Evolution of Money Through Ages

CHAPTER 1. INTRODUCTION

Historically, the international market has experienced various developments from the times of barter trade, to the introduction of the monetary system and now to the introduction of digital currencies in the name of cryptocurrencies. In reference to these developments, the instruments used as a medium of exchange have also changed and developed with respect to the needs of the market and to make the transactions more convenient. The tools used as a medium of exchange of goods is referred to as money. Economists describe money as an element that serves as an intermediate of the transaction, an aspect of accounting and reference of value. Money is used for transfer in regards to the fact that humans agreed to accept it in making various business transactions. Usually, traders would exchange their goods for money, while at the same time employees offer their services in exchange for labour. As a medium used in accounting, cash provides a platform for communicating value. Money symbolizes value, and it allows us to reward work and business conveniently. In short, money helps humans to store the cost of labour and goods. Every type of money in the market at some point proved to be efficient and has helped the market to establish itself. In respect to the evolution of money, cryptocurrencies have revolutionized the international market, which is an occurrence that was not predicted.

Hileman and Rauchs (2017) define a cryptocurrency as a virtual currency that utilizes cryptography as a security component. Even though cryptocurrencies are secure, they are also easier to transfer between two trading parties. Such transactions are facilitated through public and private keys for the sake of security. The transfer of cryptocurrencies is conducted with minimal processing fees, which allows other users to avoid the unnecessary expenses that are charged by various banks for internet and online dealings. Even so, cryptocurrencies present other security threats such as hacking. For instance, in the history of Bitcoins, one company has experienced over 40 cases of theft, which included the loss of more than 1 million U.S dollars’ worth of bitcoins.

Multinational corporations (MNCs) ought to use various payment systems to suit their diverse clients according to the specifications of each transaction and the attributes of the product. A common characteristic of such payment systems is the presence of a trusted third party, whose primary duty is to process the transaction at an agreed commission. Until in the recent development, no unit was equivalent to cash, as much as there was a need for such platforms, especially in areas that were related to micro-payment (Raymaekers 2015, p. 30). Therefore, it was not possible to directly conduct a non-reversible payment between parties; this fact was pointed out by Satoshi Nakamoto in 2008 in his publication Bitcoin: A Peer-to-Peer Electronic Cash System. According to Nakamoto there is need to have a mechanism that is based on a peer to peer networking scheme, through which a payment scheme can eliminate a financial broker and allow entities to make direct and relatively private transactions through the internet (Rabah 2017, p.107). One of the most critical features of cryptocurrencies is that as much as it on its developmental stage, it provides a means of encouraging the take-up and utilization of technology in its early phase of development, which has helped it overcome the typical problems that are faced by other innovations. The same question has been prevalent among new payment mechanisms because of strong indirect network effects in the two-sided market. In this case, two-sidedness refers to simultaneous acceptance by both groups of users in the market that is the merchant whose aim is to accept the payment and the client who makes the payments.

When the ideology perpetrated by Nakamoto was implemented in January 2009, the initial interests in bitcoins was shallow, but because cryptocurrencies have their value, which is tradable the market created the opportunities for speculating on its value. The speculations acted as stimulated interests, which is very necessary for any innovation to take off (Raymaekers 2015, p. 34). As much as the users were not able to make money from the existing cryptocurrencies in their prices, they are still capable of making payments, which contributes towards the development of cryptocurrencies at that moment in history. These activities contributed to the development of the network and appropriated the theory of network externalities, which led to an increase in its value not least from the multinational corporation perspective. Since cryptocurrencies were integrated into the stock markets and regular trading against the US dollar in 2010, the number of transactions has grown immensely (Raymaekers 2015, p. 38). In the period between August 2010 to August 2014, the monthly amount of businesses using cryptocurrencies (especially bitcoins) increased from a previous record of 12,000 million to 2.1 million USD, which implies that there has been an annual growth of 265% in the market. Subsequently, in the market value of Bitcoins increased more than 27,000 times in the US market, recording 6.3 billion USD, which is a significant growth of 1,184%.

The increment in value and a high turnover rate that has been achieved by those trading in Bitcoins is considered as one measure of the success of the system, which lured Multinational Corporations to start accepting cryptocurrencies. It is also an indicator that cryptocurrencies have a penitential of recording a significant impact on future business transactions (Choo 2015, p. 283). As stipulated earlier, cryptocurrencies currently operate both as a medium for electronic transactions as well as a medium that is considered an investment in the stock market, with the two uses of cryptocurrencies being intertwined, there is a need for an empirical study that explores both aspects simultaneously in respect to their use by multinational corporations. Hence this research intends to give a comprehensive analysis of both the characteristics and the consequences of cryptocurrencies and why multinational corporations have adopted them.

In respect to the focus subject the dissertation seeks to answer several questions, which are:

What can MNCs expect from adopting cryptocurrencies?

Are MNCs using cryptocurrencies as a substitute payment method? If so, what is then what is the primary payment method?

What are the effects the values of cryptocurrencies, and what impact will these effects have on Multinational Corporations?

Conclusion

To answer these questions, the study will use both primary and secondary data on why multinational corporations have adopted cryptocurrencies. In the process of modelling the paper, the researcher will consider a broader range of explanatory variables, which involves the supply and demand that drives Multinational Corporations into a full spectrum of the explanatory variable. The internet indexing popularity on searches using the phrase ‘cryptocurrencies,’ yielded various articles, news, books, and journals that mentioned the same keywords. The usability of these articles was quantified using computerized content analysis, which proved to be a crucial element in finding the necessary literature to be used for the study’s literature review. The number of transactions was also a crucial factor in confirming if there is a strong argument why multinational corporations use cryptocurrencies. The occurrence will be rationalised by various theories that explain the adoption of cryptocurrencies or the change in the unit of payment.

The study will explore various significant business transactions conducted via cryptocurrency. The results will help to widen the knowledge on cryptocurrency, such that it will expose various factors that contribute towards its use in the international market, which comprises of both the features of the market, the seller, the operating country (headquarters of the multinational corporations), and the use of other payment units. Rabah (2017, p.115) writes that analysing the use of cryptocurrency in both the international and the local market is an interesting topic because of various reasons. First cryptocurrencies are brand-new units in the market with many players trying to understand it and gauge whether it is a sustainable system. In respect to market capitalization bitcoin has emerged as the most prevalently used cryptocurrency followed by Ethereum and Ripple, all of which have recorded a double million amounts in US dollars. Other digital currencies have lesser value but are also increasing in the international market.

The subsequent chapter provides a comprehensive literature review on various studies that includes a SWOT analysis on cryptocurrencies. Chapter 3 will detail the methods for conducting a systematic literature review on literature published in the last five years, which will be followed by the results and discussion of findings. Lastly, the conclusion chapter will integrate all key arguments and outcomes, as well as any counter-arguments to establish a reflective stand on the collective outputs of this work and to address the research question stated above.

CHAPTER 2. LITERATURE REVIEW

2.1 Introduction

The concept of cryptocurrencies originated from a non-academic field. However, after its introduction in the market, it has directly affected both the academic and non-academic areas. Since it directly affects both the monetary and financial system, the study of cryptocurrency is vital in the business sector. The fact that cryptocurrency in the market is evolving at a faster pace means that various analyses have cropped up in a bid to explain this phenomenon. Therefore, when academically examining this field the researcher should be cautious to avoid using unverified information. Even so, the facts on academic research on cryptocurrencies have helped in revealing the limitations and constraints of cryptocurrencies and how to overcome these challenges.

2.2 Cryptocurrencies

Konoth et al. (2018, p. 1714) wrote that there are three main advantages of cryptocurrencies, which mainly include, confidentiality, obscurity, and privacy. Even so, according to the information collected from various sources, the most crucial feature of cryptocurrencies that renders it suitable for multinational corporations is that the payment process is transparent. Unlike the usual bank system of payment that involves the client only knowing the information about their account, the cryptocurrency scheme, allows every user with the system to see the transaction of all other users, making the whole process more transparent. Even if a sovereign authority does not back this transparency, the system presents a high level of openness that renders cryptocurrencies acceptable to most users, including the Multinational Corporations. Cocco et al. (2017, p. 345) wrote that the government is unlikely to allow the use of cryptocurrencies in their current structure. The authors claim that various governments are strategically positioned to prevent the use of cryptocurrencies in their existing formal monetary institutions. However, since Multinational corporations are unlikely to be controlled by any single government, they are strategically positioned to use cryptocurrencies as a mode of payment. Devoid of the national formal financial institutions, cryptocurrencies still face various challenges in the local economy, which means that they still cannot replace the local currencies in the current system. In reference to the exchange with other currencies such as the US Dollar, cryptocurrencies because they do not have a fixed value despite having massive public attention. Besides, the theoretical understanding of the importance of block-chain based cryptocurrencies is still limited. In the same line of thought, Choo (2015, p. 291) conducted a theoretically based analysis of the exchange of Bitcoins (the most common cryptocurrency) against the dollar and what determines these exchange rate, considering both economic and technical facets. As per the study, in the short term, the exchange rates of Bitcoins is determined by the changes in the economy and conditions in the marketplace, and in the long run, the Bitcoin exchange rate is determined by economic factors rather than technical factors. The researchers claimed that the study identified an essential effect of the bitcoin mining technology and a reduced significance of mining difficulty in the exchange prices of Bitcoins. Researchers such as Konoth (2018, p. 1717) have raised various issues on cryptocurrencies and taxation, claiming that there are a lot of complications that need to be fixed in terms of taxing cryptocurrency transactions, because governments are likely to lose their avenues of revenue collection if they do not check on how to tax the cryptocurrency. Chepurnoy et al. (2017, p. 332) disputed such claims, arguing that cryptocurrencies are a viable development that competes with the current modalities of currency and local regulations. Also, cryptocurrencies will provide a substitute means to economic agents of their transactions, and their existence should be encouraged by both the government and financial institutions since they offer an alternative platform for economic agents to conduct their operations so that the benefits of cryptocurrencies outperforms any detrimental features. The researchers conclude that cryptocurrencies are here to stay not unless the government declares them illegal.

Continue your exploration of Evolution of Financial Technology Impact with our related content.

2.3 How Cryptocurrencies Work

Cocco et al. (2017, p. 349) wrote that cryptocurrencies are virtual currencies that are not backed up by either physical merchandises or autonomous commitments, somewhat it depends on an integration of cryptographic safety and a peer to peer framework for observing transactions. Besides, cryptocurrencies such a Bitcoins are unintuitive such that as much as the owner of the currency is anonymous, its flow can be globally tracked. Choo (2015, p. 294) explains that cryptocurrencies are a chain of dealings from one holder to the other, and the original owner is only identified by a public key, an address that is used as a pseudonym, which means that the user can use any amount of reports and their activities using a set of statements that are not integrally knotted to the activities conducted by the owner using another set or in their physical identity. In every transaction, the initial owner signs in the platform using a secret signing tool that corresponds to their address of the address of the operation in which they established the cryptocurrency and the speech of the subsequent holder. The same address and chain of activities can be added to the established dealings that comprise of the cryptocurrency for each transaction involved in prior operations. For one to authenticate the authenticity of a bitcoin, a handler can check the legitimacy of every signature in the hawser. For the user to avoid double expenditure, it is essential that they should be aware of all these transactions. Brown (2016, p. 330) defines double spending as attempting to transfer a bitcoin that has already been sent. For one to determine, the initial transaction, which serves as a timestamp, the operation could hold and guarantee validity. The blocks are shaped into a manacle with every block referencing the prior one and consequently emphasizing on the cogency of all past dealings. The whole procedure leads to a blockchain, which can be retrieved openly by every operator in the scheme; this explanation shows how cryptocurrencies are transferred and how the system broadcasts various dealings to all handlers who are in the system. Since cryptocurrencies are decentralized, no focal authority mints these currencies such as Bitcoins, one must consider how bitcoins and other cryptocurrencies are fashioned. The minting process starts in the method of fabricating a block, every block that is accepted, that is every block integrated into the blockchain, should be in a way that when all information in the bloc is hashed, the hash starts with some numbers of zeros, which will let users discovery a specific assortment of information, blocks and a list of transactions (Brown 2016, p. 330). Once a user discovers a nonce that shows that the block comprises of the properly configured hash, the block is then broadcasted in a similar peer-to-peer means as transactions. Naturally, the scheme is intended to produce only 21 million bitcoins. Finding a block in the current market comes with a reward of 25 bitcoins (BTC). Previously the reward was 50BTC until November 2012 (Liu and Tsyvinski 2018). It is expected that it will finally drop to zero in the wake of 2140. In the business world for one to determine the efficiency or determine the success of an entity, it crucial to conduct the SWOT analysis, therefore, this study will also conduct a SWOT analysis of the same.

2.4 Strengths

The design of cryptocurrencies gives them their strength as a feasible coinage that has succeeded in improving its position over the years, importantly, the fixed limit of the cryptocurrencies that will exist. In the example of bitcoins, they will be mined with a weakening return after every four years until the maximum quantity of bitcoins is grasped (21 million). Such aspects of cryptocurrencies are essential due to the value ascribed to them. Because the cryptocurrencies have a limited amount, there will be face inflation in the market due to an overabundance of bitcoins. Besides, cryptocurrencies are perceived to be protected from inflation as a result of non-governmental interference and restrictions. Such a situation fashions a haven for investors to invest in the currency as does not lose its value because of inflation (Konoth et al. 2018, p. 1720). Cryptocurrencies are revealing their strengths as a shield against inflation due to national policies. Though as in most situations of commodities, the prices of cryptocurrencies can fluctuate widely because of various external elements. The fact that cryptocurrencies have been safeguarded from inflation and its increasing price rendered Bitcoin as the best accomplishment currency in 2015 in regards to the US Dollar Index. It implies that Bitcoin was the highest esteemed coinage in the international market in 2015. Such record is not minute record with powerhouses like the United States of America and China running the global market. For example, South America has recorded an increment in the use of cryptocurrencies especially Bitcoins, with an increase of over 500% from 2014 to 2015 (Brown 2016, p. 337). Countries like Argentina recorded a high inflation rate, which led to the citizens embracing cryptocurrencies, which resulted in the increased use of cryptocurrencies in the South American continent. In the previous years, if Argentina faced inflation, citizens would convert their local coinage to the US dollar to reserve the price of the local currency. However, the Argentinean government restricted on how much dollars US dollars the citizens could convert. Due to the government restrictions, the black market of purchasing the dollar increased which subsequently led to increased adoption of cryptocurrencies. The demand for Argentina to preserve the value of their currency has made it clear that cryptocurrencies can offer a solution to such needs. The Argentinean case is not isolated, there are several cases where countries have experienced over inflation, or sometimes the crash is experienced in the international markets, in such instances, the value of cryptocurrencies would increase because of their usage. Recent developments in regional politics saw the United Kingdom voting to leave the Europe Union, which came to be known as Brexit. Before Britain voted itself out of the Union, the price of bitcoin fell by 15%. Later after the UK had voted to leave the union the number of bitcoins increased from $550 to over $ 650 days later. In reverse, the global market experienced a significant reduction in value of assets, since investors did not have to know what to expect from the Brexit, and cryptocurrencies quickly became a viable alternative (Park et al., 2015). In such scenarios, cryptocurrencies are very strong, since they are the only monetary unit that can be bought and traded expeditiously, and used anywhere in the world. Other forms of currencies can also be exchanged, but only in person, and that money cannot be expended unless they are acknowledged locally. For instance, during certain market regimes, it is not easy to quickly convert any currency to US dollars, and in any usual case, one will have to go to a currency exchange agent. Besides, once someone has obtained the dollar, they will not be able to use it directly in their country since it is not recognized and trusted in the local markets apart from when one is in the USA. The situation is contrary when using cryptocurrencies, for one to purchase a cryptocurrency they will in need to have an online account with an online transaction, make requests and transact within minutes (Sompolinsky et al., 2016, p. 1159). Once the cryptocurrency is in the user’s numeral wallet, they would be capable of performing various acquisitions from various merchants globally. In the scenario created above, cryptocurrencies offer a more workable solution as a quick exchange for local currencies that can also gain more value than the initial value of the domestic currency. As much as other recognized currencies could become stronger and more desirable at some point in the market, in the long run, they cannot compete with the agility that cryptocurrencies bring to the market. Cryptocurrencies offer a platform that could be catapulted into legitimacy by various local governments and acceptance by global market investors and stakeholders such as Multinational Corporations to shield these entities for inflations and sinking into the global markets. Rabah (2017, p.129) concludes that an increase in the flow of cryptocurrencies will compel various vendors to accept these currencies and accommodate the needs of clients who prefer using cryptocurrencies for multiple transactions. In theory, such a scenario will lead to a cyclic effect since more vendors will be adopting the cryptocurrency technology and various users will seek to capitalize on the benefits offered by this monetary unit.

Looking for further insights on Money Laundering and Offshore Havens? Click here.

2.5 Weakness

Cryptocurrencies have few flaws, Sleiman et al. (2015, p. 333) contended that the one major weakness of cryptocurrencies is that part of their designs cannot be modified. Since the platform is a blockchain, it means that every trader in the system will be able to see every transaction. This means that the system grants its users a semi-anonymity status since a user can still track the previous owner of currencies. It also implies that the owners of the cryptocurrency cannot be identified, which is a cause of worry to some potential users of the system. Since the blockchain is publicly shared with all handlers, which implies that the chain is vulnerable to attacks since it is easy to access. The development of cryptocurrencies has been subjected to various examinations and analysis that included the DDoS attacks. Bitcoin miners and traders conducted these analyses to try and prove that the design used cannot allow the network to handle a high load of transaction rates. This means that only the transactions involving bitcoins can bring down the whole system. Sompolinsky et al. (2016, p. 1159) described this scheme as a self-destruction framework, which is an unfortunate feature in the design of many cryptocurrencies. The two weaknesses of cryptocurrencies are essential to their operations and cannot be exchanged. Park et al. (2015) commented that users might be reluctant to adopt these currencies because of such attributes. Major cryptocurrencies such as bitcoins have recently established a questionable reputation in recent developments. Issues such as the ones raised in the Silk Road saga can give cryptocurrencies a negative image and derail potential users from adopting them. The Silk Road Saga involved an online market that was hidden in dark-net, as a platform for thousands of drug merchants and closely a million drug clients to conduct illegal drug contracts. The primary currency used for transactions was bitcoins because the government could track the users due to the anonymity feature of cryptocurrencies (Gainsbury and Blaszczynski 2017, p. 485). The trade ran from 2011 to 2013 and resulted in transactions that were worth billions of US dollars. Typically, people would want criminals to be punished for their several felonies. Therefore, the anonymity feature of cryptocurrencies tends to derail the path of justice, which perceived negatively by the law-abiding citizens. If cryptocurrencies are not positively marketed and the element of anonymity portrayed as an advantage, then people might develop an attitude that criminals only use cryptocurrencies. Cryptocurrencies have also established the status of having a doubtful safety feature. In 2011 hackers robbed Magic the Gathering Online Exchange, which at that time was the main bitcoin exchanger, leading to the company going bankrupt, which led to its closure. It is estimated that hackers swindled bitcoins that were worth 460 million. Reuters blamed the CEO of the company who also the chief programmer for not implementing the new code versions of control. According to the reports, Mark Karpeles (who was the CEO) allowed various bugs and security fixes to linger in the system for weeks. Such a small loophole allowed attackers to siphon bitcoins form the agency; this breach also led to the drop of bitcoin prices across the world, since most users sold their coins with the fear of getting hacked. Ethereum also faced a similar fate in 2016, and the hackers made away with over 50 million USD. In most cases, hackers target organizations that have large cryptocurrencies and are unable to update their security features (Hayes 2017, p. 1308). Such acts of theft are the key reason why the values of these currencies reduce and also compromise on the image of cryptocurrencies. Not until larger organizations such as Multinational Corporations comprehend how security breaches can lead to attacks, hackers and their subsequent acts will hinder the adoption of cryptocurrency. According to Iwamura et al. (2014), investors have realized that the cryptocurrency network is stabilizing and instantaneous yields on investments are not absolute. The primary encryption renders resolving the whole procedure more problematic. Since June of 2016, there has been an increased cost of mining a bitcoin; this processed is referred to as, “halving event,” and it reduces the value of bitcoins repaid to miners by 50%. Miller (2016, p. 24) reasons that such measures could push out 25% of the bitcoin system that is managed in older processor hardware because it will cost more to operate the mining machines than the what could be possibly received from the mining. Furthermore, the dynamics among miners could render the whole system more susceptible to attacks than it is (Engle 2015, p. 340). The process also discourages new miners from joining the system because of the of the higher overhead needed and the constrained profits received from mining. If the halving events persist, only the most established miners are likely to exist when all bitcoins would have been mined.

The fact that cryptocurrencies can be easily traded like a commodity is both a strength and a weakness since it is tradable like a commodity, it means that it can be subjected to price fluctuations due to demand and supply. The variation in values will limit the trust of investors in the commodity because the unforeseen market dynamics could lead to potential loss of vast amounts of capital invested in the merchandise. Besides, the determinants of cryptocurrencies have not been stipulated, which still creates room for an undefined trading environment (Chuen et al., 2017). Commodities are also prone to be sold by an investor with the mentality of “buy at a low price and sell at a higher price” (Kim and Lee 2018, p. 3). Such an attitude has several effects, and one of them is that it creates a fluctuation of values. Price unpredictability creates threats, which dejects both consumers and traders from having cryptocurrencies for a more extended period. A lot of risks combined with lower levels of trust from consumers would limit the legitimacy of any commodity, and so far, cryptocurrencies suffer from the same fate. The prices of cryptocurrencies are at risk of being in a shallow market. Any investor who wants to acquire a large number of cryptocurrencies would not be able to do so without causing a noteworthy impression on the current prices of cryptocurrencies in the market. In general, cryptocurrencies are not matured currencies in contemporary business environments.

2.7 Opportunities

The current marketplace for cryptocurrencies is in a unique position, which is informed by transformative technology in an enduring financial system. The characteristic presented by cryptocurrencies can fill the gaps in the existing commercial technologies and consequently can solve the current banking issues through a peer-peer network. For example, Napster which is a peer-to-peer framework altered the music business by eliminating the middlemen (Mukhopadhyay et al., 2016, p. 745). Such transformative technologies are aimed at solving a particular problem existing with an industry. For example, cryptocurrencies have the potential of solving the problems associated with unbaked clients. A significant number of people living in developing states do not have access to a bank. For instance, Wan et al. (2017, p. 413) estimate that 70% of the population in sub-Saharan Africa have no access to banks. The technology used by cryptocurrencies would allow various people to exchange their currencies without needing a third witness like a financial institution to manage the whole process. In the case of cryptocurrencies, what the users need is access to a mobile phone, which 80% of people living in sub-Saharan Africa can access. Since cryptocurrencies have an ad-hoc networking ability, the parties involved in the trade can scan the QR codes on their phones and then print them out through the application. These traits offer a unique remedy to problems that once occurred for various years for some group of individuals, which are part of the consumers that MNCs target. These features would help in increasing the user base of cryptocurrencies and would encourage users to demand better cryptocurrency networks. There is still a huge demand for applications that would facilitate the transfer of cryptocurrencies because this technology would directly affect any industry that uses trusted third parties for transactions (ElBahrawy et al. 2017, p. 17063). Any software developer who increases usability by creating a platform that facilitates transactions would be successful. The progression of cryptocurrencies into becoming a primary currency depends on its ability to solve various problems, with the support of a growing community of developers. Duffield and Diaz (2015) contend that businesses transacting across borders are starting to see the worth of cryptocurrencies for intercontinental businesses, mainly when they need to make an emergency transaction. Cryptocurrencies are strategically positioned as a solution to such problems because of the speed and ease of every purchase. Contrary when using ordinary sales overseas, the transaction can take some days to reach the recipient, and in most cases, the money will not be in the full amount it was sent with, due to unnecessary transactional charges (Bohr and Bashir 2014, p.95). Therefore, Cryptocurrencies prove to be more advantageous over standard currencies because of its agility and easier transactions, especially when undertaking an overseas trade. E-commerce has been thriving under and are the real proponents of the traditional brick- and -mortar stores (Kim and Lee 2018, p. 6). For, example Amazon.com has grown to a point most people did not expect, and even have embarked on hiring “on-demand” delivery drivers who use their private vehicles to deliver standard packages. Such trends in growth show an effort to regulate the business’s logistics costs, which increase exponentially with amplified business. Ebay.com has also adopted PayPal, which operates like the cryptocurrencies, only that in this instance the transactions lead to withdrawal from banks. Apart from its illegal nature, Silk Road was an example of a thriving E-Commerce platform that linked consumers and retailers who used bitcoins to complete businesses (Gainsbury and Blaszczynski 2017, p. 490). E-commerce platforms have revealed how digital currency can connect traders without interference from the government and succeed. So far, online shopping is excelling, and cryptocurrencies are poised to enhance the trade, with easy payment options for both the clients and suppliers. Cryptocurrency is advantageous over traditional payment methods such as ATMs or other cash-based vendors, such that in it does not include any transactional fees. Besides, the recent developments in the field of international taxation laws have created validity for cryptocurrency as a significant means of payment. Policies on the revenue system of cryptocurrencies are needed before digital currency could be considered as a legitimate currency for transactions. In 2015, the European Court of Justice declared that it perceives bitcoin trades, as transactions that should be exempted from value-added revenue (Bohr and Bashir 2014, p. 99). More policies like these will massively increase the flow of cryptocurrency because some traders would not wish to use their currency without the knowledge of how it would affect their tax statement, irrespective of the positivity that comes with it. Another opportunity that cryptocurrencies have is they can act as a commodity like gold. The international price of gold can hugely increase when there is an event unbalances the global market, as witnessed in the Brexit move. The amount of gold in the International market increased because investors were not sure of how the market would react to the Brexit move, and used it as a haven (Duffield and Diaz 2015). The commodity is commonly accepted in the international market, and cryptocurrency has begun to emulate similar traits displayed by gold. For a long time, gold has been the key determinant of price, and that is pegged on the global reception and belief for its price. Cryptocurrencies also can become significant players in the product market (Miller 2016, p. 247). They have a peculiar characteristic that enables them to be purchased via a direct online device that generates easy access for purchasers. In case cryptocurrencies continue to be a viable refuge for bloating currencies, then it would gain trust from stockholders and citizens as it happened in Argentina.

2.8 Threats

Cryptocurrencies face a few challenges before it can be widely accepted as a legitimate currency. The fluctuation in values that affect cryptocurrencies pose doubts to investors, which eventually limits the acceptance of the coin. In a study conducted by PWC, 83% of respondents had no familiarity with cryptocurrencies. The fact that there is no centralized possession of cryptocurrencies implies that any efforts to remediate this promotion challenge by use of adverts could help in boosting the whole industry. Cryptocurrencies also face the threat of theft and fraudulent actions due to various loopholes in the system, especially when dealing as an exchanging agent. These security threats could convince someone with no background in computer systems that cryptocurrencies are unsafe, especially when investing in them (Ronca et al., 2015). As long as the law does not cover the framework used by cryptocurrencies, their legitimacy will remain to be somewhat limited, because traders ought to first believe that any transaction using cryptocurrencies ought to be legal and obligatory. Secondly, governments and markets are incredibly sluggish regarding how they react to new technology, which eventually limits the trust consumers have on cryptocurrencies. The pool of failed start-ups has increased due to security reasons; this measure can be perceived as a watermark for potential stockholders to deliberate before investing in cryptocurrencies. The cases of DAO and Mt Gox depict how security threats in the cryptocurrency sector, show how a company can lose its capital and significantly lose its value. New, business ventures in the cryptocurrency exchange business have learned that unplanned launch and haphazard can pose a significant threat to the company. Such dynamics can limit new entrants into the industry, which ultimately could hurt bitcoin, since the development of an efficient system is fundamental in improving the unit’s security and overall acceptance (Herbert and Litchfield 2015, p. 30). Implementation of enhanced security features is an essential element that each new start-up ought to have. Hacking of the DAO was foreseen and document a potential loophole even before the attack. However, one issue that hinders the implementation of a formidable security system is the decentralized nature of cryptocurrencies (Duffield and Hagan 2014). A centralized realm of cryptocurrency could be essential before the network could be fully trusted. A standards body for cryptocurrencies would help in developing security features that can be used in any cryptocurrency. However, these security features could be executed at the expense of the autonomy of the peer networks, which could cause miners to depart from the market. There is also a stiff competition to cryptocurrencies who are endeavouring to offer a substitute digital unit of exchange. Apple is among the contestants, after inventing the ApplePay (Hayes 2017, p. 1309). Besides, they are also levering their system to give consumers the capacity to recharge their debit or credit cards that are linked with their iTunes accounts with their phones. Cryptocurrencies will always face a more significant threat trying to compete with other digital currencies that have established themselves as household names such as PayPal that has been very successful on its own and in various E-commerce platforms such as eBay and has also moved to mobile payment (Wan et al. 2017, p. 418). Other companies such as Amazon, Apple, and Google have an effective marketing strategy and have also explored the mobile platform, which gives them a competitive advantage over cryptocurrencies that are hardly advertised. Mobile users want to have the capacity to purchase products directly with their phones and cryptocurrencies faces a big challenge trying to mobilize as an industry to outdo their opponents. The other threat to cryptocurrency is the confusion in US guidelines that ought to be clarified before they are accepted. The US administration is yet to identify the category of assets that cryptocurrencies fall under, which will avert market applicants from approving a digital-based corporate framework. Cryptocurrencies can be categorized as either security, commodity, currency and capital asset, and each label could have a diverse consequence on how cryptocurrency is assumed (Mukhopadhyay et al., 2016, p. 748). International perceptions of cryptocurrency varied from one country to another but seemed to be viewed positively by the examination of transactions. In the European Union, the amount of operations has reached 102, 221 each quarter, which is the highest ever recorded amount of cryptocurrency transactions; this rapid development might help in influencing the creation of policies that would ensure efficient cryptocurrency transactions (Abramaowicz 2016, p. 359). After being exempted from tax by the European Court of Justice, it implies that cryptocurrency transaction will not be taxed in the European Union. As much as this is an excellent improvement for cryptocurrency users in Europe, other markets still do not have legislation on cryptocurrencies, which severely affect the usage and acceptance of cryptocurrencies.

2.9 Conclusion

So far, it seems that cryptocurrencies are past the early adoption phase that is being experienced by new technologies that are even experienced by more conventional products such as motor vehicles. Generally, Cryptocurrencies have begun to curve some niche markets to them, which helps to advance cryptocurrencies into becoming a mainstream unit. The industry is striving to establish itself as a mainstream currency by solving some of its past problems. Some countries such as Iceland have also embarked on starting their cryptocurrencies. Such developments show that it possible that cryptocurrencies would turn into a significant trade unit in the future and that is why Multinational corporation have begun embracing it. Both the European and American markets are continuously embracing cryptocurrencies, which signifies some hope for validity and acceptance (Ronca et al., 2015). Besides, various academic analyses on cryptocurrencies are now numerous and act as a source of information to the public. The fact that cryptocurrencies can be used in multiple transactions could permit it to work as a bridge to the financial gap that the existing currencies might not be able to solve but require a more economic analysis to determine. Besides the blockchain technology can be used in additional ways like creating smart agreements. This review informs the study on the possible advantage and disadvantages of using cryptocurrencies and the future prediction of the same. This section informs the subsequent section on the best publication to analyse in regards to the research questions and the objectives of the study.

CHAPTER 3: METHODOLOGY

3.1 Introduction

This study employs qualitative research based on the collection and analysis of secondary data. Preference is placed on using data patterns that have been generated from a systematic analysis of literature that would answer the research questions that were set in chapter 1 before gathering the data. This methodology will help the study to appreciate and understand social interaction. Since the study does not focus on specific variables, the qualitative design would examine the whole study, both in depth and breath. In contrary, quantitative research deals with numerical data and seeks to demonstrate and assess links between variables. Quantitative studies tend to suit larger and randomly selected studies with specified variables. In this regard, the qualitative methodology was considered to offer a more viable platform for this study. Secondary data will, therefore, inform the outcomes of this study. As much the field of cryptocurrencies is a new concept, there are many studies that have been conducted relating to this topic. Therefore, with abundant existing literature on this field, using secondary data would be more convenient in terms of saving on time and the resources needed when collected secondary data. Furthermore, secondary data is already analysed and gives specific information about the subject being analysed. As much, it is time saving, unlike primary data, secondary data can be subjected to the original researchers’ biasness during the data collection and analysis process. Lastly, collecting primary data pertaining to multinational corporations is a challenging task, and in some instances, it might be impossible, since most companies are never comfortable disclosing their financial records and answering questions related to such especially to third parties. Therefore, tracking the use of cryptocurrencies and why these companies have adopted them might become impossible. Secondary, data remains to be a viable option of collecting data for this project. However, secondary data is prone to biasness. A systematic literature review will help in reducing this biasness. Systematic reviews aim at directly addressing the research objectives and questions. Secondly, systematic reviews use explicit statements referred to as inclusion criteria to examine every study, and determine if it can reliably and usefully address the research question.

Systematic Literature

The focus of this thesis is to give a holistic analysis of why multi-national companies have chosen to adopt cryptocurrencies as a viable payment unit and how other stakeholders have responded to the move. These stakeholders comprise of mainly government and financial institutions that are majorly being affected by the trade of these digital coins. Major countries that have been affected by the trade include South Korea, the United States of America, China, and Europe (Hileman and Rauchs 2017). Since the development and usage of cryptocurrencies have been a common subject there are various resource and literature on the same concept; the only challenge is there is no uniformity or a primary theme that discusses the study can agree on. Besides the existing biases should be put into consideration, as well as the objectives of this paper. Another possible challenge of objectiveness is the period between the currently existing cryptocurrency and the first phase of cryptocurrency is about ten years. The last ten years have seen rapid development in cryptocurrency technology. Therefore, the secondary sources that will be used should have been published within the previous five years in reference to the developments that have happened recently in the cryptocurrency market, with the expectation that articles quickly become out-dated due to the speed of developments. One limitation of researching on cryptocurrency and the cryptocurrency technology is the fact that there is no public figure or formal institutions that will provide answers to the frequently asked questions. The founder of bitcoin (the most common cryptocurrency available in the market), Nakamoto has taken a passive role and remains an anonymous figure. So far, no individual or institution has taken this role (Nadarajah and Chu 2017, p. 8). The outcome has been that the crypto-currency has been divided into different groups campaigning for divergent objectives. Contrary, governments and financial entities are organized more structurally and tackled cryptocurrency issues with unity, probably because it acts as a substitute unit to the standard currency system (Delmolino et al. 2016, p. 81). Studies on this topic reveal that there is greater objectivity from classical financial authors and a lot of subjectivities from the proponents of cryptocurrencies. The lack of organisation in the cryptocurrency field can be attributed to the fact that it is relatively in its early stages. Nevertheless, when researching what is an evolving and rapidly changing field, one should approach the analysis of various sources with an open mind, and that the existing financial institutions are reluctant to let cryptocurrencies work as an independent unit. Another limitation faced in the cryptocurrency field is the technological intricacies of the blockchain, which as a researcher one must take time to understand how it operates and determine why multinational corporations prefer using it. However, to truly understand cryptocurrencies means to unveil its functions, its computation, and engineering, which is a broad subject that needs extensive knowledge in using cryptocurrencies. Even as much as understanding the concept of cryptocurrencies seems to be challenging, users of cryptocurrencies are unlikely to understand the technology and its very minuscule details, but will still use it. Therefore, the complexity of the unit does not deter its users nor will it hinder the research. In view of the above, the first step in conducting a reliable and systematic review of current studies will be to collect historical data that will be analysed. Generally, the methodological approach will include the following steps;

Selecting the literature to be reviewed, assess the quality of the information presented within them, extract suitable data, and synthesise it.

Report the results.

Weakness

Using secondary data has its own weakness, that could affect the study if not controlled. The weakness experienced in this study is due using secondary data, which among them include the fact that the data used was collected by third parties, which might not reliable or accurate. Secondly, the primary data used in respective publications, was collected in one location, and since the topic being discussed is on multinational corporations that operate in global markets, means that the suitability of the data is compromised due to the environmental facets. Secondly, secondary data cannot be used in in its raw form, because it is not always directly related to the topic being investigated. Therefore, the researcher will always need to modify secondary data to suit the objectives of their study. The problem is that the researcher might end up misinterpreting the original information during the modification process. Lastly, secondary data can lead to copyright issues, if not well cited. In cases, where the researcher has enough time, resources, and access their respective respondents one should opt for primary data. This is because primary data offers the researcher with first-hand customized information for the study. However, this should not be interpreted that studies based on secondary data are not appropriate, instead, it means that given the two options with supporting resources, a researcher should always prefer primary data.

3.1 Locating the relevant Studies

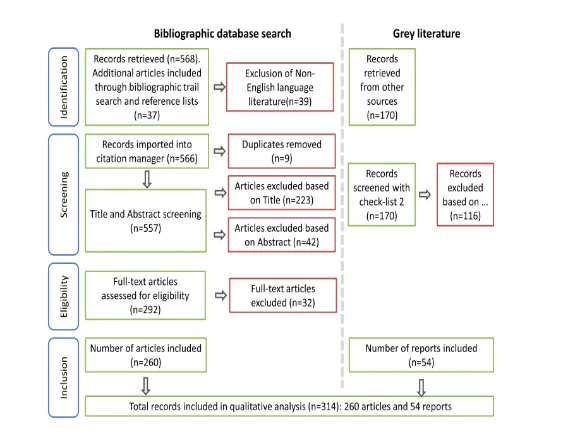

To achieve the objectives of the research, a systematic literature review was conducted using studies published from 2014 to the present day. The study used various online libraries such as Google Scholar, Jstor library and Luria library. In all these databases, the term “Cryptocurrencies” was used to search in all titles of articles. Additional explorations using the referenced literature of relevant materials were also conducted. Various electronic searches identified the relevant ‘grey literature,’ which included unpublished studies that were commissioned by relevant governmental and private, public institutions. To categorise the issued grey literature, the study assessed the first 200 searches from Google. Alternative phrases for blockchain and application were also applied in the search. The hand-picked search list in some publications also led to more grey literature, especially research and reports from various committees or policy briefs. Figure 1 gives a brief flowchart of how the studies were selected.

Besides, several refinements of that were provided by the electronic libraries were also used. In cases, where there were no abstracts in an article that publication was fully assessed to determine its relevance.

3.2 Study Evaluation

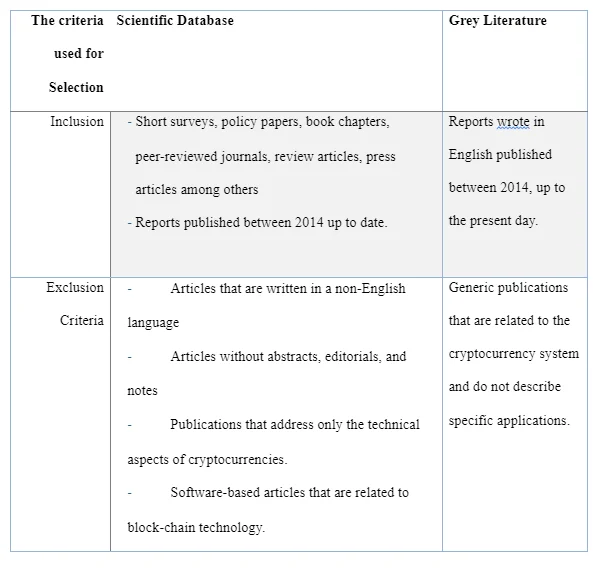

To determine whether a publication was eligible or not, each article was reviewed autonomously by the authors grounded on a set of inclusion and exclusion standards as depicted in table 1.

3.3 Descriptive Analysis

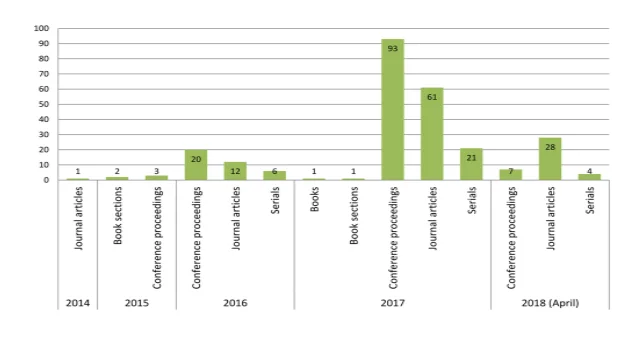

From the search conducted, a not insubstantial 260 papers published between 2014 up to the present date were eligible for analysis (for a valid and authentic analysis, grey literature was not included in the descriptive analysis). The eligible publications were categorised into key themes:

The classification of blockchain and its uses

Financial applications

Business applications

Supply Chain management

The descriptive study aims to provide the necessary insights in regards to the recent trends in cryptocurrency and its applications which will further state the reason for multinational corporation adopting the unit. By categorising the existing publication, the descriptive analysis is founded on two main standards, which are: the distribution of journals over some period and the distribution of the kind of release over a specified period. An annual analysis of the selected paper was conducted as shown in figure 2. From the investigation, the number of publications on cryptocurrency started rising in 2017. Until 2016, there were slightly more than 40 publications that existed on cryptocurrency and its applications, while in 2017 the numbers shot up to 180. Hence, it can be concluded that studies have slowly yet in a significant way increased in the cryptocurrency-enabled applications in the last couple of years. The increase in the number of publications signifies the emerging, adoption and growing nature of cryptocurrencies.

From the publications analysed it is clear that the cryptocurrency technology was first introduced through Bitcoin as the primary type of cryptocurrency (up to date it has remained one of the commonly used cryptocurrency). It has taken more than five years for academicians to acknowledge the use of cryptocurrency and the advantages that come with it. In the first years of inception cryptocurrency was perceived to be synonymous to Bitcoins, and in principle, researchers aimed at creating the infrastructure rather than analysing the application of the technology. Therefore, most publications that specifically investigated the application of cryptocurrencies were mostly published from 2016 onwards. As per the data are given in figure 2, it is clear that most scientific literature on cryptocurrencies was published in conference accounts with a growing movement. In terms of analysing the uses of cryptocurrency, most publications examined business uses of this technology, and are hence especially relevant for the purpose of this dissertation. The following sections provide a brief general classification and overview of the key themes that will be used in the final analysis based on the collected literature.

3.4 The Classification of Blockchain and its uses

Out of the 260 articles, 32 studies analysed the use of cryptocurrency as either financial or non-financial (this section will look at these studies in summary). These authors broadly agreed that cryptocurrencies are majorly used for financial purposes (Crosby et al. 2016, p. 7). This study proposed uses an application-oriented classification that is similar to what is framed by Zheng et al. (2016). Therefore, considering the definite and impending heterogeneity of blockchain solutions, the study presents a broader and in-depth classification of blockchain-based applications. In the subsequent subsections, the study offers a comprehensive classification on the existing blockchain-enabled applications that are founded on the examination of the available publications.

3.5 Financial applications

Of 48 articles reviewed, these exclusively analysed the financial applications of cryptocurrencies. Cryptocurrencies are used in various financial fields including business services, economic transactions, reimbursement of financial assets, and market forecasts (Haferkorn and Quintana Diaz 2015, p.117). Cryptocurrencies take a vibrant part in in the sustainable progress of the international economy, which ultimately trickles down as benefits to trades, the financial schemes, and the society (Nguyen 2016, p. 53). International economic institutions are exploring various conducts on how they can use cryptocurrency for financial assets, fiat currency, securities, and derived agreements (Peters and Panayi 2016, p. 252; Nijeholt et al. 2017, p. 29). For instance, cryptocurrency technology provides an immense variation to capital markets and an effectual platform for conducting processes such as securities and derivatives businesses, digital transactions, general banking activities, financial auditing, and exchange in the case of e-wallets (Van de Velde et al., 2016; ; Gao et al. 2018; Wu and Liang 2017, p. 222). Especially, a group of the market’s most prominent banks, such as Barclays have collaborated with R3 to create an operative cryptocurrency for the fiscal marketplace (Crosby et al. 2016, p. 7). Global Payment Steering is another example of banks operating at a global level with interest in adopting cryptocurrency because of its financial uses.

3.6 Business Application

Out of all the articles reviewed, 117 focused on the business use of cryptocurrencies. Cryptocurrency can become an essential source of unsettling inventions in commercial and administration by enhancing, optimising, and systematising corporate processes (Tapscott and Tapscott 2017, p. 11; Bogner et al. 2016, p. 177; Ying et al. 2018, p. 3). Most e-commerce platforms that are built on the Internet of Things (IoT) and cryptocurrency are continuously developing. An illustration can be placed in a publication by Zhang and Wen (2015, p. 990) in which the researchers propose a business framework that the transactions involved between devices are done using cryptocurrencies. Hardjono and Smith (2016, p. 32) suggested that a privacy-protective arrangement that utilizes the IoT network and blockchain like cryptocurrencies to verify the source of mining without having a third-party authentication. The use of cryptocurrencies offers a substantial performance improvement and commercialisation prospects (White 2017, p. 440; Klems et al. 2017, p. 734; Kogure et al., 2017, p. 57), enhancing reliability in e-commerce and allowing IoT businesses to optimize their procedures while saving on resources such as time and cost (Yoo and Won 2018, p. 734). Cryptocurrencies could also act as devolved business development management schemes for various initiatives. In this case, every commercial process can be sustained on the blockchain, and the workflow directing could be conducted to streamline and automate the organization processes.

3.7 Supply Chain Management

63 articles out of 260 publications concluded that cryptocurrencies were mainly used for supply chain management. The qualities presented by cryptocurrencies are anticipated to enhance transparency and responsibility on the supply chain network, which will enable a more dynamic and flexible value chain. Specifically, the use of cryptocurrencies has the potential of generating inventions in three spheres in the supply chain, which are; perceptibility, optimisation, and demand. Cryptocurrencies can also be applied in various logistics, reducing fake paper currency, reducing paperwork, facilitating tracking, and helping traders to connect directly without being manipulated by third-party policies (Hackius and Petersen 2017, p. 7; Kennedy et al. 2017, p. 9570; Lee and Pilkington 2017, p. 19; Toyoda et al. 2017, p. 17465; Tan et al. 2018, p. 39). Besides most studies have demonstrated, that by using cryptocurrencies in supply chain systems, safety is guaranteed, and can lead to further vibrant contract supervision schemes between the third- and fourth principal logistics for combination of evidence (Polim et al. 2017, p. 1589), improving tracing apparatuses and traceability declaration (Apte and Petrovsky 2016, p. 76; Lu and Xu, 2017, p. 21) offer a more comprehensive supervision across the whole supply chain, improve IP protection, provide an improved client service by giving advanced data analytics, and can offer a decentralised manufacturing systems and improve business to business transactions (Madhwal and Panfilov 2017, p. 1050; Leiding et al. 2016, p. 181; Ahmed and Broek, 2017; Yuan and Wang 2016, p. 2663 ).

3.8 Ethical Consideration

When using secondary data, the sources of data are not directly approached for their consent to use their work. However, to ensure that the study observes the required ethical considerations, any information directly or indirectly extracted from the secondary sources will be cited to acknowledge the researcher/ researchers that conducted the study. In case, where the study used is part of another research, then it means that this data can not be used freely, just by acquiring the study that cited the original research. To avoid ethical dilemmas, such studies were not used. Besides, the data obtained in these resources ought to be relevant, but not unnecessary. The data should also be analysed for some criteria such as the accuracy of the data when the data was collected, the objectives of the research and the methodology used. These factors would not only fulfil the ethical obligations of the study but will also ensure the validity of the study. Since the articles used were retrieved from various online, the login details to these platforms were protected from unauthorized access. Lastly, as the researcher, it was necessary to ensure that the data analysis was conducted appropriately.

3.9 Conclusion

The studies outlined above have depicted that as much as cryptocurrencies are developing there are still various issues that need to be addressed before this technology can be embraced. These developments will ensure that cryptocurrencies become efficient, durable, and scalable. The existing characteristics are not unique if analysed individually, however, if these features are combined it makes cryptocurrencies ideal for many applications which justifies the reason multinational companies have adopted it, even though the unit is still in its early form of development. As cryptocurrencies develop, it is expected that more industries will embrace it. The subsequent chapter will discuss the results from the literature review and give a detailed discussion of the same.

CHAPTER 4: RESULTS AND DISCUSSION

From the collection of data in accordance with the methods outlined in chapter 3, a detailed analysis was conducted on current perceptions regarding the restrictions and the prospects of the cryptocurrencies and its usability in various domains. As described in the methodology chapter, cryptocurrencies can be adopted in multiple sectors and provide limitless opportunities. As also discussed in chapter 3, different business areas have adopted cryptocurrency, and just like any other emerging technology, there must be challenges and issues that will arise. In this section, the study will discuss the reasons why multinational corporations have adopted cryptocurrencies despite their limitations and how these may limit the use of these units.

4.1 Results

Of the 260 articles analysed, 200 stipulated that for this new technology to achieve widespread adoption of consumers, it must have the following values; it ought to be considered as a store of worth, a unit of exchange and element of account. Milutinović (2018, p.105) identifies various protocols that make cryptocurrencies attractive to multinational corporations and other consumers for transactions. These characteristics vary in criticality to a virtual currency success, but to be accepted broadly, they ought to be present to some extent. Besides, cryptocurrencies should not have all the desired qualities for it to be approved, just the promise that soon the unit will have all the desired conditions. Even so, the following existing conditions render cryptocurrencies viable to be used by multinational corporations.

4.1.1 Improvements over Cash

Cryptocurrencies have proved to resolve some problems presented by cash or credit schemes. Since the development of cryptocurrencies, it has served as an alternative unit, that users can use to transact with each other freely without involving sovereign entities, financial entities. According to a study conducted by Chatzopoulos, Ahmadi, Kosta, and Hui (2018, p. 108) multinational companies, immerse a lot of capital within a financial year, and all this capital comes with a transaction fee, which in most cases takes up to 15% of the total earning from multinational companies. As most multinational companies are recording a yearly turnover worth billions of dollars, 15% means that this revenue goes to transactions. In a real sense, 15% of a billion is a lot of money. Cryptocurrencies solve a platform where companies would trade and transact without any transaction fees. Besides, the transaction fee, various inconveniences are associated with fiat currencies that cryptocurrencies solve. Cryptocurrencies are in a peculiar position whereby their decentralised architecture does not provide any single term of control that can be technically regulated or shut down if required. Therefore, it means that it provides a more reliable means of exchange as compared to fiat currency (Reinsberg 2018, p.16). Besides, with the rising digital technology the current use of computing resources in regards to efficacy and ability, it even easier to become a network validator.

4.1.2 Easy Liquidation

Sometimes arise in business when the entity would want to liquidate some of its assets to prevent a looming crisis. Cryptocurrencies act as an asset that can easily be converted into goods, services and payment units that can easily be adopted by consumers. However, the wide-scale application of virtual currencies by clients is expected to occur with cryptocurrencies that have a real-world price, as compared to a specific domain cryptocurrency. Good examples of popular convertible currencies include Bitcoins, Ethereum and Litecoin (Herbert and Litchfield 2015, p. 30). Therefore, when a company wants to deal in cryptocurrencies, they ought to adopt the popular convertible cryptocurrencies. Besides easy convertibility to authorised currency, through an exchange, some types of virtual currencies such as Bitcoin are also acceptable by numerous traders as payment for merchandise without being changed into local currency (Liu and Tsyvinski, 2018). Hence, in situations where a company has depleted its viable asserts, it can use cryptocurrency as both cash or a liquefiable assert.

4.2 Discussion

Users of cryptocurrencies do so as there is a need for a unit of currency that they can use to obtain goods and services from traders and transact with other people in a convenient and digital manner. In cases where entities would want to use cryptocurrencies to buy products and services, traders would only accept to transact with cryptocurrencies for two reasons, either the unit offers them a financial incentive, for example, lowered transaction fees or a more speedy reimbursement of dealings or there is a considerable demand for the group created by the market (Oh and Nguyen 2018, p. 51). With the current developments in the cryptocurrency expertise, the existing units can be applied in all these uses which makes it even more advantageous to trade with cryptocurrencies. The fact that cryptocurrencies have recorded an upsurge in value has given this unit a higher demand in the market, especially in economies where the consumer have lost confidence in their local fiat currency (Borri 2019, p. 11). Since multinational corporations work in countries with higher inflation such as Argentina, they would have a competitive advantage if they could trade using cryptocurrencies with their relevant clients (Pagnotta 2018). The operation costs of cryptocurrencies have also remained relatively low as equated to costs of transactions when dealing with fiat currency, which has made them a preferable unit by multinational corporations. Even so, cryptocurrencies to become the primary unit of payment, its transaction costs ought to be below three percent charge linked to credit payment to entice more traders and multinational corporations to use them. For example, the eSport world came up with a blockchain, the First Blood and the cryptocurrency is referred to as the FirstBlood Token (Conoscenti and De Martin 2016, p. 4). The cryptocurrency aims to give eSport players an opportunity to make money deprived of the fear of losing their fiat currency or depending on third parties for authentication. The coinage is used mainly for playing matches, witnessing, voting, and claiming rewards. So far, the most efficacious trading currency has been Bitcoins. With this success, third-party providers have attempted to facilitate the purchase and selling of Bitcoins on various e-commerce platforms including Amazon, which will allow clients to allocate any dollar sum of Bitcoin to use for acquisitions on Amazon. Starbucks and other retailers have used the same mechanism and the so far it has been effective. Coinbase’s ShiftCard is a Visa debit company that has established itself in some states within the United States of America and is sponsored by the handler’s Bitcoin wallet at Coinbase. In the current state, the transaction fees associated with the exchange of Bitcoins have been waived (Chepurnoy et al. 2017, p. 232). Besides, even the fiat currency is increasingly being turned into digital currency through the purchase of cryptocurrencies and electronic platforms such as Zelle; Apple pay Cash, Venmo and PayPal among other platforms (Badreddin 2018, p. 317). Multinational corporations are not likely to tolerate high transaction fees that are associated with fiat currency, while in cryptocurrencies such fees are available. The main challenge that faces the full adoption of cryptocurrencies by multinational companies is the low familiarity and adoption among users and other companies. Cryptocurrencies could equally compete with fiat currency if they were in a position to be adopted by most consumers and traders.

4.2.1 Stability

Any business will want to deal with a stable currency, and that is why the dollar has been adopted (and remains as) a standard international currency in global markets. However, in some cases, the dollar has proved to be unstable in the market, especially when the United States of America is facing an economic recession. Therefore, the instability in the fiat currencies has pushed international business to look for solutions to the problem, and so far, cryptocurrency has been an answer. Especially in cases where companies aim to use currency as an asset, cryptocurrency has filled the gap (Alessandretti et al. 2018). Companies would only desire higher volatility when investing in an asset since the instability is directly associated with higher risks and higher possibility of returns. Due to the volatility of cryptocurrencies, most multinational companies have adopted them as additional assets/investment (Zheng et al. 2018, p. 365). Additionally, the fact that cryptocurrencies are not tagged to any precise government or state permits it to take the form of uncorrelated asset, which helps in diversification. However, for the use of money clients desire a very stable unit so that they do not incur a lot of losses and that the values that are used and purchased every day are predictable. In this case, constancy does not essentially imply equality with the dominant local currencies, which in this case is the dollar, and at the same time, it does not imply to parity with other currencies that are acceptable in the global markets, after the market regularisation by the Bretton Wood institutions, where the local currencies float on principles of market demand and supply, rather than being tagged to a fixed exchange rate (Chepurnoy and Rathee 2018, p. 42). Hence, consumers desire to have enough certainty in the future cost of the currencies that they have, which implies that the ideal currency should have relatively low volatility, in respect to the leading fiat currency in the market. It is better if a currency offers a positive potential future (increase in value from its current worth). If it decreases a lot from its current value, then it can be rendered unattractive (Casino, Dasaklis, and Patsakis 2018). So far, cryptocurrency has served as an ideal unit as it offers a promising feature, which means companies can rely on it. In case of a decrease in its value, it will not be an unavoidable barrier to the short-term use of the respective virtual currencies in comparison with fiat currency, especially if the fiat currencies harbour a high transaction fee, which leads to exchange losses especially among established traders who handle a lot of money. An increase in the value of any currency will encourage consumers to save or invest in the unit, which necessarily is not fatal to the adoption cryptocurrency as a unit of payment (the way Bitcoin has been used). It the possibility that a currency might significantly drop in value that casts down in the minds of consumers, and so far, cryptocurrencies have passed that test. Some multinational companies such as Microsoft, Lionsgate Studios, and T-Mobile have openly expressed their intent to hold Bitcoins and measure their company net worth in terms of values, rather than in US dollars, which means that for these multinational corporations, cryptocurrencies would one day act as an element of account and measure (Fry 2018, p. 226). Shen and Pena-Mora (2018, p. 76789) advised that in such situations such big corporations should create a community that embraces transactions that are dominated by cryptocurrencies, which can perhaps control the future relevance of cryptocurrencies and install confidence to other users to adopt the unit. If such a community exists, even if the value of cryptocurrencies fluctuates most users would ignore the fluctuation just as users have always ignored the fluctuation of the US dollar in respect to other currencies (Masciandaro et al. 2018). In such an environment, it would mean that a significant fluctuation in the value of cryptocurrencies in a market with a steady fiat coinage, would mean fluctuation in the values of goods and services, which must be paid. However, markets with an unstable fiat currency would profit companies using cryptocurrencies. There have also been various efforts by third-party organisations, to establish cryptocurrencies that are pegged on the US dollar using various mechanisms. Some of these third-party organisations include Steem Dollars, BitUSD, CoinUSD, and NuBits. NuBits and CoinUSD. CoinUSD and NuBits were launched at the end of 2014, but so far none of them is existing because of insufficient demand. Other companies have remained in the market, but are registering low market caps and trading volume; this is an indicator that most people prefer using cryptocurrencies in their raw form and the idea of tagging it to the dollar, has not been welcomed by the market (Chen, Härdle, Hou, and Wang 2018), and that is why large corporations prefer adopting it then quantify their network using the relevant cryptocurrency rather that calculate their net worth in dollars then tag it to the desired cryptocurrency.

4.2.2 Ease of Use

Traders and consumers would prefer a technology that it is easier to use and understand. For instance, the adoption of mobile phones has occurred at a rapid pace, and even quicker for smartphones (within a decade smartphone had gone from the introduction phase to 90% market penetration in the United States of America), as much as it is a more complicated technology compared to the outdated handsets. Cryptocurrencies have struggled to gain acceptance since their adoption because clients have experienced difficulties in understanding associated technology (Zhang et al. 2018, p. 660). However, most cryptocurrency designers and third-party developers have acknowledged this issue, and have embarked on establishing a new interface that will help to speed up its adoption. There are two ways that cryptocurrencies have developed themselves to become usable for common consumers: these are through third-party platforms and interfaces and a user-friendly original plan. Third-party companies are using a more reputable cryptocurrency like bitcoin, as a payment unit behind the scenes exposes clients to a familiar banking account interface. Third-party websites such as Bitpay and Coinbase are samples where consumers can have virtual currencies through a comprehensible platform. Other platforms such as Abra have an interface that does not disclose to consumers that they have bitcoins, which makes the whole process even much more complicated. The other developing trend is that the upcoming cryptocurrencies are being designed to have a user-friendly interface (Chu 2018, p. 2323). Companies such as Stellar, Gamecredit, and Steem among others have designed cryptocurrencies that are easy to use and have a user-friendly interface. The developers of these respective units judge that the more user-friendly these platforms are, the more users it will attract. Majority of cryptocurrencies are not oriented to consumer usability. If the developments in the cryptocurrency industry continue, cryptocurrencies would attain a worldwide acknowledgment and act as a secondary payment method (Arruñada 2018, p. 55). At this point, analysts predict that cryptocurrencies will have gained a lot of value and therefore they would be expensive to acquire as compared to fiat currency (Alwen and Tackmann 2017, p. 505). Before, the value rises, multinational corporations want to acquire the possible amount of cryptocurrency in the market, such that by the time the value of cryptocurrencies increases, they would have a leverage ground of controlling the market using cryptocurrency as both the preferred means of payment and an assert.

4.2.3 The current position of cryptocurrencies