. The main problem, however, starts when people with no investing knowledge and experience notice the prices and think that they could profit. The resultant flood of investment inflates the prices to unsustainable levels and then they are triggered and they come down. The main trigger is an exhaustion of the demand. A downward shift of the demand curve pushes the prices downwards. To elaborate on this phenomenon, two of the recent bubbles are explained. First, the 1990s dot-com bubble is traceable to 1990s as it is named. In the years between 1990 and 1999, the words Web, online and internet dominated the stock market lead to tech-based stocks improving from 500 to more than 5000. Companies such as Amazon, Yahoo, and Google alongside others were started. Although most of the companies lacked the innovative vision of tech products or did not even have the products, they still earned millions. The burst was caused by a sell-off of the NASDAQ leading to the closing of the many tech companies. Unemployment that followed was associated with the economic recession that occurred. Secondly, the 2000s real estate bubble which was associated with the great recession was characterised by easy access to a mortgage in the US. As a result, the real estate demand skyrocketed as mortgage brokers, real estate agents, builders and bankers invested into the real estate business. Investors and people who did not have enough assets were loaned hundreds of thousands. On the onset of 2006, the prices started coming down and as of 2008, the entire country was experiencing and an economic meltdown. Banks were pronounced insolvent because of their excess financing of the subprime mortgages. Looking at these two examples, and the rest of the literature observed in the other sections, it is clear that the human behaviour has a role in the most asset bubble. In the following sections, the research examines the literature on the role of human behaviour in asset bubbles. More specifically, the research critically examines the literature to explore the ultimate cause of asset bubbles that are related to human actions.

Irrational Exuberance

The aspect of irrational exuberance is used to describe a situation when the investors are overly confident that the asset’s price will continue to rise. As a result, they lose sight of the value of the assets and as a result, they fail to recognise the assets deteriorating economic fundamentals as they continue to pursue higher returns. Blanchard and Watson, (1982) claims that the reason for the asset bubble associated with irrational exuberance is that many people fail to perform adequate research prior they invest their money in assets. As a result, an asset whose prices are risings will attract such investors leading to further rise before it comes down. The study attributes people's emotions to this behaviour. Also, the perceptions of conventional wisdom and random attention on investment is another cause for irrational investments. Market analysts are also sources of information used by investors and this information is based on market forecasts. Barberis and Thaler, (2003) insists on the investors’ emotions which are affected by other human behaviour factors such as loyalty, morale and their sense of fairness. It is expected that resentment by people against their corporation has an impact on the attention other investors are likely to offer in such an organisation. Resentment is caused by many factors but the most peculiar one is associated with the possible profits that a company is likely to make either over years or on a particular asset. To understand this further, Lansing, (2006) looks at the impact of the continued deterioration in income distribution. The stories on the high wealth that is created by the organisation owners could be a reason for a resentment from the public regarding the business. Also, the growth in earnings that can be realised in a market is likely to be not tolerated by the public. In a world where technology has taken over and made it a global village, Abreu and Brunnermeier, (2003) insists that foreign resentment about an organisation or an asset or even a country would also reduce the attention. The opposite of these claims would most probably be true. That is, attention or a likening of an organisation would draw more attention from investors and may cause a price rise and therefore to a bubble.

The herd behaviour

Bénabou and Tirole, (2016) notes that there are a number of reasons that have been named as the causes of asset booms and burst. Amongst these are low-interest rates with losing credit conditions as was experienced during the real estate bubble of the 2000s, poor regulations and greedy financial speculators. However, Krugman, (2009) insists that these are just proximate causes and that the ultimate cause is the human behaviour. In particular, Maor, (2014) examines the herd behaviour of humans explaining it using different aspects. The first aspect is the homoeconomicus which is created using the hypothesis of an efficient market. This hypothesis assumes that humans are rational and as such will make investment decisions based on the principle of utility maximisation. Economists using this hypothesis are able to generate mathematical equations modelling rational behaviour. McCarthy and Peach, (2004) however, criticised the model generated from the hypothesis claiming that it left most of the human emotions that include lack of knowledge, jealousy, greed, fear and incomplete information. The notion behind this claim is that humans are not entirely rational but rather are affected by a number of emotions and these have an impact on the decisions they make every day. Thaler, (2016) noted that if all humans were rational making investment decisions, in other words, if they were all home economics, then, financial crises and bubbles. Based on this observation of the failures of efficient market hypothesis, economics give birth to behavioural economics. In this branch of economics is the aspect of herd behaviour. Herd behaviour is an old human behaviour of human sticking together or safety and security. This is especially expressed in financial markets to make investment decisions. It explains the tendency to align with the views of a larger group because it helps a person to feel safe and to deal with conflict. Koh et al., (2005) looked at different investments experiments associated to herd behaviour and established that in many occasions, investor reported making the wrong decisions despite their prior knowledge that these choices were wrong simply because they watched other making similar choices. Kamalodin, (2011) expounded the herd behaviour to group thinking noting that in most corporate meetings, an original idea that has been tabled is at the end supported by everybody in the meeting despite them having expressed different opinions in the beginning. The result of this group thinking creates an illusion that all people have similar opinions and this creates loyalty and optimism in the view. People with different opinions are disregarded and seen as disloyalty. Applied practically, herd behaviour can be explained by determining in what situation an investor would be more confident between investing in an asset that has 20 market analyst investment rating and an asset with 20 hold ratings. In most cases, investors will be more comfortable investing in an asset with 20 smart analysts saying that it will be profitable. In most cases, however, the company with a lower rating is likely to perform better. Based on the herd behaviour assumption, it would be more stressful to buy an asset that is not liked by anybody.

In support of the efficient market theory, Michailova and Schmidt, (2016) stated that although the hypothesis postulates that an investor is in all times fully informed, it does not mean that homoeconomicus can foresee the future. Rather, it means that the investor is informed of all the alternative courses of action and weighed using probabilities of occurrences, an investor can correctly assess the outcome of the actions. However, following the already examined asset bubbles, it is clear that investors are not economics and hardly have any knowledge regarding the consequences of their courses of actions. This is as As Ben Bernanke (2010), Chairman of the Federal Reserve, noted in his speech: “during the worst phase of the financial crisis, many economic actors –including investors, employers, and consumers– metaphorically threw up their hands and admitted that, given the extreme and, in some ways, unprecedented nature of the crisis, they did not know what they did not know. The profound uncertainty associated with the ‘unknown unknowns’ during the crisis resulted in panicky selling by investors, sharp cuts in payrolls by employers, and significant increases in households' precautionary saving.”

Behavioral finance aspect of assets bubble

Palan, (2013) emphasis that there is an emotional component in asset bubbles and attributes this to the irrational nature of humans. However, in behavioral finance, human are explained as predictably irrational. This is why it is possible to identify the obvious attributes of asset bubble psychology. First of all, Shiller, (2003) insisted that almost all asset bubbles ever experienced have two consistent ingredients which are leverage and innovation. In all the bubbles, a financial innovation is seen to increase the leverage and liquidity. Expanded leverage provides liquidity to fund the bubble and then inevitable unwind the bubble as it unwinds downwards (Shiller, 2005). Uncertainty is the other feature and is explained as the insight force that is present in every bubble. This force leads to rapid debate on the economic value of an innovation (Rosser, 1999). Typically, the uncertainty is surrounded by a lottery effect that promises a pay-off for the investors who act first. Both of these attributes are regarded as inevitable which means that asset bubbles are inevitable. As framed by Henry Blodget, under the behavioral aspects of assets bubble if you lose your bet, you lose 100%. If you win your bet, you make 1000%.” Anchoring, hindsight bias, herd behaviour and overconfidence are all used to explain the greater fool theory in Scheinkman and Xiong, (2003). This theory assumes that rational investors will go ahead and invest in an asset they have little confidence in as long as they are sure that a more foolish investor will pay a higher value for it (Sornette and Woodard, 2010). This assumption is what makes human predictably irrational. This is why, when an asset is introduced in the market, everybody tends to believe that he or she is the first few to spot the opportunity and therefore can invest and then pull out in time before a burst (Stracca, 2004).

Chapter Four

Conclusion

The aim of this paper was to investigate the role of the human behaviour in asset bubbles. To achieve this main objective, the paper sought to find out the theories and aspects of behavioural economics that are used to explain asset bubbles and lastly the implications of asset bubbles in the economy. The study established that human behaviour plays a significant part in and is a cause of asset bubbles. In this study, an asset bubble was described as a situation where the prices of an asset exceed the intrinsic value of that asset. The principle objective of social financial matters is not to totally change how current financial matters are comprehended, nor to decimate the customary financial state of mind. Its fundamental point is to bring monetary hypothesis and this present reality closer, to advance we should utilize theoretical specialists who are more similar to humans than economists. By and large, conduct market analysts have appeared during the time that as long as we carry on as we do (i.e. like people), budgetary emergencies will dependably be with us. This is on account of we do not have boundless learning and data. Indeed, even Noble prizewinning financial specialists experience difficulty understanding the economy's complex framework. The fall of LTCM with two Nobel laureates in financial matters on its board (Robert Merton and Myron Scholes) fills in as a great illustration. So also, portfolio supervisors can never have finish information on the considerable number of stocks and bonds accessible on the planet. Since we confront a data over-burden on the planet (bothered by the web), we turn out to be exceptionally specific with the data we secure. What is more, given the certainty we have in our own particular capacity, we will probably specifically look for data that affirms our own particular view, are by nature hopeful, pompous and eager. This is simply human instinct. 'Positive reasoning', arrogance and insatiability are the reasons why we have accomplished to such an extent. Without these qualities we couldn't fly in a plane, not to mention arrive on the moon. As Gordon Gekko, the anecdotal character in the motion picture 'Money Street' broadly announced: "Voracity, for an absence of a superior word, is great. Voracity clears up, slices through, and catches the substance of the developmental soul." Yet we should pressure that arrogance and avarice, particularly in the money related markets, have too demonstrated their uglier side over and over. These traits can be so intense that they make us near-sighted, with short recollections and a numbness of history. Henceforth, we should welcome that presumptuousness also, avarice can now and again push us towards incredible innovations while other times they can cause extraordinary enduring. Hate to be the main suckers. At the point when everybody is getting rich, we generally get sucked in as we don't prefer to fall behind. Studies have demonstrated that our prosperity isn't dictated by our total salary, however or maybe by our relative pay. Our social remaining in a network is critical. In the meantime, when everybody alarms and scrambles for the leave, we typically freeze and do the same regardless of whether we are most certainly not beyond any doubt of the reason. An imperative reason is that we would prefer not to be the just a single experiencing misfortunes. In that capacity, we have a tendency to take after the group even on the off chance that the group heads in the wrong course (either in time of extreme good faith or cynicism).

So we ought to be under no fantasy that we will ever avert resource bubbles and monetary emergencies from occurring. They will be with us as long as we wander on this planet. Be that as it may, there are positive approaches to battle them. In opposition to customary shrewdness, the most ideal way isn't through fiscal arrangement or heavier monetary control (in spite of the fact that they may somewhat help). To take care of an issue, one needs to discover its underlying driver. On the off chance that people achieve emergencies, at that point finding out about our own mind can be the best device to battle emergencies. This implies including courses like back, brain science and financial history to secondary school educational programs can turn out to be extremely useful. With respect to the individuals who have officially moved on from school, getting prepared in these fields ought to be an unquestionable requirement paying little heed to call. At the finish of the day, we need such learning for taking financial risks. Ideally, an expansion in our 'insight' will enable us to comprehend that the world economy is a substantial mind-boggling, dynamic and shaky framework. One day individuals are idealistic about the future and they purchase houses, autos, and different durables while expending more extravagance administrations, for example, visiting eateries and taking some time off. And after that, the following day certainty vanishes in a puff of smoke for some reason. This can apply enough descending weight on resource costs to cause a monetary emergency. In this way, before going out on a limb, we ought to be aware that at least one variables can all of a sudden turn something that appeared to be productive/practical today into something unfruitful/unsustainable tomorrow. This is the reason the most modern banks, controllers and rating organizations experience issues foreseeing emergencies and crashes. So vulnerability concerning the future will stay with us until the end of time. History matters! Frequently history rehashes itself (yet not precisely in a similar way) yet we have a tendency to overlook it since we think it is valuable data for students of history as it were. A superior appreciation of our past makes us mindful that changes in perspective don't occur much of the time. Against this setting, we ought to know that advantage costs don't generally go up regardless of whether they have been ascending for a broadened period. Being always watchful is an unmistakably gainful system (i.e. valuations ought to never be overlooked). There is no arrival without hazard. We should comprehend that at whatever point a return is made on anything (even government bonds), there is chance included. Risk-free return basically isn't. These exercises will, with a touch of good fortune, enable us to decrease the recurrence and seriousness of benefit bubbles and money related emergencies. The key is grappling with the reality that human are closely level headed. As such, we require to comprehend that a few circumstances surpass our ability to judge probabilities.

References

- Agarwal, S., Chomsisengphet, S., Liu, C., & Rhee, S. G. (2007). Earnings management behaviors under different economic environments: Evidence from Japanese banks. International Review of Economics & Finance, 16(3), 429-443.

- Bénabou, R., & Tirole, J. (2016). Mindful economics: The production, consumption, and value of beliefs. Journal of Economic Perspectives, 30(3), 141-64.

- Breaban, A., & Noussair, C. N. (2017). Emotional state and market behaviour. Review of Finance, 22(1), 279-309.

- Bordo, M. D., & Jeanne, O. (2002). Boom-busts in asset prices, economic instability, and monetary policy (No. w8966). National Bureau of Economic Research.

- Campbell, J. Y., & Vuolteenaho, T. (2004). Inflation illusion and stock prices. American Economic Review, 94(2), 19-23.

- Campbell, J. Y. (2003). Consumption-based asset pricing. Handbook of the Economics of Finance, 1, 803-887.

- Duffy, J., & Ünver, M. U. (2006). Asset price bubbles and crashes with near-zero-intelligence traders. Economic Theory, 27(3), 537-563.

- Dufwenberg, M., Lindqvist, T., & Moore, E. (2005). Bubbles and experience: An experiment. American economic review, 95(5), 1731-1737.

- Erixon, F., & Weigel, B. (2016). The innovation illusion: How so little is created by so many working so hard. Yale University Press.

- Frydman, C., & Camerer, C. F. (2016). The psychology and neuroscience of financial decision making. Trends in cognitive sciences, 20(9), 661-675.

- Haruvy, E., Lahav, Y., & Noussair, C. N. (2007). Traders' expectations in asset markets: experimental evidence. American Economic Review, 97(5), 1901-1920.

- Himmelberg, C., Mayer, C., & Sinai, T. (2005). Assessing high house prices: Bubbles, fundamentals and misperceptions. Journal of Economic Perspectives, 19(4), 67-92.

- Hommes, C., Sonnemans, J., Tuinstra, J., & Van de Velden, H. (2008). Expectations and bubbles in asset pricing experiments. Journal of Economic Behavior & Organization, 67(1), 116- 133.

- James, D., & Isaac, R. M. (2000). Asset markets: How they are affected by tournament incentives for individuals. American Economic Review, 90(4), 995-1004.

- Koh, W. T., Mariano, R. S., Pavlov, A., Phang, S. Y., Tan, A. H., & Wachter, S. M. (2005). Bank lending and real estate in Asia: Market optimism and asset bubbles. Journal of Asian Economics, 15(6), 1103-1118.

- Thaler, R. H. (2016). Behavioural economics: past, present, and future. American Economic Review, 106(7), 1577-1600.

- Michailova, J., & Schmidt, U. (2016). Overconfidence and bubbles in experimental asset markets. Journal of Behavioural Finance, 17(3), 280-292.

- Phillips, P. C., & Yu, J. (2011). Dating the timeline of financial bubbles during the subprime crisis. Quantitative Economics, 2(3), 455-491.

- Powell, O., & Shestakova, N. (2016). Experimental asset markets: A survey of recent developments. Journal of Behavioural and Experimental Finance, 12, 14-22.

- Shiller, R.J. 2003. "From Efficient Markets Theory to Behavioural Finance." Journal of Economic Perspectives 17 (Winter), pp. 83-104.

- Smith, V. L. (2005). Behavioral economics research and the foundations of economics. The Journal of Socio-Economics, 34(2), 135-150.

- Smith, V. L., Suchanek, G. L., & Williams, A. W. (1988). Bubbles, crashes, and endogenous expectations in experimental spot asset markets. Econometrica: Journal of the Econometric Society, 1119-1151.

- Sornette, D., & Woodard, R. (2010). Financial bubbles, real estate bubbles, derivative bubbles, and the financial and economic crisis. In Econophysics approaches to large-scale business data and financial crisis (pp. 101-148). Springer, Tokyo.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts