Impact of Sanctions on Iran's Oil

Chapter 1: Introduction

1.1 Background information

Many internal and external factors affect projects. These factors could be initiated either internationally or domestically. The South Pars is a mega gas field located in Iran whose development and gas extraction activities require billions of dollars. The development of the gas field has, however, faced different challenges over the last two decades with international barriers featuring prominently.

Iran holds some of the largest proved crude oil and natural gas reserves worldwide. However, even with the abundance of reserves, crude oil production has witnessed the effects of international sanctions. For instance, even with their abundant reserves, between 2012 and 2016, their crude oil production stagnated and further declined. That was with the international sanctions whose target was on Iran`s oil exports that to a large extent hindered the progress of the energy sector of Iran. Towards the end of 2011, some sanctions were imposed by the United Nations and the European Union against Iran as a result of her involvement in nuclear activities. The sanctions were targeted on the energy sector of Iran and had the effect of impeding Iran`s abilities to sell oil. That brought about a near 1.0 drop in 2012 in exports of crude oil and condensate in comparison to the previous year. Fast forward to 2016, following the lifting of the oil sector and banking sanctions in line with the Joint Comprehensive Plan of Action (JCPOA), there was a rise in production of crude oil and condensate, and exports rose to the levels they were before the sanctions of 2012.

1.2 Research question

This paper seeks to establish the effects international and US sanctions have had on the operations of the South Pars Oil field. We explore the effects of different sanctions on the expenses of implementing the South Pars project.

1.3 Significance of study

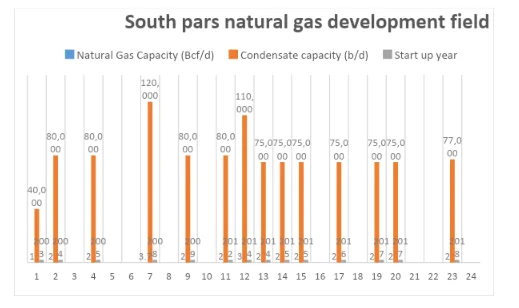

The South Pars project is the largest natural gas field located in the Persian Gulf and is shared between Qatar and Iran. The International Energy Agency estimates that the field holds up to 1,800 trillion cubic feet of in-situ natural gas and up to 50 billion barrels of natural gas condensates. Identification of impacts of conditions on select activities goes a long way in minimising the costs of implementation in the fields and other projects that are similar. That also helps with the prevention of losses of financial funds, human resources, and facilitates consumption optimisation.

CHAPTER TWO: METHODOLODY

2.1 Research approach

This research adopts an internet-based research approach which involves the use of the internet for the collection of data. This research adopts a descriptive strategy and the researcher relies on the web for collection of data specifically, carrying out online content analysis and also on. Online content analysis involves the collection of research techniques that are used for descriptions and making inferences on online material through coding and interpretation that is systematic. It is some form of content analysis that is adopted for the analysis of internet-based communication.

Content analysis analyses social interactions and communications without necessarily involving participants directly. That goes a long way in reducing the influence of the presence of the researcher on final results. When content analysis is conducted well, it follows a procedure that is systematic that other researchers can be able to replicate yielding highly reliable results. Researchers are also capable of carrying out content analysis at any time, in any locations they wish and at costs that are rather low. All a researcher requires is access to sources that are sound, verifiable and appropriate.

The dynamic nature of online material together with increased volumes in online content makes it challenging for construction of sampling frames from which random samples are drawn from. Additionally, the contents of sites also tend to differ with across different users which requires that a researcher has to be specific about their sampling frame. Another setback of content analysis research is that the results of search engines are not systematic which makes them unreliable for those researchers who wish to obtain samples that are not biased.

The researchers focus was both qualitative and quantitative, that is, they focused on counting and measuring and also focused on interpretation and understanding. To successfully carry out content analysis, the researcher first had to select the text that they would be analysing. Decisions were made on the medium and the researcher settled on websites, speeches and newspapers, and, online journal articles. A criteria for inclusion was then developed.

2.2 Criteria for inclusion

Journal articles, Websites, speeches and newspaper articles in the English language.

Journal articles, Websites, speeches and newspaper articles touching on the productivity of south pars oil and gas fields.

The researcher then proceeded to determine the levels in which they would analyse the texts that they had chosen. That involved the definition of those units of meaning that were going to be coded and setting those categories that they would use for coding. The definition of the units for coding involved the determination of whether to record the frequency of individual’s words and phrases or the treatment of themes and concepts or the presence and positioning of images. The researcher settled on the treatment of themes and concepts.

The researcher then went about coding information which involved going through different websites, reading through speeches and different newspaper articles, recording outstanding themes. After that, the researcher examined the data that they had collected with the intention of finding recurrent patterns and further drawing conclusions in response to the research question they sought to answer.

CHAPTER THREE: LITERATURE REVIEW

3.1 Sanctions on Iran

The oil and gas sectors of Iran have in recent years become the main focus of competition with the United States. Iran occupies an exceptional position in the global energy market because, while it ranks third, second and fifth respectively in terms of crude oil, natural gas, and crude oil production, it occupies the first place in terms of hydrocarbon reserves. With sanctions placed on Iran oil and gas sector however, there have been increments in the risk of investment and activity in comparison to other countries in the Middle East that are also rich in oil reserves. Recently, the US tightened its sanctions against the Islamic Republic of Iran through the imposition of pressure on foreign countries to choose between US and Iranian markets.

Alleged nuclear ambitions by Iran have brought about some imbroglio and is recognized as one of the most complex issues in recent times to confront international relations. In March 2017, to a Conference of the American Israeli Public Affairs Committee in Washington Trump issued a statement that dismantling the deal with Iran that he termed as disastrous was top of his priorities. Rex Tillerson who was the secretary of state of the US by then said that the Iran nuclear deal as a failure and further allayed fears that if Iran remained unrestrained, it would be like North Korea. Tillerson made a categorical assertion that there were serious threats to the international community that were posed by the nuclear ambitions of Iran. The lack of trust between the West and Iran regarding the nature of the nuclear program of Iran is the main root cause of the entire issue. It took a decade for Iran to sign a Joint Comprehensive Plan Of Action with P5 + 1 (USA, UK, France, Russia, China, and Germany). However, there have been inconsistencies in Iran’s behaviour since signing the deal, including its technology procurement activities that are illicit, clandestine nuclear activities, and its failure to come up with plausible evidence of it nuclear program`s peaceful purpose as they claim.

3.2 Effects of sanctions

Sanctions help achieve desired goals ranging from modest goals to those that are fairly significant. For instance, those sanctions that were introduced in the Gulf War`s aftermatch led to the increased compliance of Iraq to the resolutions that called for the destruction of their weapons of mass destruction. Additionally, in Yugoslavia, sanctions in 1995, played a huge role in forcing Serbia to agree to the Dayton agreement.

Sanctions have the potential of making matters worse. The efforts to compel other parties to joining a sanction against others who lack the willingness to sanction the target causes serious harms to different foreign policies of the United States. This was evidenced by the sanctions that the US introduced against those oversees firms that continued to violate the sanctions that were targeted towards Libya, Iran and Cuba. The threat brought about some deterrent effect on certain individuals willingness to get into proscribed business activities.

Sanctions also end up bringing about consequences that are not desirable and that were not intended. For instance, sanctions on Haiti increased the economic distress there which ended uo triggering an exodus of the people of Haiti to the USA that was rather dangerous and expensive. The Bosnian Muslim side was affected by the arms embargo that was placed on the former Yugoslavia as a result of the fact that the military stores of Bosnia Serbs and Croats were larger and they had greater access to additional supplies from outside sources. Pakistan`s military sanctions brought about increased reliance by Pakistan on a nuclear option as a result of the fact that the sanctions cut off their access to the weaponry of the US and also as a result of the weakened reliability of Pakistan on relying on America.

Sanctions that are general have the potential of baring perverse effects of bolstering societies that are statist. Through the creation of scarcity, governments are enabled to get better control of the distribution of goods. These end up bringing effects that are not desired like the triggering of large scale emigrations like in the case of Haiti, bolstering regimes and even retarding the emrgence of middle classes and civil societies.

CHAPTER FOUR: RESULTS AND DISCUSSION

4.1 Weakened economy

Most of the economic development in Iran is attributed to the oil and gas industry. The placement of sanctions on Iran lead to the drying of foreign investments and exports are badly hurt.

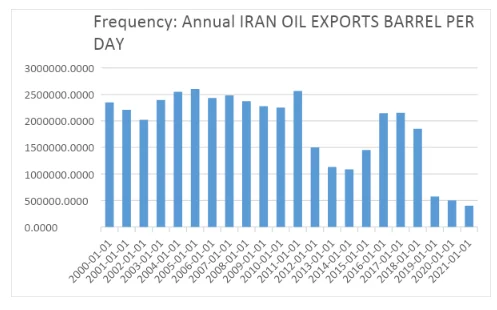

The secondary sanctions that were targeted on oil exports from Iran brought about direct and measurable effects on the countries production of crude oil as seen from the figure above. For instance, as per the figure above there was a steady decline between 2011 and 2012 in production. The decline in volumes of oil production continued to 2014. Then in 2014, during the effective JPA period the crude oil production of Iran stabilised and these stabilisation was brought about by the removal of the requirement on countries to continuously reduce imports if they intended to receive Significant Reduction Exceptions. The implementation of the JCPOA saw the waiving of sanctions on oil exports and the production and exports in Iran went back to the levels they were back in 2012. However, fast forward to 2018, the production went down again after the United States exited the JCPOA.

These reduced production trends were witnessed even at the South Pars Oil and Gas field. The project is still being developed and every sanctions impact and reduce the momentum of the development of the project.

When sanctions are placed foreign financial institutions are prohibited from making deals with banks in Iran. As a result of this, all major international banks and other smaller banks stopped providing the Iranian banks with financial services. That increasingly cuts off Iran making it hard for them to carry out trade transactions in euros and dollars. That to a large extent, affects the stability of the banking sector in Iran. In 2012, IMF issued out warnings that the soundness indicators of the banks in Iran had deteriorated which brought about significant credit risks and also brought about a significant increment of non-performing assets. Such have the potential of jeopardising the confidence placed by the members of the public on such institutions.

The most immediate effect of sanctions is the reluctance of insurance and reinsurance companies to provide coverage for ships and shipments from Iran. Eventually, the problems in insurance cripple shipping activities from Iran including their abilities to deliver oil through large tanker fleets.

IRISL, Iran`s governmental shipping company was banned by the US treasury and sanctions were also placed on any shipping companies that were accused as operating as IRISL fronts. 24 international shipping companies were banned backed in 2011 for their alleged operation as IRISL fronts. That has the effect of putting IRISL under immense pressure financially as it goes through extreme lengths for purposes of obscuring its network and the ownership of its vessels. That made the IRSIL default on different loan payments. When a company is declared as having defaulted on a loan repayment, there are far-reaching implications that come about as a result of cross-default clauses included in the majority international loans that are syndicated. According to the clause, all such loans immediately go to default and it is possible that demands for immediate payments could be made in the event borrowers default in any of their other loans. Sanctions make debtors to call in debts, lead to international insurers failing to provide cover and different ports in different parts of the world are unwelcome for Iran ships.

It is worth noting that shipping companies from everywhere in the world are dependent on and reinsurance. In line with statistical reports from Iran, Iran has faced challenges in finding willing financial institutions to pay for energy-consuming companies and in receiving incomes from their sale of oil and oil products. Financial institutions find it hard to obtain letters of credit from Middle Eastern and European banks and that makes it very hard for willing customers to pay for the oil they buy from Iran. These sanctions also make insurance companies reluctant to insuring oil shipments that are linked to Iran. That significantly reduces the number of financial institutions that are willing to partner with Iran.

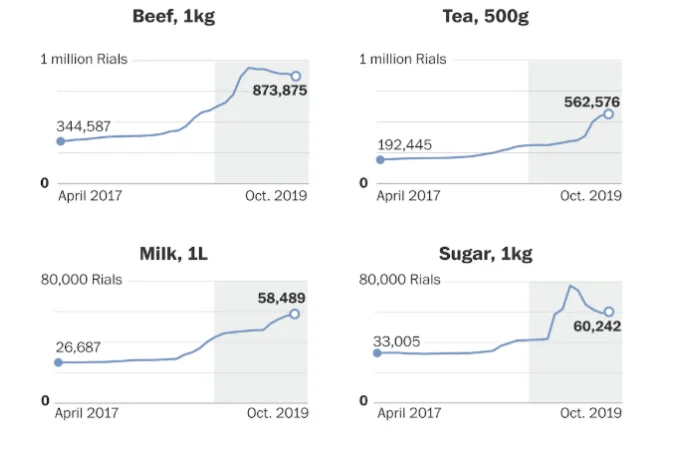

These sanctions also impair the abilities of Iranians of enjoying the freedoms of trading on open markets. Al Jazeera quoted Maziar Hashemi (name changed by Al Jazeera for purposes of concealing identity), who had recently been on a trip to Armenia and Tehran as saying that in Armenia, he had been overwhelmed by the way the world felt more accessible from their capital city. He was also quoted as saying, “In Tehran, people just want to be able to buy anything they want, whenever they want and from anywhere in the world.” This is a sentiment that most of those Iranians who still enjoy some level of purchasing power express. In the old bazaars of Tehran, however, there are complains among Iranians about the rising costs of different types of consumer products in the market. Costs of production double on different aspects and shopkeepers are forced to transfer these costs to the customers.

4.2 Lost investments

The imposition of sanctions on Iran made very many companies to pull out. Total had signed a deal phase. Now, South Pars has to reimburse Total for its investment in the field once it`s phase 11 is completed. A contract had been signed by Total back in 2017 for development of phase 1 of the field initially investing $ 1 billion.

The pulling out of these western companies has largely affected operations at south pars. The operation of the field has been left for local companies because no foreign company is willing to be subjected to US sanctions, penalties and the loss of access to the American market. It cannot be denied that Iran`s rapidly ageing oil industry is in dire need of massive investments.

The exodus of major oil companies from Iran reflected significantly on the levels of oil production. In the US, the congress published a report that stated that the oil production in Iran had fallen to about 3.9 million barrels daily from over 4.1 million daily barrels that were produced before the sanctions.

When Trump issued threats of new sanctions in Iran, Total, a French oil major, threatened to pull out of the South Pars project if the United States did not waiver to protect it from the sanctions that Washington was going to impose on those companies that did business with Iran. Total finally pulled out of a $4.8 billion Iranian gas field projected after it admitted that it had become extremely vulnerable to US` penalty threats on any company that would do business with Iran. China National Petroleum Corporation which was left overseeing the south pars oil project also quit in 2019.

CHAPTER FIVE: CONCLUSION

From this study, it is evident that sanctions on Iran oil and gas industry have had adverse effects. For a country like Iran that is largely dependent on the production and exportation of oil as a source of revenue, these declines in production and exportation badly hurt their economy. For instance, estimations by the International Monetary Fund indicated that the hard currency reserves of Iran stood at $106 billion at the end of 2011 and according to a different estimate, these figures had fallen to about $80 billion by November 2012. Consequently, the cost of basic goods also doubles in the face of sanctions. For instance, in 2016, according to data from the Statistical Center of Iran, the prices of Sugar, Milk, Beef and Tea went up.

Sanctions also interfere with free trade and distort trading activities. The prohibition of businesses is costly as it makes both imports and exports to a country expensive. Sanctions are intended at increasing trading costs and diverting trading activities in those countries that are targeted. Sanctioning countries use their influence in international financing institutions for purposes of disrupting any forms of financial relationships and even block the assets of the sanctioned country.

Bibliography

- Najibi, H., Rezaei, R., Javanmardi, J., Nasrifar, K. and Moshfeghian, M., 2009. Economic evaluation of natural gas transportation from Iran’s South-Pars gas field to market. Applied thermal engineering, 29(10).

- Perkovich, G., 2017, November. Implications of the Joint Comprehensive Plan of Action. In AIP Conference Proceedings (Vol. 1898, No. 1, p. 040001). AIP Publishing LLC.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts