Tax Avoidance Among Global Corporations

CHAPTER ONE: INTRODUCTION

1.1Background

This study investigates the issue of tax avoidance amongst global companies in the UK and explores measures being taken by the UK government to oppose this problem. There is no doubt that there have been numerous scandals around tax avoidance in the UK from transnational companies such as Google, Starbucks, Amazon and many others (Jenkins and Newell, 2013). This phenomenon couldhave significant economic impact in the UK if not tackled properly. Clearly, the issue of tax avoidance amongst multinational firms is quite complex as there are various debates as to why multinational or global firms engage in tax avoidance. There is an argument that these tax avoidance schemes are deliberate and that those who perpetuate it know rather well they are engaging in misconduct (Perrow, 2010). However, as mentioned by Perrow(2010), this foreknowledge has been deceitfully attributed to institutional, culturaland political ideologies of the host country. One thing though is clear and that is the fact that closing loopholes that allow tax evasion by global and multinational companies can help reduce financial deficits.It has been shown that when host countriesfail to addressthese loopholes and tackle the underlying issue of tax avoidance, the repercussions fall on the poorer social classes who constitute 99% of the total tax paying population in the UK (Stewart, 2012). Ultimately, this issue affects public services, by creatingextensive tax losses and increasing deficits. This study investigates the phenomenon of multinational tax avoidance in the UK. There are some interesting dynamics to be explored to discover hidden truths and meanings. For example, why does the government appear to be powerless against multinational firms? Is neoliberalism a pathway to global financial misappropriation? Why does the UK government include multinational firms in its policy but then fails to address the misconductthat these firms engage into by creating business structures that make it difficult to scrutinise financial dealings? What value does tax avoidance add to the firm and to investors? Indeed, these are the important questions that need answering andon which this study will focus. The fact that conducts such as those mentioned above exist, points to the fact that this study is relevantin providing answers to why tax avoidance amongst global, multinational companies continues to increase in the UK, despite the prevalent economic hardship affecting the middle and low income earners.

1.2 Statement of the Problem

This research study focuses on exposing theinconsistencies in the relationship between the UK government and multinational firms setting up business in the country in terms of taxavoidance, government policies and regulation, and the inclusion of these global firms in the policy making process despite the seemingly deliberate moves by these global firms to evade tax. Clausing (2009), illustrates that the relationship between international governments and multinational global firms is such that, sometimes, national governments are handicapped in rigorously and aggressively tackling multinational firms’ tax avoidance because these companies have the legal power to change business location and governments do not want to lose the revenuesthat those firms indirectly bring to the country. This predicament is causing increasing public concern given continuing economic hardship and increasing deficits to which tax avoidance is contributing negatively. In an article published in 2019, the Guardian illustrates the problem of multinational tax dodging in its report on corporate tax evasion. Multinational companies,as a result of increased globalisation, can easily establish the headquarters of their business in territories where taxes are levied at the lowest rate while locating business operations elsewhereand paying the same tax as their headquartered businesses in other territories (Guardian, 2019). Similarly, the Financial Times (2017) reports that in 2016 over £5.8bn in tax was avoided by multinational companies in the UK; these firms managed to accomplish this by registering profits in overseas territories. Since the 2008 global financial crisis, corporate tax avoidance has been an issue drawing public concern (Oats and Tuck, 2019). Despite this, the trend has continued until today raising questions about the level of transparency with which these companies report financial information and how seriously governmentsare tackling these tax avoidance issues. These problems present questions which need answering.

1.3 Aims of the Study

As outlined in the previous section, the aim of this study is to explore the strategies that the UK government is employing to effectively oppose tax avoidance by multinational global companies.

1.4 Research Questions

The research questions include:

What are the causes of tax avoidance by multinational global companies?

How can the UK government effectively combat tax avoidance by multinational companies in the UK?

Why is tax avoidance continuing to increase amongst multinational governments in the UK?

1.5 Rationale of Research

The importance of this study stands in providing some clarity over the issues of tax avoidance amongst multinational global companies in the UK. The dynamics around tax avoidance by global companies are complicated,as there are numerous reasons why tax avoidance continues to increase. An interesting but at the same time suspicious dynamic is also embedded in the relationship between the government and multinational, global businesses and how theformer is favourable to having a soft relationship rather than a hard one with the latter, in order not to drivethemaway into other fiscal territories. Wijen et al (2012) posit that, in a globalized context, there is a realization amongst countries that active collaborations and involvement of various local and global bodies, including international businesses, is essential to improve economic growth. This is especially true following the unfortunate global financial crisis in 2007/2008. The level of involvement of global businesses and the need for economic development can indeed play significant role in diminishing the aggressiveness of governments towards the practice of tax avoidance. Contractor (2016)states that global multinational tax avoidance is an important area of study because it is pivotalin global decision making as foreign direct investments are usually biased by tax inconsistencies which negatively affect individual nation states. This is one significant effect impacting the UK as cases of tax avoidance amongst multinational global companies rise. Sikka (2012) states that tax revenues are like the blood line of democracies. This imply that it will be extremely difficult for a country to be able to effectively alleviate poverty and provide essential services such as education, health, and infrastructures when tax revenue is not properly generated. This implies that, in the UK for instance, positive economic impact will be reduced if the phenomenon of tax avoidance continues unabated. According to Sikka (2012), the incidence of continuing austerity measures in the UK and less government intervention in the economy have exacerbated this issue.

The impact of the issues is negative forboth citizens and the government since the formerwould have to pay higher taxes to compensate or losethe provision of essential services,while the latter loses on income taxesoverall. There seems to be little clarity behind the phenomenon of multinational tax avoidance in the UK,since there are notclear strategies employed or outlined by the governmentto explicitly oppose tax avoidance by multinational companies. This is even more complex given that a state can exempt foreign companies from being actively taxed if the source of their business is from another territory. Indeed, this is confusing since there are not clear standard as to how global multinational companies should be taxed. This study thus aims at exploring the dynamics of this issue, as well as recommend effective strategies through which the UK government can combat this anomaly perpetuated by multinational global companies which are clearly taking advantage of gaps in tax rules in the UK.

1.6 Scope of Study

This study focuses solely on the UK. The aim is to have a better understanding of the tax avoidance challenges in the country and how the government is setting up strategies to combat the problem especially amongst multinational global companies. All data that is collected is relevant to the UK case, although the interpretation of results is broad andcould benefit other jurisdictions as well. The UK is the second biggest country in Europe by levels of nominal GDP, hence it is important to explore how tax avoidance practices in the UK links to other nations in Europe and the world at large.

CHAPTER TWO: REVIEW OF LITERATURE

2.1 Introduction

This section reviews the literature linked to this research with a view to present the various discussions and the controversies related to the topic. This study is focused on the phenomenon of tax avoidance amongst global firms in the UK and how the government is responding to oppose this issue. The literature shows that tax avoidance amongst multinational global companies is being perpetuated mostly through transfer pricing, where profits and costs are transferred from a high tax jurisdiction to a low tax jurisdiction in order to avoid paying the fair amount of tax. It is difficultto assess whether governmentsaround the world are truly doing all that is in their power to address corporate tax avoidance or not.

2.2 What is Corporate Tax Avoidance?

Tax avoidance is defined as the process of bending tax rules to gain tax advantage in a way that is not approved by parliament (Gov, 2016). The implication of this is that firms that engage in this malpractice do not operate in the spirit of the law. Hanlon and Heizman (2010) define tax avoidance as the reduction of taxes that are clearly obvious by using various tax spectrums such as tax management and tax planning amongst others, while Brealey et al (2008), claim that tax avoidance is the maximization of net present value of free cash flows after taxes. The literature on tax avoidance is multifarious with many analyses associated with corporate tax avoidance. Firstly, tax avoidance, and tax decisions in general, are determinations associated with the management of a company and the behaviours that are permissible. For example, scholars have mentioned that tax avoidance is associated with executive compensation plans, ownership structure and corporate governance (Desai and Dharmapala, 2006; Minnick and Noga, 2010). Bauer (2015) mentions in his study that there is a correlation between internal control weaknesses in firms and tax avoidance, implying that, where corporate governance is weak, then there is likely to be tax avoidance issues. Tax avoidance is not the same as tax evasion. According to the House of Commons (2020), while tax avoidance is formally compliant with the law, although aggressive and abusive, tax evasion is against the law. However, this is confusing given that those who commit tax avoidance are said not to operate in the spirit of the law (Gov, 2016). Also, there is increasing public concern arising from tax avoidance issues given that low- and medium-income earners have to pay the liabilities of multinational companies who frequently avoid tax (Guardian, 2019). However, the literature is increasingly proving that tax avoidance should not be separated from tax evasion as it is difficult to measure which circumstance areacceptable and which are not (Beer et al, 2018).

According to Healey Dennis, former UK Chancellor of the Exchequer, cited in Murphy (2008), the difference between tax avoidance and tax evasion is the thickness of a prison wall.This implies that tax evasion is a more serious issue than tax avoidance from a constitutional perspective. Whereas tax evasion is a deliberate attempt to not pay taxes or at least not the correct amount, tax avoidance consistsinactive tax planning, i.e. taking advantage of what is constitutionally permissible by law, to reduce tax payments,e.g. tax free personal allowance, tax exemption for interests earned on savings accounts, capital allowances on qualifying assets amongst other tax relief schemes approved by the law (Sikka, 2012). The difference therefore is the legal binding that supports not paying certain amount of taxes rather than an illegal attempt to not pay taxesaltogether. Therefore, the question is: what legal bindings allow taxes to be avoided or underpaid? In the next sectionthis study discusses multinational firms and tax avoidance problems.

2.3 Multinational Firms and Tax Avoidance Problems

Tax avoidance by global multinational firms has become a source of public concern especially with prevalence of harsh economic conditions which sees governments undertaking cuts and reducing public service expenditure. Tax avoidance in multinational firms occurs when international firms try to shift income to economic territories that are lightly taxed (Clausing, 2009). According to the author, governments around the world face the dilemma of taking tough decisions against these firms, due to threat of companies’ relocation and subsequent loss of employment and revenues to the country. For instance, The Guardian (2019) recently reported that the UK government planned to cancel multi-billion pounds taxes on global companies such as Google and Facebook, in an attempt to secure a trade deal with the US. This shows the political implications of the relationship between national governments and multinational firms and how this affects taxation. Contractor (2016)illustrates some tax avoidance strategies used by multinational, global companies with various impacts. According to the author, some of these tax avoidance strategies have minimal impact and are approved by the host nation, for example, deferral and exemption of affiliate income, transfer pricing and royalty payments. Deferral and exemption of affiliate income occurs when the host nation does not tax the extra profits made by the firm’s affiliates, while transfer pricing occurs when the firm pays higher amounts to affiliates where taxes are lower and then disburses lower amounts where taxes are higher. Lastly, royalty payments occur when profits are shifted from one nation to another where taxes are lower. For example, the Independent (2018)shows that the US received illegal state aid from Ireland in 2016 by paying an unfair corporation tax of 1 percent. Other practices include so called intercorporate loans which is a system whereby the government gives companies the right to deduct interest payments on loans as an alternative way to expense. Another tax avoidance strategy illustrated by Contractor (2016) is the so-called parent overheads and costs. The latter mainly refers to costs such as R&D, incurred by the parent company in a particular nation, which can beallocated to subsidiaries in other nations. Finally, the most critical tax avoidance strategy is the inversion strategy. This is adopted whenever a global company shifts its corporate headquarters to a territory where corporate tax is lower in order not to pay the fair amount of taxes. For example, in Ireland, corporate tax is levelled at 12.5%, whereas in a country like the US it is levelled at over 35%. If a multinational global company decides to choose Ireland as its base but with affiliates in the US, it will only pay the maximum tax in Ireland, causing the US to lose billions of tax money (Contractor, 2016). Beer et al (2018), differentiate between thesource country and the residence countryin the context of corporate taxing and tax avoidance. The former is the place where the business investments take places with the presence of physical labour, while the latter is where the business receives its income and where is deemed to have its primary location (Beer, 2018). Therefore, the source country is the one with primary right to tax, whereas the residence country have only passive or limited rights.

The most common of all the tax avoidance strategies, as highlighted by the existing literature, is transfer pricing. According to Sikka and Wilmott (2010), transfer pricing is an optimal allocation of costs and revenues to divisions, subsidiaries, and joint ventures within a group or company. Transfer pricing enables multinational global companies to avoid paying the fair amount of corporate tax. It enables global companies shift profits from high tax jurisdictions to low tax jurisdictions. Baker (2005) says that transfer pricing is used by virtually all multinational global companies and is quite invisible to members of the public and difficult for governments to detect. There are many examples of multinational tax avoidance by multinational firms such as Google, Starbucks, Amazon and others which have perpetuated tax avoidance through transfer pricing. In the next section, this research discusses multinational firms and tax avoidance in the UK.

2.4 Multinational Firms and Tax Avoidance in the UK

The problem of tax avoidance in the UK has become a recurrent issue, with billions of pounds being lost due to tax avoidance by multinational global companies. This section of the literature review presents some statistics of tax avoidance by multinational companies in the UK to highlight the extent of the problem. Firstly, the Independent (2019) provides evidence that the UK is the largest enabler of tax avoidance in Europe. Companies such as Google and Amazon have been mentioned as prominent companies that have exploited the UK government for billions of dollars. According to the Independent’s report, over £395 billion pounds are lost yearly to multinational global companies. To put it in perspective, this is more than three times the annual budget for the NHS. The Guardian (2020) reports that, between 2012 and 2017, five global companies including Apple, Google, Facebook, Cisco and Microsoft made over £30b in profits but shifted these offshore to avoid corporate taxes and paid merely £933m which accounted for just 3% of the total profits. The report further shows that foreign companies pay muchfewer corporate taxes, over the threshold of 14%,compared to local small and medium businesses, thus reducing income earnings to the UK by over £25b. The BBC (2013) provided a report which showed that in 2012 Starbucks had sales of over £400m but did not pay any corporation tax. In fact, as at 2016 when Campbell and Helleloidpublished their article on multinational tax avoidance, Starbucks, which had operated in the UK for over 15years, had paid the UK government corporation tax only once (Campbell and Helleloid, 2016). This is an example that shows the seriousness of tax avoidance crimes committed by multinational global companies. Amazon, which had sales in the UK of over £3.35b, only paid £1.8m in corporation tax. Similarly, Google made profits of £395 in 2011 but only paid £6m in taxes. Sikka (2012), claims that tax avoidance in the UK is thought to be fuelled by an increase in corporation and personal tax rates, as companies become discouraged in investing and doing business. Even though corporation tax in the UK has been reduced since 1982, from 52% to 22% in 2014, tax avoidance in the UK continues to increase. Evidence suggests that the UK government has not been truthful with the actual figure of tax avoidance. HMRC (2010) put the yearly tax avoidance figure at £40 billion despite leaked government documents showing that it actually isbetween £97 billion and £150 billion. Murphy (2010) states that the right figure is £120 billion yearly, while the National audit office (2007) stated that, between 2005 and 2006, only 220 multinational global companies out of 700 operating in the UK, paid no corporation tax and 210 paid less than £10 million, with many others claiming tax losses. Sikka (2012), further positsthatBarclays bank declared UK profits of over £4.6 billion in 2009, yet it only paid £113 million in corporation tax, while Vodafone declared global pre-tax profits of over £9.549 billion including £1.3 billion in the UK in 2012, yet it paid no corporation tax in the UK. Vodafone made profits of over £1.2 billion in the UK in 2011 but it only paid £140 million in corporation tax to the UK government. These and many more examples give a clear picture of the significant losses in revenues that the UK government has borne over the years, but despite this, the government has not engaged aggressively to solve the issue and there doesn’t seem to be an effective strategy in place to combat the phenomenon.

The question remains as to what measures the UK government is taking to ensure that these tax avoidance problems are addressed. How serious is the UK government with regards to ensuring tax avoidance is opposed? In the next section, this study discusses why tax avoidance is increasing amongst multinational global firms in the UK.

2.5 Why is Multinational Firm tax Avoidance Increasing in the UK?

Generally, multinational tax avoidance is increasing worldwide, not just in the UK. One of the reasons given is that many capitalistic countries around the world continue to seek for opportunities to expand their economies (Sikka and Willmott, 2010).With this increasing competition, many global firms take advantage of these nations by employing transfer pricing strategies to effectively relocate profits from high tax areas to low tax areas. There is also the issue of the ongoing appearance of microstates, which constitutethe greatest percentage of tax havens where avoidance is significantly encouraged.By means of soft legislations, these countriestry to induceinternational companies to set up their businesses in their jurisdiction, which in turn enables them to keep perpetuating tax avoidance (Sikka and Willmott, 2003). In the UK, there is no doubt that multinational global firm avoidance is increasing, despite efforts to address it. The question is, why is this so? This section discusses some of these issues with the aim to expose some of the dynamics underlying the problem. Evidence on multinational global tax avoidance in the UK show that the phenomenon is growing. For instance, The Independent (2019) claims that the UK is the greatest enabler of tax avoidance in the world with an accusation that the UK is not doing enough to tackle this problem. As a result, there continues to be extensive revenue losses accruing to the UK government. According to the Independent (2019), the UK turns a blind eye to this issue. One of the reasons for this increase stands in the fact that international rules and profit declarations are not being strictly implemented in the UK, and instead the government is actually dismantling international tax systems and creating loopholes for these multinational global companies to continue perpetuating these misconducts. Another reason why international and global tax avoidance continues to increase is that multinational companies have strong foreign connections. Hence, countries with which the UK haspolitical interests may impede genuine efforts to enforce legislation with global companies. For example, the Guardian (2019) reports that, despite the intention of the UK to take tough actions towards global companies that perpetuate tax avoidance, the US had opposed any kind of aggressive approach towards firms with US interests. This shows that international politics may prevent aggressive approach to tackling multinational firm tax avoidance. Also, with increasing globalization, countries are finding it difficult to keep up with the challenges of transfer pricing as subsidiaries can spread across different jurisdictions. Transfer pricing makes it possible for global firms to allocate taxes and profits from high tax jurisdictions to lower tax jurisdiction areas. Sikka (2012) identifies the problem of law interpretation with the subtle line between tax avoidance and tax evasion. It is difficult to differentiate between them and firms tend to take advantage of imprecisions of the law system. The tax avoidance industry itself is enforced by very technical, well trained accounting and finance experts making it difficult for government to track down these firms. Furthermore, as argued by Sikka, globalisation has triggered an emergence of tax havens since the 1970s making it very easy for global firms to spread across different countries operating similar business to the disadvantage of the tax system.

Marshall and Bernhagen (2017) assert that political behaviour can be influenced by the relationship between national interests and business goals. Firms’ business relations with the state are influenced by their level of conformity to government policies.If these are strained, businesses can move to other territories where policies favour them more (Marshall and Bernhagen, 2017). The result is that countries like the UK, which relygreatly on tax revenues will be forced to cooperate in order not to lose these firms to other countries. In a capitalist economy like the UK, firms have normative power (Hart, 2004). One way they display power is using their financial position to lobby the political class to their own benefit. The single market under the EU for example is one of the largest, if not the largest trade zone in the world making it acritical area for multinational firms to target (Rasmussen and Carroll, 2014). In the UK, for example, many of these multinational firms come through the national government, lobbying to influence policy (Bennett, 1997). Indeed, the degree to which a political arena is attractive in terms of the corresponding relationship between government and business affects to a large extent the business lobbying and the firm establishment. Evidence from the literature shows clearly that the UK has not been rigid with multinational companies, with respect to tax avoidance. Dyreng et al (2014) enumerated on the findings by ActionAid, a global non-profit firm dedicated to ending poverty.It was found that, despite the UK’s Companies Act,emanated in 2006,which demanded companies to disclose names and locations of all subsidiaries, more than half of the FSTE 100 global firms did not disclose the names and locations of their sister companies. The implication of this is that,although there are clear laws in the UK preventing the cases of tax avoidance amongst multinational firms, these are not being complied with, suggesting poor enforcement. This begs the question of whether, truly, the UK government is serious on tackling global multinational firm tax avoidance. Finally, despite any relationship existing between global firms and the government, continuing to allow these companies to operate in this manner will have significant effect on citizen welfare because of increasing shortage in government revenues. In the next sub-section, this study shows how tax avoidance could be combatted.

2.5 How can Multinational/Global Firm Tax Avoidance be combatted?

So, far, in this review, it seems obvious that there is clear evidence of multinational firm tax avoidance in the UK and thishas a significant negative impactonbudget revenues in the UK. The question thus is, what is the government doing about it? Firstly, it is important to note that there is a difference between domestic tax avoidance and multinational global tax avoidance. Multinational tax avoidance happens on a cross border level while domestic tax avoidance happens within a country. A typical example of cross border tax avoidance was explained above, as happening when profit is transferred from a higher taxed country to a lower taxed country. As discussed in previous sections, billions of monetary transactions have been lost in the UK, thereby causing major divergence between what is collected and what should be collected (Bowler, 2009). In combatting the phenomenon, Bowler (2009) have suggested to erase the line that separates tax avoidance and tax evasion as it is difficult to differentiate what is acceptable and unacceptable tax avoidance. Whether tax avoidance or tax evasion, the causes need to be identified, andlater it is possible todeal with it more effectively (Bowler, 2009). Yet another suggestion by Bowler is to close tax boundaries and prevent tax substitutes otherwise companies would always have options to avoid tax. After all, the approach used by the government to abate global multinational tax avoidance has not been effective.Despite HMRC giving false hopes about tax avoidance success,the phenomenon is steadily rising in the UK (see Independent, 2019). The UK remains the biggest tax avoidance enabler amongst multinational global companies in the world allowing billions of pounds to escape the state coffers with government endlessly promising to preventinternational companies such as Google and Amazon from perpetuating tax avoidance through profit shifting (Independent, 2019). This shows that tax avoidance measures being employed by the UK government are ineffective.

Beer (2018), states that countries in different regions use similar frameworks for combatting tax avoidance. For example, OECD countries use the Inclusive framework such as the General Anti-Avoidance Rule (GAAR), while the European Union expects its member states to use similar anti-tax avoidance framework as stipulated by the Union. One specific strategy suggested the inclusion ofadditional regulation in the transfer pricing, which would involve setting out specific methods for calculating transfer pricing and transfer requirements and setting penalties if these are not followed (Beer et al, 2018). According to Riedel et al (2015), when transfer pricing rules are tightened, tax sensitivity of corporate profits can be reduced by 50%. The danger with this, however, is that global companies may begin to report less profit. The use of media and social groups such as pressure groups have been suggested as possible means of combatting multinational tax avoidance. For example, Dyreng et al (2014), suggest that social monitors can help oversee multinational firms’ behaviour. Their research was consistent with previous studies which showed that external social monitors can instill pressure on multinational firms to behave appropriately (Smith, 1995; Wilde, 2013; Ertimur et al, 2012). In 2012, there was public scrutiny on Starbucks which was found not to have paid tax to the UK government despite reporting profits. The resultant negative report led to verbal aggression from members of Parliament, customer boycott of stores, drop in the company’s ratings and closures of stores (Christensen et al, 2014). Such negative backlash induced Starbucks to pay its corporate tax due and relocating some of its stores (Dyreng et al, 2014). Even if firms refuse to comply with laws that are written down, having external public pressure can change global firms’ behaviour and even induce stricter law enforcement by government (Dyreng et al, 2014). Public scrutiny of firms can lead to reputational damage, customer boycotts, political backlash, shareholder penalties and tax enforcement actions. Political sensitivity and pressure are also considered a way of combatting corporate tax avoidance by multinational firms. For instance, Choy et al (2014), mention the impact of political outcry and how this, coupled with public pressure, increased pressure on multinational firms as in the case of Starbucks. Dyreng et al (2014) confirm that political sensitivity has an impact on multinational firms with regards to tax avoidance. Indeed, political sensitivity, media and public monitoring of multinational firms can instill some discipline in the multinational firm behaviour towards corporate tax.

Other strategies include the thin capitalization rules and CFC rules. The thin capitalization rules establishpractices for correct debt interest and is effective in debt shifting by global multinational companies (Bloiun et al, 2018), while the CFC rules state that multinational global companies’ income is subject to domestic taxation, thereby giving the domestic country right over taxation of the international firm (Clifford, 2017). After thediscussion conducted above, one critical question remains: could it be that the problem is in the implementation of the measures, and not in the anti-tax avoidance measuresthemselves? Despite disclosure rules and other measures employed in the UK for example, cases of multinational tax avoidance have been on the raise in the UK. The question is then: how effective are tax avoidance laws and how effectively are the laws implemented in the UK? This study is indeed timely in exploring these issues. Despite the above, it has been proven that, with increasing financial difficulties and social stability issues being experienced by many nations, there is now increasing scrutiny by nations on transfer pricing (Willmott and Sikka, 2010). Eden et al (2005)claim that nations are also strengthening audit and imposing stricter financial penalties for tax avoidance offences. There seems to bea sudden realisation amongst nations that allowing tax avoidance by global firms can also bring negative reputation to their countries. Overall, it is pertinent to state that tax avoidance issues amongst multinational companies remain a divisive and inconclusive topic in academia as there is no general agreement about tax avoidance and whether nations do not deliberately address it or whether they are genuinely unable to detect it. In the next section this research discusses the impact of tax avoidance on an economy.

2.6 Impact of Tax Avoidance to an Economy

From the analysis above, there are implications for aggressive tax avoidance amongst multinational global companies. This section discusses some of the impacts of tax avoidance on an economy. Firstly, corporate tax avoidance is said to be:mostly conducted by multinational firms with international operations rather than family owned businesses (Donohoe, 2015), more common amongst firms owned by private equity shareowners (Badertscher, et al, 2013), and greater in firms where managers get compensation based on after tax earnings (Phillips, 2003). There is a moral question for managers of such companies. This arises out of the fact that, companies which perpetuate this, even though they may not have committed crime, have surely not operated in the spirit of the law (Lenz, 2018). Within the eyes of the public, questions about the genuineness of both businesses and government will continue to suffix. From the discussions and analysis above, tax avoidance creates a gulf between what is actually earned and the potential of what should be earned. This means that a country in which tax avoidance occurs will suffer losses in revenues, which in turn can affect economic growth and the quality of public services delivered. Dalu et al (2012)state that tax avoidance ignites investment distortions which cause economic challenges because of both undervalued figures and inflammatory pressures. According to World Finance (2015), tax avoidance causes significant consequences for individuals in society. There are social and economic effects. It erodes public trust and reduces the availability of public services as public funds diminish. However, since there is risk of companies moving from one location to another as a result of strict corporate tax rules, government themselves can alter tax rules in such a way that it provides havens for the global companies to continue to perpetuate tax avoidance leading to revenue losses for the countries concerned (Clausing, 2009). There are also negative effects for the companies themselves who perpetuate these tax avoidance sins. For example, according to Ernest and Young (2014), there is reputational risk for these companies because of the way the public perceives them from a morality perspective. Enumerating further, Ernest and Young (2014), states that more than 89% of global firms express concerns over media coverage around tax avoidance issues and the negative impact this can have on their business and their relationship with government and members of the public. Significant damage can be done to a company’s reputation which can have serious consequences on their profitability and growth. Overall, corporate tax avoidance carries negative impact both for the company and for the nation itself. Negative media image can backfire on the company just as customers can begin to boycott the firm and profitability can be lowered. In the same way, a nation’s revenue can be negatively affected through reduced revenue which can diminish the quality of public goods and services being delivered.

2.7 Conclusion

This review has explored some issues related to corporate tax avoidance amongst multinational companies. Corporate tax avoidance amongst multinational global firms is causing significant losses to economies as corporate taxes are underpaid and shifted. According to the Independent, the UK is the greatest tax avoidance enabler globally, and billions of pounds are being lost yearly to multinational firms such as Google, Starbucks and Amazon, amongst others. The measures being employed by the UK government to combat these malpractices by multinational global companies appear not to be effective as the incidence of tax avoidance continues to rise, causing public outcry as government continues to cut cost and public services are eroded. This study is thus seen as effective and timely in trying to explore these issues and to recommend more effective strategies for combatting corporate tax avoidance in the UK. In the next section, the methodology containing the procedures and the process of data collection and analysis is discussed.

3.0 METHODOLOGY

3.1 Introduction

This section discusses the overall research methodology approach used in this study. This includes the research methods, the philosophical stance, the methods of analysis and other important processes involved in collecting and interpreting data. Research methodology comprises the approach involved in data collection to answer the research questions. Saunders and Rojon (2012), states clearly that research methodology is the theory of how research should be taken, covering the philosophical assumptions and research underpinnings with an implication of methods used. Methods is the process in which data was collected to provide answers to the research questions. The focus of this study is on endeavouring to find answers to the problem of increasing multinational, global firms avoiding corporate taxes and how the UK government is addressing this issue. The importance of exposing the intricacies concerning multinational tax avoidance in the UK cannot be overemphasised given that billions of pounds are lost each year to this problem (Bauer, 2015). There is need to understand what strategies the UK government is currently employing to address this issue and how effective these are. The intention of this study was to use a qualitative approach. In advancing the course of this study, this research acknowledges that there are challenges with deciding whether the number of research participants can be decided a priori (Braun and Clarke, 2016; Bryne, 2015). However, the perspective of this study is that the numbers of research participants should be emergent as research progresses and adaptive due to the unpredictability of situations (Simm et al, 2018). However, due to the current coronavirus pandemic and the challenges of reaching participants, this study decided to opt for a secondary sourced data to answer the research questions.

3.2 Research Method

This section discusses the research method employed in this study. According to Ghauri et al (2020), before beginning a research, the researcher must be sure of what they are doing, that is, clarifying the perspective of the research and the benefits is essential. Where there is a problem, an appropriate research method is required to resolve that problem. According to Kuhn (1970), research is, in the first instance, the process of solving specific problems under specific conditions. The goal is to endeavour to improve knowledge in aarea and to understand why things happen the way they happen. Saunders et al (2012), state that research methods consist of details on how data was collected and analysed, the techniques used in collecting the data, the way sample was selected, and the way data was analysed. In this study, the purpose of the research and the problem it is trying to solve endeared the researcher to engage in a qualitative methodology with the aid of phone interviews and qualitative questionnaires.

3.3 What is Secondary Data?

Scholars have commented on the increasing availability of research data, already collected and analysed in specific areas (Smith et al, 2011; Andrews et al, 2012). The implication is that there may be abundance of data in archives available for researchers. According to Johnston (2014), secondary data can be defined as data that was collected by someone else for a specific purpose. This kind of data is especially useful for researchers who have limited time and resources. Corti (2018), defines secondary data as information that is re-used from a different or new perspective or when a researcher attempts to ask new questions from older data. The key or the underpinning factor with regards to secondary data is that the latter is not primary but has instead been collected by another researcher. This study was careful with the data source selected and confident with the quality of data used. In the next sub-section, the benefits and problems of secondary data are discussed, highlighting how this related to this research.

3.3.1 Strengths and Weaknesses of Secondary Data

Secondary data has its strengths as well as its weaknesses. Secondary data can help solve the problem of data collected from populations that are difficult to reach (Corti, 2018). Available or already used, data can be extended to represent unique value. Such data can be useddifferently, and its potentials can be effectively exploited. One of the main strengths of secondary data is that it can help solve the problem of costs (Mauthner, 2012). Primary data can be quite expensive to collect whereas secondary data can minimise costs by using sources already collected by other researchers (Morrow et al, 2014). As cost is reduced so time is saved compared to how long it takes to collect primary data. Such time optimization can lead to the acceleration of the speed of a research (Doolan and Froelicher, 2009). One of the benefits of this is that it enabled the study to be completed on time as well as reduced the cost of primary data collection through interviews or questionnaires. Secondary data can allow for validity and generalization of results when the sample of the research data is large (Smith et al, 2011). Furthermore, when such data is available, it can provide quality evidence for a researcher. For this study, it has enabled the utilization of quality data for quality analysis and evaluations. Johnston (2014) states that secondary data, if sourced effectively, can be used to address research questions. The purpose of this study was to explore the reasons why tax avoidance by multinational global companies in the UK continues to increase. The questions revolve around how it can be combatted and why this has been so difficult to undertakeespecially considering the damaging consequences it carries to the UK economy. A disadvantage of using secondary data, as explained by Gunn and Faire (2011), is that re-using another researcher’s information can add complexity when trying to familiarise with the sample and evaluate the reliability of that data. Edwards (2012), states that defining the secondary data set targeted is essential, but this is sometimes difficult to do. When a researcher, just as in this case, does not participate in the physical collection of theinformation, that intimacy between the researcher and the data may be weakened. The researcher did not collect data through interviews or through questionnaires, hence the opportunity to probe or to ask questions was not available. Corti (2018), claims that another difficulty with secondary data can be related to sampling, just as in qualitative and quantitative research. The way samples are chosen as well as their representativeness can be issues in primary research just as in secondary research. This study endeavoured to predefine the secondary data clearly. This study also followed the steps recommended by Corti (2018) when attempting to use a secondary sample, which includes ensuring rigorous investigation and data fit. This also encompassesthe original source, how the data was constructed, the relationship between the researcher and the participants of the research etc. Other factors considered by this study about using secondary sources were the quality of the data and the exclusion of missing data-points and most importantly, ethical issues when using secondary research. The processes of using and analysing the secondary data is discussed in greater details in section 3.5. In the next sub-section, the difference between secondary and primary research is discussed.

3.3.2 Differentiating Secondary from Primary Research

Secondary and primary research are not the same thing. There are differences between primary research and secondary research. The table below highlights the differences asdescribed by Streefkerk (2018).

3.3.3 Addressing Ethical Concerns

Firstly, the idea behind using secondary data was not to validate or criticise the information collected by another researcher, but rather to use the information as a fit between this study and the research questions of this study. This dissertation understands that ethical issues such as anonymity, confidentiality, data protection and informed consent do not only apply to primary research but also secondary research (Mauthner, 2012). Therefore, this study endeavoured to follow ethical guidelines as provided by the researcher’s institution when carrying out the study whether it is primary or secondary research. Although the data has not been collected primarily, it was essential that it did not identify personal subjects or participants’ information and it was appropriately sourced and of good quality (Tripathy, 2013). The data used in this study comprises information that is freely available on the internet, journal articles and books. All evidence and information were freely available and there were no restrictions to usage. The research was not connected or part of a larger study but independentlyundertaken by the researcher. The quality of the content of the data was a key factor to base the analysis on true premise. To verify it, a systematic approach was used, where several other studies on similar topics were explored to ensure that similar information and evidence were being generated. This systematic approach actively filtered the year of research material, with emphasis on more recent evidence to be abreast with latest developments in the subject area. The idea was to synthesize relevant information on tax avoidance problem by multinational global companies in the UK for the purpose of analysis. According to Petticrew and Roberts (2006), systematic study is focused on synthesising evidence from several studies for the purpose of an effective summary analysis. This can also help with the elimination of bias when choosing articles. While this study was unable to effectively implement the strict procedure of a systematic study, because of the time frame and other logistical reasons, it nevertheless attempted to identify articles focused on the topic area with relevant information that can be synthesised and summarised for effective analysis. Also, this study acknowledges that many relevant articles may have been exempted, however, the articles used presented sufficient and effective information. This is provided in the subsequent section, 3.4. In summary, ethical challenges were addressed by ensuring that all recommended guidelines by the university are followed, that no data is traceable to any participant, that data is freely available in books, journals, internet, or relevant public forum. Also, ownership of all data was identified by referencing appropriately. Since data was not collected originally, the researcher also ensured that the data collected were accurate, the period of the data collection, and the quality of the content of the data. There were no hard copy data and hence no problem of physical security of data, however for all soft copies, they were safely stored in the researcher’s laptop with password to access the laptop, only known to the researcher. In the next section, the researcher presents the data used in the analysis of this study.

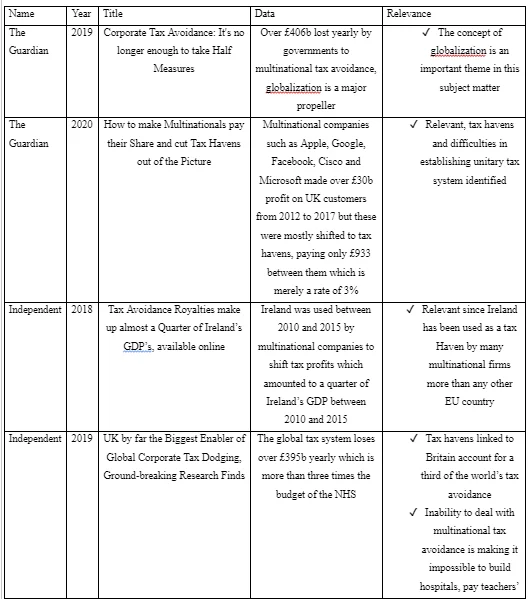

3.4 Multinational Global Tax Avoidance Data

From the discussion above, the data selected from internet sources are presented below.

3.4.1 Independent Data (Independent, 2019)

3.4.2 Internet Data

3.4.3 Literature Review Data

3.5 Analysis in Secondary Research

This session discusses analysis of secondary research. The research asked several questions which include the following.

What are the causes of tax avoidance amongst multinational global companies?

How can the UK government effectively combat tax avoidance amongst multinational companies in the UK?

Why is tax avoidance continuing to increase amongst multinational governments in the UK?

Analysing the research data is analysing information which has already been collected to answer the research questions which is provided above. According to Johnston(2014), the key to analysing secondary data is to first develop the research questions, identify the data set and then thoroughly evaluate the data. This research had sufficient data to answer the research questions as presented in sub-sections 3.4, 3.4.1, 3.4.2 and 3.4.3. These studies provided some empirical evidence that was considered sufficient to address the purpose of this study. Nonovel research completely uses their original data and this unused data can be directed towards addressing other research questions (Johnston, 2012). However, most important is the fact that the key to making use of already collected data is how this can be used to provide answers that are a good fit between the research questions and the information collected (Doolan and Froelicher, 2009). This is conformable in this study which has been able to select secondary data through rigorous investigation and which provides a compatibility between the research questions and the answers the research is trying to provide. This study further ensured that every data collected provided viability towards making contributions to the overall purpose of the research, which is to explore strategies through which the UK can combat multinational tax avoidance in the UK as this is currently increasing at an alarming rate. Some steps were taken in this research, as provided by Johnston (2014), towards ensuring that the data set collected were appropriate for the study’s purpose such as categorising clearly the source of the data, the year, and the type of data collected, purpose and the findings of the research. This can further prove the quality of the secondary research, for instance, Boslaugh (2007) states that the time when a primary data is collected needs to be clearly stated in order to ensure that old and unviable information are not being collected as evidence. This study focused on recent data, with the lest recent being from 2010 in order not to use a false or outdated evidence as basis for current analysis. From the data collected above, several themes were identified, which are all important in addressing the purpose and questions of this research. It is believed that these themes need to be discussed further to addressthe increasing multinational global tax avoidance in the UK and how the government is planning to solve the problem. The important themes which are discussed further in chapter four include the following:

Internal control mechanisms of a multinational global organization have a causal link to whether that organization would be involved in tax avoidance. Could this be an area of investigation where the UK government could possibly format winning strategies to combat multinational global tax avoidance in the UK?

Globalization is an important enabler of multinational global tax avoidance. The ease of transfer pricing and the difficulties of border protectionism in the goal for economic development creates an avenue for multinational global tax avoidance. This needs further discussion especially in relation to tax havens and how to terminate them.

The role of public media and activist groups and the impact they can have on multinational global companies, especially due the pressure they can exercise on these companies’ public image. There is evidence that political pressure, public activist pressure, media pressure and citizen pressure can propel governments to act and dissuade multinational companies from engaging in tax avoidance.

The government and business relations and the politicization of the relationship. When does a government draw a boundary between their relations with businesses and the economic goals? Is the UK government turning a blind eye to multinational tax avoidance because of the overall benefits these companies provide by doing business in UK territories? This again needs to be explored further.

Lastly, the economic impact of tax avoidance, the impact on citizens and provisions of quality public services in an important theme identified in the data which needs to be discussed further also.

In summary, this chapter has highlighted some important features ofusing secondary data and how these differ from primary data. It has also clearly provided some important themes from the data collected, which provide important discussion points that can help address the purpose and questions of this research. The implications of these are further discussed in chapter four, which is the chapter that follows.

CHAPTER FOUR: IMPLICATIONS OF STUDY

4.1 Introduction

This section discusses the implications of the findings of this study. As mentioned in section 3.5, five main themes emerge from the secondary data and literature review. These themes are fully discussed here along with the strategies that could help the UK government to combat global firm tax avoidance.

4.2 Internal Control Mechanism

The internal control system of a multinational firm is a key determinant to whether a company will engage in tax avoidance or not since internal control mechanisms have been found to have a causal link to whether that organization would be involved in tax avoidance. From the literature and from the secondary data, it emerges that tax avoidance by multinational firms is deliberately carried out, helped by an organizational structure that makes it possible to avoid tax. However, from the perspective of Bauer (2015), tax avoidance is not deliberate because multinational global firms may have weak corporate governance system or weak internal control systems that make tax avoidance possible. There is also the idea that multinational companies which have executive compensation plans tend to avoid tax. Dyreng et al. (2010) state that individuals with incremental compensation plan play significant roles in determining the level of tax avoided, because they try to find ways to cover up for the compensation plans. Executive compensation plans can consist of stealth compensation, executive loans, payments to departing executives, and retirement benefits amongst others (Bebchuk and Fried, 2003). The implication of this is that money is being spent and, depending on the type of ownership, there may be the need to ensure that, despite aggressive compensation plans, profit is still reported at the end of the financial year. This perspective on internal control system has an implication for the UK government and their capacity to combat multinational firm tax avoidance. This would mean developing an effective auditing process that rigorously scrutinises the internal control systems and executive compensation plans of multinational firms. According to Alvin et al. (2003), an internal control system of an organization consists of: maintaining systems that are reliable, ensuring that reliable information is provided timely, protecting assets, optimizing the use of resources, preventing and detecting error and preventing fraud. With this system in place, organizations can perform financially, providing accurate and transparent financial information (Sebbowa, 2009). If the UK government develops an effective procedure for auditing internal control systems, then tax avoidance due to executive compensation plans will be discouraged. This statement is acknowledged on the gov.co.uk website where it is confirmed that greater commitment to financial transparency, through an effective internal auditing process, can help address issues of financial inconsistencies. This will also help regulating multinational tax avoidance behaviour and financial irregularities. Tax avoidance is classified as a corrupt behaviour and studies show that both corruption and tax avoidance negatively affect economic growth (Shehata and Farooq, 2018). Therefore, for the benefit of shareholders, governments, and the society, enforcing an effective external auditing mechanism is essential to

enhance financial transparency and reducing fraudulent practices within businesses (Shehata and Farooq, 2018). External auditing is the process of auditing financial statements prepared by an organization as required by the law. This means that external auditors would audit financial information already audited internally. Cazurra (2008), defines external auditors as people who are responsible for detecting and disclosing fraudulent acts such as any form of bribery and corruption with the organization. Therefore, external auditors appointed by government can easily detect financial inconsistencies and tax avoidance acts. It follows that the major implication under this perspective is that the UK Government and policy makers must immediately introduce laws and regulations requiring multinational firms to have all financial activities audited both internally and externally and ensure that these are rigorously implemented.

4.3 Government/Business Relations

Government and business relations is another theme discussed in this study. The secondary data and the literature review show that the relationship between governments and businesses have consequences on the severity with which governments combat multinational tax avoidance by firms. The issue stands in the balance between multinational corporate power and state power. The question is also whether governments should allow businesses to operate without intervention or intervene to regulate. In this section, Britain’s economic policy history will be discussed, along with the rationale for these implemented policies. There is no doubt that the foundation of the British economy lies in the industrial revolution, when there was great strive in agriculture, cotton, iron and coal industries. Since it was an underdeveloped era, when society was advancing and many discoveries were being made, there was no definite government intervention. However, as noted by Barker (2005), liberalism had a significant impact on British economy at the turn of the 20th century, fostering the ideas of individual liberty, free trade, laissez faire, political autonomy, and no government intervention. Thus, businesses and individuals were given freedom to thrive with little or no regulation imposed on trade. Another implication for liberal policy drive is that globalization is championed. In a liberal and global world, dynamic markets, business convergence and expansions are the status-quo (Pauly and Reich, 2009). According to the liberal thinking, governments should have very limited influence on how businesses operate, allowing them to thrive, operating easily across borders while governments draw back. The problem is that when multinational firms are given freehand to operate, then it becomes very easy for them to engage in tax avoidance. In the 1970s, Margaret Thatcher pursued a deregulatory economic policy encouraging flexibility and competition (Lacey, 2012). The idea behind Neoliberalism is the prioritization of private ownership, deregulation of the national economy, competition and marketization. Neoliberalism, like liberalism, removed major regulatory hindrances to foster a competitive, effective marketization system (This week, 2018). The implication for this study from these two perspectives is that the governments’ interest to see business development and economic growth sometimes comes with a price, such as relegating citizens to the background and lifting businesses to the clouds. For instance, Hood (1991) claims that, in the attempt to commercialise Britain, citizens were turned to consumers who must be satisfied by effective service delivery from businesses. This kind of economic policy thrives in a climate where governments encourages smooth and peaceful relations with businesses to achieve the goal of the policy. Kim and Milner (2019) assert that business lobbying and multinational policy influences dominated this era. The point this study is making, based on multinational tax avoidance, is that the economic policy of a nation can largely influence the degree at which multinational firms avoid tax. Therefore, to combat the problem, the type of economic policy and regulation is key. If the government is desperate to grow the economy, whatever the price, then businesses would lobby for policies that favour them, exerting political power over the government. Kim and Milner (2019) claim that multinational global firms exert power over domestic businesses and seek to control the political will of the state, while in most cases, the state is powerless to defend its position. Lam (2016) mentions that, when governments intervene in economic matters, their conduct can lead to conflicts between governments and businesses. The problem is that governments do not want to lose the presence of multinational firms in their territory, hence they can sometimes agree to the multinational firms’ demands. Data 3.4, i.e. the reports from the online newspapers, show that the UK government has not been aggressive enough in tackling multinational firms with regards to tax avoidance. Thus, questions have been asked as to whether Margaret Thatcher’s capitalist policy has benefitted the long-term welfare of British citizens. Whereas Thatcherism was more focused on liberal capitalism, it should be highlighted that, prior to the 1970s, Britain had been a nationalistic state since after the Second World War, with the government taking over major public services. Fast forwarding to the present post Brexit era, scholars have claimed that Britain is about to return to its nationalistic, sovereign past, ending previous Anglo-British globalist world perspective (Scotto, 2018). The following question - necessary for future empirical study – then becomes: how would a post Brexit, nationalistic Britain define government and business relationships in pursuing economic policies? How would nationalism in Britain help combat multinational tax avoidance? One thing that is certain is that relations between the British government and businesses will have a defining role on how effective multinational tax avoidance can be opposed.

Another dynamic of this important theme generated from this study is the role of external government auditing on multinational firms in Britain. It is argued in this study that an effective external auditing mechanism championed by the government is important in regulating financial activities within multinational firms. Government auditing can help detect any kind of financial inconsistencies in any organization. However, from this perspective, this position would be difficult to pursue if the government’s relations with business are not strong. For example, the Independent (2019) provides evidence that the UK is the largest enabler of tax avoidance in Europe and that companies such as Google and Amazon have been accused of exploiting the UK government for billions of dollars without triggering an aggressive response by the UK government. This gives an indication that the UK government has a somewhat relaxed approach to multinational firms because of economic reasons. From data 3.4.1 in section 3, the UK is presented to be host to the most damaging tax havens which carry very high corporate tax haven scores (Independent, 2019). As can be seen in data 3.4.1, the UK seems to be less aggressive towards addressing and curbing the problem of multinational tax avoidance (Independent, 2019). This has been acknowledged politically by both the conservative and the labour party which have promised to curb the phenomenon, by ensuring royalties on UK sales are transferred to tax havens. However, the question remains: to what extent the UK government is rigorously implementing these strategies? In a capitalistic world, such as the one in which we live, the relationship between governments and businesses is ever more scrutinised, North (1990) asserts that governments are in charge of ensuring that the rules of capitalism are played out effectively, yet governments do not operate without engaging with firms. Therefore, understanding the dynamics of this engagement is important because of the need to identify where the boundary lies between government and businesses relations, such that this relationship does not compromise the authority that governments have. According to Marshall and Bernhagen, (2017), political behaviour can influence the government and business relations. Businesses tend to have a smoother relationship with governments when regulations suit them, but on the other hand, businesses will take the option of moving territories if governments become stricter on regulations. In a capitalist economy like the UK, firms have normative power (Hart, 2004). One way they display power is using their financial position to lobby the political class to their own benefit. The single market under the EU zone for example is one of the largest, if not the largest trade zone in the world, making it an all-important area for multinational firms to target (Rasmussen and Carroll, 2014). In the UK, many of these multinational firms target the national government, lobbying to influence policy (Bennett, 1997. The implication of this is that multinational tax avoidance cannot be combatted by the UK government if these firms have normative power. If governments put the primacy of the economy first, their power to address multinational tax avoidance would remain limited. In summary, the UK government must become tough with regulations and rules of law concerning multinational tax avoidance by creating a genuine boundary between itself and businesses. The engagement of businesses in policy making must not adversely affect the position of the government in ensuring firms pay the appropriate tax and produce quality products and services at reasonable costs. If the UK government remains soft, then businesses would continue to avoid paying the right tax and the UK would continue to be a tax avoidance enabler in the world. This is a major implication for this study which focuses on the seriousness for the UK to become stricter and curb multinational tax avoidance.

4.4 Globalization

Globalization has a role to play with regards to the operations of multinational firms and how they can avoid paying corporate taxes. Globalization is a driver of capitalism because it enables transnational operations. According to Beck (2018), Globalization is subjecting national states to powerless control of their territories and depriving them of their political will. Global companies, with their power, can decide for themselves where to invest, produce, reside, and pay taxes, making it very possible to live somewhere and pay taxes in another place (Beck, 2018). Globalization indeed, with regards to this study, has created a world of increasing corporate power and multinational hegemony. The problem is thus how governments can respond to this threatening, dominating power of multinational firms. Multinational firms are different from other kinds of businesses such as domestic businesses and can be easily differentiated from them. For example, multinational firms operate on a larger scale than domestic firms and are larger exporters than domestic firms (Bernard et al, 2009). Another difference is that multinational global firms have more employees than domestic firms, they employ a higher number of skilled workers, spend more on R&D to be more productive. Hence, multinational firms are economic global forces. Due to their size, they want to influence policies in countries where they operate, in particular: trade policies, foreign policies and even immigration policies (Kim and Osgood, 2019). As powerful actors therefore, the question is whether national governments have the courage to tame them through hard regulation. With regards to this study, we can see from the data discussed previously that globalization links nations together for the sake of business trade and for other bilateral reasons. We can also infer that globalization makes it possible for multinational companies to operate in different locations at the same time with a tendency to weaken the power of governments. Also, multinational firms and businesses drive the economy. Their presence and trade in a nation is vital for economic development. It is therefore inducible from this study that dealing with multinational tax avoidance will require cooperation from different countries. Unfortunately, as we see from the data, one of the problems is that there is no globalized regulation for international companies, making it difficult to oppose transfer prizing. The OECD is only beginning to take into consideration the proposed unitary system of combating tax avoidance, but no full commitment has been made yet (Guardian, 2020). An effective international tax avoidance regulation that applies amongst all international firms is necessary to prevent tax profit shifting to other territories. Unfortunately, the UK applies a territorial system where multinational companies are taxed from their resident and source country only (Beer et al. 2020). This means that a multinational company would have a presence in the UK but would not be fully taxed on its profits since its headquarters are in another territory. As a result, many multinational companies such as Google, Amazon and Starbucks avoided paying the right amount of tax. For instance, the BBC (2013) showed that Starbucks made profits of £400million in 2012 but paid no tax, Amazon made sales in the UK in 2011 of £3.35b but only reported a tax expense of £1.8m, Google paid only £6m after making profits of £395m in 2011. Multinational companies continue to use free trade and the little barriers which globalization provides to make their way through countries and exploiting them by not paying tax. For example, in the UK, a global firm can continue to expand its branches and grow, yet paying little or no tax to the UK government because it can claim there are no profits for which to pay corporate tax (Guardian, 2020). While many claim that it is not an offence to avoid tax since it is not tax evasion, the question is what impact will this have on the economy? What impact will this have on the quality of life, if the government is unable to meet the delivery of essential services since it is not receiving the expected overall tax? Another dynamic within globalization is that countries now compete for multinational firms’ investments in their respective countries. This kind of competition aims at ensuring their own economic growth. Multinational companies take advantage of this and try to minimise their tax bills (FT, 2020). This strategy by multinational organizations has become very obvious to countries, hence the establishment of the base erosion and Profit Shifting (BEPS), a collaborative strategy by international nations to curb the avoidance of tax by multinational firms which take advantage of gaps in corporate tax requirements. However, how effective is BEPS? This study acknowledges that the UK government has attempted to implement it (Guardian, 2020), however, there have been difficulties amongst other OECD nations in holding a coordinated front. The study also acknowledges that, in dealing with this problem, there should be no differentiation between the UK based multinational firms and foreign multinational firms. As seen in data 3.4, the Guardian (2020) clearly states that there are resistances from foreign countries with business interests in companies avoiding tax. The US responded to the UK’s decisions to increase tax on some US multinational firms by threatening to increase tax on UK car exports. Furthermore, from the same Guardian source classed under data 3.4 of this study, it appears that the OECD taxation rules under BEPS have only endeavoured to curtail tax avoidance by UK multinational firms but not foreign multinational firms.

The implication for this study is that the UK must have an effective coordinated approach with other countries where multinational companies operate, enabling sufficient information sharing amongst the countries. This can make it difficult for multinational companies to shift profits abroad. Also, every profit made by each company should be taxed in that territory, irrespective of where the headquartered are located. The ability of the UK to aggressively adopt and implement a unitary global tax system is key to combatting multinational firms’ tax evasion. While this system was initially rejected by OECD due to fear of losing foreign direct investments, in 2019 the proposal for unitary global multinational taxing has been embraced as a potential solution to the problem of multinational firms’ tax avoidance. In summary, this study agrees with the Guardian (2020) in stating the latter as a possible solution if rigorously implemented. It is the unitary global tax system which will divide the multinational firms’ profits equally amongst all countries where these operate, giving each country the right to tax multinational firms from the profits that were made in their territories. Whatever the outcome is, an international coordinated tax system is key to combatting multinational firms’ tax avoidance from a global perspective. The difficult task is now to create an effective coordination body for all nations involved in the fight of this issue.

4.5 Public Media and Activist Groups

Another dynamic presented in this study, with implication for how multinational firms’ tax avoidance can be combatted in the UK, revolves around Public media and activist groups’ influence. This also investigates how politicians and citizens react to the avoidance of tax by multinational firms and the impact this is having on the economy. As seen in data 3.5, Dyreng et al (2014) find that public activists can influence multinational firms’ behaviour. That is, when people protest multinational tax avoidance, the impact this has on the multinational firm’s image can be devastating, thereby causing a shift in behaviour. This is because a negative public image can adversely affect the multinational company, especially with regards to how customers perceive it and the potential effect it could have on its profitability. Also, the BBC reported in 2013 that protest multinational tax avoidance is beyond a small group of people because citizens also have become involved and are not happy with the immorality of such a conduct. According to Edwards (1999), citizens are now being seen in the corridors of power and they have a role to play in international policy development. Edwards et al (2014), discussing the concept of civil society, claim that we live in a world where people come together to advance the course they believe in, not because they try to make profits, but because of their ideals and their willingness to take collective action. One of the reasons why citizens are putting pressure on governments to be strict in enforcing multinational firms to pay tax is because there is increasing strain on government budgets with financial cuts in places, which in turn is affecting the quality of services being delivered while increasing pressure on citizens to pay more taxes. The Guardian (2020) reports that, between 2010 and 2020, austerity and budget cuts have left significant scars in the lives of people. Since the financial crisis of 2008, the British government has intervened in the economy, by cutting costs. One of the implications of this is the drop of life expectancy and lowered quality of life, yet within the same period, companies like Starbucks have significantly underpaid tax, thereby reducing the expected income of government BBC (2013). The seriousness of the impact of multinational firms not paying the right taxes on the economy is enormous. There is a rebound effect on citizens of not paying the expected corporate taxes. This has led to increased use of social media by citizens to express their displeasure and put pressure on the government. For example, the Guardian (2020) states that a large number of citizens have resorted to the use of social media to air frustrations such as the Hansard Society survey where people expressed dissatisfaction with the disjointedness of the British economy and the various cuts in funding. Specific public service area on which British citizens have complained include environmental pollution, poor local services, poor social care services, poor health services, lesser local government spending power, criminal justice system and others. An increased public scrutiny is required. Dyreng et al (2015), while investigating the impact of ActionAid’s scrutiny of multinational firms’ corporate tax disclosure and the impact of this on corporate tax behaviour, found that indeed, pressure group scrutiny can have a positive influence on corporate tax behaviour. All noncompliant UK multinational firms which were scrutinised increased their disclosure, reduced their tax avoidance behaviour, and reduced their subsidiaries in tax haven compared to multinational firms which were not scrutinised. The overall summary of this investigation is that when public groups heap pressure on multinational global firms, this can have a positive effect on tax avoidance.