Cryptocurrency Market Analysis and Recommendations

Introduction

The purpose of conducting this research study is to analyse the current cryptocurrency markets and recommend the investors on ways to create value with it for the long run. Herein the researcher explored different aspects of cryptocurrency and how they relate with real currencies and trading units. The data for this study was collected through secondary sources. To analyse the researcher has used the data both qualitative and quantitative techniques. In the following paragraphs, the technique of thematic analysis has been used to analyse the data in a qualitative manner.

Data Analysis

Various themes have been presented in the following paragraphs.

Theme 1: Concept of cryptocurrencies and blockchain technology

In recent some years, there have been a lot of changes and developments in the way currencies function. One of the key developments has been the emergence of blockchain technology and cryptocurrencies. During this study, it was observed that cryptocurrencies have now become a leading way for investors to make investments and make money. They are now considered as a revolution in the investment market. The study also revealed that cryptocurrencies could be considered a breakthrough in electronic payment methods (Yli-Huumo, Park and Smolander, 2016). Essentially it has made the process of making and receiving payments a lot simpler and effective. Over the years cryptocurrencies have gained a lot of traction, and they have become extremely popular among the people. In many businesses and such a transaction, they are now considered as the preferred way for payments. One of the main reasons for such explosive growth of cryptocurrency is ‘bitcoin’ (Eyal, 2017).

Essentially cryptocurrency is a digital asset which has been designed to work as a medium of exchange for the users. As the name suggests, it uses very strong cryptography techniques to ensure the security of the financial transactions. Moreover, similar cryptography is used in controlling the creation and distribution of additional units as well as to verify the transfer of the assets. Many of the experts and authors have stated that today it is one of the safest means of making and receiving payments. In contrast to traditional digital currency and central banking systems which are centralised in nature, the cryptocurrencies are decentralised ones (Umeh, 2016). Cryptocurrencies, since are decentralised in nature, operate through distributed ledge technology, also known as blockchain. It acts as a database for public financial transactions made by the users. As opposed to the more traditional systems such as the Federal Reserve System, which issues new bonds and currencies by printing fiat money, the entire cryptocurrency system produces new units which are publicly known as well. Today there are more than 1800 cryptocurrency specifications, the safety, integrity and balance of which is maintained by the miners through ledgers. The miners use their computers to mine new currencies and thus keep the flow of cryptocurrencies.

The blockchain technology is used to validate each of the cryptocurrency’s coins. It is an ever growing list of records, also known as blocks. They are linked and secured through a very strong cryptography system.

Theme 2: Criticism of cryptocurrency and blockchain

During the study, it was observed that cryptocurrencies are some of the most popular forms of making and receiving payments. They have evolved and grown considerably over the years and today are extremely popular. However, cryptocurrencies and blockchain have been criticised by numerous experts and authors on the subject matter. One of the key criticisms was that if it gets lost, then it is gone forever (Chapron, 2017). This means that whoever possesses the cryptocurrency has the right to use. Once it is lost, there is no way to recover it. This has been one of the main limiting factors of cryptocurrency. With a significant increase in the number and intensity of hacking, there are more chances that the people might lose ownership to the cryptocurrency. This is a major risk for the people. If for any reason they lose the currency, then it would be lost forever. Due to this reason, many people still do not prefer to use the said currency system.

Another major criticism identified during the research was that it is like a pyramid or bubble scheme. Since it is invisible and has no real-world value, there are more chances that it might become obsolete and thus will be of no use for the person who possesses them (Dai and Vasarhelyi, 2017). Further the current study also revealed that cryptocurrency is not a mainstream currency system. Due to this its real-world value and importance also decrease considerably. Since they are prone to hacking and malware many governments around the world, do not consider them to be legal. The fact that the users of such currency are anonymous, the currency can be used for a number of illegal trades and activities as well, such as funding terrorism, or other such activities (Hayes, 2017).

Theme 3: Features of Cryptocurrency

Dig deeper into Market Dynamics and Herding Behaviour with our selection of articles.

Today cryptocurrencies and the blockchain technology are extremely popular. They are considered the most effective way of sending and receiving payments. While conducting the study, it was noted that one of the key features of cryptocurrency is decentralisation. Cryptocurrencies are largely decentralised, meaning that no central authority or figure controls the flow of the currencies and its units (Fry and Cheah, 2016). This means that cryptocurrencies are not controlled and monitored by the governments or its departments. Rather it is an ‘open world’ system and the users are free to own and control as much cryptocurrency as they can. This makes it all the more lucrative and attractive for the investors and other such people.

Another key feature of the cryptocurrencies is that they are highly flexible. Addresses and other such information can be very easily modified and updated. Thus it can be said that the cryptocurrencies are very easy to use and maintain. The users only have to ensure that they are kept in a secure location so that they are not hacked into or used by any other third party (Li and Wang, 2017). In addition to this, since the transactions are not location specific, i.e. the parties involved do not have to meet with one another physically, cryptocurrencies can be very easily transferred among different countries.

Many authors and researchers have claimed that transparency is the biggest feature of using cryptocurrencies. Herein, every transaction is broadcasted to the entire world. This means that every person can easily know the total amount of cryptocurrency currently in circulation and how many additional units are being produced (Gandal and Halaburda, 2016). Due to this reason, it is very easy for people to track down the currencies. The miners can use this information to develop a proper strategy for mining the cryptocurrencies such as bitcoins.

Theme 4: Cryptocurrency as a new investment opportunity

In recent some years, a lot of development and changes have been observed in the investment market. They have essentially changed the whole market. Many studies have revealed that currently, they are the best investment options, as although the risks are considerably high, the return gained by the investors is massive. Thus it can be said that the cryptocurrencies have emerged as one of the best and highly lucrative investment opportunity. More and more people are investing in the cryptocurrencies, even though they have been banned in many countries (Surowiecki, 2011). In essence, it can be said that the cryptocurrencies have taken the international financial market by a storm.

Herein many of the experts have also stated that since it is very volatile in nature, only a limited amount should be invested in the cryptocurrencies. However, if such investments are maintained over a long period of time, they can become a great tool for retirement investment as well. Due to this reason, an increasing number of people are investing in the cryptocurrency, and the majority of these individuals are the young people. One of the main reasons for investing in cryptocurrencies is the potential for massive returns (Sompolinsky, Lewenberg and Zohar, 2016). There are many examples of individuals who had invested in the cryptocurrencies at its early stages, and now they are earning huge amount of money every year through it. Many of the studies pointed out that investing in cryptocurrencies is a long-term ‘game’. This means that the individual should think of the long-term, as these can provide the best returns only at a later stage of time.

Increased liquidity is another main reason that has transformed cryptocurrencies into one of the best and highly effective investment options. It is very easy to buy and sell the cryptocurrencies. This means that if any individual is in need of quick cash, they can sell the cryptocurrencies they own, either all of it or a part of it depending on their requirement, and they are more likely to generate cash easily through it (Kim, Kang and Kim, 2016). Moreover, investing in the cryptocurrencies is very simple. The investors have to pay a very small fee, and they can get started almost immediately. This makes investing in the cryptocurrencies even more attractive and lucrative for the investors. There is potential for earning more than their original investment in a very short period of time.

Theme 5: Difference between cryptocurrency and stock market

In the present market trends, both cryptocurrency and shock market are addressed as important elements of money and financial market, but different studies have found that the operation of the crypto market is significantly different from the stock market. If an individual wants to invest in stock, then that particular investor invests in a company. On the other hand, investment in cryptocurrency is mainly focused on investment in a currency of certain company (Abramaowicz, 2016). In this context, the first major difference is related to the User Base and Revenue of cryptocurrency and the stock market. In this context, different studies have found that the creation of cryptocurrencies was carried out for fun that has not any kind of clear blueprint and projections. In this regards, some of the cryptocurrencies are not having clear-cut revenue and user base, but these currencies have kept high market cap due to speculations. Most of these are termed as a scam, and any other organization does not back these. Therefore, there is a significant difference identified as compared stock market trading (Harwick, 2016). All the public stocks in the stock market are mainly backed by a company that has certain revenue and user base for managing the investment of people.

Further investigations have determined that the element of Price Volatility as an important factor through which difference between cryptocurrency and the stock market can be measured. Prices of Cryptocurrencies are highly volatile as compared to the stock market because cryptocurrencies do not have any kind of intrinsic or tangible value. Furthermore, Ethereum is having the semi-tangible value and stocks are completely tangible value. This thing makes cryptocurrencies more volatile as compared to stocks (Raymaekers, 2015). Therefore, the monetary value of cryptocurrency can be increased by 1000 per cent within in less than a month.

When the price of cryptocurrency is going to fall, that means it is time to enter the market even, but this approach does not work similar to stocks. Furthermore, the total market capitalisation of the cryptocurrencies is unknown, and the crypto market is also subjected to manipulation, but the stock market cannot be manipulated. This thing determines the different aspects of price fluctuation. In addition to that safety and security of investment is also considered as an important element in which cryptocurrencies have been addressed as most vulnerable in order to being hacked with reference to stocks in the stock market. In the recent studies, almost 4 million Bitcoins have been lost as a result of various causes for the forever and many more (ElBahrawy, Pastor-Satorras and Baronchelli, 2017). The main reason behind the loss of cryptocurrencies is identified that users lose their private keys. In addition to that users also have lost all hopes for recovering their assets as a loss of entering key. In addition to that hackers have focused on getting user’s private keys so as these hackers are able to get unauthorised access for these coins. Moreover, the stolen coins become almost impossible to get recovered. On the contrary, hacked funds can still be recovered in the stock market. Apart from that stocks are getting hacked which are not gone forever. Furthermore, investors also stand a chance for gaining access over the stocks again (Cocco, Concas and Marchesi, 2017). This thing is being termed as the most important gaps when the comparison of stock is carried out with cryptocurrencies. In different studies, Market Volatility is also an important element for making a comparison. In this regards, Cryptocurrencies are highly volatile with reference to the traditional stock market. The volatility of cryptocurrency is significantly high because cryptocurrency market is not similar to intrinsic or tangible value as compared to the stock market. Ethereum has maintained some tangible value because it is a blockchain of a smart contract for other platforms (Hughes and Middlebrook, 2015). In addition to that cryptocurrency market can easily be manipulated while the stock market cannot be as easily manipulated as a result of fluctuation. Moreover, the value of the coin could easily increase or decrease to100x as compared to its initial value.

The main component to determine the difference is 24/7 Market. In the cryptocurrency, the value of coins is changed every minute, every hour as well as every day. Furthermore, the dealing of cryptocurrencies is carried out between peer to peer through the network. Therefore, it can be traded by any two individuals any time of the day. Cryptocurrency exchanges also work 24/7, but stock markets are not working 24/7 because these markets are worked as per the schedule of the local stock market (Pacy, 2014).

Theme 6: The growth and recent trends in the cryptocurrency market

For taking investment decision in the cryptocurrency market, the evaluation of current trends and growth factors is playing important role. In different studies, it has been addressed that the number of cryptocurrencies along with their exchanges platforms are growing significantly each year. In this context, it has been examined that there are more than 190 exchanges available for virtual currency as compared to 70 exchanges which were in three years. Furthermore, there has been significant growth addressed in demand of cryptocurrency along with significant growth has been addressed in the numbers of cryptocurrencies and trading platforms increase (Vigna and Casey, 2015). In studies, there are currently 1,568 different cryptocurrencies identified in 2018. The breaks down of these currencies are carried out in the 654 tokens and 914 coins. The application of virtual currency has been stated with the emergence of bitcoin, which was introduced in 2009, and some other various launches are addressed in the following years. Apart from that, some other experiments were also addressed in the form of altcoins which has started its operations in 2011 along with Namecoin, iXcoin, SolidCoin and others. In addition to that Litecoin followed soon after its operation in similar duration with other countries (Chepurnoy, Fan and Zhou, 2017).

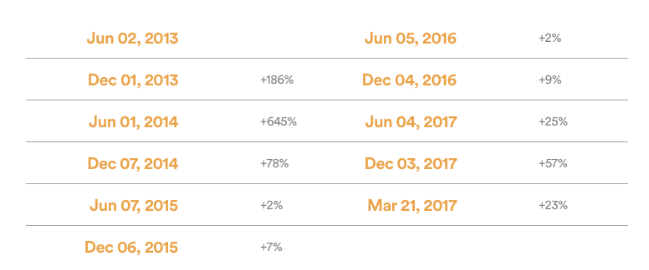

From December 2013 to 2017, numbers of cryptocurrencies have been increased from 40 to 1,273 with 3,083% increase rate. It shows significant trends in the occurrence of new currencies and the emergence of new markets for the trading of virtual currencies.

In addition to that, the below-mentioned table is showing the number of cryptocurrencies which are circulated in June and December each year since June 2013 with reference to the current number in March 2018. It has been examined that the largest six-monthly growth was in June 2014 that was recorded 645% more coins as compared to December 2013. In addition to that, the growth rate of virtual currency is picked up again in 2017 with the emergence of 1,568 cryptocurrencies recorded in March 2018.

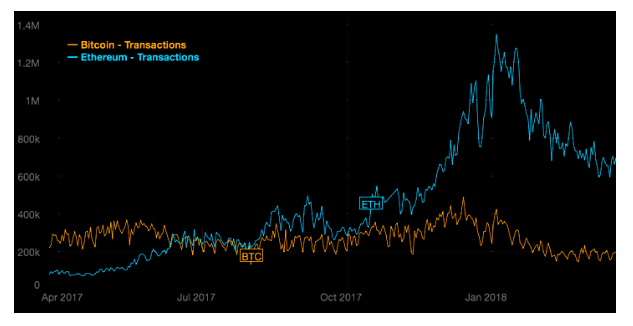

Some other studies have determined that the number of transactions based on the blockchain has been significantly increased over certain time duration. The evaluation of different statistics has determined that bitcoin has made a significant visible appearance on the charts in 2011 with 13,900 transactions but some negative trends are addressed in the number transaction during the period of 2012. The assessment of other virtual currency services is addressed that Ethereum has recorded 2,881 transactions in 2015. In the virtual currency market, Ethereum has maintained significant growth in recent years that play an important role in influencing investment decisions of an individual (Bakar, Rosbi and Uzaki, 2017). Further assessment has determined Ethereum finally has overtaken bitcoin in the total growth of transactions which have been made in a day with recorded numbers of 292,941 as compared to a transaction made by bitcoin’s 268,951 transactions. During this period, Bitcoin has failed to manage its growth in a number of transactions in a day in 2014. However, Bitcoin has topped in the total number of 490,459 transactions on the blockchain in December 2017. Apart from that Ethereum has gained significant growth with a peak of a total of 1.35 million transactions during the period of January 2018.

Further investigation has determined the current drop in a number of transactions for bitcoin and Ethereum. In addition to that, the cumulative total of all blockchain transactions is not limited to cryptocurrencies such as bitcoin and Ethereum. Therefore, it can be stated that the cryptocurrency market has maintained significant growth which is not associated with two top currencies.

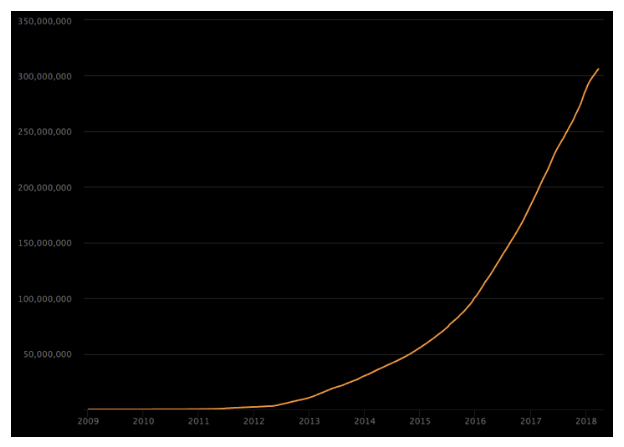

Further investigation has determined that there were over 305.61 million transactions recorded through blockchain. This is significant increased addressed which is reached 48.27% as compared to total 206.12 million which have been recorded in the period of 2017. Further investigation has determined that the growth in blockchain transactions is not limited to cryptocurrencies such as bitcoin and Ethereum so as the interest of external visitor has significantly increased as a result of a change in market trends (Sat, 2016). In addition to that, the trading volume on major blockchain exchanges has been grown significantly over the last two years. This metric equates to the amount of cryptocurrency coins traded within a 24-hour period so as it is difficult to examine. In 2016, the amount of cryptocurrency has been traded on major blockchain exchanges. The total volume of exchange is US$21.4 million. This value has kept significant growth in 2017 with the trading volume which is peaked to US$5.4 billion. This information represents an increase of +24,949.62% within the period of the nine-month period.

Further evaluation has determined a fall in price to US$1.97 billion. As a result of the change in the market environment, the total amount is traded between the range of US$188.5 million and US$3.1 billion (Heid, 2013). Therefore, the value of exchange trade volume remains volatile with reference to change in growth trends. This thing leads to a positive impact on the views of stakeholders about the different aspects of cryptocurrency.

Theme 7: The future growth factors in cryptocurrency

There have been several factors addressed which are playing an important role in the growth of the cryptocurrency market. In this context, emerging market uptake is identified as the most important factor for the growth of virtual currency. In this context, Potential geographic markets are considered as such as the market for cryptocurrencies that include countries with less developed financial infrastructure, but these countries have high smartphone usage. For example, over the half of total national GDP is controlled by a digital currency in Kenya (Bentov, Daian and Juels, 2017). Apart from that, some other countries which are facing issues related to the significant devaluation of nation’s currency are able to take appropriate advantage of different efficiencies offered by cryptocurrencies through which movement of money can be controlled. Apart from that the potential impact of new emerging market uptake becomes more relevant with Bitcoin. This is because Bitcoin is addressed as most widely adopted cryptocurrency and more than 14 million Bitcoins have been circulated with the highest level of adoption along with the lowest level of volatility (Rose, 2015). Therefore, it can be stated the cryptocurrency is offering several benefits in new emerging market trends. In addition to that different market, regulations are playing an important role in managing the growth of virtual currency. In this context, different studies have addressed that Bitcoin has gained significant benefit from permissive regulation within the western countries.

On the other hand, there are significant restrictions addressed in Asia. As a result of this China has banned the Bitcoin and influenced significant reduce at Bitcoin prices over the world. This thing indicates the importance of global acceptance to blockchain that plays an important role in managing different aspects of overseas demand for virtual currency. For achieving the widespread adoption among financial institutions, there are different regulations formulated for ensuring safe and secure transactions during the handling of Bitcoin (Simonite, 2013).

Furthermore, the Global deregulation leads a significant impact on the both Bitcoin and Ether in a different form. Bitcoin is identified most profitable currency which is being treated as a currency that offers significant value growth as a result of deregulation and also offering significant access into numerous market and ease of transactions across borders. In addition to that Ether would likely see greater value as a result of widespread adoption and reduction of limitations with the smart contract application (Gorbunov and Micali, 2015).

In this context, some other studies have determined that Commodity Markets for Everything Digital is identified as the most important aspects of digital currency management. In this context, one of the biggest areas facing disruption in virtual currency is related to electronically deliverable based on different services such as compute, bandwidth and other similarities. In the context, different studies have determined that advancement in blockchain technology will reduce difficulties marketplaces in order to form and bring a huge amount of supply online. This approach has found very effective for increasing the effectiveness of trade practices and safety and security of financial data. It increases the appropriateness of digital technologies with reference to trade management and fund transfer (D’Alfonso, Langer and Vandelis, 2016).

In addition to that virtual currency offers Fully Decentralized Exchanges for managing the challenges of building a liquid. Therefore, the decentralised market is identified the most important and future growth element of virtual currency. Currently, centralised exchanges have maintained significant control in the transmission of monetary resources. On the contrary, the different market forces are playing important role in developing new market opportunities for virtual currencies and their promotion in the new market (Pittman, 2016). Apart from that, some other major drivers are also addressed which are playing important in the promotion of decentralisation such as government regulations. This is because, in the traditional currency market, exchange of currencies and the financial transaction has become heavily regulated that have a significant impact on the interest of people towards new types of virtual currencies which are offering more liquidity and profitability to customers (Buterin, 2013). In some countries, the token offering has been deemed as an illegal equity offering, but the importance of this type of offering method plays an important role in changing the perception of an individual.

Apart from that, there is a lot of underlying infrastructures required to build for managing the decentralised exchanges and also plays an important role in discovering and share order volume, split economic. In addition to that, the development of an appropriate consumer and professional trading infrastructure is playing important for making the transaction more easy and approachable through different online tools without any restrictions. An ecosystem will be considered the ancillary products and services that surround the cryptocurrency (Hughes and Middlebrook, 2015). It can be hard to sell a cryptocurrency’s ecosystem because it is extremely hard to predict if the feature will be successful before it is tried. Therefore, it can be stated that development of the decentralised system will be found very effective for development and growth of virtual currency in the new market because in new markets application of latest technology and security features in companies for taking the appropriate support of government authorities. In this context, some important examples are addressed in which When bitcoin was released, it opened up a new world with endless possibilities inside (Kim, Kang and Kim, 2016). Bitcoin was open sourced which meant that anyone could clone the project and make their own version of bitcoin. Altcoins are some of those coins that have been created thanks to bitcoin.

In some cases of success, the innovation will be technical, and other times the innovation will be overridden by a stronger force. Bitcoin is one of the largest and most popular coins. This means that there is a community of people that use bitcoin and will continue to use it because its success has captured their attention (Li and Wang, 2017). In order to predict how a cryptocurrency will do long term, you have to look at the community around it.

Theme 7: Assessment of future growth trends in cryptocurrency

In previous years, the cryptocurrencies have addressed negative growth, but this sector is expected for experiencing the double-digit growth in different trading volumes in upcoming years, According to different studies, it has been addressed that the crypto trading volume will grow by 50% in 2019. In the United States, the total volume of cryptocurrencies traded is going to overtake the trading volume of corporate debt in the upcoming year. Further trends have shown that crypto-based trading volume is set to reach 10% of the total equity trading volume within the world’s largest economy (Chapron, 2017). In the current estimation, the volume of U.S. equities is going to increase to US$74 trillion in which the amount of US$7.3 trillion is traded through crypto trading.

In addition to that, the trading fees gained by crypto exchanges in the last year was almost on par with the US$2.2 billion which was mainly generated by global equities as well as the amount of US$2.6 billion is generated through retail brokers demonstrating. This growth in trading fees generated by cryptocurrency exchanges has been attributed to an increase in the number of institutional investors as well as growing retail adoption. The total trading volume in the crypto market has found very effective in order to predict growth prediction (Hayes, 2017). In this context, top 20 exchanges will be considered as growth divers’ in the future virtual currency market. It includes top 20 categories are playing important role for managing the value of cryptocurrency that includes Binance, Bitfinex, Bithumb, Bitmex, Coinbase Pro, HitBTC, Huobi and OKex. For managing growth, different new technology-based channels are playing an important role in developing new market opportunities. In this context, lightning is termed as a decentralised network which is going to offer smart contract functionality in the blockchain to enable instant payments across a network of participants. Apart from that, an individual is able to manage this new technology by using real Bitcoin/blockchain transactions along with the application of its native smart-contract scripting language and also high speed and secure transaction (Eyal, 2017). In addition to that Bidirectional Payment, Channels plays important for enhancing the flow of a transaction in which two participants are creating a ledger entry on the blockchain which requires both participants to sign off on any spending of funds. In this section, both parties are able to create transactions which can refund the ledger entry to their individual allocation by avoiding the broadcast of information to the blockchain. The creation of ledger entry is mainly carried out by creating many transactions spending from the current ledger entry output (Raymaekers, 2015). By developing a network or information of two-party ledger entries, it is possible to find a path across the network similar to routing packets on the internet so as the optimum flow of transaction will be scheduled.

Theme 7: Evolution of cryptocurrency

There have been numerous changes in the world of cryptocurrencies. These have made the new currency system stringer mad better. Through these changes, cryptocurrencies have gained the popularity they now have. Today, Bitcoin introduced in 2009 is the leading cryptocurrency and also the most popular one. Cryptocurrencies were first introduced in the 80s by an American cryptographer – David Chaum. He developed an algorithm that allowed for a more central, secure information exchange between the parties involved (Pacy, 2014). This gave birth to cryptocurrencies. One of the key developments in the cryptocurrency world was the establishment of DigiCash. The central aspect of it was that it dealt directly with the individuals. This provided an unparalleled reach to this form of currency which ultimately played a crucial role in the development of the modern-day cryptocurrencies. Deep reach among the target customers helped DigiCash to develop a very strong image in the market, which then helped it to create a very strong customer base. However, the Netherland’s government suspected some foul play and forced DigiCash to deal with only licensed banks (Sat, 2016). This significantly reduced the target customer base of the company and even jeopardised its very existence. DigiCash eventually folded in the 1990s, leaving a significant hole in the cryptocurrency market.

‘b-money’ was introduced around the same time by a software engineer – Wei Dai. It was a virtual currency architecture that consisted of many features of the modern-day cryptocurrencies. There were two main principles of b-money – decentralisation and complex anonymity. However, b-money was never used as a means of exchange (Buterin, 2013). It was left on the shelf and reduced overall functionality and efficiency of the cryptocurrency systems, as they were left largely useless and ineffective for the modern day users. BitGold was another major innovation in cryptocurrencies that relied heavily on blockchain technology. It was developed by Nick Szabo (Heid, 2013). It used blockchain features that are used by the modern-day cryptocurrencies such as ass Bitcoins, Erethuem, LiteCoin, etc. Although BitGold never became popular and had not been used as a means of exchange, it was one of the most important evaluations in the cryptocurrencies. It played a crucial role in the development of the current cryptocurrency environment.

After the emergence of DigiCash, there was not much innovation and research in the cryptocurrency market. The whole focus was shifted towards research and investment in electronic financial transactions and ways to make them smoother and more efficient and effective. However, cryptocurrencies that mimicked DigiCash were developed and introduced in countries such as Russia and other parts of the world. These further helped in the development of cryptocurrency technology and made the blockchain technology more efficient and secure. During this time, developers and authorities paid attention to developing this technology and make it secure for the users (Vigna and Casey, 2015). During the late 90s and early 2000s, the most prominent virtual currencies were that of e-gold. The company worked as a digital gold buyer and dealt only in gold. Its customers sent their old jewellery and other such forms of gold to the warehouses of e-gold, and in turn, they received ‘e-gold’, which is a form of virtual or e-currency. It can be used to trade with other holders of e-gold or exchange their e-gold for physical US currency. They could even use their e-gold to buy physical gold (Brown, 2016).

The development of this service added a whole new dimension in the world of cryptocurrencies, as it helped in understanding that the cryptocurrencies can also be used as a means of making actual, real-world exchanges (Bakar, Rosbi and Uzaki, 2017). This expanded capabilities of the new virtual currency system and made it more desirable for the users. By the mid-2000s e-gold had millions of active accounts and conducted transactions worth billions annually. However, the inadequate and ineffective security measures followed by the company attracted a lot of hackers. Phishing scams had become very common and were usually associated with e-gold. Lax security measures left the users of e-gold vulnerable to financial loss (Kim, Kang and Kim, 2016). The company and the virtual currency system finally ceased to exist in 2009, around which time Bitcoin, developed by Satoshi Nakamoto was introduced. Bitcoins are considered as the first modern cryptocurrency. It was the first publicly used means of exchange that consisted of decentralised control, user anonymity, and record keeping through blockchain. These features mad bitcoins very safe option for the users. In late 2010, many new alternatives to bitcoins such as Litecoin were being introduced. They were considered as far more effective means of making a public exchange through a cryptocurrency system.

Theme 8: Individual Investment Evolution

While conducting this study, the researcher observed that the cryptocurrencies and the blockchain technology have not only changed the virtual currency market, but they have also started to gain more and more investment from individual investors. This has completely changed the face of cryptocurrencies and made them into the global phenomena that they are today. The interest for virtual currencies among the people, i.e. the individual investors has peaked significantly. Many authors and experts on the subject matter have stated that every individual should own cryptocurrencies, regardless of their budget (Surowiecki, 2011). This is because of the changing technology and more reliance on virtual payment systems. According to some of the past studies those who had invested in cryptocurrencies such as bitcoins, today they are ‘millionaires and billionaires’. Although some of the studies showed that many people think they have missed out on the opportunity or the ‘crypto party’, essentially there are still a lot of possibilities, and the people can still earn a great deal by investing in such systems.

Currently, the cryptocurrency such as the Bitcoins are valued at $9000, and many experts and venture capitalists have predicted that by 2022, the overall value of Bitcoin will be upwards of $250,000. Furthermore, investing in the cryptocurrency market is a very simple process. Since the investors or the users are given the ability to buy and sell fractions of fractions of the virtual currency, there is no limitation on how the people could invest (Dai and Vasarhelyi, 2017). Many of the studies further showed that people could buy a part or even smaller parts of the currency. Essentially it all depends on a budget of the individual investor. This means there is practically no limitation to how the people want to buy and sell or exchange their cryptocurrencies. Thus it can be said that in recent some years individual or micro-investments in cryptocurrencies have increased significantly. As this technology is being further developed, it will encourage more individual investment from the public.

Theme 9: Risks in cryptocurrencies

Cryptocurrencies have become the leading form of investment for people around the world. During the study, it was observed that the cryptocurrencies such as bitcoins possess a great amount of risks and threats that can have a significant impact on the users and the general public (Yli-Huumo, Park and Smolander, 2016). These have made investing in the cryptocurrencies a significantly risky decision. Many authors and experts have stated that this is one of the key risks of low investments in the cryptocurrencies. It has now become imperative for the authorities that they develop proper security measures to reduce the risks as much possible.

One of the key risks found in many studies and cited by many experts can be viewed in terms of security. Cryptocurrencies generally are not considered to be very safe. For instance, once the wallet of bitcoins is lost, it can never be retrieved (Umeh, 2016). Thus if an individual’s computer gets scammed, or if the person is scammed into paying through bitcoins, then there is no way to get that amount back. This scares people from investing too heavily in such a system. Increasing number of hacking and phishing scams further complicates the matter. In addition to this, it is intangible, illiquid and uninsured. This means that it is a form of currency that does not exist physically, meaning that it can neither be insured nor it can be sold for quick cash. This makes investing in cryptocurrencies even riskier. In recent some years, it has been observed that cryptocurrencies are being used for terrorism and illegal and fraudulent activities.

Discussion of findings

One of the key developments has been the emergence of blockchain technology and cryptocurrencies. During this study, it was observed that cryptocurrencies have now become a leading way for investors to make investments and make money. They are now considered as a revolution in the investment market. The study also revealed that cryptocurrencies could be considered a breakthrough in electronic payment methods. Primarily it has made the process of making and receiving payments a lot simpler and effective (Harwick, 2016). Over the years cryptocurrencies have gained a lot of traction, and they have become extremely popular among the people. In many businesses and such a transaction, they are now considered as the preferred way for payments. One of the main reasons for such explosive growth of cryptocurrency is ‘bitcoin’.

Essentially cryptocurrency is a digital asset which has been designed to work as a medium of exchange for the users. As the name suggests, it uses very strong cryptography techniques to ensure the security of the financial transactions. Moreover, similar cryptography is used in controlling the creation and distribution of additional units as well as to verify the transfer of the assets (Pacy, 2014). Many of the experts and authors have stated that today it is one of the safest means of making and receiving payments. In contrast to traditional digital currency and central banking systems which are centralised in nature, the cryptocurrencies are decentralised ones. Cryptocurrencies, since are decentralised in nature, operate through distributed ledge technology, also known as blockchain. It acts as a database for public financial transactions made by the users.

However, cryptocurrencies and blockchain have been criticised by numerous experts and authors on the subject matter. One of the key criticisms was that if it gets lost, then it is gone forever. This means that whoever possesses the cryptocurrency has the right to use. Once it is lost, there is no way to recover it (Heid, 2013). This has been one of the main limiting factors of cryptocurrency. With a significant increase in the number and intensity of hacking, there are more chances that the people might lose ownership to the cryptocurrency. This is a major risk for the people. If for any reason they lose the currency, then it would be lost forever. Due to this reason, many people still do not prefer to use the said currency system.

Another major criticism identified during the research was that it is like a pyramid or bubble scheme. Since it is invisible and has no real-world value, there are more chances that it might become obsolete and thus will be of no use for the person who possesses them. Further the current study also revealed that cryptocurrency is not a mainstream currency system (D’Alfonso, Langer and Vandelis, 2016). While conducting the study, it was noted that one of the key features of cryptocurrency is decentralisation. Cryptocurrencies are largely decentralised, meaning that no central authority or figure controls the flow of the currencies and its units. This means that cryptocurrencies are not controlled and monitored by the governments or its departments. Rather it is an ‘open world’ system and the users are free to own and control as much cryptocurrency as they can (Abramaowicz, 2016). This makes it all the more lucrative and attractive for the investors and other such people.

Another key feature of the cryptocurrencies is that they are highly flexible. Addresses and other such information can be very easily modified and updated. Thus it can be said that the cryptocurrencies are very easy to use and maintain. The users only have to ensure that they are kept in a secure location so that they are not hacked into or used by any other third party (Li and Wang, 2017). In addition to this, since the transactions are not location specific, i.e. the parties involved do not have to meet with one another physically, cryptocurrencies can be very easily transferred among different countries.

Many authors and researchers have claimed that transparency is the biggest feature of using cryptocurrencies. Herein, every transaction is broadcasted to the entire world. This means that every person can easily know the total amount of cryptocurrency currently in circulation and how many additional units are being produced.

Herein many of the experts have also stated that since it is very volatile in nature, only a limited amount should be invested in the cryptocurrencies. However, if such investments are maintained over a long period of time, they can become a great tool for retirement investment as well. Due to this reason, an increasing number of people are investing in the cryptocurrency, and the majority of these individuals are the young people (Dai and Vasarhelyi, 2017). One of the main reasons for investing in cryptocurrencies is the potential for massive returns. There are many examples of individuals who had invested in the cryptocurrencies at its early stages, and now they are earning huge amount of money every year through it. Many of the studies pointed out that investing in cryptocurrencies is a long-term ‘game’. This means that the individual should think of the long-term, as these can provide the best returns only at a later stage of time.

Increased liquidity is another main reason that has transformed cryptocurrencies into one of the best and highly effective investment options (Chapron, 2017). It is very easy to buy and sell the cryptocurrencies. This means that if any individual is in need of quick cash, they can sell the cryptocurrencies they own, either all of it or a part of it depending on their requirement, and they are more likely to generate cash easily through it. Moreover, investing in the cryptocurrencies is very simple. The investors have to pay a very small fee, and they can get started almost immediately. This makes investing in the cryptocurrencies even more attractive and lucrative for the investors. There is potential for earning more than their original investment in a very short period of time.

In studies, there are currently 1,568 different cryptocurrencies identified in 2018. The breaks down of these currencies are carried out in the 654 tokens and 914 coins. The application of virtual currency has been stated with the emergence of bitcoin, which was introduced in 2009, and some other various launches are addressed in the following years. Apart from that, some other experiments were also addressed in the form of altcoins which has started its operations in 2011 along with Namecoin, iXcoin, SolidCoin and others. In addition to that Litecoin followed soon after its operation in similar duration with other countries. One of the key risks found in many studies and cited by many experts can be viewed in terms of security. Cryptocurrencies generally are not considered to be very safe (Eyal, 2017). For instance, once the wallet of bitcoins is lost, it can never be retrieved. Thus if an individual’s computer gets scammed, or if the person is scammed into paying through bitcoins, then there is no way to get that amount back.

REFRENCES

Bakar, N.A., Rosbi, S. and Uzaki, K., 2017. Cryptocurrency Framework Diagnostics from Islamic Finance Perspective: A New Insight of Bitcoin System Transaction. International Journal of Management Science and Business Administration, 4(1), pp.19-28.

Bentov, I., Daian, P. and Juels, A., 2017. Tesseract: Real-Time Cryptocurrency Exchange using Trusted Hardware. IACR Cryptology ePrint Archive, 2017, p.1153.

Brown, S.D., 2016. Cryptocurrency and criminality: The Bitcoin opportunity. The Police Journal, 89(4), pp.327-339.

Buterin, V., 2013. Primecoin: the cryptocurrency whose mining is actually useful. Bitcoin Magazine, 8.

Chapron, G., 2017. The environment needs cryptogovernance. Nature News, 545(7655), p.403.

Chepurnoy, A., Fan, L. and Zhou, H.S., 2017. TwinsCoin: A Cryptocurrency via Proof-of-Work and Proof-of-Stake. IACR Cryptology ePrint Archive, 2017, p.232.

Cocco, L., Concas, G. and Marchesi, M., 2017. Using an artificial financial market for studying a cryptocurrency market. Journal of Economic Interaction and Coordination, 12(2), pp.345-365.

D’Alfonso, A., Langer, P. and Vandelis, Z., 2016. The Future of Cryptocurrency. Ryerson University, p.25.

Dai, J. and Vasarhelyi, M.A., 2017. Toward blockchain-based accounting and assurance. Journal of Information Systems, 31(3), pp.5-21.

ElBahrawy, A., Pastor-Satorras, R. and Baronchelli, A., 2017. Evolutionary dynamics of the cryptocurrency market. Royal Society open science, 4(11), p.170623.

Eyal, I., 2017. Blockchain technology: Transforming libertarian cryptocurrency dreams to finance and banking realities. Computer, 50(9), pp.38-49.

Fry, J. and Cheah, E.T., 2016. Negative bubbles and shocks in cryptocurrency markets. International Review of Financial Analysis, 47, pp.343-352.

Gandal, N. and Halaburda, H., 2016. Can we predict the winner in a market with network effects? Competition in cryptocurrency market. Games, 7(3), p.16.

Gorbunov, S. and Micali, S., 2015. Democoin: A Publicly Verifiable and Jointly Serviced Cryptocurrency. IACR Cryptology ePrint Archive, 2015, p.521.

Harwick, C., 2016. Cryptocurrency and the Problem of Intermediation. The Independent Review, 20(4), pp.569-588.

Hayes, A.S., 2017. Cryptocurrency value formation: An empirical study leading to a cost of production model for valuing bitcoin. Telematics and Informatics, 34(7), pp.1308-1321.

Heid, A., 2013. Analysis of the Cryptocurrency Marketplace. Retrieved February, 15, p.2014.

Hughes, S.J. and Middlebrook, S.T., 2015. Advancing a Framework for Regulating Cryptocurrency Payments Intermediaries. Yale J. on Reg., 32, p.495.

Kim, Y.B., Kang, S.J. and Kim, C.H., 2016. Predicting fluctuations in cryptocurrency transactions based on user comments and replies. PloS one, 11(8), p.e0161197.

Li, X. and Wang, C.A., 2017. The technology and economic determinants of cryptocurrency exchange rates: The case of Bitcoin. Decision Support Systems, 95, pp.49-60.

Pacy, E.P., 2014. Tales from Cryptocurrency: On Biocoin, Square Pegs, and Round Holes. New Eng. L. Rev., 49, p.121.

Raymaekers, W., 2015. Cryptocurrency Bitcoin: Disruption, challenges and opportunities. Journal of Payments Strategy & Systems, 9(1), pp.30-46.

Rose, C., 2015. The evolution of digital currencies: Bitcoin, A cryptocurrency causing A monetary revolution. The International Business & Economics Research Journal (Online), 14(4), p.617.

Sat, D.M., 2016. INVESTIGATION OF MONEY LAUNDERING METHODS THROUGH CRYPTOCURRENCY. Journal of Theoretical & Applied Information Technology, 83(2).

Sompolinsky, Y., Lewenberg, Y. and Zohar, A., 2016. SPECTRE: A Fast and Scalable Cryptocurrency Protocol. IACR Cryptology ePrint Archive, 2016, p.1159.

Umeh, J., 2016. Blockchain double bubble or double trouble?. Itnow, 58(1), pp.58-61.

Vigna, P. and Casey, M.J., 2015. Cryptocurrency: how Bitcoin and digital money are challenging the global economic order. Random House.

Yli-Huumo, J., Park, S. and Smolander, K., 2016. Where is current research on blockchain technology?—a systematic review. PloS one, 11(10), p.e0163477.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts